Reciprocal Tariffs: Assessing Second-Order Risks To Key Indian Sectors

Table of Contents

Impact on Indian Exports

Reciprocal tariffs, where countries retaliate with matching tariffs, significantly impact a nation's export competitiveness. For India, a large exporter, this poses a substantial risk.

Reduced Global Competitiveness

Retaliatory tariffs imposed by other nations directly diminish the competitiveness of Indian exports in global markets. This is because:

- Increased export costs: Tariffs increase the price of Indian goods in foreign markets, making them less attractive compared to competitors.

- Loss of market share to competitors: As Indian goods become more expensive, buyers may switch to cheaper alternatives from countries not facing retaliatory tariffs.

- Potential for decreased foreign investment in export-oriented industries: Uncertainty and reduced profitability due to tariffs can discourage foreign investment, hindering growth in export sectors.

These factors directly impact Indian export competitiveness and necessitate a strategic response to maintain market share and attract foreign investment amidst global trade tariffs.

Sector-Specific Analysis

The vulnerability of specific Indian export sectors to reciprocal tariffs varies greatly. A detailed sector-specific analysis is crucial:

- Indian textile exports: This labor-intensive sector is highly sensitive to tariffs, potentially leading to job losses and factory closures if export demand falls.

- Pharmaceutical tariffs: India is a major pharmaceutical exporter. Increased tariffs could severely impact its competitiveness, particularly in generic drug markets.

- IT services trade: While less directly affected by tariffs on physical goods, uncertainty in the global trade environment could dampen demand for Indian IT services.

Understanding the tariff sensitivity for each sector is crucial for targeted policy interventions and support measures to mitigate the negative impacts.

Domestic Price Inflation and Consumer Costs

Reciprocal tariffs not only affect exports but also significantly impact domestic prices and consumer welfare.

Increased Import Costs

Reciprocal tariffs lead to higher prices for imported goods, directly contributing to inflation within India. This impact is felt across various aspects:

- Impact on essential goods: Tariffs on essential imports, such as food and energy, directly increase the cost of living for consumers, disproportionately affecting low-income households.

- Inflationary pressure: Increased import costs translate into higher prices for domestic goods and services, leading to a rise in the Consumer Price Index (CPI) and overall inflationary pressure.

- Effect on consumer purchasing power: Inflation erodes consumer purchasing power, reducing demand and potentially impacting economic growth.

- Potential for social unrest: Significant price increases for essential goods can lead to social unrest and political instability.

Impact on Domestic Industries

While higher import costs can provide some protection for domestic industries, the long-term implications are complex:

- Protection for domestic producers: Increased import costs can make domestic products more competitive, potentially benefiting local producers.

- Potential for price gouging: Domestic producers might exploit the situation by raising prices excessively, negating the benefits of tariff protection.

- Long-term implications for economic efficiency: Protectionist measures can stifle innovation and competition, leading to lower economic efficiency in the long run.

Foreign Investment and Capital Flows

Uncertainty generated by reciprocal tariffs has a significant chilling effect on foreign investment and capital flows into India.

Deterrent to Foreign Direct Investment (FDI)

The uncertainty surrounding trade policies significantly reduces investor confidence:

- Reduced investor confidence: Companies are hesitant to invest in countries with unpredictable trade environments, fearing potential losses from retaliatory tariffs.

- Negative impact on capital inflows: Reduced FDI negatively impacts capital inflows, hindering investment in infrastructure, technology, and job creation.

- Implications for job creation and economic growth: Decreased investment directly impacts job creation and overall economic growth.

Impact on Portfolio Investment

Reciprocal tariffs can also create volatility in Indian financial markets:

- Potential capital flight: Investors might withdraw their portfolio investments from India if they anticipate further trade tensions and economic uncertainty.

- Volatility in the stock market: Uncertainty leads to increased volatility in the Indian stock market, impacting investor sentiment and potentially causing losses.

- Impact on the rupee's exchange rate: Capital flight can weaken the Indian rupee, making imports more expensive and further fueling inflation.

Geopolitical Implications and Trade Relations

Reciprocal tariffs have far-reaching geopolitical consequences, impacting India's relationships with its trading partners.

Strained International Relations

Escalating trade tensions can damage diplomatic relations:

- Impact on diplomatic relations: Reciprocal tariffs can strain relations with key trading partners, leading to diplomatic disputes and hindering cooperation on other issues.

- Potential for trade wars: Escalation of trade disputes can lead to full-blown trade wars, with devastating consequences for global economic growth.

- Repercussions on India's global standing: Engaging in trade wars can damage India’s reputation as a reliable and predictable trading partner.

Diversification Strategies

To mitigate the risks associated with reciprocal tariffs, India needs to diversify its export markets:

- Exploring new export destinations: India should actively explore new markets and reduce its reliance on any single trading partner.

- Strengthening trade agreements with alternative partners: India must strengthen its trade relationships with countries less likely to impose retaliatory tariffs.

- Building resilience: Diversification strategies are key to building resilience against shocks from global trade disputes.

