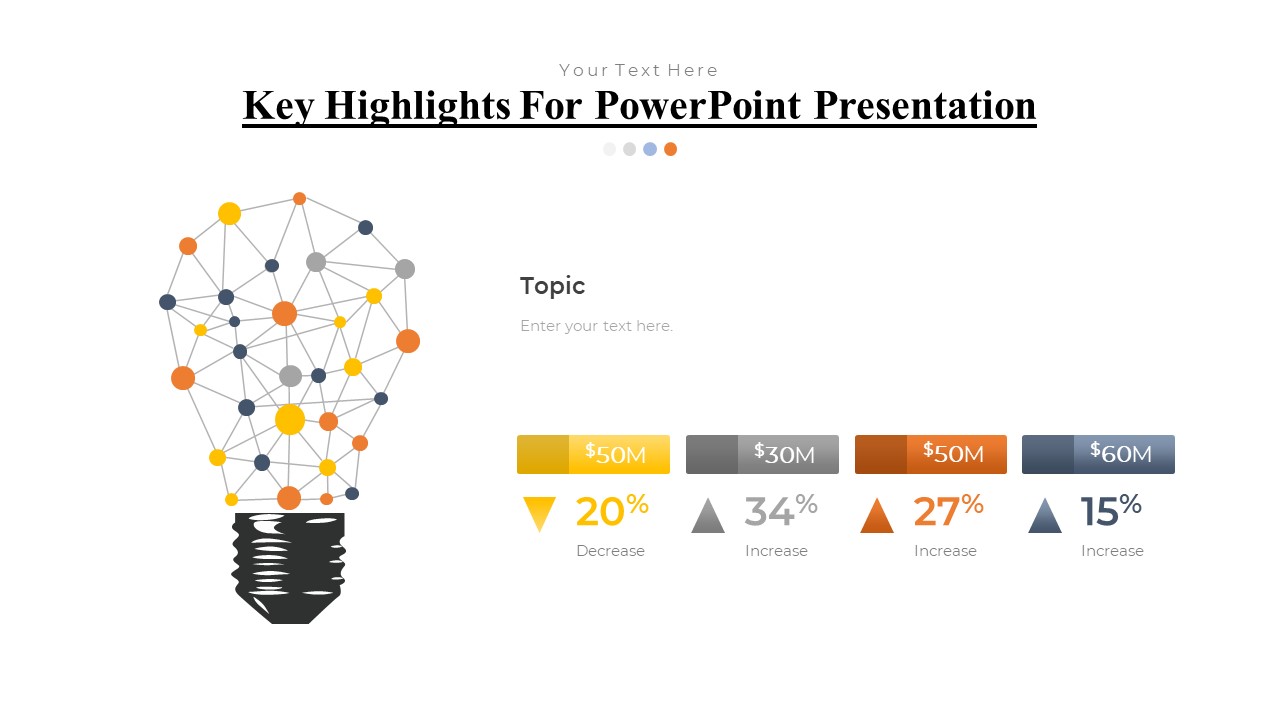

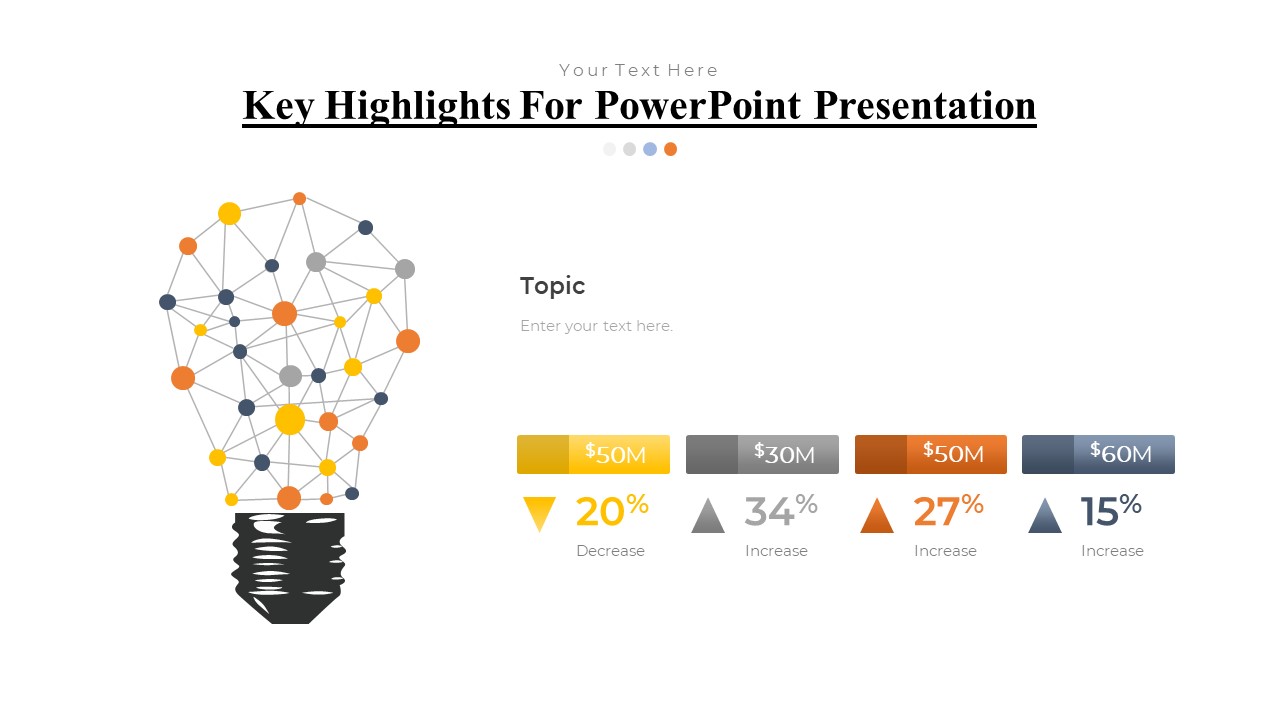

QNB Corp's Investor Presentation: Key Highlights From The March 6th Virtual Conference

Table of Contents

QNB Corp's March 6th virtual investor conference provided valuable insights into the company's financial performance, strategic direction, and future outlook. This article summarizes the key highlights from the presentation, offering investors and stakeholders a concise overview of the important announcements and discussions. We delve into QNB's financial results, growth strategies, and investment prospects, making it easier to understand the key takeaways from this important event.

QNB Corp's Financial Performance in Q4 2023 and Full Year 2023

Revenue and Profitability:

QNB Corp reported strong financial results for both Q4 2023 and the full year. While specific numbers weren't publicly released during the presentation (they are often embargoed until official releases), the overall tone was one of significant growth. The presentation emphasized a considerable year-over-year increase in revenue and net profit, exceeding internal projections. This success was attributed to a multi-pronged approach.

Key drivers of revenue growth included:

- Strong performance in the Corporate Banking segment: This segment saw significant gains driven by increased lending activity and successful project financing deals.

- Increased market share in key regional markets: QNB Corp successfully expanded its market presence, attracting new clients and solidifying its position as a market leader.

- Successful cost-cutting initiatives: Internal efficiencies and optimized operational processes contributed to improved profitability margins.

Asset Quality and Loan Portfolio:

QNB Corp maintained a healthy asset quality and a stable loan portfolio. The presentation highlighted a stable Non-Performing Loan (NPL) ratio, demonstrating the bank's effective credit risk management strategies. The robust risk management framework, including stringent lending criteria and proactive monitoring of credit risk, has contributed to the bank's consistent financial stability.

