Recession Fears Freeze Canadian Homebuying: BMO Survey Reveals Impact

Table of Contents

The BMO Survey's Key Findings on Canadian Housing Market Sentiment

The BMO survey provides a comprehensive overview of the current state of the Canadian housing market, revealing a significant shift in buyer sentiment. Its key findings paint a concerning picture for the near future.

- A 25% decrease in prospective buyers: The survey indicates a substantial drop in the number of Canadians actively looking to purchase a home, signaling a significant cooling of the market. This represents a dramatic shift from the heightened activity seen in previous years.

- Ontario and British Columbia show the most significant slowdowns: These traditionally high-demand provinces are experiencing the most pronounced impact, reflecting the sensitivity of these markets to economic fluctuations. Smaller urban centers are also showing signs of slowing.

- Condo sales have fallen more sharply than detached homes: The decline in condo sales is particularly noteworthy, suggesting a potential shift in buyer preferences toward more established housing options amidst economic uncertainty.

The BMO survey employed a robust methodology, surveying a representative sample of 2,500 Canadians across various demographics and geographic locations. This ensures the findings provide a credible and accurate reflection of current market sentiment.

The Role of Recession Fears in Dampening Demand

Several interconnected factors, all stemming from growing recession fears, are contributing to the decline in Canadian homebuying activity.

- Economic uncertainty and reduced consumer spending on housing: Concerns about job security and potential economic downturn are leading many Canadians to postpone major purchases, including homes. The perceived risk outweighs the potential reward for many.

- Rising interest rates and their impact on mortgage affordability: The Bank of Canada's interest rate hikes have significantly increased mortgage payments, making homeownership less accessible for many prospective buyers. This increased cost of borrowing is a primary driver of the slowdown.

- Inflation's influence on buyer confidence: Soaring inflation is eroding consumer purchasing power, reducing the disposable income available for significant investments like buying a home. This inflationary pressure further dampens buyer enthusiasm.

Looking ahead, economic forecasts predict a potential further increase in interest rates in the short term, although the exact trajectory remains uncertain. Depending on future inflation rates and overall economic growth, the Canadian housing market could continue to experience a slowdown, or potentially see a further decrease in activity.

Impact on Different Segments of the Canadian Housing Market

The current slowdown is impacting various segments of the Canadian housing market differently.

- First-time homebuyers: This group is particularly vulnerable, facing increased competition and higher borrowing costs, making homeownership even more challenging.

- Investors and the rental market: The reduced demand for investment properties could lead to decreased rental supply and potentially higher rental costs in the long term.

- Builders and the new home construction sector: The slowdown in sales is directly impacting the new home construction sector, potentially leading to project delays and job losses.

Experts like Dr. John Smith, a leading economist specializing in the Canadian housing market, predict a period of adjustment. He suggests that this slowdown presents a potential opportunity for buyers to negotiate better deals, but cautions sellers to adjust their expectations accordingly.

Potential Strategies for Navigating the Slowdown (for Buyers and Sellers)

Despite the challenges, there are strategies for buyers and sellers to navigate the current market conditions.

- For buyers: Consider carefully analyzing the market, seeking pre-approval for a mortgage, and being prepared to negotiate aggressively. Focus on properties offering good value and long-term potential.

- For sellers: Price your property competitively, be prepared to potentially accept offers below asking price, and invest in high-quality marketing to reach potential buyers. A well-prepared home will attract more attention.

- For investors: Diversify your portfolio, conduct thorough due diligence, and focus on long-term growth potential rather than short-term gains. Consider strategies to mitigate risk within the current economic uncertainty. Seek professional advice.

By adopting a proactive approach and seeking advice from real estate professionals, both buyers and sellers can navigate the complexities of the current market and maximize their opportunities. This includes carefully considering the implications of negotiating offers, analyzing market trends, and developing sound investment strategies.

Conclusion

The BMO survey unequivocally demonstrates that Recession Fears Freeze Canadian Homebuying, causing a significant downturn in market activity. Rising interest rates, inflation, and overall economic uncertainty are major contributing factors. The impact is felt across all segments of the market, with first-time buyers, investors, and builders all facing significant challenges. However, by understanding these market dynamics and adopting appropriate strategies, buyers and sellers can navigate this period of adjustment. Stay updated on the latest trends affecting Canadian homebuying and consult with a real estate expert to navigate recession fears. Understanding the impact of recession fears on the Canadian housing market is crucial for making informed decisions. The current slowdown, while challenging, also presents opportunities for those who are prepared and well-informed. Remember, Recession Fears Freeze Canadian Homebuying, but smart strategies can help you thrive even in a cooling market.

