PwC's Departure: A Case Study Of Nine Sub-Saharan African Countries

Table of Contents

Reasons for PwC's Withdrawal

PwC's decision wasn't arbitrary; it stemmed from a confluence of factors, primarily regulatory hurdles and unfavorable economic conditions.

Regulatory Scrutiny and Compliance

Increased regulatory pressure and stricter compliance requirements played a significant role. Meeting international auditing standards (IAS) and adapting to the diverse local regulations across nine countries proved exceptionally challenging for PwC. This created a considerable reputational risk, particularly given the global scrutiny surrounding auditing practices.

- Increased compliance costs: Implementing and maintaining compliance with ever-evolving regulations significantly increased operational costs for PwC.

- Difficulties in harmonizing standards: The lack of harmonization between international and local accounting standards created complexities and inconsistencies in auditing practices.

- Risk of sanctions and penalties: Non-compliance with regulations exposed PwC to potential fines, legal action, and reputational damage, impacting their global brand.

- Example: Specific instances of regulatory hurdles in individual countries (e.g., difficulties in obtaining necessary licenses or navigating complex tax regulations) could be investigated further to provide deeper insight into PwC's withdrawal decision.

Economic Factors and Market Conditions

Beyond regulatory concerns, economic factors significantly influenced PwC's decision. The affected markets presented challenges related to profitability, competition, and stability.

- Limited profitability: Return on investment (ROI) in these markets may have fallen below PwC's global standards, prompting a reassessment of resource allocation.

- Intense competition: The presence of both local and international accounting firms created a highly competitive landscape, reducing pricing power and profit margins.

- Economic instability and political risk: Political uncertainty and economic volatility in some regions presented significant challenges for long-term operational planning and investment.

- Talent acquisition and retention: Attracting and retaining highly skilled professionals in these markets proved difficult, particularly given competition from other industries and international organizations.

Impact on Affected Countries

PwC's departure carries significant implications for the nine Sub-Saharan African countries involved. The impact spans audit services, financial reporting, and the wider economic landscape.

Implications for Audit and Assurance Services

The withdrawal of a major international player like PwC leaves a void in the audit and assurance services landscape.

- Reduced access to high-quality audits: Businesses, particularly larger corporations and those seeking foreign investment, now face reduced access to high-quality audits conducted by a globally recognized firm.

- Diminished investor confidence: The absence of PwC may negatively impact investor confidence, potentially hindering foreign direct investment (FDI) in these countries.

- Increased reliance on smaller firms: Businesses will likely shift to smaller, local accounting firms, some of which may lack the resources and expertise to conduct equally rigorous audits.

- Challenges in maintaining audit independence: Maintaining the independence and objectivity of audits becomes more challenging when the pool of potential auditors shrinks.

Economic and Financial Consequences

The long-term economic and financial consequences of PwC's withdrawal are potentially substantial.

- Negative impact on economic growth: Reduced investor confidence and the potential for increased financial reporting irregularities could negatively impact economic growth.

- Hindered foreign investment: Foreign investors may be hesitant to invest in countries with perceived weaknesses in auditing and financial reporting standards.

- Increased financial reporting irregularities: A weakened audit landscape may lead to an increase in financial reporting irregularities and fraudulent activities.

- Impact on financial market stability: The credibility of financial markets in these countries could be undermined, potentially leading to increased volatility and reduced investor participation.

Future Implications and Strategies

Addressing the challenges created by PwC's departure requires proactive strategies focused on strengthening local capacity and attracting alternative auditors.

Strengthening Local Capacity

Investing in local accounting talent and infrastructure is crucial.

- Investing in education and training: Significant investments in training programs for local accountants are needed to improve their skills and expertise in international accounting standards.

- Developing robust regulatory frameworks: Strengthening regulatory frameworks and improving enforcement mechanisms are essential to ensuring compliance and maintaining high audit standards.

- Promoting cooperation: Collaboration between international and local accounting firms can facilitate knowledge transfer and capacity building.

- Building resilient local institutions: Establishing and supporting strong, independent local audit institutions is essential for the long-term stability of the financial sector.

Attracting Alternative Auditors

Attracting other multinational auditing firms to these markets is vital to fill the gap left by PwC.

- Improving the business environment: Creating a more attractive business environment, reducing bureaucratic obstacles, and improving transparency and accountability in government and business are crucial.

- Targeted policy initiatives: Governments can implement specific policies to attract foreign investment and encourage other international accounting firms to establish operations in these countries.

- Promoting transparency and good governance: Stronger governance and transparency initiatives will attract more investment and improve investor confidence.

Conclusion:

PwC's withdrawal from nine Sub-Saharan African countries presents a significant challenge. The reasons are complex, involving both regulatory and economic factors. The impact on these countries could be profound, impacting audit quality, investor confidence, and economic growth. Addressing this requires a multifaceted approach: strengthening local capacity, attracting alternative audit providers, and improving the overall business environment. Failure to act decisively risks hindering economic development and destabilizing these vital markets. Therefore, understanding the implications of PwC's departure is crucial for policymakers, businesses, and investors in Sub-Saharan Africa. Further research and focused action on mitigating the risks associated with this withdrawal are paramount for the continued development of these nations.

Featured Posts

-

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025 -

Adhd

Apr 29, 2025

Adhd

Apr 29, 2025 -

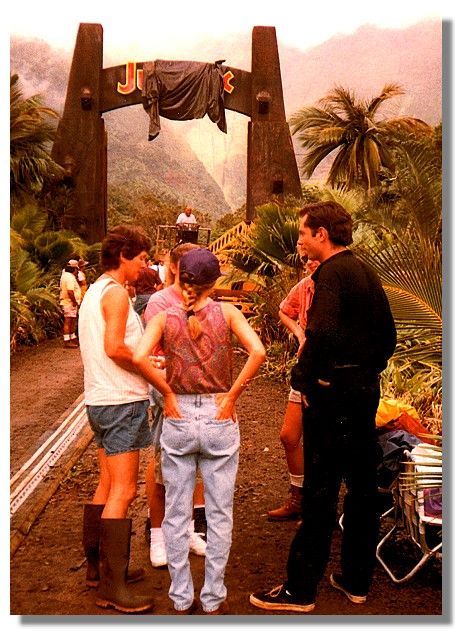

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025

Behind The Scenes Jeff Goldblum And The Flys Ending

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025

Latest Posts

-

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025 -

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025 -

Amanda Owen And Clive Owen The Latest Developments In Their Divorce

Apr 30, 2025

Amanda Owen And Clive Owen The Latest Developments In Their Divorce

Apr 30, 2025 -

Amanda Owens Emotional Response To Clive Owen Split A New Chapter

Apr 30, 2025

Amanda Owens Emotional Response To Clive Owen Split A New Chapter

Apr 30, 2025 -

Amanda Owens Post Divorce Business Ventures And Family Life

Apr 30, 2025

Amanda Owens Post Divorce Business Ventures And Family Life

Apr 30, 2025