Recent Treasury Market Activity: An April 8th Perspective

Table of Contents

Yield Curve Movements and Their Implications

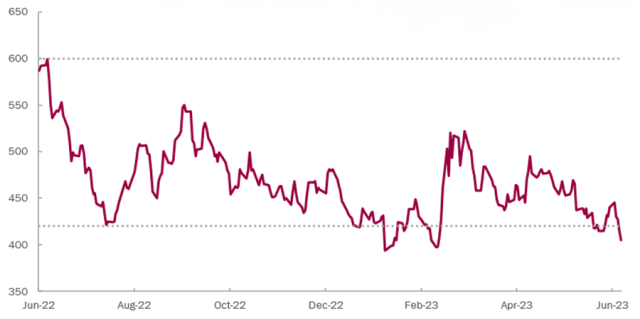

The Treasury yield curve, a graphical representation of yields across different Treasury maturities, offers valuable insights into the economy's trajectory. Analyzing recent movements is crucial for understanding potential risks and opportunities.

Shifting Yields Across Maturities

On April 8th, we observed notable shifts across various Treasury maturities:

- 2-year Treasury yield: Increased by [Insert Percentage]% reflecting [Insert Reason, e.g., anticipation of further rate hikes].

- 10-year Treasury yield: Increased by [Insert Percentage]%, suggesting [Insert Reason, e.g., rising inflation concerns].

- 30-year Treasury yield: Increased by [Insert Percentage]%, potentially indicating [Insert Reason, e.g., long-term inflation expectations].

The shape of the yield curve itself is significant. An inverted yield curve (where short-term yields exceed long-term yields) is often seen as a predictor of economic recession, while a steepening curve can signal accelerating growth. The current shape of the Treasury yield curve and its recent evolution are crucial indicators of future interest rate risk. Analyzing the yield spread between different maturities provides further insight into market expectations.

Impact on Borrowing Costs

Changes in Treasury yields directly influence borrowing costs for both corporations and the government.

- Increased yields make it more expensive for corporations to issue debt, impacting capital expenditures and expansion plans.

- Higher yields increase the government's financing costs, potentially affecting its ability to fund social programs and infrastructure projects.

The relationship between Treasury yields and other interest rates is also crucial. For example, increases in Treasury yields typically lead to higher mortgage rates and consumer loan rates, impacting consumer spending and economic growth. Understanding these interconnected dynamics is essential for navigating the complexities of "government borrowing costs" and "corporate bond yields."

Inflation Expectations and Treasury Demand

Inflation is a key driver of Treasury market activity. Recent inflation data and Federal Reserve policy play pivotal roles in shaping investor demand.

Inflation Data and its Influence

Recent inflation data releases, including the Consumer Price Index (CPI) and Producer Price Index (PPI), have [Insert Description of Recent Inflation Data - e.g., shown continued elevated inflation, signaling persistent inflationary pressures]. This influences investor demand for Treasury securities, particularly inflation-protected securities (TIPS), as a hedge against inflation. Investors seek to protect their portfolios from the erosion of purchasing power caused by rising prices. The "real yields" on TIPS, adjusted for inflation, become a critical consideration in investment decisions.

Federal Reserve Policy and its Role

The Federal Reserve's monetary policy significantly impacts Treasury market activity. Recent announcements and decisions by the Fed [Insert Description of Recent Fed Actions - e.g., have signaled continued commitment to fighting inflation through further interest rate hikes]. These actions influence interest rates and investor sentiment toward Treasuries. The implications of quantitative easing (QE) or its potential reversal, as well as the target for the federal funds rate, are crucial factors influencing Treasury yields.

Geopolitical Events and Market Volatility

Geopolitical events can introduce significant volatility into the Treasury market, as investors react to uncertainty and seek safe havens.

Impact of Global Uncertainty

Recent geopolitical events, such as [Insert Specific Geopolitical Events - e.g., the ongoing war in Ukraine], have contributed to market volatility. These events increase investor risk aversion, leading to a "flight to safety" and increased demand for U.S. Treasury securities, considered a relatively safe haven asset. The impact of geopolitical risk on Treasury prices can be substantial, causing significant price swings. The perception of safety inherent in Treasury securities is a key element affecting their demand during periods of global instability.

Conclusion: Recent Treasury Market Activity: A Summary and Call to Action

Recent Treasury market activity, as of April 8th, reflects a complex interplay of factors. Yield curve movements suggest [Insert Summary of Yield Curve Implications]. Elevated inflation and the Federal Reserve's response are driving interest rates higher. Finally, geopolitical uncertainty continues to influence investor sentiment and demand for safe-haven assets. These combined factors have significant implications for investors, businesses, and the broader economy. Understanding these dynamics is crucial for making informed investment decisions and navigating the evolving economic landscape. To stay informed on "Treasury market trends" and effectively "analyze Treasury yields," continue monitoring reliable financial news sources and consider consulting with financial professionals. Gain a deeper understanding of "Treasury market dynamics" to make well-informed investment choices.

Featured Posts

-

Quinoas New Rival The Next Generation Of Superfoods

Apr 29, 2025

Quinoas New Rival The Next Generation Of Superfoods

Apr 29, 2025 -

Usps Mail Delays Louisville Congressman Demands Transparency

Apr 29, 2025

Usps Mail Delays Louisville Congressman Demands Transparency

Apr 29, 2025 -

Slowing Rent Increases Persistent High Housing Costs In Metro Vancouver

Apr 29, 2025

Slowing Rent Increases Persistent High Housing Costs In Metro Vancouver

Apr 29, 2025 -

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

High Valuations In The Stock Market Bof As Rationale For Investor Calm

Apr 29, 2025

High Valuations In The Stock Market Bof As Rationale For Investor Calm

Apr 29, 2025

Latest Posts

-

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025 -

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025 -

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025 -

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025 -

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025