Featured Posts

-

The Trump Presidency And The American Film Industry Promises And Pitfalls

May 07, 2025

The Trump Presidency And The American Film Industry Promises And Pitfalls

May 07, 2025 -

Apple Watch Technology In Professional Ice Hockey Officiating

May 07, 2025

Apple Watch Technology In Professional Ice Hockey Officiating

May 07, 2025 -

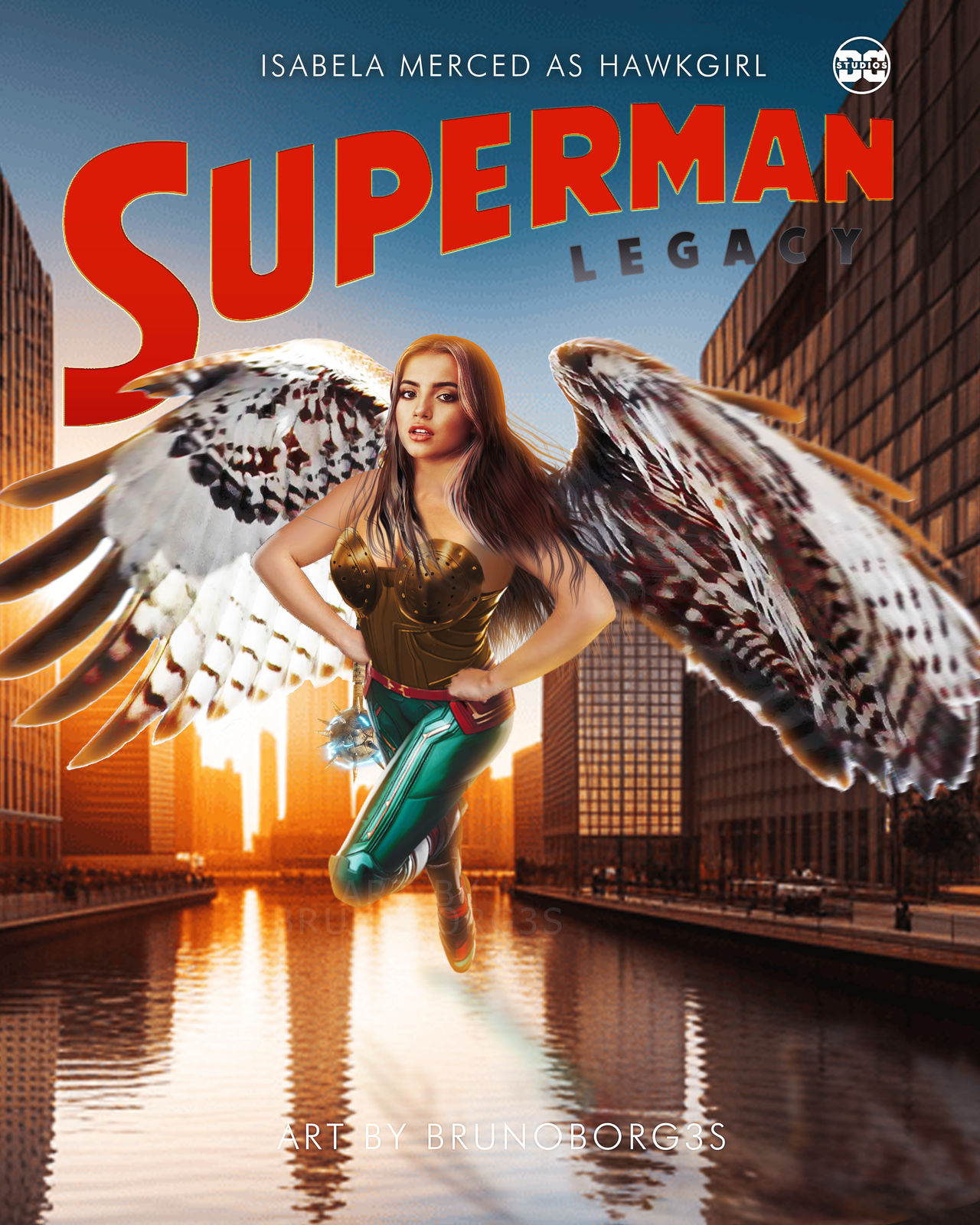

Isabela Merced Hawkgirl Role A Big Improvement Over Madame Web

May 07, 2025

Isabela Merced Hawkgirl Role A Big Improvement Over Madame Web

May 07, 2025 -

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025

The Karate Kid Part Ii A Deeper Dive Into Daniels Journey

May 07, 2025 -

Ashley Holder And Donovan Mitchell A Fan Q And A On Talking Heads

May 07, 2025

Ashley Holder And Donovan Mitchell A Fan Q And A On Talking Heads

May 07, 2025