Real Estate Crisis: Home Sales At Record Lows

Table of Contents

High Interest Rates: The Primary Culprit

Rising interest rates are the undeniable primary driver of the current real estate crisis. Mortgage rates have skyrocketed, significantly increasing borrowing costs and dramatically reducing the affordability of homes for many potential buyers. This housing affordability crisis is impacting even those with solid credit scores and substantial savings.

-

Comparing Rates: In the past year, average mortgage rates have nearly doubled, jumping from around 3% to over 7% in some regions. This increase represents a monumental shift in the cost of homeownership.

-

Impact of a 1% Increase: A mere 1% increase in interest rates can translate to hundreds of dollars more in monthly mortgage payments, pushing many potential buyers out of the market. This drastically reduces the pool of qualified buyers and dampens demand.

-

Fewer Qualified Buyers: The increased cost of borrowing has directly resulted in a significant decrease in the number of buyers who can afford to purchase a home, creating a buyer's market in many areas.

Inflation and Economic Uncertainty

High inflation and the looming threat of a recession are further exacerbating the real estate crisis. These factors erode consumer confidence and reduce the willingness of individuals to make significant financial commitments like purchasing a home. The uncertainty surrounding future economic conditions makes many potential buyers hesitant to enter the market.

-

Inflation Statistics: Inflation rates are at their highest in decades, impacting the purchasing power of consumers across the board. This means that even if buyers can afford a mortgage payment, the real value of their money is diminished.

-

Eroding Purchasing Power: The increasing cost of essential goods and services, alongside rising mortgage rates, shrinks buyers’ disposable income, making home purchases less feasible.

-

Impact on Buyer Behavior: Fear of a recession and potential job losses is causing many people to delay major purchases, further contributing to the decline in home sales and creating a downward spiral in the property market.

Limited Housing Inventory: A Supply-Side Squeeze

Adding to the challenges is a significant shortage of homes available for sale. This low inventory is a result of several factors, creating a supply-side squeeze that is pushing prices higher despite the overall downturn.

-

Inventory Levels: Current housing inventory levels are far below historical averages, creating a highly competitive market even in a buyer's market.

-

Low New Construction Rates: Several factors limit new home construction, including labor shortages, rising material costs, and bureaucratic hurdles. This further constricts the supply of homes.

-

Supply Chain Issues: Disruptions to the supply chain continue to impact construction timelines and costs, slowing the pace of new housing development and contributing to the shortage. The limited supply, in turn, fuels bidding wars and higher prices, even in this downturn.

Shifting Market Dynamics: From Seller's to Buyer's Market

The real estate market has undergone a dramatic shift. We've moved from a seller's market characterized by multiple offers and bidding wars to a buyer's market where buyers have significantly more negotiating power.

-

Seller's vs. Buyer's Market: A seller's market favors sellers with high demand and low supply, while a buyer's market gives the advantage to buyers with more choices and less competition.

-

Pricing Strategies: Sellers are now forced to adjust their pricing strategies, often reducing asking prices and extending days on the market to attract buyers. Buyers, on the other hand, can negotiate more effectively and even request repairs or concessions.

-

Market Indicators: We are seeing evidence of this shift with price reductions becoming more common and homes staying on the market for longer periods than in recent years.

Conclusion

The record low home sales currently signify a significant real estate crisis. High interest rates, coupled with inflation, economic uncertainty, and a limited housing inventory, have created a perfect storm impacting both buyers and sellers. The shift from a seller's market to a buyer's market offers some advantages to buyers, but overall, the real estate market remains challenging. Understanding the implications of this real estate crisis is crucial for making informed decisions. Stay informed about market trends and consult with real estate professionals for expert advice to navigate this complex and challenging market. Understand the implications of the current real estate crisis and make informed decisions about your property. Learn more about navigating this challenging market today!