Conclusion

The implementation of reciprocal tariffs carries significant second-order risks for key Indian sectors. Understanding the potential impact on exports, inflation, foreign investment, and geopolitical relations is crucial for mitigating these risks. Policymakers must carefully consider the long-term consequences before implementing such measures. Businesses need to adapt proactively to navigate the changing trade landscape and explore diversification strategies. A comprehensive analysis of the potential implications of reciprocal tariffs is vital for ensuring the sustained growth and stability of the Indian economy. Therefore, a thorough assessment of the second-order risks associated with reciprocal tariffs is crucial for informed decision-making and proactive risk management.

Featured Posts

-

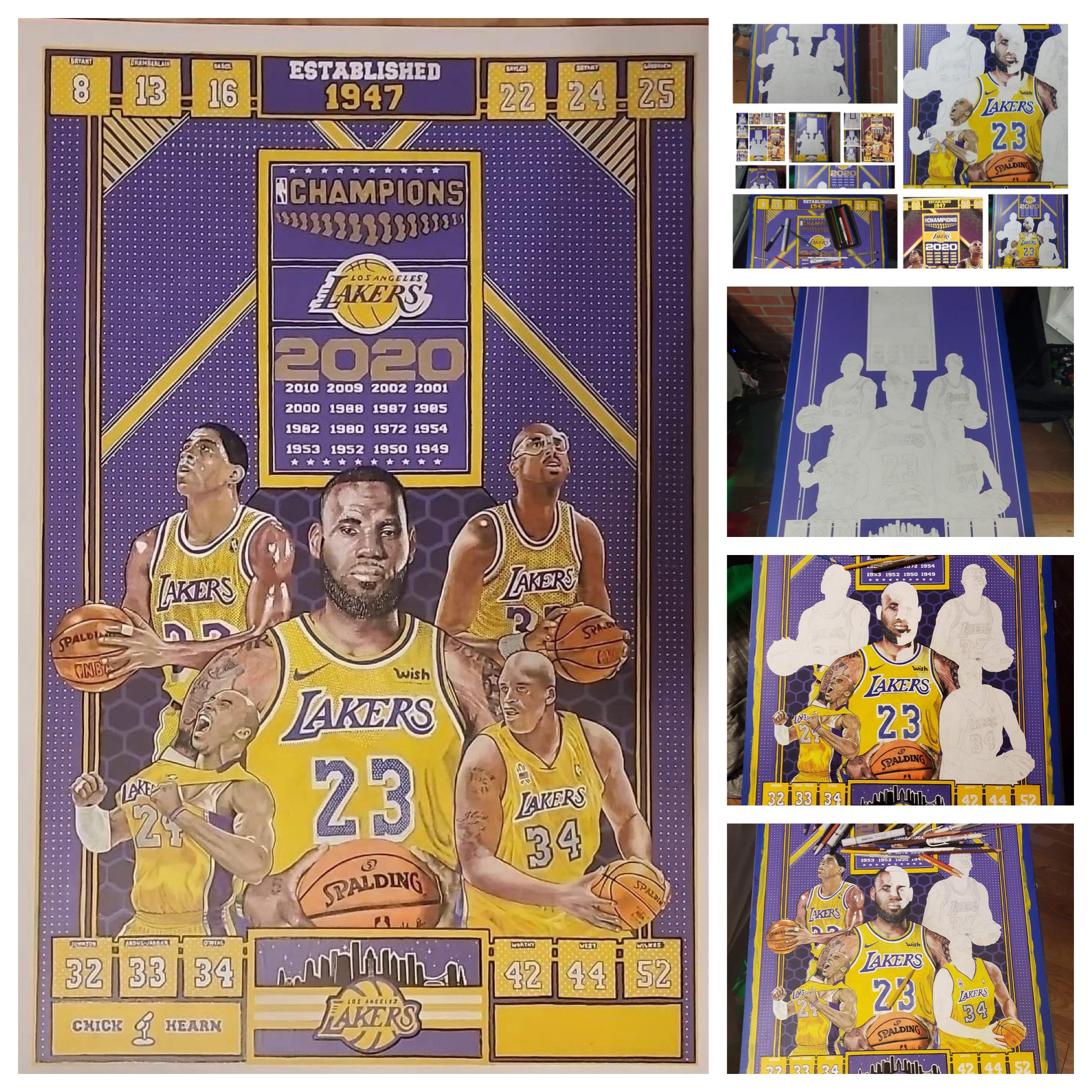

Follow The La Lakers Season With Vavel United States

May 15, 2025

Follow The La Lakers Season With Vavel United States

May 15, 2025 -

Luis Arraez And Jason Heyward In Padres Lineup Pregame Notes And Sweep Prediction

May 15, 2025

Luis Arraez And Jason Heyward In Padres Lineup Pregame Notes And Sweep Prediction

May 15, 2025 -

Dodger Slumping Left Handed Hitters A Look At The Recent Struggles And Potential Comeback

May 15, 2025

Dodger Slumping Left Handed Hitters A Look At The Recent Struggles And Potential Comeback

May 15, 2025 -

College Van Omroepen Hoe Vertrouwen Binnen De Npo Wordt Hersteld

May 15, 2025

College Van Omroepen Hoe Vertrouwen Binnen De Npo Wordt Hersteld

May 15, 2025 -

Syzitiseis Kompoy Sigiarto Dimereis Sxeseis Kypriako Kai I Elliniki Proedria Tis Ee

May 15, 2025

Syzitiseis Kompoy Sigiarto Dimereis Sxeseis Kypriako Kai I Elliniki Proedria Tis Ee

May 15, 2025