Recent Bitcoin Rebound: Signs Of A Market Recovery?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Technical Indicators

Technical indicators offer valuable insights into the short-term momentum and potential future direction of Bitcoin's price. Let's examine some key indicators:

- Relative Strength Index (RSI): The RSI, a momentum indicator, recently moved out of oversold territory, suggesting a potential shift in momentum from bearish to bullish. However, it's crucial to note that the RSI alone isn't a definitive confirmation of a sustained recovery.

- Moving Average Convergence Divergence (MACD): The MACD, which identifies changes in momentum, has shown signs of a bullish crossover, further supporting the potential for a continued upward trend in the Bitcoin price. This convergence, however, needs to be validated by sustained price action.

- Volume: Increased trading volume accompanying the price surge strengthens the signal, suggesting genuine buying pressure. Conversely, low volume could indicate a weak rally susceptible to reversal.

(Include charts/graphs visualizing RSI, MACD, and trading volume here)

On-Chain Metrics

On-chain metrics provide a deeper understanding of the underlying activity on the Bitcoin network, offering valuable insights into the sustainability of the rebound.

- Transaction Volume: An increase in transaction volume suggests heightened network activity and increased user engagement, which can be viewed as a positive sign for the Bitcoin price.

- Mining Difficulty: Changes in mining difficulty indicate the computational power dedicated to Bitcoin mining. A rising difficulty suggests a robust network and growing interest, indirectly supporting the price.

- Exchange Flows: A net outflow of Bitcoin from exchanges can be interpreted as a bullish sign, suggesting investors are holding rather than selling.

(Include charts/graphs visualizing transaction volume, mining difficulty, and exchange flows here)

Macroeconomic Factors Influencing Bitcoin's Performance

Inflation and Interest Rates

The relationship between Bitcoin and macroeconomic factors like inflation and interest rates is complex. While Bitcoin is often considered a hedge against inflation, rising interest rates can divert investment away from riskier assets, potentially impacting the Bitcoin price negatively. The recent rebound, however, suggests that other factors are currently outweighing these macroeconomic pressures.

- Inflation Expectations: Persistent inflation, even with interest rate hikes, could still drive investors towards alternative assets like Bitcoin, providing support for the recent Bitcoin price increase.

- Quantitative Easing (QE): Any potential shift towards QE policies by central banks could positively impact Bitcoin’s price by injecting liquidity into the market.

Regulatory Developments

Regulatory clarity and favorable regulatory developments can significantly influence investor confidence and Bitcoin's price.

- Positive Regulatory Announcements: Positive regulatory developments in key jurisdictions could boost investor confidence and lead to increased demand, contributing to the Bitcoin rebound.

- Regulatory Uncertainty: Conversely, ambiguous regulations or negative regulatory actions can trigger sell-offs and negatively impact the Bitcoin price.

Institutional and Retail Investor Sentiment

Institutional Investments

Institutional investors, with their significant capital, play a pivotal role in driving Bitcoin's price.

- Increased Institutional Holdings: A surge in institutional investments suggests growing confidence in Bitcoin as a long-term asset, bolstering the market.

- Grayscale Investments: The activities of large investment firms like Grayscale can significantly influence the market, with their buying pressure adding to the upward momentum.

Retail Investor Activity

Retail investor activity, characterized by increased trading volumes and sentiment shifts, also significantly impacts Bitcoin's price.

- Increased Trading Volume: A significant increase in retail trading volume accompanied the recent price surge, suggesting strong participation from retail investors.

- FOMO (Fear Of Missing Out): The rapid price increase could trigger FOMO among retail investors, further fueling the rally.

Potential Challenges and Risks

Volatility and Market Corrections

Bitcoin's price is inherently volatile, and despite the recent rebound, the possibility of future corrections remains.

- Profit-Taking: Profit-taking by investors who jumped on the recent rally could lead to price corrections.

- Negative News: Unexpected negative news, either market-related or geopolitical, can trigger significant price drops.

Geopolitical Risks

Geopolitical events can create uncertainty in the market, impacting the Bitcoin price.

- Global Conflicts: Global conflicts or escalating tensions can cause investors to move towards safer assets, potentially impacting Bitcoin's price negatively.

- Regulatory Crackdowns: Stringent regulatory measures imposed in key markets can negatively impact Bitcoin's price.

