Q1 2024 Fremantle Revenue Down 5.6%: Budget Cuts Hit Entertainment Spending

Table of Contents

Detailed Analysis of Fremantle's Q1 2024 Financial Performance

Fremantle's Q1 2024 financial performance reveals a complex picture. While the overall revenue decrease is concerning, a granular analysis helps pinpoint the specific areas affected.

Revenue Breakdown

The reported 5.6% drop in revenue wasn't evenly distributed across Fremantle's diverse portfolio. According to Fremantle's official press release [insert link to press release here], the most significant losses stemmed from:

- Television Production: A decrease of 8% in revenue, primarily due to fewer commissioned projects from major broadcasters. This reflects the industry-wide trend of reduced budgets allocated to traditional television programming.

- Film Production: A 4% decline, attributed to delays in project greenlighting and increased competition for funding.

- Digital Revenue: While experiencing a slight increase (2%), this growth was insufficient to offset losses in other sectors.

However, there were some bright spots: Fremantle’s unscripted formats division showed modest growth, indicating a continued demand for this type of content, even in a tighter budget environment. This demonstrates the importance of diversification in the current climate.

Impact of Budget Cuts on Production

Reduced budgets from broadcasters and streaming platforms have directly impacted Fremantle's production pipeline. Budget cuts have resulted in:

- Project Delays: Several projects have been postponed, awaiting secured funding or revised budgets.

- Project Cancellations: Some productions have been cancelled entirely, impacting Fremantle's profitability and projected revenue.

- Cost-Cutting Measures: Fremantle has implemented cost-cutting measures, including streamlining operations and exploring more efficient production techniques. This includes greater reliance on co-productions and leveraging existing IP.

The changing landscape of content commissioning, with streaming platforms increasingly focusing on cost-efficiency and data-driven decision-making, is fundamentally altering Fremantle’s business model, necessitating adaptability and innovation.

Broader Trends in Entertainment Spending and the Media Industry

The decline in Fremantle's revenue isn't an isolated incident; it reflects larger trends impacting the entire entertainment industry.

Macroeconomic Factors

Several macroeconomic factors contribute to the reduced entertainment spending:

- Inflation: Rising inflation erodes consumer disposable income, forcing individuals to cut back on discretionary spending, including entertainment.

- Rising Interest Rates: Higher interest rates make borrowing more expensive, impacting investment in the media sector, both for production and acquisitions.

- Recessionary Pressures: The threat of a recession further dampens advertising revenue, a critical income stream for many media companies.

These factors combine to create a challenging environment for content creators and distributors.

Streaming Wars and Content Saturation

The intense competition within the streaming industry further exacerbates the situation:

- Increased Competition: The proliferation of streaming platforms has intensified competition for viewers, leading to cost-cutting measures by these platforms.

- Content Saturation: The sheer volume of content available saturates the market, making it harder for individual projects to stand out and secure substantial budgets.

- Evolving Strategies: Streaming services are adapting their strategies, prioritizing profitability over sheer volume of content. This means more selective commissioning and a stricter focus on ROI.

Future Outlook and Potential Strategies for Fremantle

Predicting Fremantle's future performance requires careful consideration of current trends.

Predicting Future Performance

The outlook for Fremantle remains cautiously optimistic. While the current economic climate presents challenges, several factors might influence future performance:

- New Revenue Streams: Fremantle is exploring opportunities in gaming and interactive content to diversify its revenue streams.

- Technological Advancements: New technologies and platforms present both opportunities and challenges, requiring strategic adaptation.

- Strategic Partnerships: Strategic partnerships and acquisitions could bolster Fremantle’s position in the market.

The potential for recovery hinges on Fremantle’s ability to adapt to the evolving landscape and capitalize on emerging opportunities.

Adaptation Strategies

Fremantle needs to adopt several strategies to thrive in this challenging environment:

- Cost Optimization: Implementing rigorous cost-optimization initiatives and improving production efficiency will be crucial.

- High-Demand Genres: Focusing on high-demand genres and formats to maximize return on investment will be critical.

- Market Diversification: Expanding into new markets and territories will help reduce reliance on any single market.

Conclusion

Fremantle's Q1 2024 revenue decline underscores the impact of budget cuts on entertainment spending, reflecting broader macroeconomic pressures and the competitive realities of the streaming industry. The company's future success hinges on its ability to adapt to these challenges through cost optimization, diversification, and strategic partnerships. Staying informed about Fremantle’s performance and the evolving landscape of the media industry is essential. Subscribe to industry news, follow relevant financial reports, and conduct further research on the impact of budget cuts on entertainment spending and the future of Fremantle’s revenue to navigate this dynamic and challenging market. Understanding these trends is key to understanding the future of the entertainment industry.

