Quantum Stocks Surge In 2025: Rigetti And IonQ Lead The Charge

Table of Contents

Rigetti Computing: A Deep Dive into its Stock Performance

Rigetti Computing has emerged as a significant force in the quantum computing industry, contributing to the overall surge in quantum stocks.

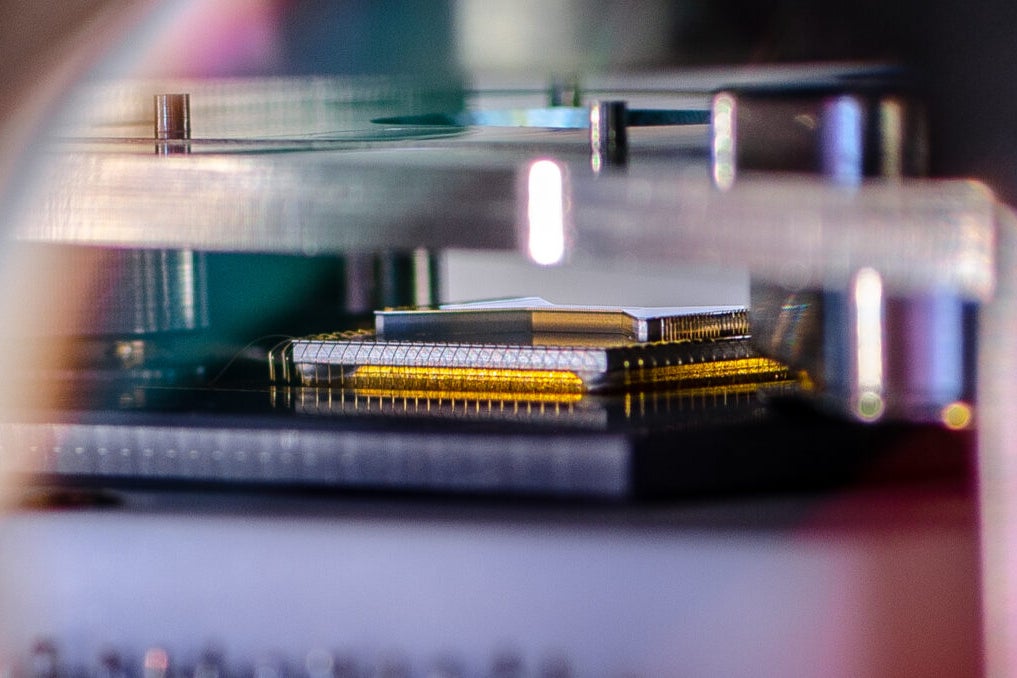

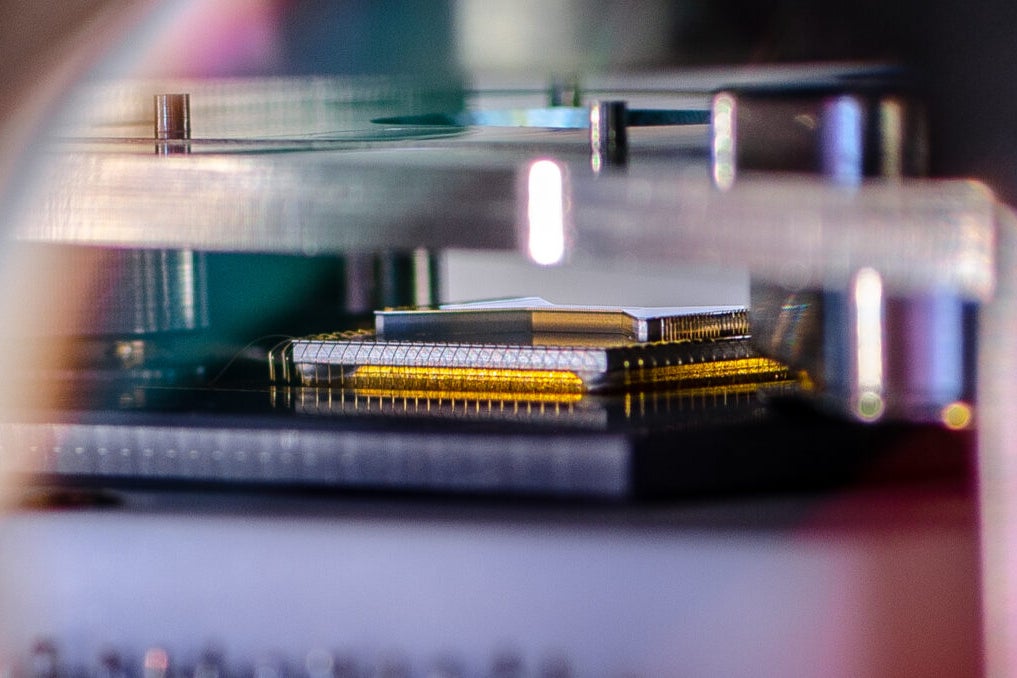

Analyzing Rigetti's Technological Advancements

Rigetti's stock performance is closely tied to its technological progress. Key advancements driving investor confidence include:

- Development of its multi-chip architecture: This innovative approach promises to significantly increase the computational power of its quantum computers.

- Progress in qubit coherence times: Longer coherence times translate to more stable and reliable quantum computations, a crucial factor for practical applications.

