Record Canadian Investment In US Equities Amidst Trade War Uncertainty

Table of Contents

Why the Surge in Canadian Investment in US Equities?

Several compelling factors contribute to the recent surge in Canadian investment in US equities. These include the attractive valuation of US assets, the strategic benefits of portfolio diversification, and the impact of the US dollar's exchange rate.

Attractive Valuation of US Assets

Compared to the Canadian market, US equities have presented relatively attractive valuations in recent years. This is driven by several factors, including strong economic growth projections for certain sectors and specific investment opportunities.

- Robust US Economic Growth: Positive forecasts for the US economy have fueled investor confidence, making US equities a more appealing investment option.

- Sector-Specific Opportunities: Specific sectors, such as technology and healthcare, have demonstrated exceptional growth potential, drawing significant Canadian investment. The technology sector, in particular, offers numerous high-growth opportunities, while healthcare is seen as a relatively stable and resilient sector.

- Lower Valuation Multiples: In some instances, US equities have shown lower price-to-earnings ratios (P/E ratios) compared to their Canadian counterparts, indicating potentially better value for investors.

Diversification Strategies

A key driver of increased Canadian investment in US equities is the desire for portfolio diversification. Geographical diversification reduces overall risk by spreading investments across different markets. This is particularly crucial in a volatile global market where domestic market fluctuations can significantly impact returns.

- Reducing Domestic Market Risk: By investing in US equities, Canadian investors can mitigate the impact of downturns in the Canadian market, thereby reducing their overall portfolio volatility.

- Currency Hedging: While the US dollar's fluctuations can impact returns, diversification across currencies inherently mitigates risk, providing a cushion against significant losses from any single currency movement.

- Access to a Wider Range of Assets: The US market offers access to a much broader range of companies and investment opportunities compared to the Canadian market, facilitating greater diversification.

The Role of the US Dollar

The US dollar's exchange rate plays a significant role in the attractiveness of US investments for Canadian investors. When the Canadian dollar weakens against the US dollar, US equities become relatively cheaper for Canadian investors, boosting their purchasing power.

- Exchange Rate Fluctuations: The relationship between the CAD and USD is dynamic, and fluctuations can directly affect the profitability of investments. A weaker CAD increases the return when converted back to Canadian dollars.

- Currency Hedging Strategies: Sophisticated investors often employ currency hedging strategies to mitigate the risks associated with exchange rate volatility. These strategies aim to lock in favorable exchange rates, protecting investment returns from adverse currency movements.

Navigating Trade War Uncertainty

The ongoing trade tensions between the US and other countries, including Canada, undeniably impact investment decisions. While uncertainty remains a significant factor, investors employ various strategies to mitigate associated risks.

Impact of Trade Policies on Investment Decisions

Trade policy changes, such as tariffs and trade disputes, can significantly impact investment decisions. These uncertainties create volatility and require careful consideration.

- Tariff Impacts: Tariffs imposed on goods traded between the US and Canada can disrupt supply chains and affect the profitability of companies operating in these sectors.

- Supply Chain Disruptions: Trade disputes can cause disruptions to global supply chains, creating uncertainty and potential delays for businesses.

- Market Volatility: Trade war uncertainty often results in increased market volatility, making it crucial for investors to carefully assess their risk tolerance.

Long-Term Outlook and Investor Sentiment

Despite the uncertainty, many investors maintain a positive long-term outlook on the US and Canadian economies. The current investment trend may reflect both long-term strategic planning and a tactical response to market conditions.

- Long-Term Growth Potential: Despite trade tensions, many analysts remain optimistic about the long-term growth potential of both the US and Canadian economies.

- Market Sentiment: Investor sentiment is crucial. If confidence prevails, the current investment trend could continue despite short-term uncertainties.

- Expert Opinions: Market analysts and financial experts provide valuable insights into investor sentiment and long-term economic projections, guiding investment strategies.

Conclusion

The record Canadian investment in US equities is a complex phenomenon driven by a confluence of factors. Attractive valuations in specific US sectors, strategic portfolio diversification needs, and the impact of the US dollar's exchange rate all contribute significantly. While trade war uncertainty presents a challenge, investors are actively employing strategies to mitigate the risks associated with these global economic shifts. Understanding these dynamics is crucial for informed investment decisions.

To learn more about cross-border investment opportunities and navigate the intricacies of Canadian investment in US equities, consult with a qualified financial advisor. They can help you develop a personalized investment strategy tailored to your risk tolerance and financial goals, particularly in times of trade war uncertainty. Further reading on portfolio diversification and the dynamics of North American trade relations can also be beneficial in making informed decisions.

