PwC's Global Retreat: Analysis Of Country Exits Following Accounting Scandals (Bangkok Post)

Table of Contents

PwC, one of the "Big Four" accounting firms, has recently undertaken a strategic retreat, withdrawing from several countries amidst increased scrutiny following a series of high-profile accounting scandals. This article analyzes the factors contributing to this "global retreat," examining the aftermath of significant accounting scandals and their implications for PwC's future strategy and the global accounting landscape. We will delve into specific country examples and explore the broader consequences for regulatory oversight and investor confidence. The impact of these events extends far beyond PwC, affecting the entire accounting profession and demanding a reassessment of transparency and accountability standards.

The Impact of High-Profile Accounting Scandals on PwC's Reputation

Damage to Brand Trust and Client Confidence

The damage to PwC's reputation following several accounting scandals has been significant, leading to a loss of client trust and considerable financial repercussions. Specific scandals have eroded public confidence in the firm's auditing practices and ability to ensure financial transparency.

- Example 1: [Insert Country and brief description of a specific scandal, including relevant dates and key figures involved. Quantify the financial impact if possible. E.g., "In Country X, PwC's audit of Company Y was heavily criticized for overlooking [specific issues], resulting in a multi-million dollar fine and significant reputational damage." ]

- Example 2: [Insert Country and brief description of another scandal. Follow the same format as above.]

- Example 3: [Insert Country and brief description of another scandal. Follow the same format as above.]

The loss of clients, both large corporations and smaller businesses, is substantial. The resulting decrease in revenue streams directly impacts PwC's profitability and necessitates strategic restructuring. Furthermore, the scandals have shaken investor confidence, causing concerns about the reliability of financial statements audited by PwC, potentially affecting stock valuations and investment decisions.

Increased Regulatory Scrutiny and Fines

Following the scandals, PwC has faced intensified regulatory scrutiny in various jurisdictions. This increased oversight has resulted in significant financial penalties and operational challenges.

- Increased Investigations: Regulatory bodies are conducting more thorough investigations into PwC's auditing practices and internal controls.

- Heavier Fines: Substantial fines and penalties have been levied in several countries for failing to meet regulatory standards and ethical obligations. This adds significant costs to the firm's operations.

- Enhanced Compliance Requirements: PwC is now subjected to stricter compliance requirements, demanding increased resources and expertise to navigate the complex regulatory landscape. This translates to higher operational costs and potential delays in project completion.

Strategic Decisions: Country Exits and Restructuring

Analyzing Specific Country Withdrawals

PwC's strategic response has included withdrawing from or significantly scaling back operations in several countries. These decisions are often linked to a combination of factors: unfavorable regulatory environments, unsustainable market conditions, and persistent reputational damage.

- [Country A]: [Explain the reasons for PwC's withdrawal or scaled-back operations in this specific country, citing specific events and regulatory pressures. Mention the impact on the local accounting market.]

- [Country B]: [Explain the reasons for PwC's withdrawal or scaled-back operations in this specific country, citing specific events and regulatory pressures. Mention the impact on the local accounting market.]

- [Country C]: [Explain the reasons for PwC's withdrawal or scaled-back operations in this specific country, citing specific events and regulatory pressures. Mention the impact on the local accounting market.]

Restructuring and Future Global Strategy

The country exits are part of a broader restructuring strategy aimed at enhancing PwC's risk management, improving compliance procedures, and strengthening internal controls. This includes:

- Investment in Technology: Implementing advanced technology to improve audit quality and efficiency.

- Enhanced Training Programs: Investing in rigorous training for auditors to uphold ethical standards and professional competence.

- Strengthened Internal Controls: Implementing more robust internal control systems to prevent future accounting scandals.

This restructuring is critical to safeguarding PwC's future competitive position in the increasingly demanding global market.

