PwC's African Retreat: Exit From Senegal, Gabon, Madagascar, And More

Table of Contents

PwC's Strategic Restructuring in Africa

PwC's African retreat is part of a broader global restructuring strategy focused on enhancing efficiency and profitability. The firm is adapting to evolving market conditions and a changing business landscape, necessitating a reassessment of its global footprint. This restructuring involves a consolidation of resources in key markets and a renewed emphasis on digital transformation services. The aim is to streamline operations, optimize resource allocation, and improve overall financial performance.

- Focus on efficiency and profitability: PwC is prioritizing markets with the highest growth potential and profitability. This involves divesting from less profitable operations.

- Adapting to changing market conditions: Economic volatility and shifting regulatory landscapes in certain African countries have influenced PwC's decision-making process.

- Consolidation of resources in key markets: PwC is concentrating its resources on strategically important African markets where it sees significant opportunities for growth.

- Increased focus on digital transformation: The firm is investing heavily in digital technologies and services, aligning its strategy with the growing demand for digital solutions across the continent.

Specific Countries Affected by PwC's African Retreat

Senegal

PwC's withdrawal from Senegal likely reflects a combination of factors, including market saturation and economic challenges within the Senegalese business environment. The impact on local clients involves the need for a smooth transition to alternative service providers. Employees affected by the restructuring will require support in finding new opportunities.

- Number of employees affected in Senegal: The exact number of employees affected has not been publicly disclosed by PwC.

- Client transition plans: PwC is likely working with its clients in Senegal to ensure a seamless transfer of services to other firms.

- Potential future presence in Senegal: At present, a return to Senegal seems unlikely, but future market conditions could potentially change this.

Gabon

The situation in Gabon is unique, shaped by specific economic factors and the Gabonese government's response to PwC's decision. The withdrawal reflects a strategic assessment of the long-term viability of its operations in the country, given prevailing economic conditions and competitive pressures.

- Economic factors affecting PwC's decision: Factors such as fluctuating oil prices and overall economic growth rates may have played a significant role.

- Gabonese government reaction: The government's reaction, if any, remains to be seen, though it will likely be focused on ensuring continued access to auditing and consulting services.

- Future prospects for auditing and consulting services in Gabon: The departure of PwC creates opportunities for local and regional firms to expand their market share.

Madagascar

Madagascar's specific economic and political landscape played a crucial role in PwC's decision to exit the market. The relatively small market size and a competitive landscape likely contributed to the strategic retreat.

- Market size and potential: Madagascar presents a smaller market compared to other African nations, making it less strategically important for PwC's overall operations.

- Competitive landscape: The existing competitive landscape may have made it difficult for PwC to maintain a profitable presence.

- Reasons for exit from Madagascar: A combination of economic and competitive pressures likely led to the decision.

Other Affected Countries

While Senegal, Gabon, and Madagascar are highlighted, PwC’s African retreat has reportedly affected other countries as well. Further research into specific news sources and official PwC statements is encouraged to identify these additional locations.

Impact on the African Business Landscape

PwC's retreat significantly impacts the African business landscape. It reduces access to international auditing and consulting expertise, potentially hindering growth in certain sectors. However, it also creates opportunities for local firms to expand and fill the void.

- Reduced access to international auditing and consulting expertise: Some businesses may find it challenging to secure the same level of expertise previously provided by PwC.

- Opportunities for local firms to fill the gap: Local firms can benefit from increased demand for auditing and consulting services.

- Potential for increased competition among remaining international firms: Remaining international firms may experience intensified competition as they strive to acquire PwC's former clients.

- Impact on foreign investment in Africa: The retreat might affect the perception of the African market among foreign investors, though this impact is likely to be relatively limited.

PwC's Future Strategy in Africa

PwC's future strategy in Africa will likely focus on consolidating its presence in key markets, prioritizing growth in specific sectors like technology and finance. It will involve a carefully planned geographic concentration strategy, focusing on regions with high growth potential.

- Focus on specific sectors (e.g., technology, finance): PwC will likely target sectors experiencing significant growth and technological disruption.

- Geographic concentration strategy: Resources will be concentrated in markets offering the greatest returns on investment.

- Plans for future investment in Africa: PwC will probably continue to invest in Africa, but in a more targeted and selective manner.

Conclusion

PwC's African retreat, encompassing exits from Senegal, Gabon, Madagascar, and other countries, represents a significant strategic shift. While the reasons are multifaceted, involving global strategy and market dynamics, the impact on Africa's business environment will be profound. This PwC African retreat presents both challenges and opportunities, necessitating adaptation among local firms and strategic reassessment for international players. To remain informed on the evolving ramifications of the PwC African retreat, continue following reputable business news. Understanding this situation is vital for any business operating within, or contemplating investment in, the African continent.

