Profitable Dividend Investing: A Straightforward Approach

Table of Contents

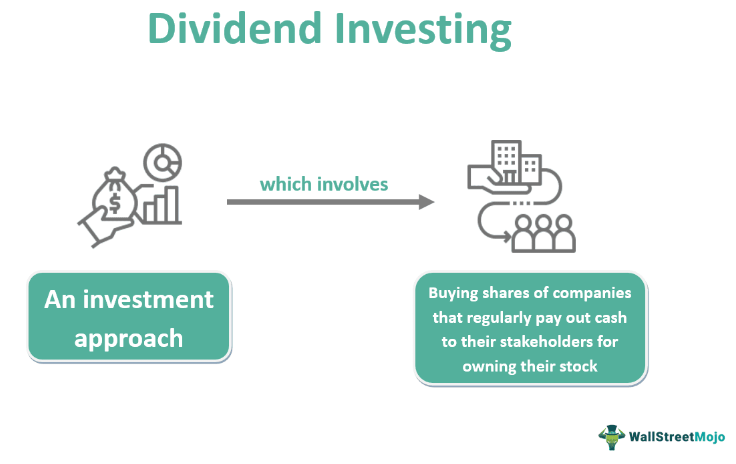

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. There are several types of dividends:

- Regular Dividends: Paid out consistently on a set schedule (e.g., quarterly). These are the most common type.

- Special Dividends: One-time payments, often made when a company has exceptionally high profits or completes a major transaction.

- Stock Dividends: Paid out in additional shares of the company's stock instead of cash.

The Benefits of Dividend Investing

Profitable dividend investing offers several key advantages:

-

Passive Income Generation: Dividends provide a regular stream of passive income, supplementing other income sources and potentially accelerating wealth accumulation. For example, a well-diversified portfolio of dividend stocks can provide a reliable monthly or quarterly income stream.

-

Potential for Capital Appreciation: While dividend income is a significant benefit, the value of the underlying stocks can also appreciate over time, leading to capital gains. Historically, many dividend-paying companies have demonstrated strong long-term growth.

-

Reduced Portfolio Volatility: Dividend-paying stocks often exhibit lower volatility compared to growth stocks, offering a more stable investment experience. This can be particularly beneficial during market downturns.

-

Hedge Against Inflation: Dividends can help protect your portfolio against inflation. As inflation rises, companies often increase dividends to maintain shareholder value, thereby preserving purchasing power. Consider the historical data showing the long-term correlation between dividend growth and inflation.

Risks of Dividend Investing

While profitable dividend investing offers many benefits, it's essential to acknowledge the associated risks:

-

Dividend Cuts: Companies can reduce or eliminate dividends due to financial difficulties or strategic shifts. Thorough due diligence is crucial to mitigate this risk.

-

Company Bankruptcy: If a company goes bankrupt, dividend payments cease, and investors may lose their initial investment. Diversification can help reduce this risk.

-

Reinvestment Risk: Reinvesting dividends assumes future growth, which isn't guaranteed. Careful selection of companies with a history of growth is vital.

-

Tax Implications: Dividend income is taxable, so understanding the tax implications is crucial for maximizing returns. Utilizing tax-advantaged accounts can help mitigate this.

Selecting Profitable Dividend Stocks

Analyzing Dividend Yield

Dividend yield is calculated by dividing the annual dividend per share by the stock's current market price. It represents the percentage return on your investment from dividends alone. While a high dividend yield might seem attractive, it's crucial not to solely focus on this metric. A high yield could signal underlying financial problems.

Evaluating Dividend Payout Ratio

The payout ratio shows the percentage of a company's earnings paid out as dividends. A sustainable payout ratio is generally considered to be below 70%. A higher ratio could indicate that the company may struggle to maintain its dividend payments in the future.

Assessing Financial Health

Analyzing a company's financial health is crucial before investing. Key metrics include:

- Debt-to-Equity Ratio: Measures the proportion of debt to equity financing. A lower ratio indicates better financial stability.

- Return on Equity (ROE): Shows how efficiently a company uses shareholder investments to generate profits. A higher ROE is generally preferred.

- Free Cash Flow (FCF): Represents the cash flow available to the company after covering operating expenses and capital expenditures. Strong FCF is vital for sustainable dividend payments.

Considering Dividend Growth History

A consistent history of dividend growth is a positive indicator of a company's financial strength and its commitment to returning value to shareholders. Examine the company's track record to gauge its ability to increase dividends over time.

Building a Diversified Dividend Portfolio

Diversification Strategies

Diversifying your dividend portfolio across different sectors, industries, and geographies helps mitigate risk. Don't put all your eggs in one basket! Consider investing in different types of companies, geographical locations and sectors to limit your exposure to any one specific risk.

Reinvestment Strategies

Reinvesting dividends through Dividend Reinvestment Plans (DRIPs) allows you to buy more shares, compounding your returns over time. This strategy can significantly accelerate wealth building.

Portfolio Monitoring and Adjustments

Regularly review and rebalance your portfolio to maintain your desired asset allocation and adapt to changing market conditions. Rebalancing involves selling some of your higher-performing investments and buying more of your underperforming ones to maintain your target allocation.

Tax Implications of Dividend Investing

Tax Rates on Dividends

Dividend income is taxed at either the ordinary income tax rate or the capital gains tax rate, depending on the holding period and the type of stock. Understanding these implications is vital for effective tax planning.

Tax-Advantaged Accounts

Consider investing in dividend stocks within tax-advantaged accounts like 401(k)s and IRAs to minimize your tax burden. These accounts offer significant tax benefits, potentially leading to higher overall returns.

Conclusion

Profitable dividend investing is a powerful strategy for building wealth, but it requires careful planning and execution. By understanding the fundamentals, selecting high-quality dividend stocks, building a diversified portfolio, and managing tax implications, you can create a steady stream of income and achieve long-term financial success. Remember, consistent profitable dividend investing requires patience and strategic planning.

Start your journey towards profitable dividend investing today! Learn more about building a successful dividend portfolio and securing your financial future. Research and carefully select stocks that align with your risk tolerance and financial goals. Remember, consistent profitable dividend investing requires patience and strategic planning.

Featured Posts

-

Investing In Middle Management A Strategy For Enhanced Productivity And Employee Retention

May 11, 2025

Investing In Middle Management A Strategy For Enhanced Productivity And Employee Retention

May 11, 2025 -

100 Mtv Unplugged Episodes Now Streaming The Complete List

May 11, 2025

100 Mtv Unplugged Episodes Now Streaming The Complete List

May 11, 2025 -

Whoops Broken Promises User Anger Over Free Upgrade Denial

May 11, 2025

Whoops Broken Promises User Anger Over Free Upgrade Denial

May 11, 2025 -

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 11, 2025

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 11, 2025 -

O Keefes New Sting Operation Implications For Prince Andrew

May 11, 2025

O Keefes New Sting Operation Implications For Prince Andrew

May 11, 2025