The Broader Implications for the Accounting Profession

Increased Demand for Transparency and Accountability

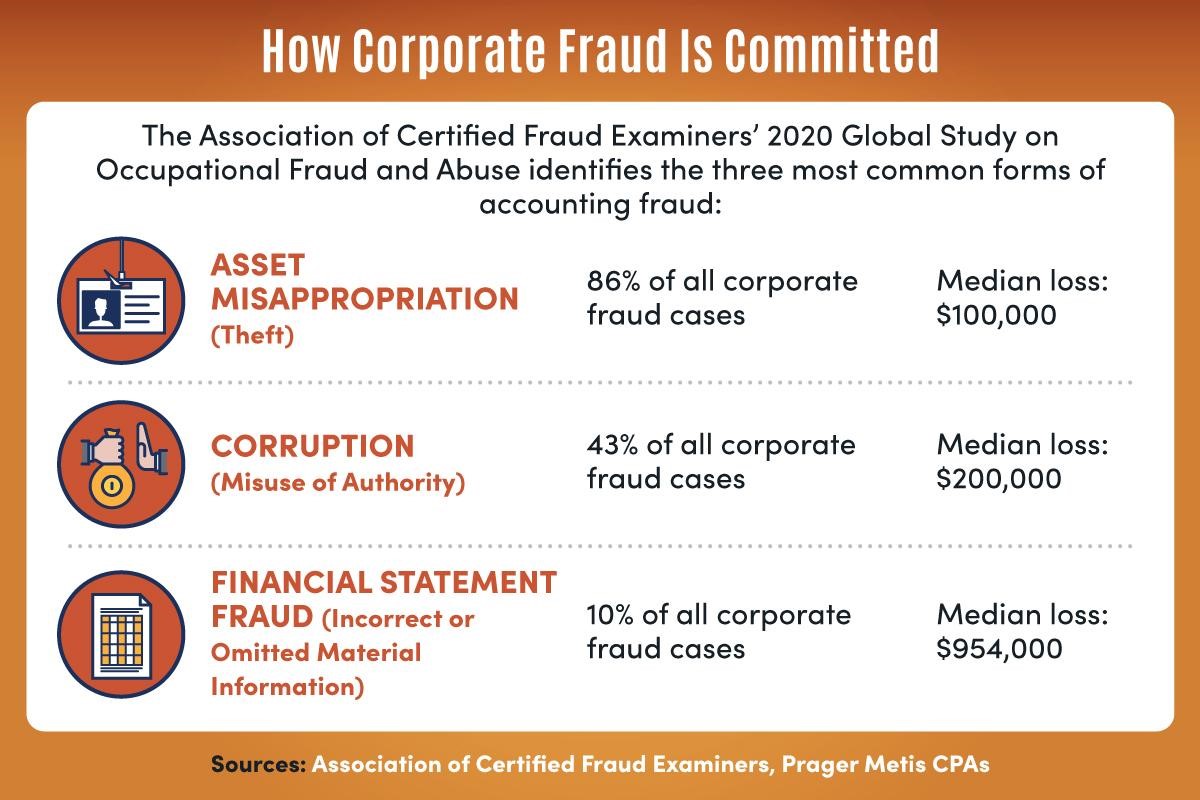

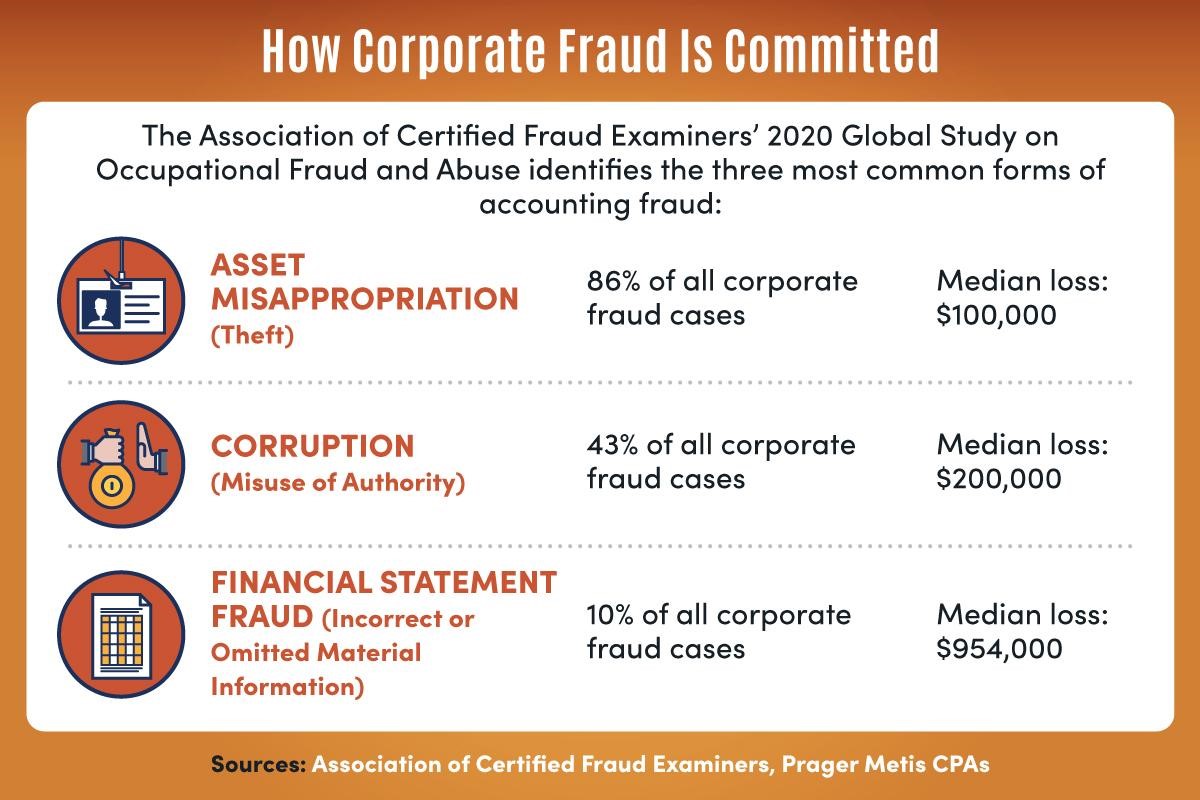

The PwC scandals have intensified calls for greater transparency and accountability within the accounting profession. This includes:

- Strengthening Regulatory Oversight: Regulatory bodies need to enhance their oversight of accounting firms to prevent future scandals.

- Improving Investor Protection: Measures need to be implemented to better protect investors from fraudulent financial reporting.

- Enhancing International Accounting Standards: International accounting standards need continuous review and improvement to adapt to evolving business models and prevent manipulation.

The Future of the Big Four Accounting Firms

The events surrounding PwC's global retreat have significant implications for the Big Four accounting firms and the future of the industry. These events may lead to:

- Increased Competition: Smaller accounting firms may gain market share due to concerns about the Big Four's reliability.

- Industry Consolidation: Mergers and acquisitions might become more prevalent to strengthen market positions.

- Changes in Audit Methodologies: There may be a shift towards more rigorous and technology-driven audit methodologies.

Conclusion:

This analysis of PwC's strategic retreat reveals a complex interplay between high-profile accounting scandals, increased regulatory pressure, and the firm's own strategic responses. The events highlight a critical need for greater transparency, accountability, and robust regulatory oversight within the accounting profession. PwC's actions, while impacting its global presence, also underscore the evolving landscape of the global accounting industry.

Call to Action: Understanding the implications of PwC's global retreat is crucial for investors, businesses, and regulators alike. Stay informed on developments in the accounting world and the impact of these scandals by following further analysis and commentary on PwC accounting scandals and their global repercussions.