Conclusion

The recent Bitcoin rebound is a complex phenomenon driven by a confluence of factors, including improved technical indicators, potentially positive on-chain metrics, and a shift in investor sentiment, both institutional and retail. While the surge offers a glimmer of hope for a market recovery, the inherent volatility of Bitcoin and the influence of macroeconomic and geopolitical events necessitate cautious optimism. Profit-taking and unexpected negative news could trigger corrections. While the recent Bitcoin rebound offers a glimmer of hope, it's crucial to stay informed about the ongoing developments. Continue to monitor the Bitcoin market and conduct thorough research before making any investment decisions. Understanding the nuances of Bitcoin price movements, including the interplay of technical analysis, on-chain metrics, and macroeconomic factors, is key to navigating this dynamic market. Stay informed on the latest Bitcoin price news and developments to make well-informed investment choices.

Featured Posts

-

Trump Attorney Generals Ominous Message To Political Rivals

May 09, 2025

Trump Attorney Generals Ominous Message To Political Rivals

May 09, 2025 -

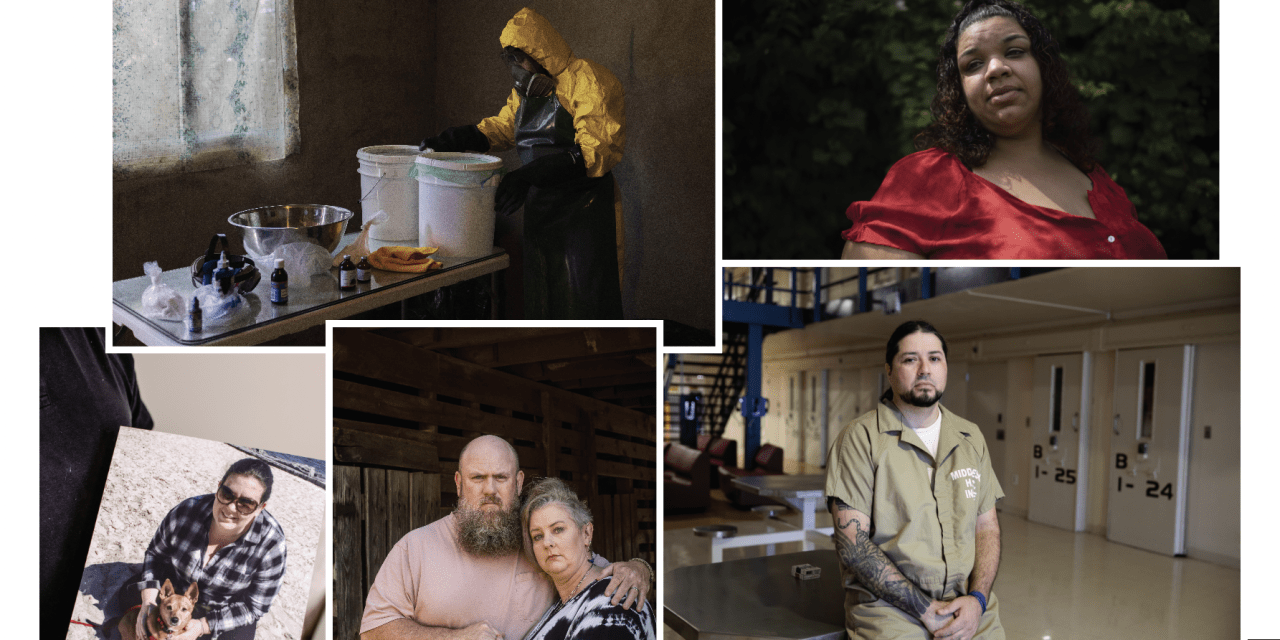

Did The Fentanyl Crisis Open Doors For U S China Trade Talks

May 09, 2025

Did The Fentanyl Crisis Open Doors For U S China Trade Talks

May 09, 2025 -

Pam Bondis Planned Release Of Documents Related To Epstein Diddy Jfk And Mlk