Featured Posts

-

Reliance Industries Shares Post Significant Gains Following Earnings Announcement

Apr 29, 2025

Reliance Industries Shares Post Significant Gains Following Earnings Announcement

Apr 29, 2025 -

2025 International Games The Packers Potential Participation

Apr 29, 2025

2025 International Games The Packers Potential Participation

Apr 29, 2025 -

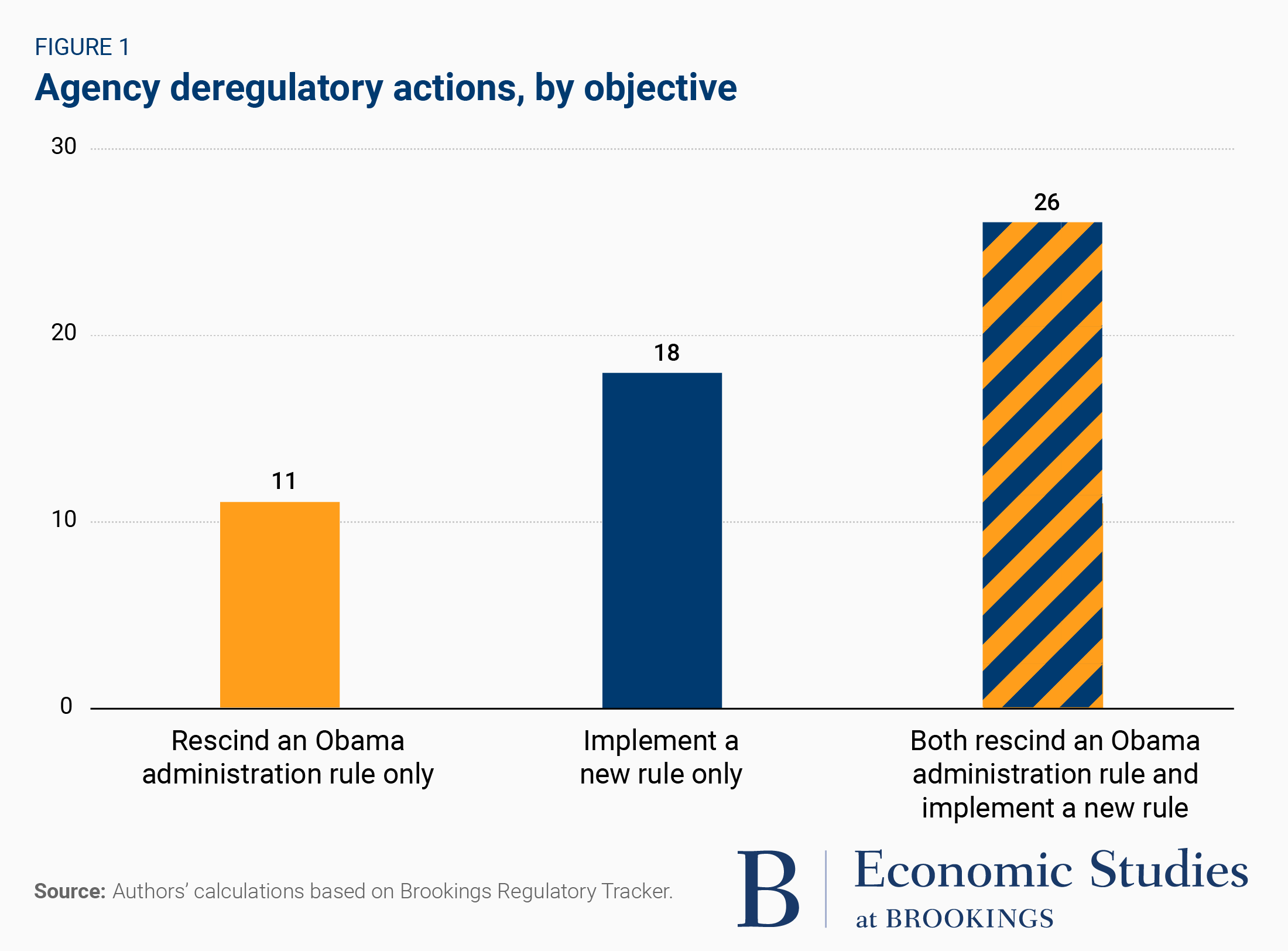

100 Days After Evaluating Trumps Trade Deals Deregulation Efforts And Executive Actions

Apr 29, 2025

100 Days After Evaluating Trumps Trade Deals Deregulation Efforts And Executive Actions

Apr 29, 2025 -

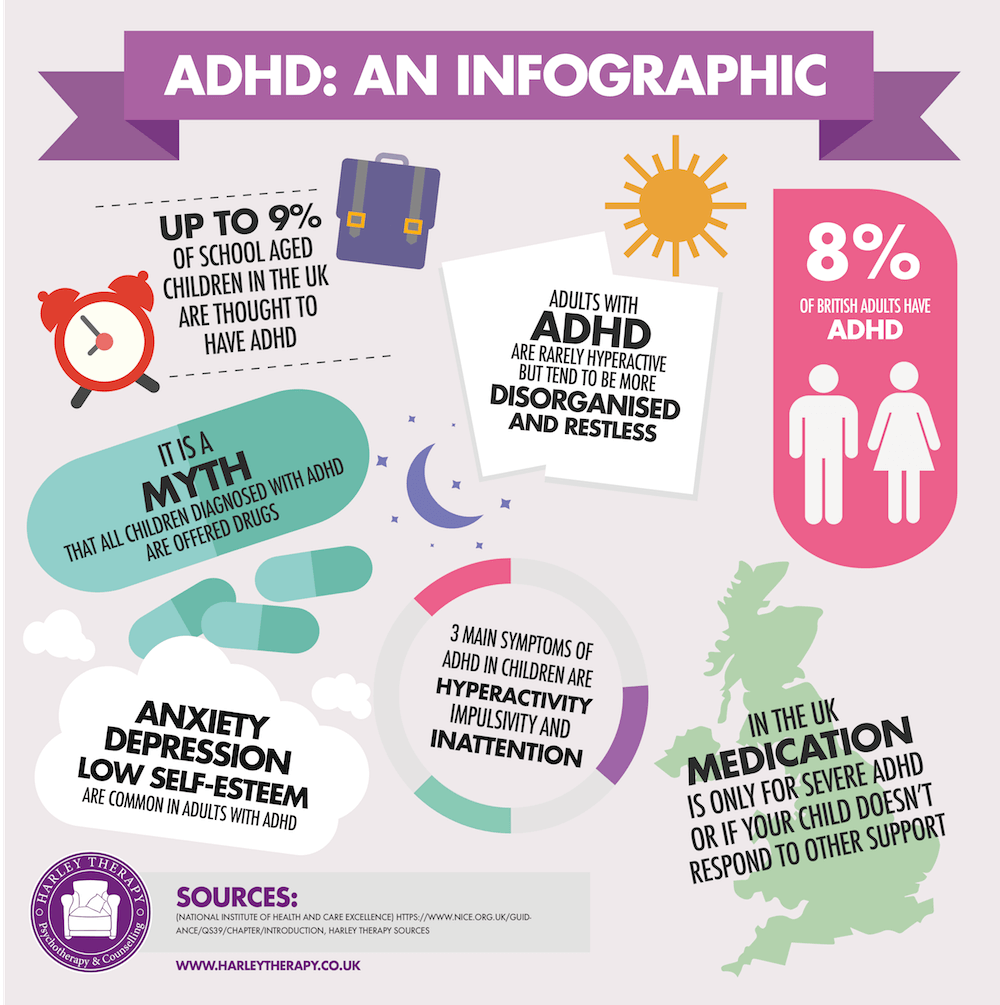

Adult Adhd Understanding Your Symptoms And Seeking Help

Apr 29, 2025

Adult Adhd Understanding Your Symptoms And Seeking Help

Apr 29, 2025 -

Spain Vs Usa An Americans Tale Of Two Very Different Lives

Apr 29, 2025

Spain Vs Usa An Americans Tale Of Two Very Different Lives

Apr 29, 2025

Latest Posts

-

Amanda Owen Ravenseat Farm Faces New Challenges

Apr 30, 2025

Amanda Owen Ravenseat Farm Faces New Challenges

Apr 30, 2025 -

Amanda Owens Strength And Resilience In The Wake Of Her Divorce

Apr 30, 2025

Amanda Owens Strength And Resilience In The Wake Of Her Divorce

Apr 30, 2025 -

Amanda Owen Addresses Recent Challenges Following Split From Clive Owen

Apr 30, 2025

Amanda Owen Addresses Recent Challenges Following Split From Clive Owen

Apr 30, 2025 -

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025 -

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025