Recession Resistance: A Deep Dive Into Uber's Stock Performance

Table of Contents

Uber's Business Model and its Resilience

Uber's success hinges on a robust and adaptable business model. Understanding its resilience requires examining its key components.

The Two-Sided Marketplace

Uber operates a two-sided marketplace connecting riders and drivers, creating a powerful network effect. This means the platform becomes more valuable as more users join – attracting more riders draws more drivers, and vice versa. Key aspects include:

- Network effects: The more users, the greater the platform's utility.

- Pricing dynamics: Uber utilizes dynamic pricing, adjusting fares based on demand, maximizing revenue during peak times.

- Geographical diversification: Uber operates globally, mitigating risk associated with economic downturns in specific regions.

- Commission-based revenue: Uber earns a commission on each ride and delivery, creating a scalable and relatively low-risk revenue stream.

Diversification Beyond Ridesharing

Uber's diversification beyond its core ridesharing business is a significant factor in its potential recession resistance. Uber Eats, its food delivery service, and its freight business provide additional revenue streams and buffer against economic shocks to the ride-sharing sector.

- Revenue breakdown across segments: Analyzing the proportion of revenue from ridesharing versus Uber Eats and freight reveals the company's diversification strength. A healthy balance mitigates reliance on a single sector.

- Growth potential in different sectors: The food delivery market and the freight industry offer significant growth opportunities, particularly as consumer behavior evolves.

- Competitive advantages in each area: Uber's established brand recognition and technological infrastructure provide competitive advantages in each market segment.

Cost-Cutting Measures and Operational Efficiency

Uber has demonstrated a capacity to adapt to changing economic conditions. Its ability to manage costs and driver incentives is crucial during downturns.

- Dynamic pricing strategies: Adjusting prices based on demand allows Uber to maintain profitability even during periods of reduced demand.

- Technological advancements for efficiency: Uber's investment in technology improves operational efficiency, reducing costs and improving the driver experience.

- Driver retention programs: Maintaining a loyal driver base is vital, and incentive programs and support systems can enhance driver retention even during slower periods.