May 09, 2025

Pam Bondis Planned Release Of Documents Related To Epstein Diddy Jfk And Mlk

May 09, 2025 -

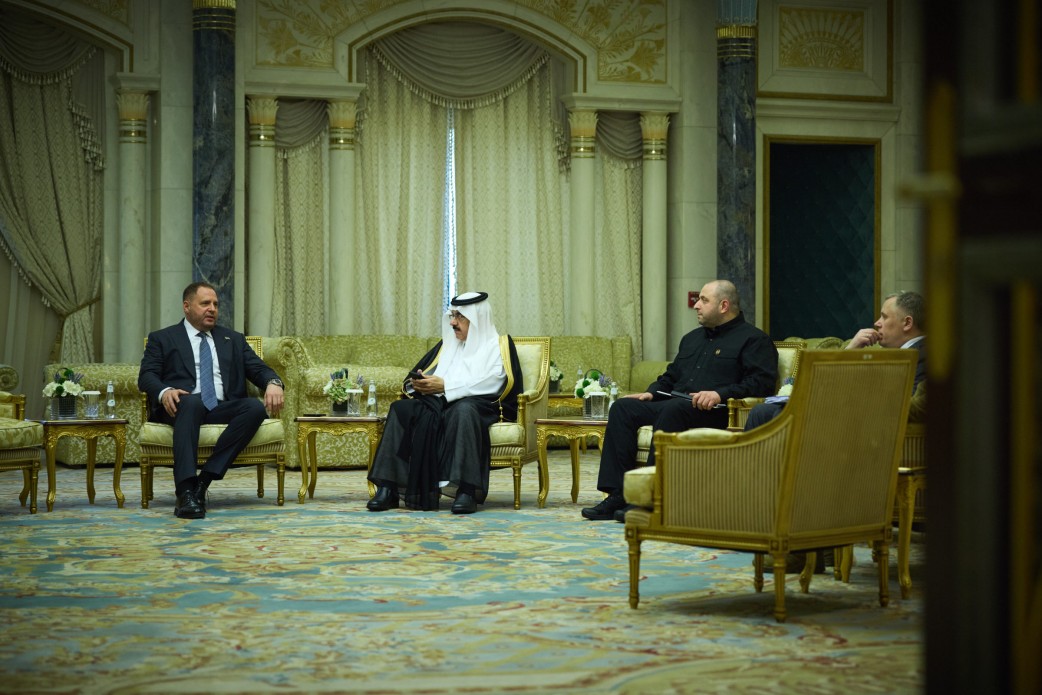

Ukraine Conflict Putins Victory Day Ceasefire Takes Effect

May 09, 2025

Ukraine Conflict Putins Victory Day Ceasefire Takes Effect

May 09, 2025 -

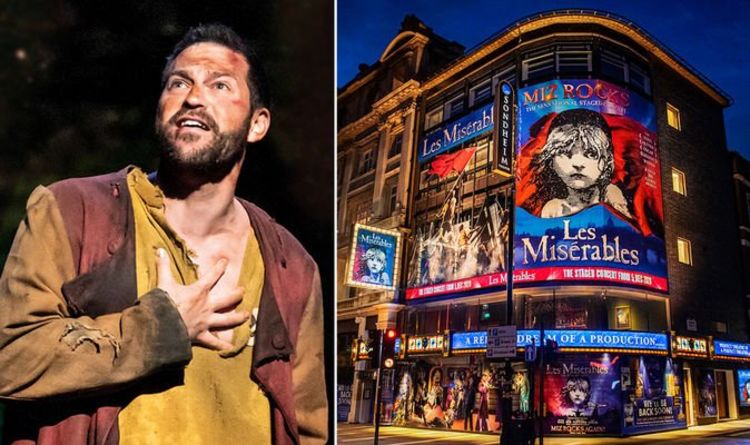

Les Mis Cast May Boycott Trumps Kennedy Center Performance

May 09, 2025

Les Mis Cast May Boycott Trumps Kennedy Center Performance

May 09, 2025

Latest Posts

-

High Potential Season 2 Predicting The Fate Of Season 1s Most Underrated Character

May 09, 2025

High Potential Season 2 Predicting The Fate Of Season 1s Most Underrated Character

May 09, 2025 -

High Potential Why The Season 1 Underdog Deserves A Season 2 Spotlight And Maybe A Villainous Arc

May 09, 2025

High Potential Why The Season 1 Underdog Deserves A Season 2 Spotlight And Maybe A Villainous Arc

May 09, 2025 -

Find Out When The Next High Potential Episode Airs On Abc

May 09, 2025

Find Out When The Next High Potential Episode Airs On Abc

May 09, 2025 -

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 09, 2025

The Lasting Impact Of High Potential An 11 Year Retrospective On Psych Spiritual Success

May 09, 2025 -

Is This Show The Best Replacement For Roman Potential Spoilers Ahead Of Season 2

May 09, 2025

Is This Show The Best Replacement For Roman Potential Spoilers Ahead Of Season 2

May 09, 2025