PwC's Strategic Shift: Leaving Nine African Nations

Table of Contents

PricewaterhouseCoopers (PwC), a global giant in professional services, has announced a significant strategic shift, withdrawing its operations from nine African nations. This decision, impacting its audit, consulting, and tax services, has sent ripples through Africa's economic landscape, sparking considerable debate about the future of international business on the continent. This article will delve into the reasons behind PwC's departure, its impact on affected countries, and the broader consequences for the African business environment. The PwC Africa withdrawal represents a pivotal moment, prompting a critical examination of the challenges and opportunities within the continent's evolving business climate.

Reasons Behind PwC's Withdrawal from Nine African Nations

Keywords: Market challenges, profitability, regulatory hurdles, risk assessment, strategic review, cost-benefit analysis, operational efficiency.

PwC's decision to exit nine African nations wasn't arbitrary. It stems from a comprehensive strategic review, weighing the cost-benefit analysis of maintaining operations in these specific markets. Several key factors contributed to this significant shift:

-

Unsustainable Profitability: In certain markets, the return on investment simply didn't justify the continued operational costs. Maintaining a presence in low-profitability regions requires substantial resources, diverting them from more lucrative areas.

-

Increased Regulatory Complexities: Navigating the regulatory landscape in some African nations proved increasingly challenging and costly. Compliance requirements, bureaucratic hurdles, and shifting regulations added significant operational burdens.

-

Strategic Portfolio Reassessment: PwC conducted a global portfolio review, reallocating resources to regions with higher growth potential and better alignment with its overall strategic objectives. This involved a difficult but necessary prioritization of markets.

-

Focus on Higher-Growth Markets: The firm is focusing its investments on markets offering more significant opportunities for growth and expansion, allowing for greater profitability and sustainable long-term success.

-

Risk Assessment and Mitigation: Operating in some politically or economically unstable regions presents inherent risks. PwC's decision reflects a proactive approach to risk management, prioritizing stability and security for its operations and employees.

-

Talent Acquisition and Retention: Attracting and retaining skilled professionals in certain locations proved difficult, adding another layer of operational complexity. This talent shortage impacted the overall effectiveness and efficiency of operations.

Impact on the Affected African Nations

Keywords: Job losses, economic consequences, audit market disruption, alternative service providers, business continuity, investor confidence.

PwC's withdrawal has immediate and long-term implications for the affected African nations. The consequences are multifaceted:

-

Job Losses: The most immediate impact is the loss of jobs within PwC itself, as well as the ripple effect on related industries. Support staff, suppliers, and even clients may experience knock-on effects.

-

Audit Market Disruption: The departure of a major player like PwC disrupts the audit and accounting sector, increasing the workload on remaining service providers. This may lead to capacity constraints and potentially higher costs for businesses.

-

Impact on Foreign Direct Investment (FDI): PwC's exit could negatively affect investor confidence, potentially discouraging future foreign direct investment. International investors often look to the presence of established global firms as a sign of market stability and credibility.

-

Need for Local Capacity Building: The departure creates an opportunity for local accounting and consulting firms to expand their services and develop greater expertise. This requires investment in training and development to meet the growing demand.

-

Business Continuity Challenges: Some businesses reliant on PwC's services may face challenges ensuring business continuity. Finding suitable replacement providers and adapting to new service structures will take time and resources.

Specific Countries Affected and their Unique Circumstances

Keywords: [List specific countries PwC is leaving – e.g., Burundi, Eritrea, etc.] – followed by relevant keywords for each country like economic conditions, political stability, etc.

This section would list the nine specific countries and provide a brief overview of their unique economic and political circumstances that contributed to PwC's decision. For example, a country with significant political instability might be highlighted as a higher-risk environment. Another might be described in terms of its challenging business regulatory framework.

The Broader Implications for International Business in Africa

Keywords: Foreign investment, economic development, regulatory environment, business climate, market access, growth potential.

PwC's decision sends a signal to the international business community about the challenges of operating in certain African markets. It emphasizes the importance of a supportive regulatory environment and stable business climate for attracting and retaining foreign investment.

-

Regulatory Improvements Crucial: The need for improved regulatory frameworks, reduced bureaucracy, and predictable legal systems cannot be overstated. A clear and consistent regulatory environment builds investor confidence and encourages economic development.

