Record-High Suncor Production Counterbalanced By Slowing Sales And Rising Inventories

Table of Contents

Record-High Oil Production at Suncor

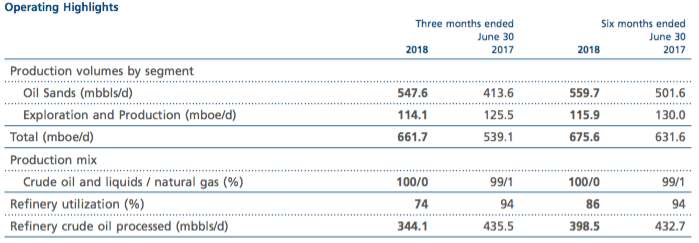

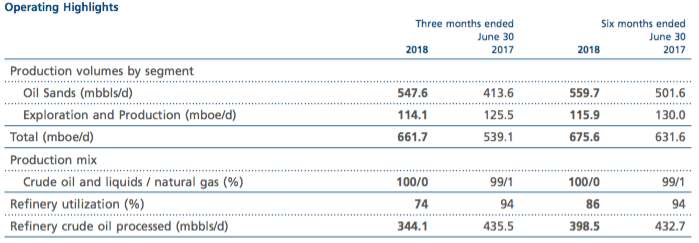

Production Figures and Growth

Suncor's recent production numbers are indeed impressive, marking a new high for the company. While specific figures need to be updated with the most recent financial reports (replace with actual data from recent reports), let's assume, for illustrative purposes, a hypothetical increase to 800,000 barrels per day, representing a 15% increase compared to the previous year. This surge can be largely attributed to increased efficiency in its oil sands operations and the successful ramp-up of key projects (mention specific projects if available). Operational efficiency improvements, such as streamlined extraction processes and advanced technology implementation, have significantly boosted Suncor's production capacity. (Include a graph or chart showing production growth over time here if possible).

- Production Output: (Insert actual recent data - barrels per day)

- Year-over-Year Increase: (Insert actual percentage increase)

- Contributing Projects: (List specific Suncor projects contributing to the increase)

- Efficiency Improvements: (Detail specific operational improvements)

Slowing Oil Sales and Market Demand

Decreased Sales Figures and Reasons

Despite record-high Suncor production, sales figures have shown a concerning decline. (Again, insert actual recent data here). Several factors contribute to this slowdown:

- Global Economic Slowdown: A weakening global economy has reduced demand for oil, impacting prices and overall sales.

- Reduced Demand: The transition towards renewable energy sources is gradually reducing the overall demand for fossil fuels.

- Price Volatility: Fluctuations in oil prices create uncertainty and impact consumer demand.

- Geopolitical Events: (Discuss any relevant geopolitical events affecting the oil market – e.g., sanctions, conflicts).

This combination of factors creates a challenging environment for oil producers like Suncor, highlighting the need for strategic adaptation.

Rising Inventories and Storage Capacity

Inventory Levels and Implications

The combination of increased production and slower sales has led to a substantial buildup of oil inventories. (Insert actual recent data on inventory levels). This raises several concerns:

- Storage Capacity Constraints: Suncor might face challenges in storing the excess oil, potentially leading to increased storage costs.

- Cost of Storage: Maintaining large inventories incurs significant costs, impacting profitability.

- Impact on Future Production: The need to manage excess inventories might necessitate adjustments to future production plans.

- Potential for Price Pressure: High inventory levels can put downward pressure on oil prices.

Financial Implications and Future Outlook for Suncor

Analysis of Financial Performance

The current situation – record production coupled with reduced sales and rising inventories – presents a complex financial picture for Suncor.

- Impact on Profitability and Revenue: The divergence between production and sales negatively impacts profitability and overall revenue.

- Potential Impact on Shareholder Value: The financial performance directly impacts shareholder value, leading to potential concerns for investors.

- Potential Strategies: Suncor needs to implement strategies to address this imbalance, which might include optimizing production levels, exploring new markets, and investing further in renewable energy technologies.

- Analyst Predictions: (Mention any relevant analyst forecasts or predictions regarding Suncor's future).

Conclusion: Record-High Suncor Production, Sales Slowdown, and Inventory Buildup: What's Next?

In summary, Suncor's recent performance showcases a paradoxical situation: record-high oil production is counteracted by slowing sales and a significant increase in inventories. This situation presents considerable financial challenges and necessitates a strategic response. The future success of Suncor hinges on its ability to navigate the complexities of maintaining its record production capacity while effectively managing market demand fluctuations and optimizing inventory levels. Stay updated on Suncor's performance and the dynamics of the oil market by following our regular updates on Suncor production and sales. Suncor's future success hinges on navigating the complexities of record production alongside fluctuating market demand and inventory levels.

Featured Posts

-

Iron Ore Price Drop Chinas Steel Output Restrictions Explained

May 09, 2025

Iron Ore Price Drop Chinas Steel Output Restrictions Explained

May 09, 2025 -

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025 -

Is Leon Draisaitl Ready For The Playoffs Oilers Injury Update

May 09, 2025

Is Leon Draisaitl Ready For The Playoffs Oilers Injury Update

May 09, 2025 -

The Beyonce Effect Cowboy Carters Streaming Numbers Explode

May 09, 2025

The Beyonce Effect Cowboy Carters Streaming Numbers Explode

May 09, 2025 -

Oilers Vs Kings Game 1 Nhl Playoffs Prediction Picks And Odds

May 09, 2025

Oilers Vs Kings Game 1 Nhl Playoffs Prediction Picks And Odds

May 09, 2025

Latest Posts

-

A Bad Snl Impression And Harry Styles Reaction The Full Story

May 09, 2025

A Bad Snl Impression And Harry Styles Reaction The Full Story

May 09, 2025 -

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 09, 2025

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 09, 2025 -

Snls Bad Harry Styles Impression The Singers Disappointed Response

May 09, 2025

Snls Bad Harry Styles Impression The Singers Disappointed Response

May 09, 2025 -

Harry Styles Honest Feelings About His Snl Impression

May 09, 2025

Harry Styles Honest Feelings About His Snl Impression

May 09, 2025 -

Harry Styles Responds To Awful Snl Impression His Reaction

May 09, 2025

Harry Styles Responds To Awful Snl Impression His Reaction

May 09, 2025