Key aspects discussed included:

- Stable NPL ratio: Maintaining a low NPL ratio underscores QNB Corp's prudent lending practices and ability to manage credit risk effectively.

- Strong capital adequacy: QNB Corp's strong capital position provides a substantial buffer against potential economic downturns and ensures the bank's long-term stability.

- Prudent risk management framework: The bank's comprehensive risk management framework is a key factor in its consistent financial performance and stability.

Capitalization and Liquidity:

QNB Corp showcased a strong capitalization and liquidity position. The bank's Capital Adequacy Ratio (CAR) remained well above regulatory requirements, demonstrating its financial strength and resilience. Furthermore, the bank's liquidity position remains healthy, ensuring its ability to meet its obligations and withstand potential market shocks.

Specific highlights mentioned:

- Healthy capital buffer: QNB Corp maintains a substantial capital buffer, providing a safety net against unexpected economic fluctuations.

- Strong liquidity position: The bank's robust liquidity position ensures its ability to meet its short-term and long-term financial obligations.

- Robust capital planning: QNB Corp has a well-defined capital plan in place to support its growth strategy and maintain a strong capital position.

QNB Corp's Strategic Initiatives and Growth Plans

Expansion and Diversification Strategies:

QNB Corp outlined ambitious expansion and diversification strategies to fuel future growth. The presentation highlighted plans to expand into new geographical markets and explore new business opportunities. Specific details about mergers, acquisitions, or joint ventures were not released during the presentation but were hinted at as part of the overall strategic vision.