-

Stable Business Climate Essential: Political stability, economic predictability, and a low level of corruption are crucial for attracting foreign investment. These factors influence the risk assessment conducted by international businesses.

-

Opportunities for Local Firms: PwC's withdrawal creates opportunities for local firms to expand their market share and provide services to a wider client base. This emphasizes the importance of capacity building and investment in local talent.

-

Market Access and Growth Potential: While challenges remain, Africa's long-term growth potential is undeniable. Addressing the issues highlighted by PwC's decision is essential to unlocking this potential and attracting further foreign investment.

Conclusion

PwC's strategic retreat from nine African nations is a significant development with far-reaching consequences for the continent's economy. The decision underscores the challenges faced by international businesses in navigating specific African markets, highlighting the need for improved regulatory environments and a stable, predictable business climate. While the immediate impacts may be negative in some areas, it also presents opportunities for local firms to grow and meet the increased demand for professional services. Understanding the complexities of this strategic shift is crucial for businesses operating in or considering expansion into the African market. To stay informed about the evolving landscape and make informed decisions regarding your business in Africa, continue to monitor news and analysis on PwC Africa and related market trends. Staying abreast of developments related to PwC Africa and the wider African business environment is crucial for informed decision-making.

Featured Posts

-

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025 -

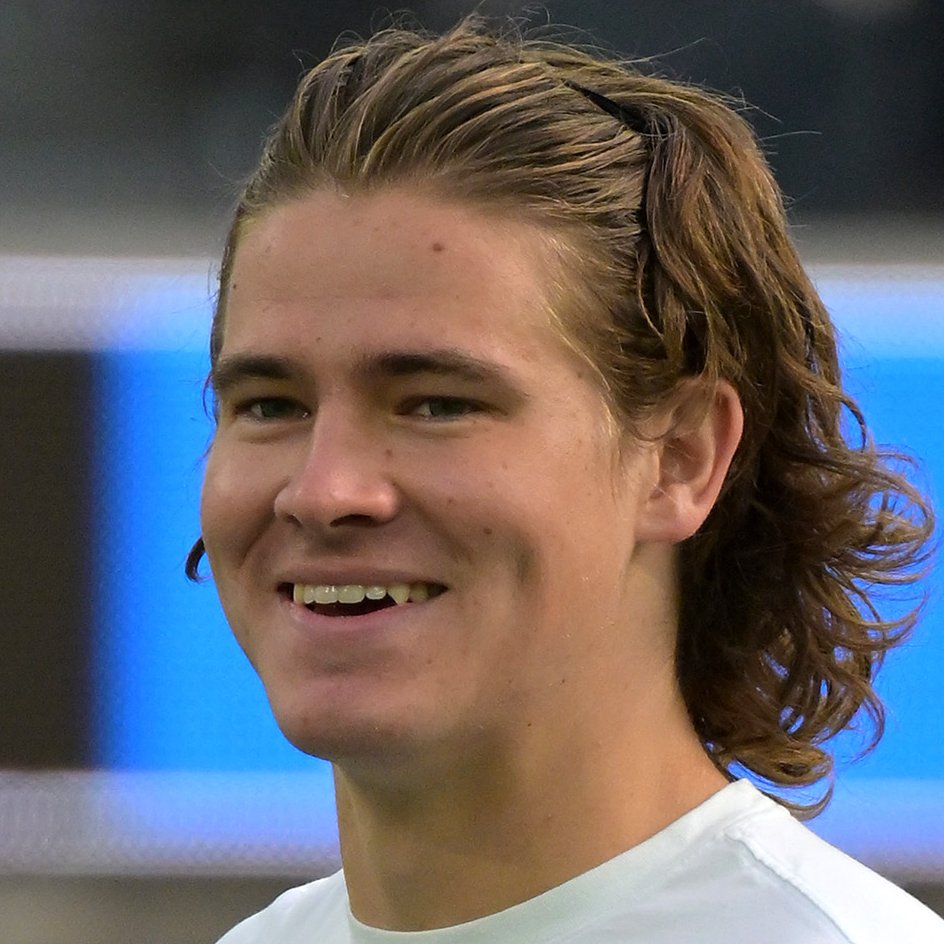

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 29, 2025 -

Understanding Pw Cs Decision To Leave Nine African Markets

Apr 29, 2025

Understanding Pw Cs Decision To Leave Nine African Markets