- Securing key patents: Rigetti's intellectual property portfolio strengthens its competitive position and attracts further investment.

- Successful collaborations with major research institutions and corporations: These partnerships validate Rigetti's technology and broaden its market reach, boosting investor confidence. Examples might include collaborations on specific applications within healthcare or finance.

- A clearly defined roadmap: Rigetti’s public roadmap outlining future milestones and product releases provides transparency and helps manage investor expectations.

Rigetti's Financial Performance and Market Valuation

Rigetti's stock price has experienced significant volatility, mirroring the inherent risks and rewards associated with investing in a nascent technology.

- Stock price trends: Tracking the stock's highs and lows throughout 2025 will be crucial in understanding investor sentiment and market reaction to news and announcements.

- Market capitalization: Analyzing Rigetti's market cap will reveal its relative size and valuation within the quantum computing sector.

- Investor sentiment: Monitoring news articles, analyst reports, and social media sentiment will provide insights into the overall market perception of Rigetti's prospects.

- Financial news impact: Significant financial news, like funding rounds, partnerships, or product launches, will directly affect the stock's performance.

Investment Risks and Opportunities in Rigetti Stock

Investing in Rigetti, like any quantum computing stock, comes with significant risks:

- High Volatility: The stock price is highly susceptible to market fluctuations and news events.

- Long-term Uncertainty: The quantum computing industry is still in its early stages, making long-term projections uncertain.

- Competition: The field is competitive, and Rigetti faces pressure from other companies developing quantum technologies.

However, the potential rewards are equally significant:

- High Growth Potential: Successful development and commercialization of quantum computing could lead to exponential growth in Rigetti's stock value.

- First-Mover Advantage: Establishing a leading position in the market could provide considerable competitive advantages.

IonQ: Another Giant in the Quantum Stock Market Boom

IonQ, another prominent player, contributes significantly to the excitement surrounding quantum stocks.

IonQ's Unique Approach to Quantum Computing Technology

IonQ's technology differentiates itself through:

- Trapped ion technology: This approach offers potential advantages in terms of qubit stability and scalability compared to other quantum computing architectures.

- High-fidelity qubits: IonQ's focus on high-fidelity qubits translates to more accurate and reliable computations.

- Proprietary control systems: IonQ's advanced control systems are crucial for managing and manipulating its qubits effectively.

IonQ's Financial Performance and Investor Appeal

Similar to Rigetti, IonQ's financial performance influences its stock price:

- Stock price trends: Monitoring IonQ's stock price will provide insights into market perception and investor confidence.

- Market capitalization: Comparing IonQ's market cap to Rigetti's allows for a relative valuation within the sector.

- Significant partnerships: Major contracts or collaborations with industry giants can significantly impact IonQ's stock price.

Risk Assessment and Investment Potential of IonQ Stock

Investing in IonQ also involves risks:

- Technological hurdles: Overcoming technical challenges in scaling up trapped ion technology remains a crucial factor.

- Competition: The competitive landscape demands continuous innovation and adaptation.

However, the investment potential is substantial, driven by:

- Technological leadership: IonQ's advanced technology positions it favorably in the market.

- Strong investor backing: Significant investments from prominent firms suggest confidence in IonQ's long-term prospects.

The Broader Quantum Computing Market and its Influence on Stock Prices

The overall quantum computing market significantly impacts individual quantum stock prices.

Factors Driving the Surge in Quantum Stock Prices

Several factors contribute to the surge:

- Technological breakthroughs: Continued advancements in qubit technology and algorithms are fueling investor enthusiasm.

- Government and corporate investment: Significant funding from governments and large corporations indicates growing confidence in the field's potential.

- Emerging applications: The potential applications of quantum computing across various sectors—from drug discovery to financial modeling—drive significant investor interest.

Future Predictions and Long-Term Outlook for Quantum Stocks

Predicting the future of quantum stocks is inherently challenging, but several factors suggest potential for continued growth:

- Market expansion: The quantum computing market is expected to expand significantly over the next decade.

- Stock price increases: Further technological advancements and successful commercial applications could lead to substantial stock price increases.

- Challenges and obstacles: Scaling up quantum computers and developing practical applications remain significant challenges.

Conclusion: Navigating the Exciting World of Quantum Stocks

The surge in quantum stocks in 2025, particularly those of Rigetti and IonQ, reflects the immense potential and excitement surrounding quantum computing. While significant investment opportunities exist, investors must carefully consider the inherent risks associated with this emerging technology. Thorough due diligence, understanding the technological landscape, and assessing the financial performance of individual companies are crucial before investing in quantum stocks. Further research into specific company reports, industry analyses, and technological advancements will provide a more in-depth understanding and inform your investment strategy within this rapidly evolving market. Remember to always invest wisely and understand the risks involved before committing to any quantum stock.

Featured Posts

-

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 21, 2025

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 21, 2025 -

Ev Mandate Opposition Grows Among Car Dealers

May 21, 2025

Ev Mandate Opposition Grows Among Car Dealers

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 21, 2025 -

Young Louth Food Entrepreneur Shares Business Expertise

May 21, 2025

Young Louth Food Entrepreneur Shares Business Expertise

May 21, 2025 -

Trans Australia Run A New Record In The Making

May 21, 2025

Trans Australia Run A New Record In The Making

May 21, 2025