Record Investments In Indian Real Estate: A 47% Increase In Q1 2024

Table of Contents

Factors Driving the Record Investment in Indian Real Estate

Several interconnected factors contributed to the unprecedented surge in investment in Indian real estate during Q1 2024.

Economic Growth and Increased Disposable Incomes

India's sustained economic growth has fueled a surge in consumer confidence and disposable incomes. This positive economic environment has directly translated into increased purchasing power, making real estate a more accessible and attractive investment option for a broader segment of the population.

- Rising middle class and their increased spending capacity: The expanding Indian middle class represents a significant driving force behind increased real estate demand. Their growing disposable incomes empower them to invest in properties, both for residential and investment purposes.

- Positive economic indicators like GDP growth and employment rates: Steady GDP growth and improving employment rates indicate a healthy and expanding economy, further bolstering investor confidence in the real estate sector. These positive indicators reduce the perceived risk associated with real estate investments.

- Impact of government initiatives supporting economic growth: Government initiatives aimed at stimulating economic growth, such as tax reforms and infrastructure development projects, have played a vital role in creating a favorable environment for real estate investments.

Favorable Government Policies and Infrastructure Development

Government policies have played a significant role in shaping the positive sentiment surrounding Indian real estate investment. Various initiatives have streamlined the investment process and incentivized both domestic and foreign investors.

- Impact of infrastructure development projects (e.g., smart cities, metro rail): Massive infrastructure development projects, including the development of smart cities and expansion of metro rail networks, have significantly enhanced the appeal of several regions, boosting property values and attracting substantial investments.

- Tax incentives for real estate investments: Tax benefits and incentives offered by the government have made real estate investments more attractive, reducing the overall cost and encouraging higher participation.

- Regulatory reforms simplifying the investment process: Regulatory reforms aimed at simplifying the investment process, reducing bureaucratic hurdles, and improving transparency have enhanced investor confidence and facilitated smoother transactions.

Increased Demand for Housing and Commercial Spaces

The surge in investment is also fueled by a rapidly increasing demand for both residential and commercial properties. This demand is primarily driven by population growth, urbanization, and the expansion of various industries.

- Growing urban population and migration to cities: India's ongoing urbanization trend, with a significant population shift from rural to urban areas, has created a massive demand for housing across various price segments.

- Increased demand for affordable housing: The government's focus on affordable housing initiatives has further spurred demand, creating opportunities for investors in this rapidly growing segment.

- Growth of e-commerce and its impact on commercial real estate: The booming e-commerce sector has driven a significant increase in demand for warehousing and logistics spaces, further boosting investments in the commercial real estate market.

Geographical Distribution of Investments

The record investment in Indian real estate during Q1 2024 wasn't uniformly distributed across the country. Certain regions experienced significantly higher growth compared to others.

- Investment hotspots in India (e.g., Mumbai, Delhi-NCR, Bengaluru): Major metropolitan areas like Mumbai, Delhi-NCR (National Capital Region), and Bengaluru continued to attract the lion's share of investment, driven by factors like robust infrastructure, employment opportunities, and established real estate markets.

- Regional disparities in investment levels: While major cities witnessed substantial growth, regional disparities in investment levels remain. Factors like infrastructure development, connectivity, and local economic conditions influence investment flows across different regions.

- Factors driving investment in specific regions (e.g., infrastructure, connectivity): Improved infrastructure, better connectivity, and the presence of major industries are key factors driving investment in specific regions, making them attractive hubs for real estate development.

Future Outlook for Indian Real Estate Investments

The outlook for the Indian real estate sector remains largely positive, with projections suggesting continued growth in the coming years. However, potential challenges must be considered.

- Predictions for future investment growth in Indian real estate: Experts predict sustained growth in the Indian real estate market, driven by ongoing urbanization, economic growth, and favorable government policies. However, the pace of growth might fluctuate depending on various economic factors.

- Potential risks associated with real estate investment (e.g., interest rate hikes, inflation): Potential risks include interest rate hikes, inflation, and fluctuations in the global economy. These factors can influence investor sentiment and impact real estate market performance.

- Opportunities for investors in different property segments: Despite potential risks, opportunities exist for investors in various segments, including affordable housing, commercial real estate, and luxury properties. Diversification of investment portfolios can mitigate risks.

Conclusion: Capitalizing on the Boom in Indian Real Estate Investments

The remarkable 47% surge in Indian real estate investment during Q1 2024 underscores the sector's robust growth trajectory. This significant increase is driven by a combination of economic growth, supportive government policies, and a strong demand for both residential and commercial properties. While potential challenges exist, the overall outlook for the Indian real estate market remains positive, presenting significant opportunities for astute investors. Don't miss out on this exciting period of growth. Explore the lucrative opportunities presented by the booming Indian real estate market. Learn more about investment strategies today!