Apr 29, 2025 -

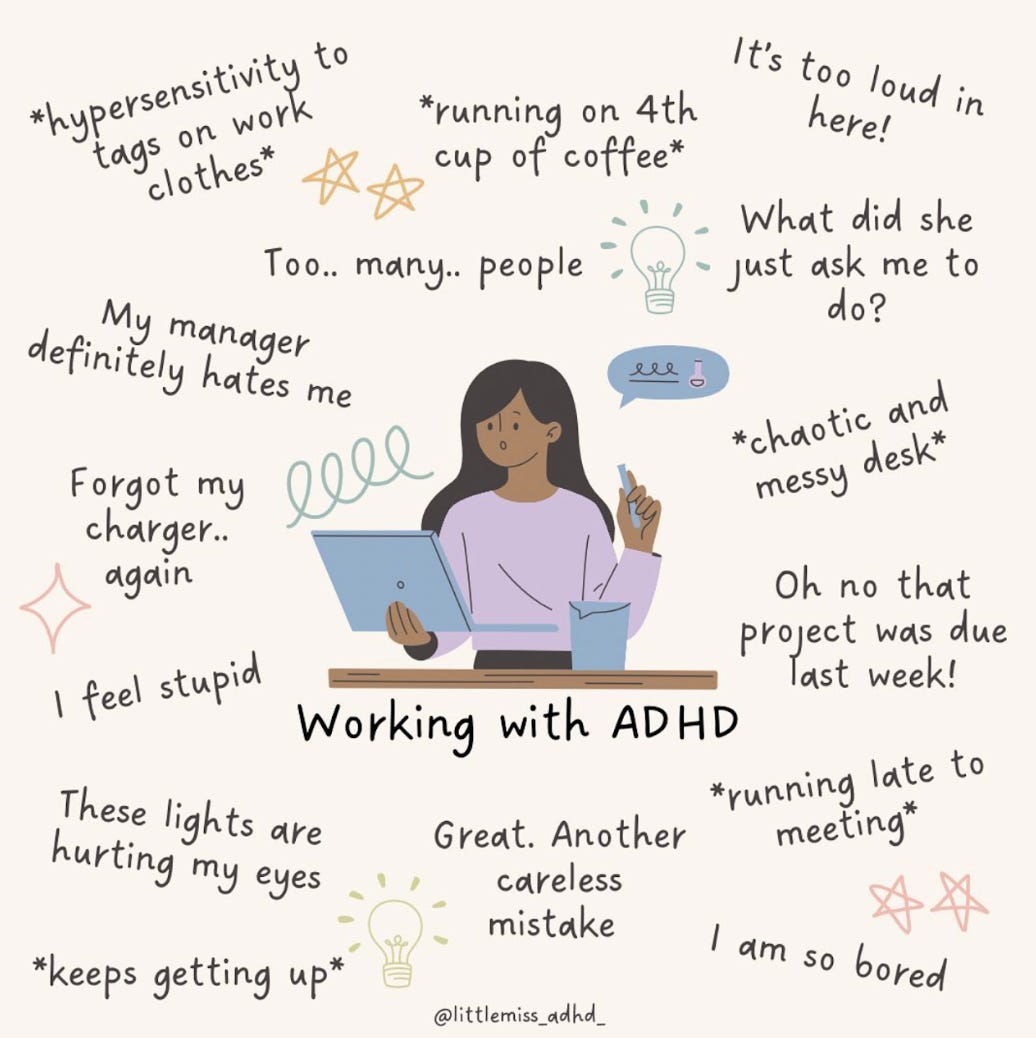

Understanding Adhd Misconceptions Fueled By Tik Tok

Apr 29, 2025

Understanding Adhd Misconceptions Fueled By Tik Tok

Apr 29, 2025 -

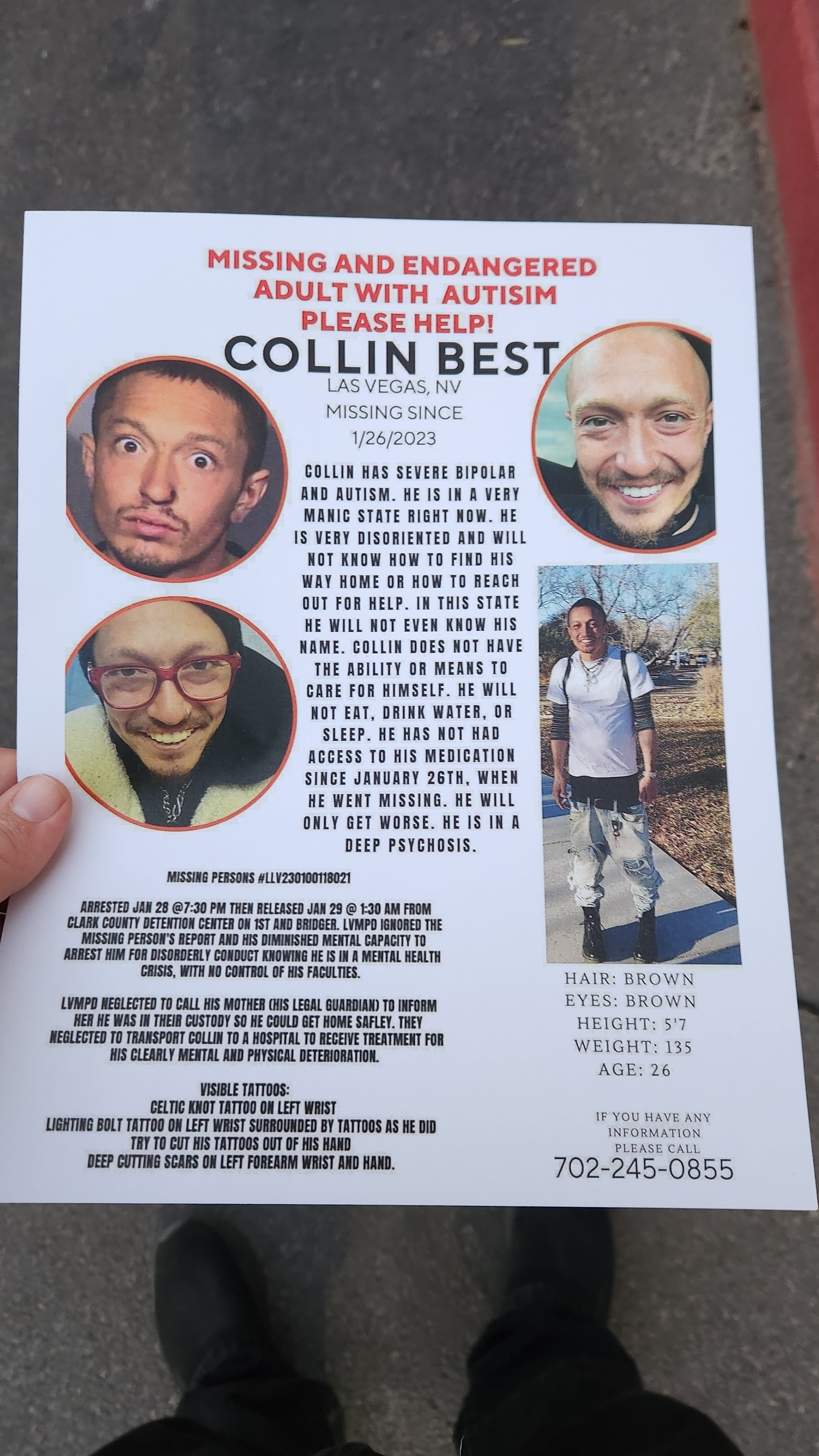

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025

Family Appeals For Information On Missing British Paralympian In Las Vegas

Apr 29, 2025

Latest Posts

-

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025

Life On Our Farm Next Door Amanda Clive And Their Family

Apr 30, 2025 -

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025

Meet Amanda Clive And Kids A Day In The Life Of Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And The Kids Country Life

Apr 30, 2025 -

Our Farm Next Door Amanda Clive And Their Kids Daily Life

Apr 30, 2025

Our Farm Next Door Amanda Clive And Their Kids Daily Life

Apr 30, 2025 -

Amanda Owens Ravenseat A Family Update Amidst Recent Setbacks

Apr 30, 2025

Amanda Owens Ravenseat A Family Update Amidst Recent Setbacks

Apr 30, 2025