Featured Posts

-

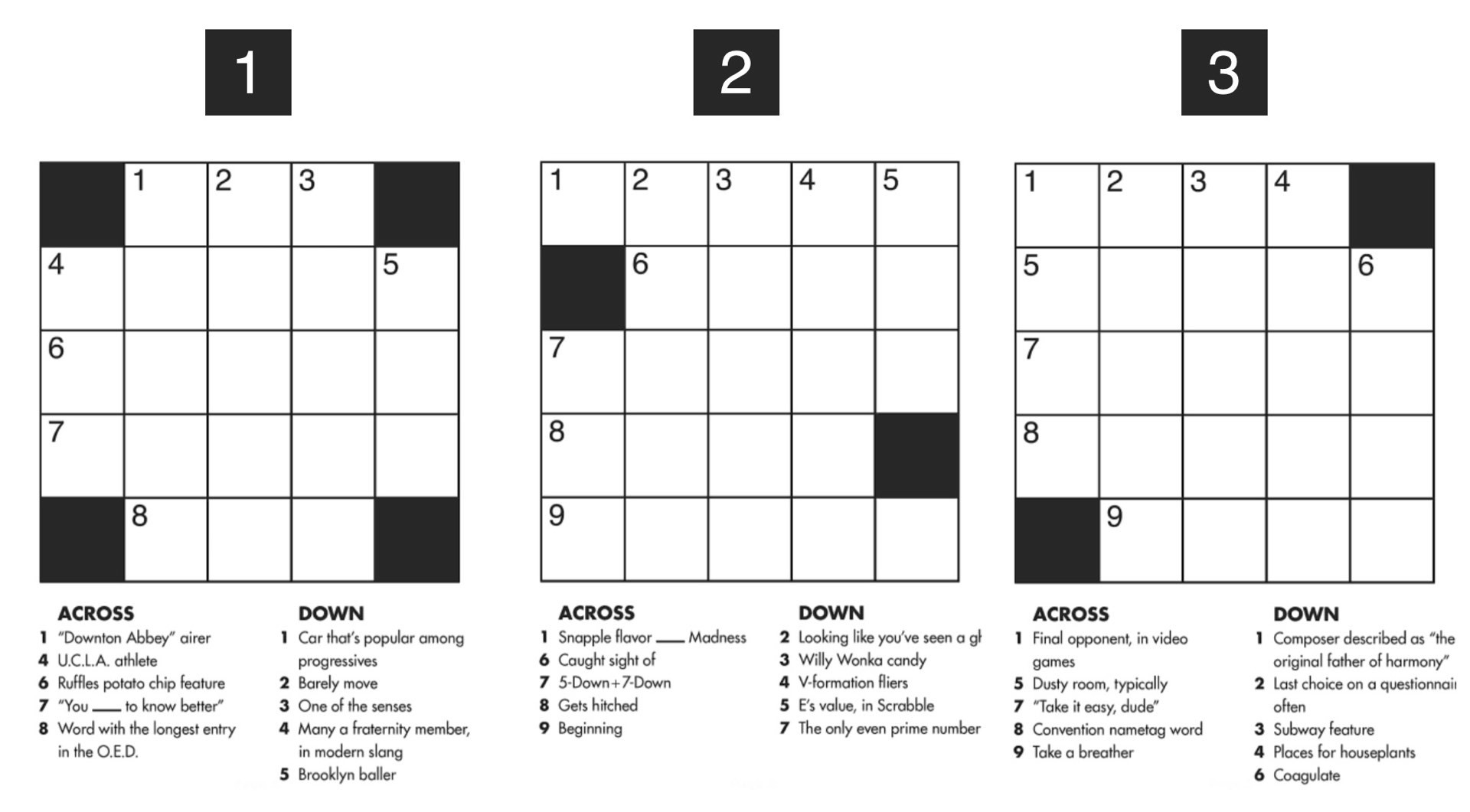

Nyt Mini Daily Puzzle May 13 2025 Full Solutions And How To Play

May 20, 2025

Nyt Mini Daily Puzzle May 13 2025 Full Solutions And How To Play

May 20, 2025 -

Manchester Uniteds New Forward A Strategic Masterstroke By Amorim

May 20, 2025

Manchester Uniteds New Forward A Strategic Masterstroke By Amorim

May 20, 2025 -

I Tzenifer Lorens Mia Akomi Kori Gia Tin Agapimeni Ithopoio

May 20, 2025

I Tzenifer Lorens Mia Akomi Kori Gia Tin Agapimeni Ithopoio

May 20, 2025 -

Porsches Tightrope Walk Navigating The Luxury Market Between Ferrari And Mercedes During Trade Disputes

May 20, 2025

Porsches Tightrope Walk Navigating The Luxury Market Between Ferrari And Mercedes During Trade Disputes

May 20, 2025 -

Hmrc Letter Thousands Of Uk Households Earning Over 23 000 Affected

May 20, 2025

Hmrc Letter Thousands Of Uk Households Earning Over 23 000 Affected

May 20, 2025