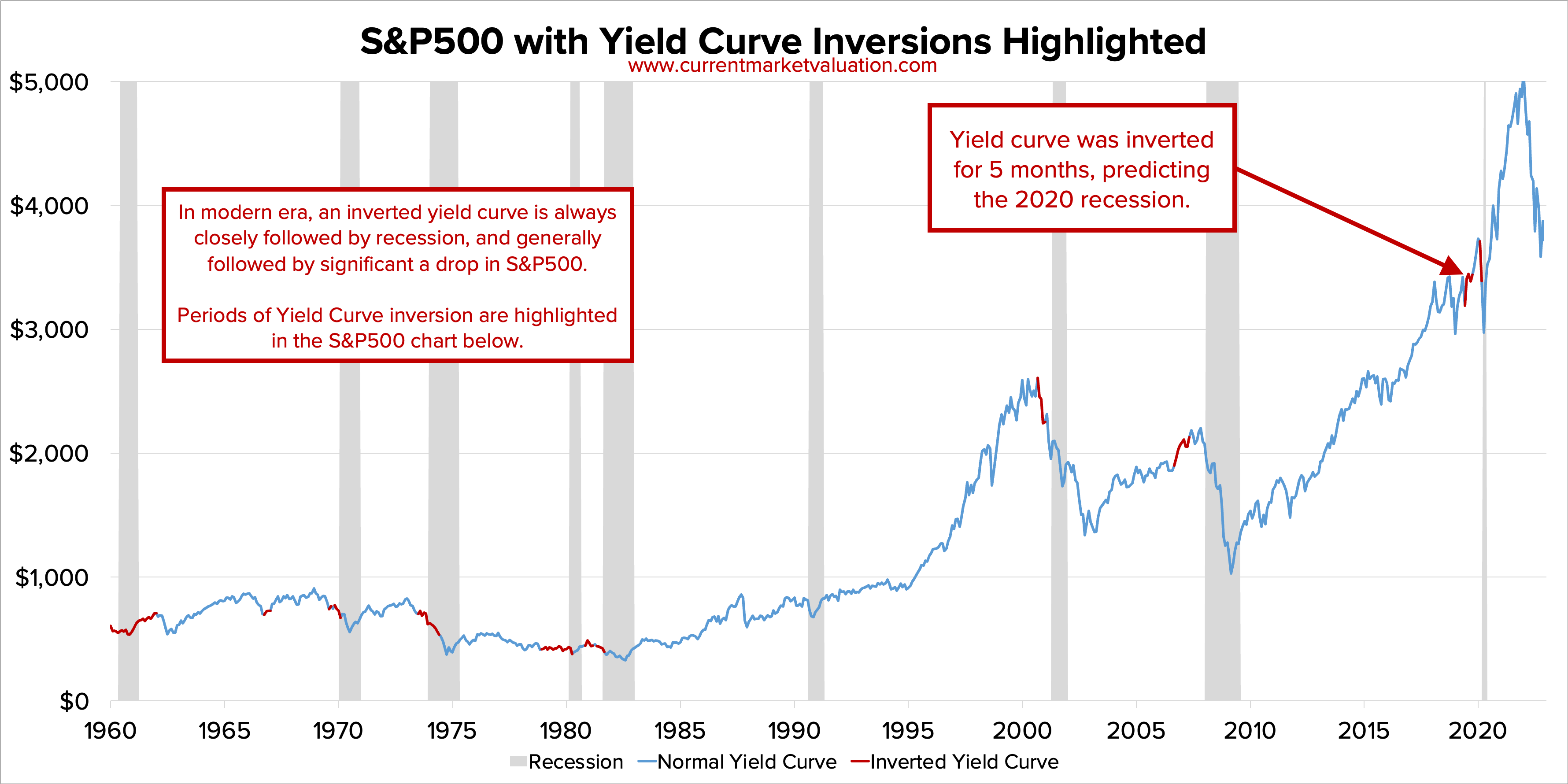

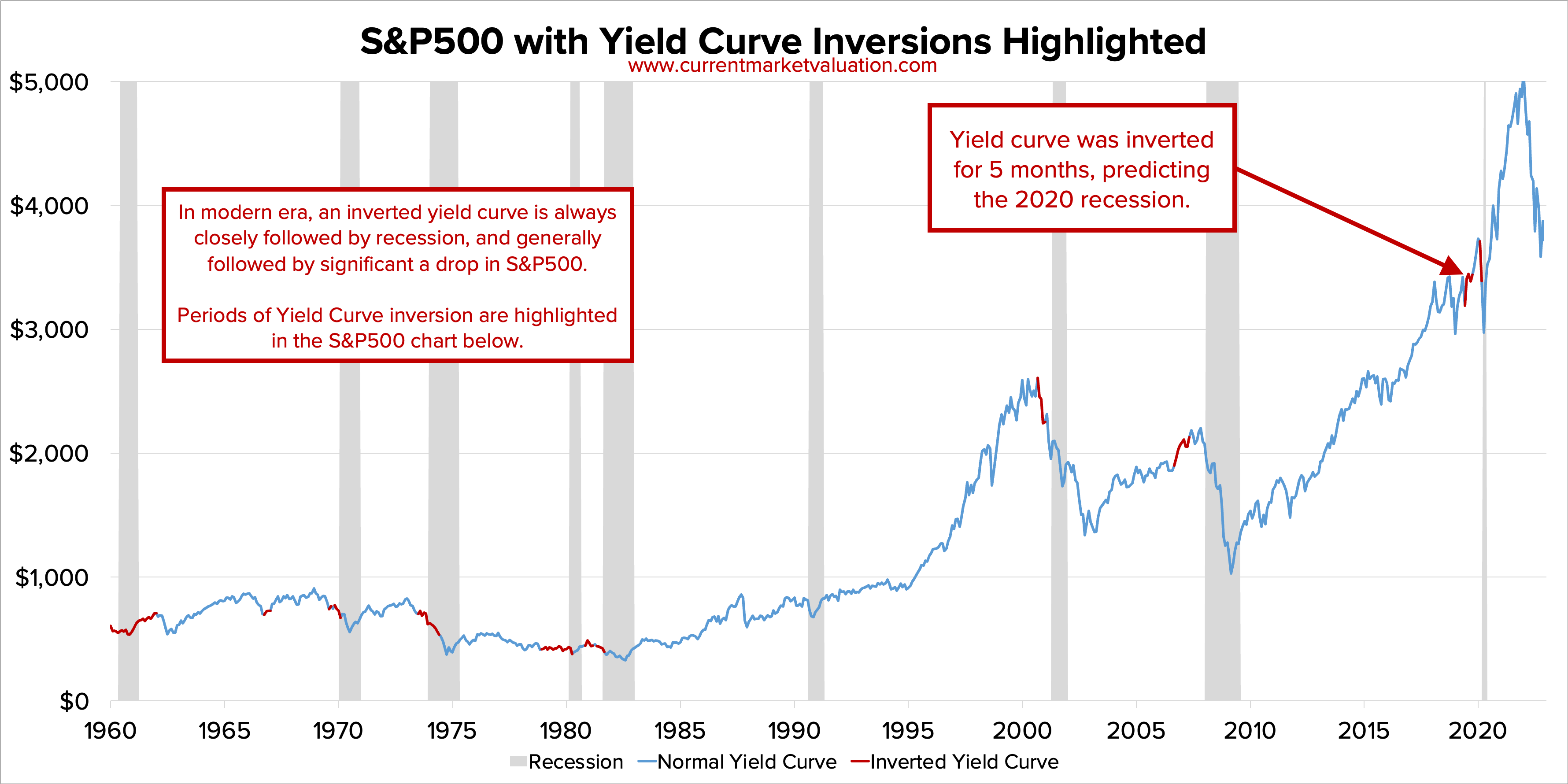

Historical Performance During Economic Downturns

Analyzing Uber's past performance during economic slowdowns provides valuable insights into its recession resistance.