Featured Posts

-

Canadian Investors Pour Into Us Stocks Defying Trade War Concerns

Apr 23, 2025

Canadian Investors Pour Into Us Stocks Defying Trade War Concerns

Apr 23, 2025 -

Naylor Delivers Go Ahead Run As Diamondbacks Top Brewers

Apr 23, 2025

Naylor Delivers Go Ahead Run As Diamondbacks Top Brewers

Apr 23, 2025 -

Michael Lorenzens Impact On The Game Statistics And Achievements

Apr 23, 2025

Michael Lorenzens Impact On The Game Statistics And Achievements

Apr 23, 2025 -

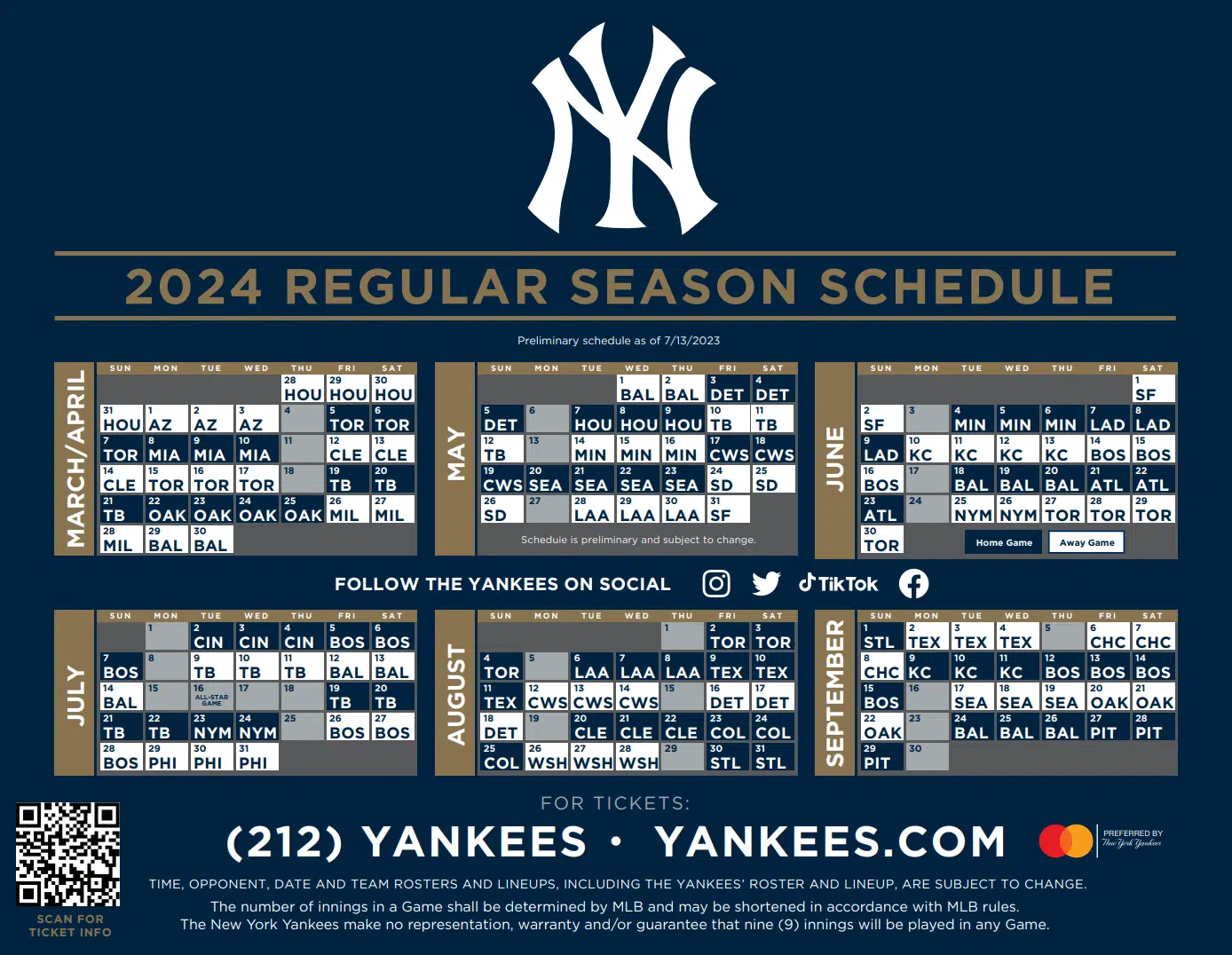

Yankees Opening Day Win Key Plays And Performance Analysis

Apr 23, 2025

Yankees Opening Day Win Key Plays And Performance Analysis

Apr 23, 2025 -

Yankees Winning Strategy On Full Display In Opening Day Victory

Apr 23, 2025

Yankees Winning Strategy On Full Display In Opening Day Victory

Apr 23, 2025

Latest Posts

-

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 09, 2025

Edmonton Oilers Leon Draisaitl A Hart Trophy Finalists Banner Season

May 09, 2025 -

2025 Nhl Trade Deadline Predicting The Stanley Cup Playoffs

May 09, 2025

2025 Nhl Trade Deadline Predicting The Stanley Cup Playoffs

May 09, 2025 -

Draisaitl Injury Update Edmonton Oilers Leading Goal Scorers Status

May 09, 2025

Draisaitl Injury Update Edmonton Oilers Leading Goal Scorers Status

May 09, 2025 -

2024 25 Nhl Season The Biggest Storylines To Watch

May 09, 2025

2024 25 Nhl Season The Biggest Storylines To Watch

May 09, 2025 -

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025