PwC's African Retreat: Reasons Behind The Exit From Nine Countries

Table of Contents

Financial Viability and Profitability Challenges in Specific Markets

Operating in Africa presents unique financial challenges. The diverse economic landscapes across the continent mean that profitability varies significantly from country to country. PwC's decision to withdraw from certain markets suggests struggles with sustained profitability in specific regions.

Several factors contributed to these financial difficulties:

- High Operating Costs: Many African nations have high operating costs, including expenses related to infrastructure, security, and talent acquisition. These costs can significantly impact profit margins, especially in smaller markets with limited client bases.

- Limited Client Base: In some sectors and regions, the demand for PwC's services may be limited, leading to insufficient revenue generation to offset operational expenses. This is particularly true in countries with less developed economies or those experiencing economic downturns.

- Difficulties in Recovering Fees: Collecting fees from clients can be challenging in certain African markets due to various factors, including delayed payments, currency fluctuations, and bureaucratic hurdles. This impacts cash flow and overall financial health.

- Currency Fluctuations and Exchange Rate Risks: The volatility of African currencies poses significant risks for multinational corporations. Unfavorable exchange rates can erode profits and make it difficult to maintain a stable financial position.

Regulatory and Compliance Concerns in Africa

Navigating the regulatory landscape in Africa is notoriously complex. Each country has its own unique set of laws, regulations, and accounting standards, creating a significant compliance burden for multinational firms. This complexity played a key role in PwC's decision to withdraw from some markets.

Key compliance challenges include:

- Stringent Compliance Requirements: Meeting the diverse and often stringent compliance requirements across different African countries adds significant operational costs and administrative overhead.

- Risks Associated with Non-Compliance: Non-compliance with local regulations can result in substantial penalties, legal repercussions, and reputational damage, potentially outweighing the benefits of operating in those markets.

- Difficulties in Managing Diverse Regulatory Frameworks: The sheer complexity of managing different regulatory frameworks across multiple countries creates logistical and administrative challenges, requiring specialized expertise and significant resources.

- Specific Regulatory Hurdles: Examples of specific regulatory hurdles faced by PwC in certain countries might include difficulties in obtaining necessary licenses or permits, complex tax laws, or stringent anti-corruption regulations.

Strategic Realignment and Focus on Key Markets

PwC's decision to withdraw from nine African countries is also part of a broader strategic realignment. The firm is likely prioritizing resource allocation towards larger, more profitable markets in Africa and globally. This strategic shift focuses on maximizing returns and strengthening its position in key sectors.

The strategic realignment involves:

- Resource Allocation: PwC is likely reallocating resources to high-growth potential markets in Africa where they see greater opportunities for expansion and profitability.

- Focus on Key Sectors: The firm is likely focusing on expanding its services in key sectors like technology and finance, where the demand for professional services is expected to grow significantly in the coming years.

- Consolidation of Operations: Consolidating operations in key markets allows for greater efficiency and resource optimization. This can lead to cost savings and improved profitability.

- Strengthening Presence in Key Countries: While withdrawing from some markets, PwC is likely strengthening its presence and expanding its services in other key African countries where they see significant opportunities for growth.

Impact on PwC's Reputation and Future Strategy in Africa

While PwC's withdrawal from certain African markets might raise concerns about its commitment to the continent, it is crucial to view this move within the context of its overall global strategy. This strategic retreat does not necessarily signal a complete disengagement from Africa.

The long-term impact includes:

- Maintaining a Presence: PwC maintains a presence in key African countries, demonstrating its ongoing commitment to the continent.

- Alternative Service Models: The firm may explore alternative models for serving clients in the exited markets, such as partnering with local firms or leveraging technology to provide remote services.

- Strengthening Client Relationships: Maintaining strong relationships with existing clients is paramount, ensuring a smooth transition and minimizing any negative impact on their businesses.

- Transparent Communication: Open and transparent communication about the strategic decisions is crucial for maintaining its reputation and building trust with stakeholders.