Past Recessions and Uber's Response

While Uber is a relatively young company, its relatively short history includes periods of economic uncertainty. Examining its stock price fluctuations and revenue trends during these periods offers valuable data points:

- Stock price fluctuations: Analyzing the volatility of Uber's stock price during previous economic downturns reveals its sensitivity to market fluctuations.

- Revenue growth/decline during those periods: Comparing revenue growth during economic downturns against periods of economic expansion provides a measure of its resilience.

- Company strategies implemented: Understanding the strategies Uber employed during past economic challenges (e.g., cost-cutting measures, marketing campaigns) provides insight into its adaptive capacity.

Comparison to Traditional Transportation

Comparing Uber's performance to traditional transportation companies during economic hardship highlights the potential advantages of its business model:

- Impact of ride-sharing on public transit usage: The increased adoption of ride-sharing may have reduced reliance on public transport, affecting the traditional transportation sector disproportionately during downturns.

- Competitive landscape analysis: Uber's ability to compete with and potentially displace traditional transportation options provides a key advantage during challenging economic times.

Factors Influencing Uber's Recession Resistance

Several factors beyond its business model influence Uber's resilience during economic downturns.

Consumer Spending Habits

Consumer spending habits significantly impact Uber's performance. Understanding consumer behavior during economic uncertainty is key:

- Impact of discretionary spending on ride-hailing: Ride-hailing services are often considered discretionary spending, making them vulnerable to reduced consumer spending during economic downturns.

- The price sensitivity of Uber's customer base: Analyzing the price elasticity of demand for Uber's services reveals the impact of price changes on ridership during tough economic conditions.

Regulatory Landscape and Legal Challenges

The regulatory environment and legal battles can significantly affect Uber's financial stability:

- Government regulations: Changes in regulations concerning ride-sharing and labor laws could impact Uber's operations and profitability.

- Labor disputes: Ongoing labor disputes and legal challenges related to driver classification and employee benefits pose financial risks.

- Legal costs: The costs associated with legal battles can strain Uber's financial resources.

Technological Innovation and Future Growth

Uber's investments in autonomous vehicles and other innovative technologies could drive future growth and enhance its recession resistance:

- Autonomous vehicle development: Successful deployment of autonomous vehicles could significantly reduce operational costs and improve efficiency.

- Potential impact on profitability: Autonomous vehicles could dramatically alter Uber's cost structure, potentially improving profitability even during economic downturns.

- Future market share projections: Forecasting Uber's future market share considering technological advancements and competitive dynamics helps assess its long-term prospects.

Conclusion

Uber's potential for recession resistance is a complex issue. While its diverse business model, dynamic pricing, and technological innovation offer advantages, its dependence on discretionary spending and exposure to regulatory challenges remain significant risks. Its historical performance during previous economic slowdowns provides some data points, but a longer track record is needed for definitive conclusions. While no investment is entirely recession-proof, understanding the factors influencing Uber's stock performance is crucial for informed investment decisions. Further research into Uber stock and the broader recession-resistant investment landscape is recommended before making any financial commitments. Consider consulting with a financial advisor to determine if Uber stock aligns with your risk tolerance and investment goals.

Featured Posts

-

Snl O Maik Magiers Ypodyetai Ton Ilon Mask Kritiki Kai Analysi

May 18, 2025

Snl O Maik Magiers Ypodyetai Ton Ilon Mask Kritiki Kai Analysi

May 18, 2025 -

Highlights From Snls Jack Black Episode Ego Nwodims Standout Performance

May 18, 2025

Highlights From Snls Jack Black Episode Ego Nwodims Standout Performance

May 18, 2025 -

O Kasselakis Kai To Mellon Tis Ellinikis Naytilias Prokliseis Kai Eykairies

May 18, 2025

O Kasselakis Kai To Mellon Tis Ellinikis Naytilias Prokliseis Kai Eykairies

May 18, 2025 -

The 2025 Spring Breakout Rosters Key Players To Watch

May 18, 2025

The 2025 Spring Breakout Rosters Key Players To Watch

May 18, 2025 -

Historic Canterbury Castle Purchased For 705 499

May 18, 2025

Historic Canterbury Castle Purchased For 705 499

May 18, 2025

Latest Posts

-

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025 -

Daily Lotto Monday 28 April 2025 Results

May 18, 2025

Daily Lotto Monday 28 April 2025 Results

May 18, 2025 -

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025 -

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025 -

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025