Featured Posts

-

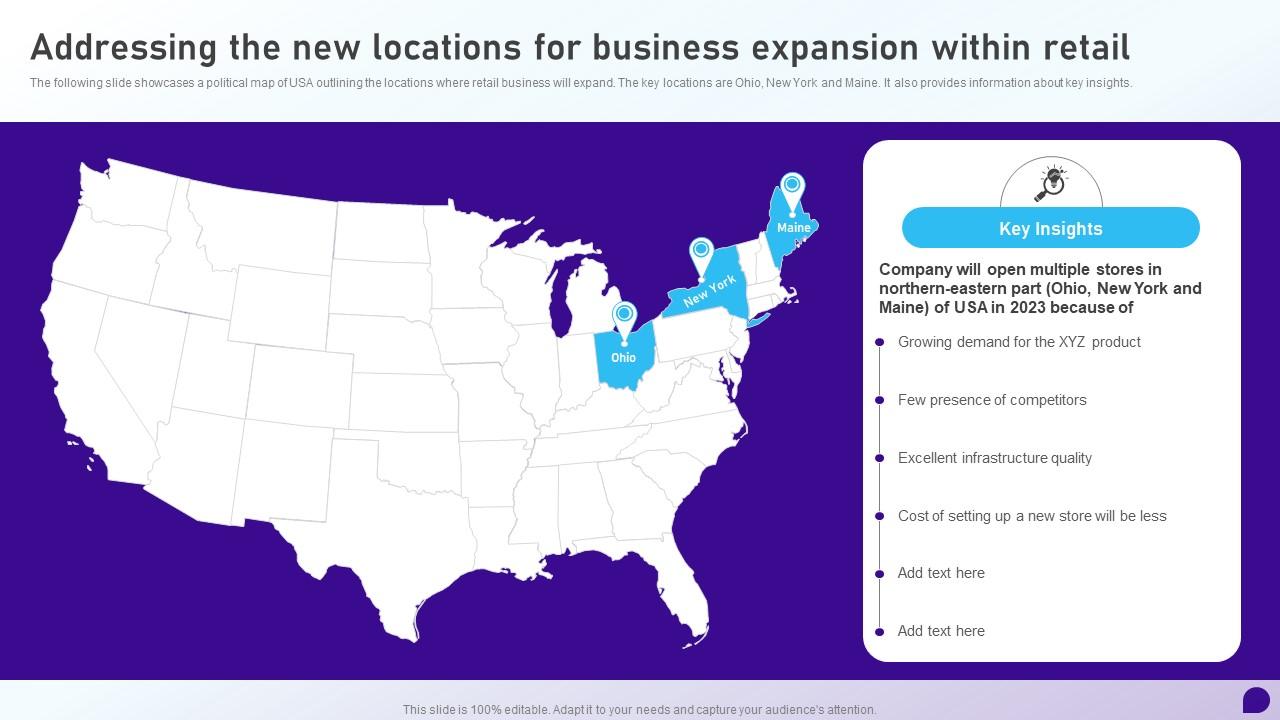

Mapping The Countrys Hottest New Business Locations

Apr 29, 2025

Mapping The Countrys Hottest New Business Locations

Apr 29, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

Apr 29, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

Apr 29, 2025 -

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

Apr 29, 2025

Cassidy Hutchinsons Memoir Key Witness To January 6th Details Plans For Fall Release

Apr 29, 2025 -

Fc Kaiserslautern Vs Bayern Muenchen Champions League Begegnung

Apr 29, 2025

Fc Kaiserslautern Vs Bayern Muenchen Champions League Begegnung

Apr 29, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony To Feature In Upcoming Memoir

Apr 29, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony To Feature In Upcoming Memoir

Apr 29, 2025

Latest Posts

-

Amanda Owen Ravenseat Farm Faces New Challenges

Apr 30, 2025

Amanda Owen Ravenseat Farm Faces New Challenges

Apr 30, 2025 -

Amanda Owens Strength And Resilience In The Wake Of Her Divorce

Apr 30, 2025

Amanda Owens Strength And Resilience In The Wake Of Her Divorce

Apr 30, 2025 -

Amanda Owen Addresses Recent Challenges Following Split From Clive Owen

Apr 30, 2025

Amanda Owen Addresses Recent Challenges Following Split From Clive Owen

Apr 30, 2025 -

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025

Amanda Owens Next Chapter Life Work And Family After Divorce

Apr 30, 2025 -

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025

The Future Of Amanda Owen Ambitions And Challenges After Split

Apr 30, 2025