Featured Posts

-

3 Billion Loan Cut How The Trump Administration Affected Sunnova Energy

May 30, 2025

3 Billion Loan Cut How The Trump Administration Affected Sunnova Energy

May 30, 2025 -

Affaire Rn Le Jugement En Appel Et La Rapidite De La Justice

May 30, 2025

Affaire Rn Le Jugement En Appel Et La Rapidite De La Justice

May 30, 2025 -

Jon Jones Scathing Rebuke Of Tom Aspinall Shut Your Mouth

May 30, 2025

Jon Jones Scathing Rebuke Of Tom Aspinall Shut Your Mouth

May 30, 2025 -

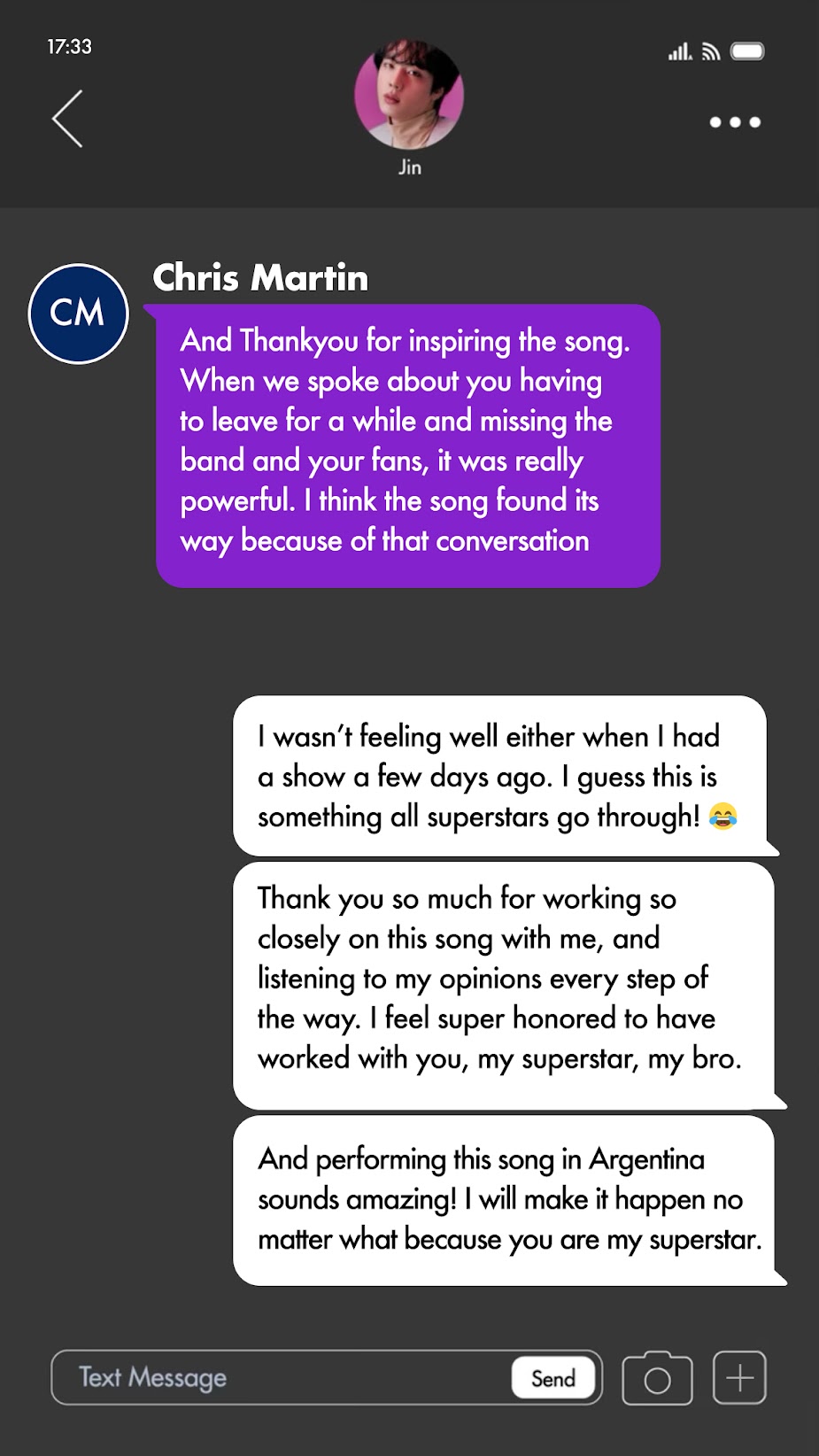

Bts Comeback Confirmed Jin Hints At Speedy Return After Coldplay Seoul Show

May 30, 2025

Bts Comeback Confirmed Jin Hints At Speedy Return After Coldplay Seoul Show

May 30, 2025 -

Jones Vs Aspinall Heated Exchange Highlights Ufc Rivalry

May 30, 2025

Jones Vs Aspinall Heated Exchange Highlights Ufc Rivalry

May 30, 2025