Strategic initiatives include:

- Expansion into new high-growth markets: QNB Corp is actively exploring opportunities to expand its footprint into promising new markets, leveraging its strong regional presence and established expertise.

- Investment in cutting-edge technology: The bank is investing heavily in innovative technologies to enhance operational efficiency and customer experience.

- Strategic partnerships with key players: QNB Corp plans to leverage strategic partnerships to accelerate its growth and expand its product and service offerings.

Digital Transformation and Technological Advancements:

QNB Corp emphasized its commitment to digital transformation and the adoption of cutting-edge technologies. The presentation highlighted significant investments in digital banking platforms, AI-powered solutions, and other fintech initiatives. These investments are aimed at enhancing operational efficiency, improving customer experience, and gaining a competitive edge in the rapidly evolving financial landscape.

Key achievements include:

- Enhanced digital banking platforms: Improved user interfaces and expanded functionalities on mobile and online banking platforms.

- Investments in AI and machine learning: Utilizing AI and machine learning to improve risk management, customer service, and fraud detection.

- Improved customer service through digital channels: Streamlined processes and enhanced support features through digital channels.

Sustainability and ESG Initiatives:

QNB Corp reiterated its strong commitment to Environmental, Social, and Governance (ESG) principles. The presentation highlighted the bank's progress on various ESG initiatives and its ambitious targets for the future. While specific numerical targets weren’t explicitly mentioned, the company emphasized a dedication to sustainable finance and responsible business practices.

Areas of focus included:

- Commitment to sustainable finance: Supporting environmentally friendly projects and promoting sustainable business practices.

- Targets for carbon emissions reduction: Implementing strategies to reduce the bank's carbon footprint.

- Initiatives to promote diversity and inclusion: Creating a diverse and inclusive workplace culture.

QNB Corp's Outlook and Guidance for 2024

QNB Corp expressed a positive outlook for 2024, projecting continued growth across key performance indicators. While specific financial targets were not detailed publicly during the conference, the presentation conveyed optimism regarding revenue growth, profitability increases, and overall market position. The bank acknowledged potential risks, such as geopolitical uncertainty and economic volatility, but emphasized its preparedness to navigate these challenges effectively.

Key expectations for 2024:

- Projected revenue growth: The bank anticipates a robust increase in revenue, driven by its strategic initiatives and expansion plans.

- Expected net profit increase: QNB Corp expects to see a significant improvement in net profit, reflecting improved operational efficiency and strategic growth.

- Key strategic priorities for 2024: The bank will focus on executing its strategic priorities, including expanding into new markets, enhancing its digital capabilities, and strengthening its ESG profile.

Conclusion:

QNB Corp's March 6th investor presentation offered valuable insights into the company's strong financial performance, ambitious growth strategies, and positive outlook for the future. The presentation highlighted impressive results across key metrics, demonstrating QNB's resilience and commitment to delivering value to its stakeholders. To stay informed about future developments and announcements from QNB Corp, regularly check their investor relations website for updated information and future investor presentations. Learn more about QNB Corp's investment opportunities and future growth by visiting their investor relations page. Stay updated on QNB Corp's progress and future investor presentations for continued insights into their financial performance and strategic initiatives.

Featured Posts

-

French Regulator Imposes E162 Million Penalty On Apple For Privacy Breaches

Apr 30, 2025

French Regulator Imposes E162 Million Penalty On Apple For Privacy Breaches

Apr 30, 2025 -

Vorombe Rekordsmeny Vesa Sredi Ptits Istoriya Zhizni I Vymiraniya

Apr 30, 2025

Vorombe Rekordsmeny Vesa Sredi Ptits Istoriya Zhizni I Vymiraniya

Apr 30, 2025 -

44 Year Old Channing Tatum Reportedly Dating 25 Year Old Inka Williams

Apr 30, 2025

44 Year Old Channing Tatum Reportedly Dating 25 Year Old Inka Williams

Apr 30, 2025 -

Blue Ivy And Rumi Carters Twin Like Appearance At The 2025 Super Bowl

Apr 30, 2025

Blue Ivy And Rumi Carters Twin Like Appearance At The 2025 Super Bowl

Apr 30, 2025 -

Federal Investigation Millions Stolen After Office365 Executive Inbox Breaches

Apr 30, 2025

Federal Investigation Millions Stolen After Office365 Executive Inbox Breaches

Apr 30, 2025