Featured Posts

-

Josh Hart Injury Report Playing Status For Knicks Vs Celtics February 23rd

May 17, 2025

Josh Hart Injury Report Playing Status For Knicks Vs Celtics February 23rd

May 17, 2025 -

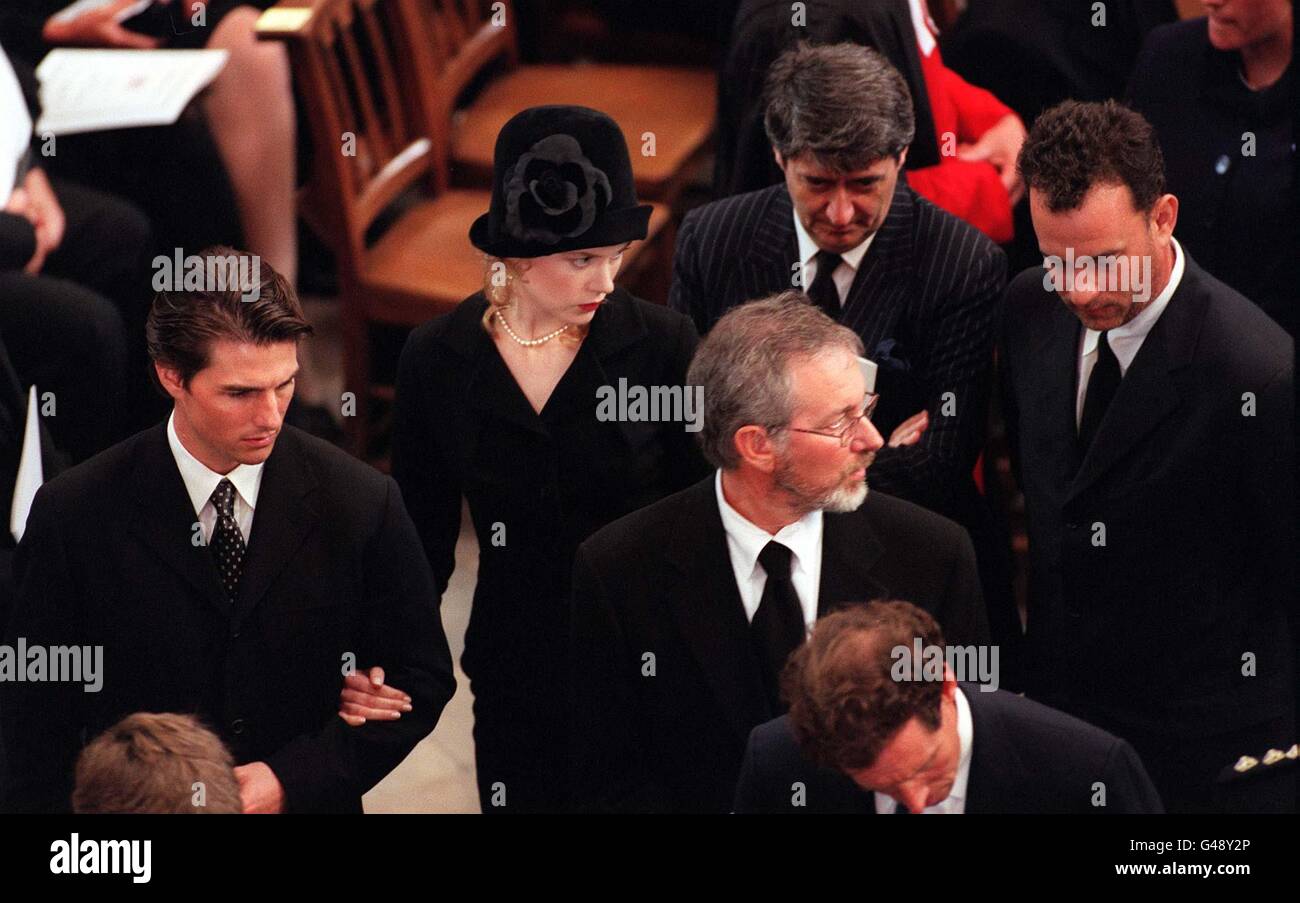

Tom Cruise And Tom Hanks Hilarious 1 Iou A Hollywood Anecdote

May 17, 2025

Tom Cruise And Tom Hanks Hilarious 1 Iou A Hollywood Anecdote

May 17, 2025 -

Tom Cruises Dating History Examining His High Profile Romances

May 17, 2025

Tom Cruises Dating History Examining His High Profile Romances

May 17, 2025 -

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025

Top Bitcoin Online Casino 2025 Why Jack Bit Is The Best Crypto Casino

May 17, 2025 -

Seth Rogens The Studio A Perfect 100 Rotten Tomatoes Score

May 17, 2025

Seth Rogens The Studio A Perfect 100 Rotten Tomatoes Score

May 17, 2025

Latest Posts

-

0 0 Everton Vina Y Coquimbo Unido Empatan En Un Partido Sin Goles

May 17, 2025

0 0 Everton Vina Y Coquimbo Unido Empatan En Un Partido Sin Goles

May 17, 2025 -

Analisis Del Partido Talleres 2 0 Alianza Lima

May 17, 2025

Analisis Del Partido Talleres 2 0 Alianza Lima

May 17, 2025 -

Everton Vina Y Coquimbo Unido Reporte Del Partido 0 0

May 17, 2025

Everton Vina Y Coquimbo Unido Reporte Del Partido 0 0

May 17, 2025 -

Partido Belgica Portugal Resultado Final 0 1 Y Detalles

May 17, 2025

Partido Belgica Portugal Resultado Final 0 1 Y Detalles

May 17, 2025 -

Goles Y Resumen Del Partido Talleres 2 0 Alianza Lima

May 17, 2025

Goles Y Resumen Del Partido Talleres 2 0 Alianza Lima

May 17, 2025