Recent Shifts In The Canadian Dollar Exchange Rate

Table of Contents

H2: Impact of Commodity Prices on the CAD Exchange Rate

The Canadian economy is heavily reliant on the export of commodities, with oil and natural gas being particularly significant. Global commodity prices, therefore, exert a powerful influence on the CAD's value. This makes the Canadian dollar highly sensitive to fluctuations in the global energy markets. Fluctuations in the value of these exports directly impact the CAD exchange rate and the Canadian economy as a whole.

- Rising oil prices typically strengthen the CAD. Increased demand and higher prices for Canadian oil and gas lead to greater export revenue, boosting the demand for the Canadian dollar in the forex market.

- Declining commodity prices weaken the CAD. Conversely, a drop in global commodity prices reduces export revenue, diminishing the demand for the CAD and leading to a weaker exchange rate.

- Global demand for Canadian resources plays a significant role. Factors like global economic growth, energy consumption patterns, and geopolitical events influence the global demand for Canadian commodities and consequently impact the CAD exchange rate. For example, increased global demand for energy during periods of economic growth is usually accompanied by a stronger Canadian dollar.

- Analyzing recent trends in oil and gas prices reveals a strong correlation with CAD movement. Tracking the price of West Texas Intermediate (WTI) crude oil and benchmark natural gas prices provides valuable insight into potential future CAD exchange rate movements. This correlation needs to be monitored closely by anyone wanting to understand the Canadian currency.

H2: Influence of Interest Rate Differentials on the Canadian Dollar

Differences in interest rates between Canada and other major economies significantly influence currency exchange rates. The Bank of Canada's monetary policy decisions, particularly interest rate hikes or cuts, directly impact the CAD's attractiveness to investors. This is crucial in understanding the fluctuations in the CAD exchange rate.

- Higher interest rates in Canada attract foreign investment, strengthening the CAD. Higher interest rates offer better returns to foreign investors, increasing demand for the Canadian dollar.

- Lower interest rates relative to other countries weaken the CAD. Conversely, lower interest rates make the Canadian dollar less attractive compared to other currencies, leading to reduced demand and a weaker exchange rate.

- Comparing Canadian interest rates with those of major trading partners (e.g., the US) is crucial. Analyzing the interest rate differential between Canada and the US, in particular, provides insights into the USD/CAD exchange rate. The US dollar is a major trading partner for the Canadian dollar and strongly influences its performance.

- Inflation significantly impacts Bank of Canada decisions and subsequent CAD movement. The Bank of Canada adjusts interest rates to manage inflation, impacting investor sentiment and influencing the CAD exchange rate. Higher-than-expected inflation could lead to interest rate hikes and a stronger CAD, while lower-than-expected inflation may result in rate cuts and a weaker CAD.

H2: Geopolitical Factors and their Effect on the CAD Exchange Rate

Global events and geopolitical uncertainty significantly influence investor sentiment and currency values. Events affecting Canada's major trading partners, especially the US, have a direct impact on the CAD. This means monitoring global events for their possible impact on the Canadian dollar is essential.

- Recent geopolitical events and their impact on the CAD should be carefully considered. Global conflicts, political instability in major economies, and trade disputes can all create uncertainty and affect the CAD.

- Global trade tensions significantly influence the Canadian economy and currency. Trade disputes or sanctions imposed on Canada or its trading partners can negatively affect exports, weakening the CAD.

- Political stability (or instability) in Canada and its trading partners is a key factor. Political uncertainty in Canada or its major trading partners can decrease investor confidence and lead to a weakening of the CAD.

