Recession Anxiety: BMO Survey Shows Dip In Canadian Homebuying Activity

Table of Contents

Key Findings of the BMO Survey

The BMO survey paints a picture of a market significantly impacted by anxieties surrounding the economy. Several key findings highlight the growing reluctance among Canadians to enter the housing market.

Decline in Purchase Intentions

The survey revealed a considerable decrease in the number of Canadians planning to purchase a home in the next six to twelve months. Specifically, the percentage of respondents expressing a strong intention to buy dropped by 15% compared to the previous quarter's survey, a significant shift indicating a growing sense of caution. This decline was particularly pronounced amongst younger buyers (aged 25-34), with a 20% decrease in purchase intentions, likely reflecting their increased sensitivity to rising mortgage rates and economic instability. Regional variations also emerged, with provinces like Ontario and British Columbia showing steeper declines than the national average, suggesting that regional economic factors also play a key role.

Impact of Rising Interest Rates

The surge in mortgage rates is a primary driver of this slowdown. The Bank of Canada's efforts to combat inflation through interest rate hikes have directly impacted borrowing costs, making mortgages considerably more expensive.

- Mechanics of Rate Hikes: Each percentage point increase in interest rates translates to a substantial increase in monthly mortgage payments. For example, a 1% increase on a $500,000 mortgage can add hundreds of dollars to monthly payments, significantly impacting affordability for many potential buyers.

- Impact on Affordability: Higher borrowing costs effectively shrink the pool of potential homebuyers, particularly those with less disposable income or who rely on higher loan-to-value mortgages. This is pushing many prospective buyers to either delay their purchase or reconsider their budget, leading to decreased demand.

- Future Rate Predictions: Economists predict continued interest rate volatility in the coming months. Further increases, although not guaranteed, would exacerbate the current situation and potentially trigger more significant declines in homebuying activity.

Heightened Economic Uncertainty

Fears surrounding a potential recession are significantly impacting consumer confidence and, in turn, the housing market.

- Contributing Factors: High inflation, concerns about job security in certain sectors, and geopolitical instability are all fueling recession anxiety among Canadians. This anxiety leads to a wait-and-see approach regarding major financial commitments such as home purchases.

- Hesitation in the Housing Market: The uncertainty makes potential buyers hesitant to commit to a long-term financial obligation like a mortgage, preferring to wait for clearer economic indicators before making such a significant investment.

- Expert Opinion: Leading economists are expressing caution, with many forecasting a period of slower economic growth or a mild recession in the near future. This uncertainty is further dampening consumer confidence and impacting homebuying decisions.

Implications for the Canadian Real Estate Market

The decreased demand stemming from recession anxiety has several far-reaching implications for the Canadian real estate market.

Potential Price Corrections

Reduced buyer demand is increasing the likelihood of price corrections, particularly in overheated markets.

- Price Drops or Stagnation: A decrease in demand can lead to price stagnation or even modest price decreases in specific regions. Areas that experienced rapid price growth in recent years are likely to be the most vulnerable to price adjustments.

- Regional Variations: The impact will likely vary across the country. Markets with already high inventory levels or those heavily reliant on investor activity may see more significant price corrections.

- Emergence of a Buyer's Market: In certain regions, a shift towards a buyer's market is becoming increasingly probable, offering opportunities for those who are able to navigate the current climate.

Impact on Builders and Developers

The slowdown in homebuying activity will inevitably impact the construction industry.

- Project Delays and Cancellations: Reduced demand could lead to delays or even cancellations of new construction projects, particularly those with lower pre-sale rates. This could result in job losses within the construction sector.

- Impact on Employment: A decrease in construction activity will directly affect employment levels in the industry, potentially leading to layoffs or reduced hiring.

- Market Adaptation: Builders and developers may need to adapt their strategies, potentially by offering incentives or focusing on more affordable housing options.

Shifting Market Dynamics

The current conditions are compelling buyers and sellers to adjust their strategies.

- Buyer Strategies: Buyers are becoming more cautious, focusing on securing financing at favorable rates, negotiating prices aggressively, and carefully assessing property values.

- Seller Strategies: Sellers may need to adjust their asking prices to reflect the current market reality, offer more flexible terms, or provide incentives to attract buyers.

Looking Ahead: Navigating the Uncertain Market

Despite the current challenges, navigating the market successfully requires careful planning and informed decision-making.

Advice for Potential Homebuyers

For those still considering purchasing a home, careful planning is paramount.

- Financial Planning: Thorough financial planning, including assessment of debt, savings, and potential mortgage payments, is crucial.

- Professional Advice: Seeking advice from a qualified financial advisor can help navigate the complexities of securing a mortgage and making informed financial decisions.

- Realistic Expectations: Having realistic expectations regarding pricing and market conditions is essential to avoid disappointment and make rational purchasing decisions.

Predictions for the Canadian Housing Market

Experts offer varying predictions for the Canadian housing market.

- Short-Term Outlook: Many anticipate a period of slower growth or price stabilization in the short term, with some predicting modest price corrections in certain markets.

- Long-Term Outlook: The long-term outlook remains less certain. However, long-term demographic trends and underlying demand suggest a continued need for housing, indicating a potential rebound once economic uncertainty subsides.