Conclusion: Assessing the Long-Term Implications of PwC's African Retreat

PwC's exit from nine African countries is a complex issue driven by a combination of financial viability challenges, regulatory hurdles, and strategic realignment. Operating in diverse African markets presents unique and significant complexities. However, PwC's continued presence in several key African nations shows its commitment to the continent's long-term development. The firm’s future strategy likely involves a more targeted and focused approach, prioritizing markets with higher growth potential and aligning resources with key strategic objectives. We encourage readers to share their thoughts on PwC's African Retreat and join the discussion on the challenges and opportunities facing multinational firms operating in Africa. [Insert link to relevant PwC resources here, if available].

Featured Posts

-

Ais Limited Thinking A Closer Look At Current Capabilities

Apr 29, 2025

Ais Limited Thinking A Closer Look At Current Capabilities

Apr 29, 2025 -

Analyse Deutsche Teams In Champions League K O Duellen

Apr 29, 2025

Analyse Deutsche Teams In Champions League K O Duellen

Apr 29, 2025 -

Sanctuary Cities Under Scrutiny Trumps New Executive Order

Apr 29, 2025

Sanctuary Cities Under Scrutiny Trumps New Executive Order

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information And Purchase Guide

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information And Purchase Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Tips And Strategies For Harwich And Manningtree

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Tips And Strategies For Harwich And Manningtree

Apr 29, 2025

Latest Posts

-

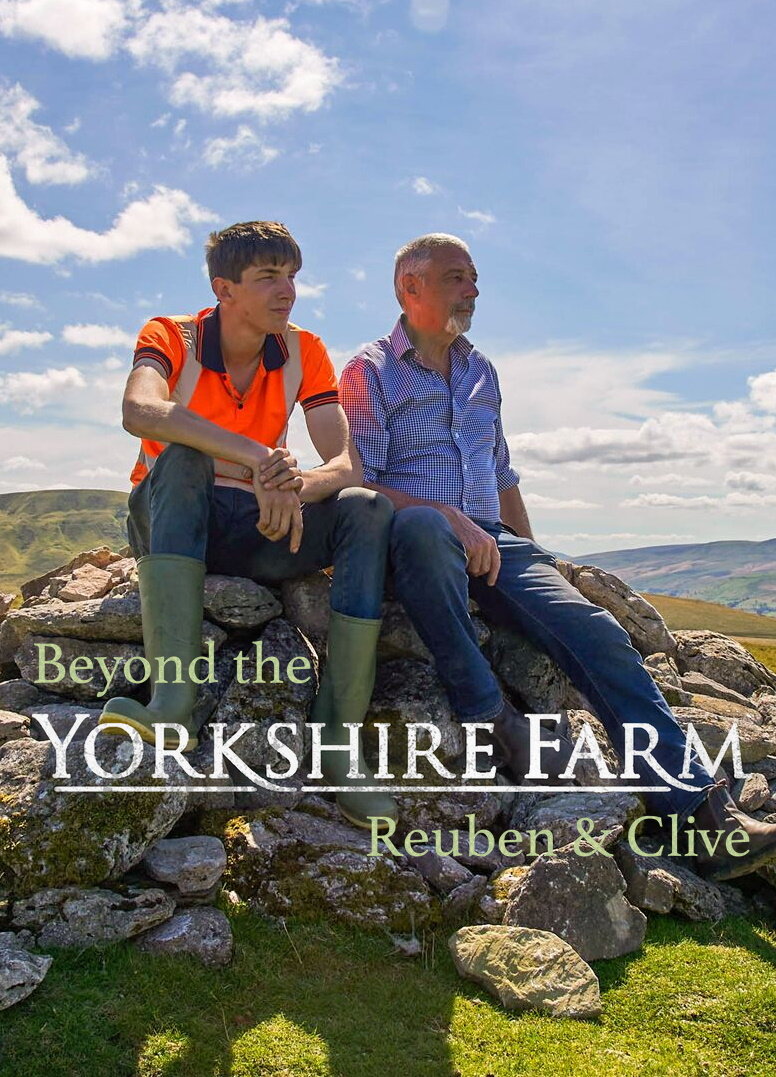

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025 -

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025 -

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025