PwC US: Internal Probe Leads To Partner Brokerage Relationship Termination

Table of Contents

Details of the Internal Investigation at PwC US

The internal investigation at PwC US, the specifics of which remain partially undisclosed, was reportedly triggered by an anonymous tip-off alleging potential conflicts of interest. While the exact timeframe isn't publicly available, sources suggest the investigation spanned several months. The scope extended beyond the single partner, encompassing a review of related business practices to ensure no systemic issues existed.

- Timeline of Events: While precise dates remain confidential, the timeline likely involved initial reporting, preliminary investigation, thorough fact-finding, and finally, the decision to terminate the partnership.

- Key Individuals Involved: Besides the terminated partner, the investigation likely involved internal audit teams, legal counsel, and potentially external investigators. The involvement of senior management at PwC is also probable.

- Types of Evidence Gathered: The investigation likely relied on a combination of documentary evidence (emails, financial records, brokerage statements), witness interviews, and potentially forensic accounting analysis.

Nature of the Partner's Brokerage Relationship and the Violations

The nature of the terminated partner's brokerage relationship is still somewhat unclear, but reports suggest it involved personal investments. The violations discovered appear to center around undisclosed conflicts of interest, potentially breaching SEC regulations and internal PwC policies. The investigation uncovered instances where the partner's personal investments might have created a conflict with PwC's professional obligations to its clients.

- Specific Regulations Violated: Depending on the precise nature of the violations, this could include various SEC rules concerning insider trading, confidentiality, or conflicts of interest.

- Potential Financial Implications for PwC: While the direct financial impact on PwC might be limited, reputational damage could lead to lost business and increased regulatory scrutiny, resulting in significant indirect costs.

- Impact on Client Trust: The incident undoubtedly damages client trust. Maintaining client confidentiality and avoiding conflicts of interest are paramount for accounting firms; any breach significantly erodes this trust.

PwC US's Response and Actions Taken

PwC US issued a public statement acknowledging the investigation and the termination of the partner's relationship. The statement emphasized the firm’s commitment to ethical conduct and its zero-tolerance policy towards violations of its code of conduct. The partner in question faced termination, and further disciplinary actions might be pending.

- Public Relations Strategy Employed by PwC: The firm likely focused on a transparent and proactive approach, highlighting its commitment to ethical conduct and steps taken to address the issue.

- Internal Reforms Implemented: PwC is expected to enhance its compliance procedures, including stricter monitoring of employee investments, more rigorous conflict-of-interest checks, and improved training programs for its partners and employees.

- Commitment to Transparency and Ethical Conduct: The firm's response underscores its dedication to maintaining high ethical standards and regaining the trust of its clients and stakeholders.

Implications for the Broader Accounting Industry

The PwC US Partner Brokerage Relationship Termination incident has far-reaching implications for the entire accounting profession. It serves as a stark reminder of the critical importance of adherence to ethical codes and stringent regulatory compliance. The incident is likely to increase regulatory scrutiny of accounting firms, potentially leading to stricter rules and increased oversight.

- Potential for Increased Regulatory Scrutiny: Regulatory bodies might conduct more frequent audits and introduce stricter regulations to prevent similar incidents.

- Impact on PwC’s Reputation: The incident could tarnish PwC's reputation, impacting client relationships and future business opportunities.

- Lessons Learned for Other Accounting Firms: Other accounting firms need to review and strengthen their internal controls, compliance programs, and employee training to mitigate the risk of similar ethical breaches.

The PwC US Partner Brokerage Relationship Termination: Key Takeaways and Future Outlook

The internal investigation at PwC US, resulting in a partner's brokerage relationship termination, highlights the crucial need for strong ethical standards and robust compliance programs within the accounting industry. The incident underscores the potential consequences of violating regulations and failing to prevent conflicts of interest. The long-term effects remain to be seen, but the incident undoubtedly serves as a cautionary tale for the entire profession. To stay informed on further developments regarding this "PwC US Partner Brokerage Relationship Termination" and similar cases, subscribe to our updates or follow reputable financial news sources. Learn more about best ethical practices in accounting by exploring resources from leading professional organizations.

Featured Posts

-

Ftc Probes Open Ais Chat Gpt Implications For Ai Development

Apr 29, 2025

Ftc Probes Open Ais Chat Gpt Implications For Ai Development

Apr 29, 2025 -

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025 -

Porsches International Success An Australian Perspective

Apr 29, 2025

Porsches International Success An Australian Perspective

Apr 29, 2025 -

Capital Summertime Ball 2025 A Step By Step Ticket Guide For Harwich And Manningtree Residents

Apr 29, 2025

Capital Summertime Ball 2025 A Step By Step Ticket Guide For Harwich And Manningtree Residents

Apr 29, 2025 -

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

Apr 29, 2025

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

Apr 29, 2025

Latest Posts

-

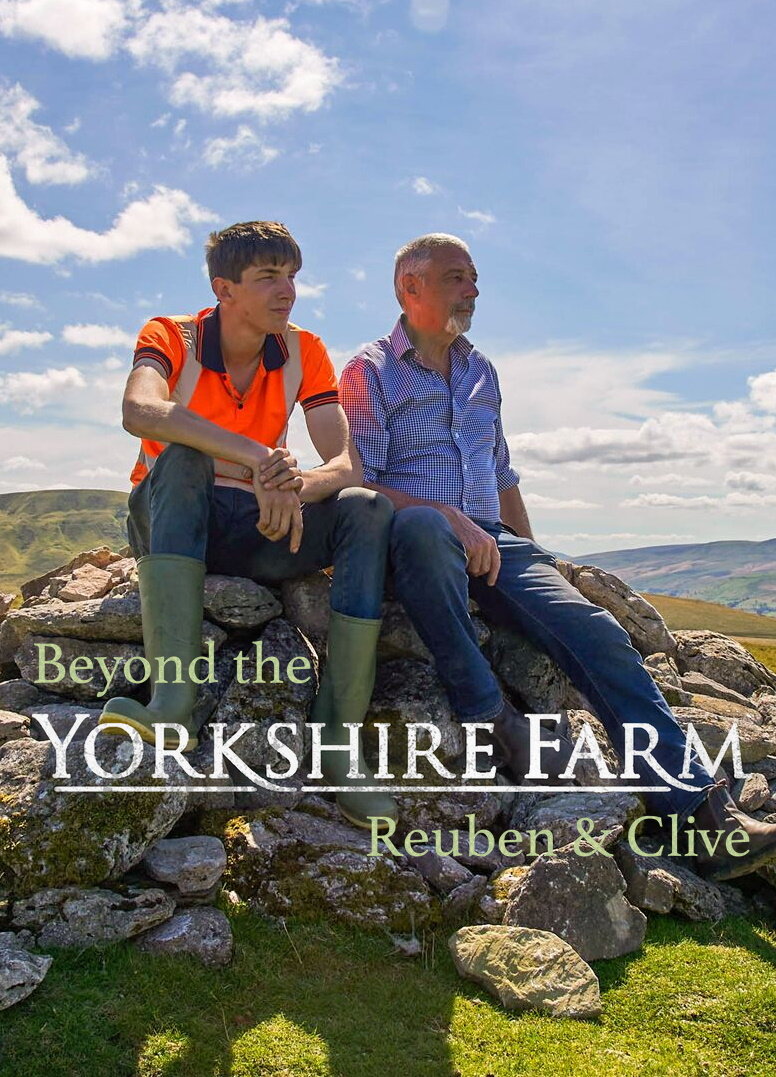

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025 -

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025 -

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025