Conclusion

The BMO survey unequivocally demonstrates that recession anxiety is significantly impacting Canadian homebuying activity. Rising interest rates and widespread economic uncertainty are creating a more cautious and challenging environment in the Canadian real estate market. While the future remains uncertain, understanding the current dynamics is paramount for both buyers and sellers. Staying informed about market trends and seeking professional financial advice is vital for navigating this complex period. Continue to monitor the impact of recession anxiety on the Canadian housing market to make informed decisions based on the latest data. Learn more about how recession anxiety is shaping the Canadian homebuying landscape by following our ongoing updates on the Canadian housing market.

Featured Posts

-

Warriors Win Thriller Hold 3 1 Series Lead Against Rockets

May 07, 2025

Warriors Win Thriller Hold 3 1 Series Lead Against Rockets

May 07, 2025 -

Carney Trump Meeting Key Expectations And Potential Outcomes

May 07, 2025

Carney Trump Meeting Key Expectations And Potential Outcomes

May 07, 2025 -

Atfaqyt Laram Wimbratwr Lzyadt Tdfq Alsyah Ila Albrazyl

May 07, 2025

Atfaqyt Laram Wimbratwr Lzyadt Tdfq Alsyah Ila Albrazyl

May 07, 2025 -

Are Rihanna And A Ap Rocky A Couple New Romance Speculation

May 07, 2025

Are Rihanna And A Ap Rocky A Couple New Romance Speculation

May 07, 2025 -

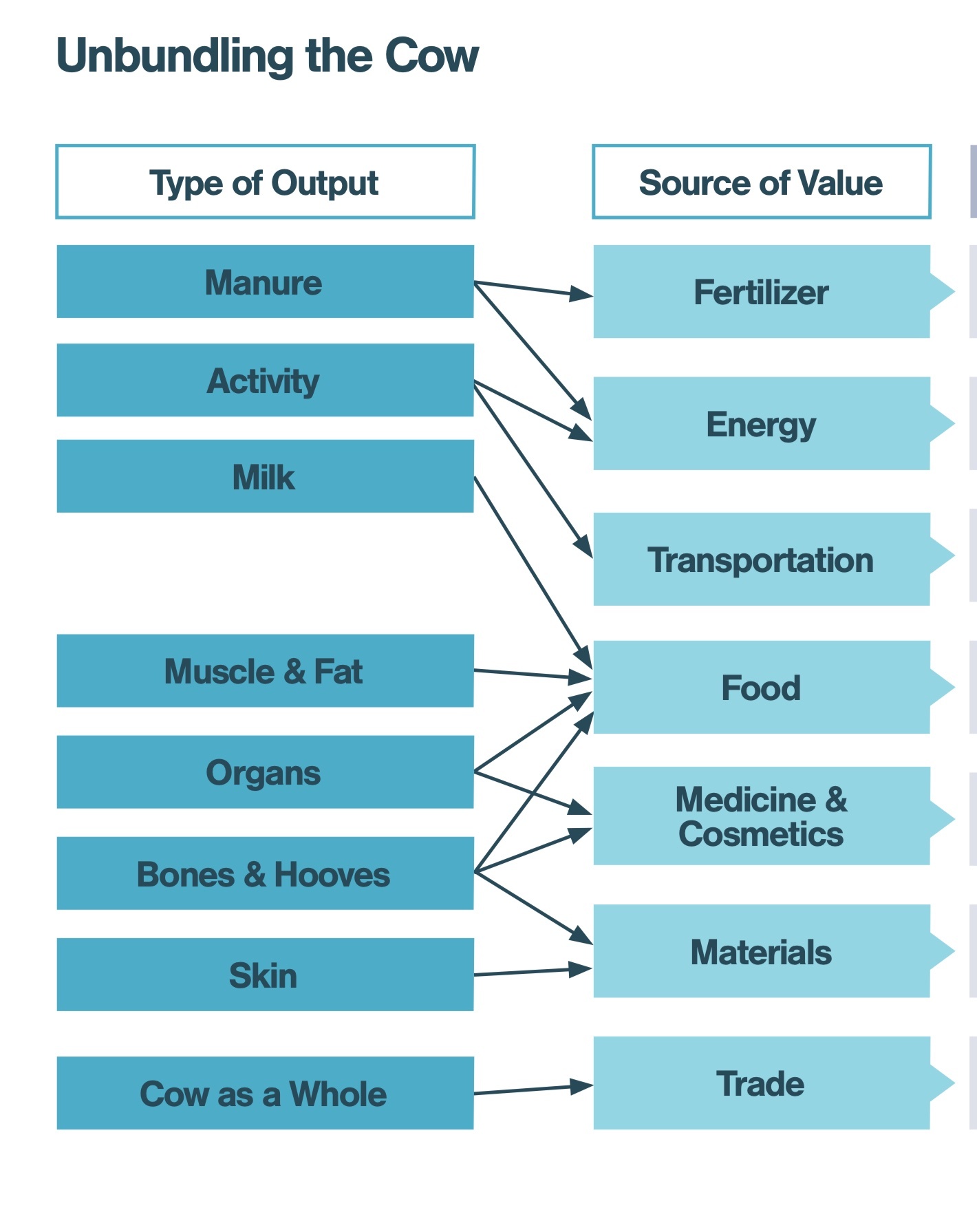

The Economic Impact Of Flooding On Livestock Production

May 07, 2025

The Economic Impact Of Flooding On Livestock Production

May 07, 2025