Protecting Your Portfolio: S&P 500 Downside Insurance Options

Table of Contents

Understanding S&P 500 Risk and the Need for Downside Protection

The S&P 500, while historically a strong performer, is not immune to market volatility. Understanding this risk and implementing appropriate downside protection is vital for preserving capital and achieving your investment goals.

Market Volatility and its Impact on the S&P 500

Market corrections and crashes are a natural part of the investment cycle. The S&P 500, as a broad market index, reflects these fluctuations. History shows periods of significant decline, impacting investor confidence and potentially leading to substantial portfolio losses.

- Examples of past market crashes: The 1987 Black Monday crash, the dot-com bubble burst of 2000, and the 2008 financial crisis all demonstrate the potential for sharp and unexpected drops in the S&P 500.

- Impact on investor confidence: Sharp market declines can erode investor confidence, leading to panic selling and further market pressure.

- Importance of diversification: Diversification, while not a form of downside insurance in itself, is a crucial component of a robust risk management strategy.

Identifying Your Risk Tolerance and Investment Goals

Before implementing any downside protection strategy, it's critical to understand your own risk profile. This involves considering your investment timeline, experience level, and overall financial objectives.

- Time horizon: A longer time horizon allows for greater risk-taking, while shorter-term goals might necessitate more conservative strategies.

- Investment experience: Experienced investors may be more comfortable with complex hedging strategies, while beginners may prefer simpler approaches.

- Overall financial goals: Your investment goals (e.g., retirement planning, down payment on a house) significantly influence your risk tolerance and the appropriate level of downside protection.

S&P 500 Downside Insurance Options: Strategies and Tools

Several strategies can offer downside protection for your S&P 500 investments. Each carries its own set of benefits, drawbacks, and associated costs.

Put Options for S&P 500 Protection

Put options are contracts giving the buyer the right, but not the obligation, to sell an underlying asset (like an S&P 500 index fund or ETF) at a specific price (the strike price) before a certain date (the expiration date). They act as insurance, limiting potential losses if the market falls below the strike price.

- Advantages: Defined risk (premium cost is the maximum loss), potential for significant gains if the market drops substantially.

- Disadvantages: Premium costs erode potential profits if the market rises, time decay reduces option value as expiration approaches.

- Types of Put Options Strategies: Covered puts (selling puts on shares you already own) and cash-secured puts (selling puts with sufficient cash to buy the underlying asset if assigned) are popular strategies.

- Calculating Potential Profit/Loss: Understanding option pricing and the factors that affect it (volatility, time to expiration, interest rates) is crucial for accurate profit/loss calculations.

Inverse ETFs and Shorting the Market

Inverse exchange-traded funds (ETFs) aim to profit from market declines. Shorting the market involves borrowing shares and selling them, hoping to buy them back at a lower price. Both strategies can be leveraged, magnifying both potential gains and losses.

- Risks: Inverse ETFs and short selling carry significant risk, particularly in volatile markets. Potential losses are theoretically unlimited.

- Leveraged Gains and Losses: Leveraged inverse ETFs amplify price movements, potentially leading to substantial gains or losses.

- Specific Inverse S&P 500 ETFs: Examples include inverse ETFs tracking the S&P 500 (check your brokerage for available options).

Diversification and Asset Allocation

Diversifying across different asset classes (stocks, bonds, real estate, commodities) is a fundamental risk management strategy. This helps reduce the impact of losses in any single asset class, acting as a form of downside protection for your S&P 500 holdings.

- Benefits: Reduces portfolio volatility, mitigates the risk of significant losses due to market downturns in a specific sector.

- Asset Allocation: Strategically allocating your assets across different asset classes based on your risk tolerance and investment goals is key. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Stop-Loss Orders

Stop-loss orders are instructions to sell a security when it reaches a specified price. They help limit potential losses but don't guarantee protection against market fluctuations.

- How Stop-Loss Orders Work: Once the stop price is triggered, the order becomes a market order, selling your holdings at the prevailing market price.

- Potential for Slippage: Slippage (the difference between the expected and actual execution price) can occur, especially during volatile market conditions.

- Suitable for Active Traders: Stop-loss orders are best suited for active traders who are closely monitoring their positions.

Choosing the Right S&P 500 Downside Insurance Strategy for You

Selecting the appropriate downside protection strategy depends heavily on your individual circumstances and risk profile.

Assessing Your Risk Tolerance and Financial Goals

Reassessing your risk tolerance and financial goals is crucial before implementing any strategy.

- Investment Timeline: Your time horizon significantly influences your choice of strategy. Long-term investors may tolerate more risk.

- Risk Aversion: Highly risk-averse investors might favor strategies offering greater downside protection, even if it means lower potential upside.

- Capital Preservation Goals: If preserving capital is paramount, prioritize strategies that minimize potential losses.

Considering Transaction Costs and Fees

Carefully analyze the costs associated with each strategy.

- Commission Fees: Brokerage commissions for trading stocks, ETFs, and options can significantly affect your overall returns.

- Premium Costs for Options: Put option premiums represent the cost of your downside protection.

- Expense Ratios for ETFs: Inverse ETFs and other ETFs have expense ratios that reduce your returns over time.

Seeking Professional Financial Advice

Complex hedging strategies should be approached with caution. Seeking advice from a qualified financial advisor is highly recommended.

- Benefits of Professional Guidance: Financial advisors can help you develop a personalized portfolio strategy tailored to your specific needs.

- Personalized Portfolio Management: A professional advisor can manage your portfolio, implement and adjust your downside protection strategy, and provide ongoing support.