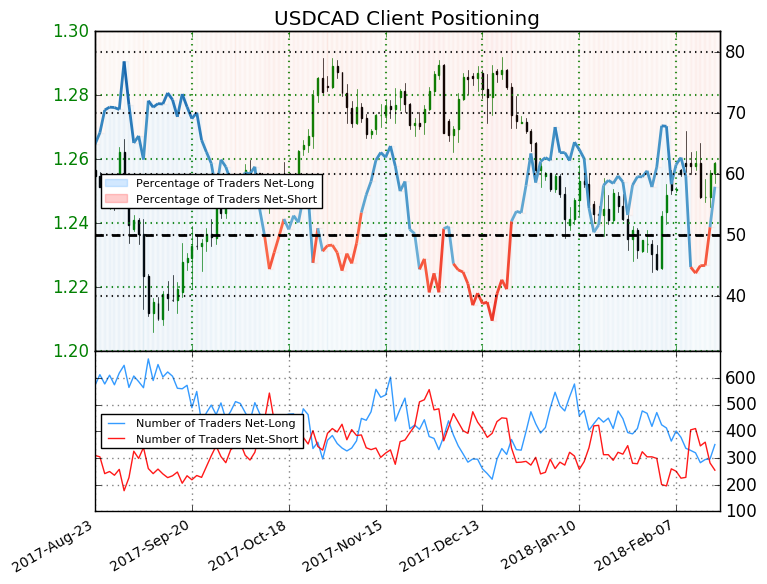

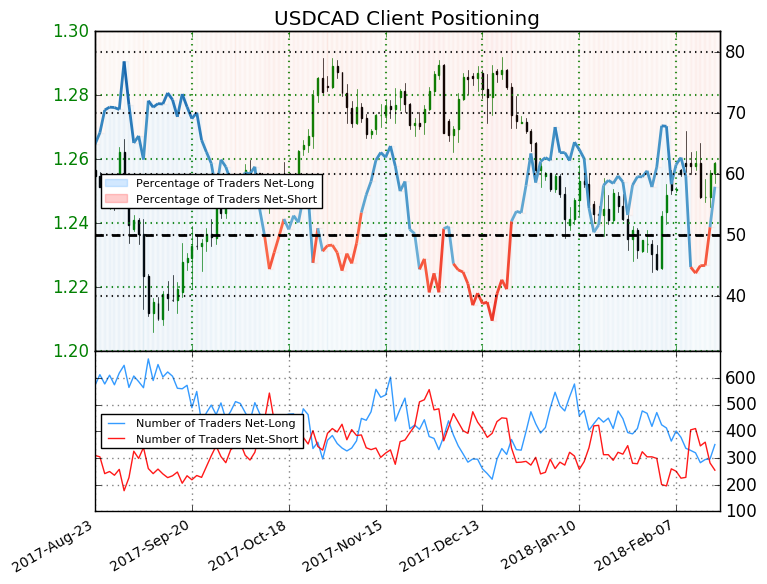

H3: The US Dollar's Role in CAD Fluctuations

The US dollar's strength or weakness significantly affects the CAD, as the US is Canada's largest trading partner. The USD/CAD exchange rate is a key indicator of the Canadian dollar's performance. Understanding the relationship between these two currencies is vital for navigating the CAD exchange rate.

- An inverse relationship generally exists between USD strength and CAD strength. A strengthening US dollar typically leads to a weakening Canadian dollar, and vice versa.

- Recent trends in the USD and their correlation with CAD movements should be carefully analyzed. Monitoring the US dollar index (DXY) provides valuable insights into potential USD/CAD exchange rate movements.

- Charts and graphs visualizing the USD/CAD relationship are helpful for understanding the dynamics. Regularly tracking the USD/CAD exchange rate can inform decision-making regarding investments and international transactions.

3. Conclusion:

Recent shifts in the Canadian dollar exchange rate result from a complex interplay of commodity prices, interest rate differentials, geopolitical factors, and the influence of the US dollar. Understanding these dynamic influences is vital for navigating the complexities of international finance and the Canadian forex market.

Call to Action: Stay informed about the latest developments impacting the Canadian dollar exchange rate to make informed decisions regarding investments, international transactions, and business planning. Regularly monitor the CAD exchange rate, analyze the USD/CAD exchange rate, and consult financial experts for personalized guidance on managing your exposure to Canadian currency fluctuations.

Featured Posts

-

Invest Smart A Geographic Analysis Of The Countrys Best Business Opportunities

Apr 24, 2025

Invest Smart A Geographic Analysis Of The Countrys Best Business Opportunities

Apr 24, 2025 -

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

Analysis At And Ts Concerns Over Broadcoms Extreme V Mware Price Hike

Apr 24, 2025

Analysis At And Ts Concerns Over Broadcoms Extreme V Mware Price Hike

Apr 24, 2025 -

The Danger Of Skipping Mammograms Learning From Tina Knowles Breast Cancer Journey

Apr 24, 2025

The Danger Of Skipping Mammograms Learning From Tina Knowles Breast Cancer Journey

Apr 24, 2025