Conclusion

Protecting your S&P 500 portfolio from market downturns is essential for long-term investment success. This article explored several S&P 500 downside insurance options, each with its own benefits and risks. From put options and inverse ETFs to diversification and stop-loss orders, the key is to choose a strategy aligned with your individual risk tolerance and financial goals. Remember to carefully consider all factors and, if necessary, consult with a financial professional before implementing any strategy. Start protecting your portfolio with the right S&P 500 downside insurance today!

Featured Posts

-

Lempron Tzeims Analyontas Tin Epidosi Ton 50 000 Ponton

Apr 30, 2025

Lempron Tzeims Analyontas Tin Epidosi Ton 50 000 Ponton

Apr 30, 2025 -

Celebrations Avec Armes A Feu La Carriere Et La Famille D Une Star De Nba En Peril

Apr 30, 2025

Celebrations Avec Armes A Feu La Carriere Et La Famille D Une Star De Nba En Peril

Apr 30, 2025 -

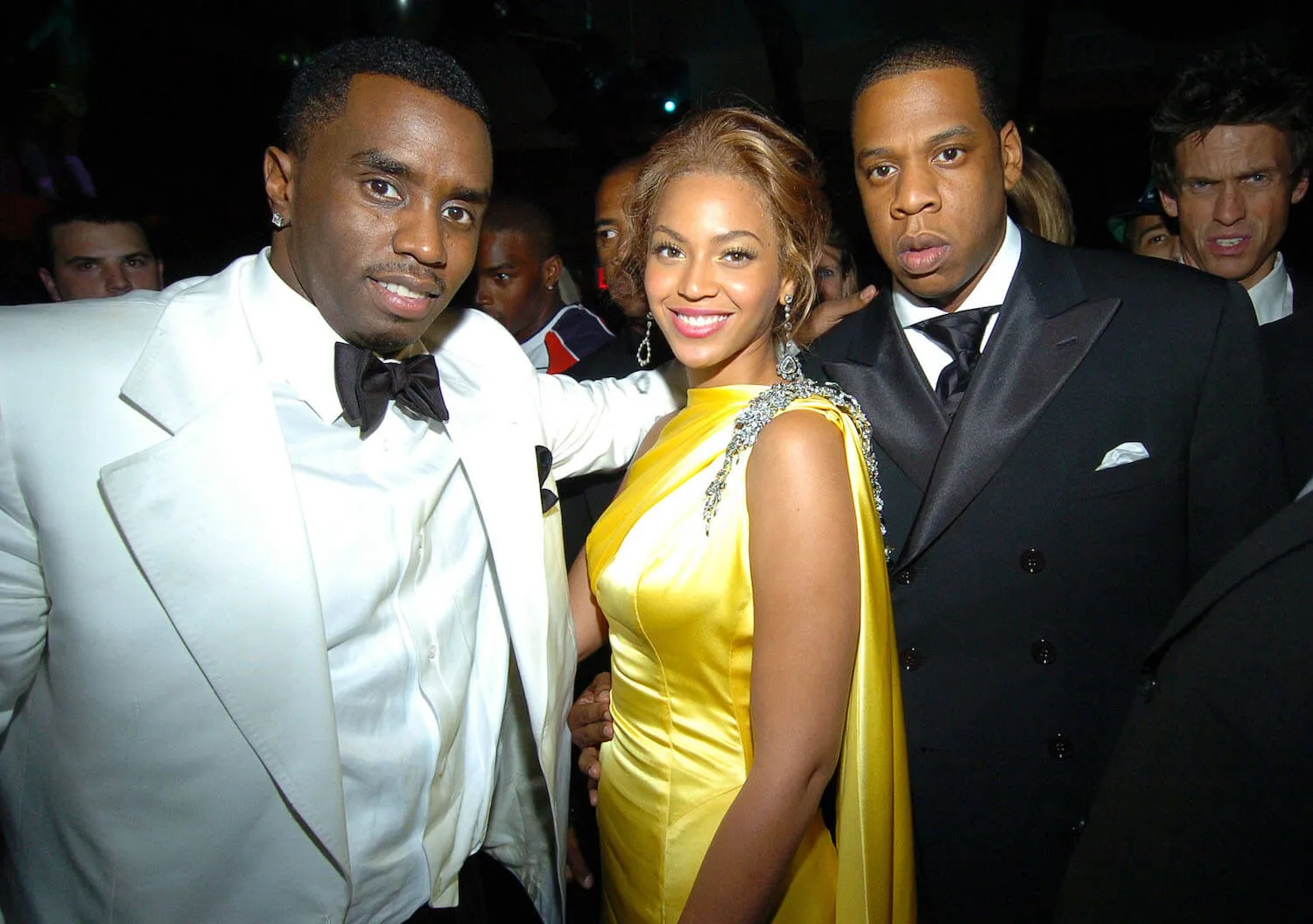

Aanklacht Tegen Diddy Beyonce En Jay Z Niet Langer Betrokken

Apr 30, 2025

Aanklacht Tegen Diddy Beyonce En Jay Z Niet Langer Betrokken

Apr 30, 2025 -

Limited Time Offer Grab 14 Adidas Slides Now

Apr 30, 2025

Limited Time Offer Grab 14 Adidas Slides Now

Apr 30, 2025 -

Ovechkin I Ego Rekord V N Kh L Reaktsiya Zakharovoy

Apr 30, 2025

Ovechkin I Ego Rekord V N Kh L Reaktsiya Zakharovoy

Apr 30, 2025