Recordati And The Impact Of Tariff Volatility On M&A Activity In Italy

Table of Contents

The Italian Pharmaceutical Market Landscape

The Italian pharmaceutical market is a significant player in Europe, characterized by a mature yet dynamic landscape. It's a large market with substantial revenue, boasting a robust regulatory framework overseen by AIFA (Agenzia Italiana del Farmaco). Key players include both multinational corporations and domestic companies, vying for market share in a competitive environment. The market is characterized by:

- Market Growth Projections: While growth is projected to be moderate in the coming years, the market remains attractive due to its aging population and high healthcare expenditure.

- Key Trends: The increasing demand for generic drugs, coupled with the continuous need for innovative therapies, shapes the competitive landscape. Precision medicine and digital health are emerging as key areas of focus.

- Competitive Landscape Analysis: The market is characterized by both strong competition from established players and the emergence of innovative biotech companies.

Recordati's M&A Strategy and Recent Activities

Recordati has a long history of strategic acquisitions, leveraging M&A to expand its product portfolio and geographic reach. Their success stems from a meticulous approach, carefully selecting targets that align with their core competencies and market strategy. However, they haven't been immune to challenges.

- Examples of Successful and Unsuccessful Acquisitions: Recordati's acquisition of [Insert example of a successful acquisition and briefly explain why it was successful]. Conversely, [Insert example of a less successful acquisition and briefly explain the challenges].

- Key Factors Driving Recordati's M&A Decisions: Their decisions are largely driven by the potential for synergistic benefits, market expansion into new therapeutic areas, and the acquisition of innovative products or technologies.

- Analysis of their Target Companies: Recordati typically targets companies with established products in specific therapeutic areas and often focuses on geographic expansion within Europe.

The Impact of Tariff Volatility on M&A Decisions

Tariff volatility significantly impacts the pharmaceutical industry. Fluctuations create uncertainty regarding the cost of raw materials, many of which are imported. This uncertainty directly influences:

-

Impact on Pricing Strategies and Profitability: Increased import tariffs lead to higher production costs, potentially squeezing profit margins and making it difficult to maintain competitive pricing.

-

Impact on Investor Confidence and Deal Valuations: The uncertainty surrounding tariffs makes it difficult to accurately forecast future revenues and profitability, impacting investor confidence and making it harder to secure favorable deal valuations.

-

Specific Examples: The imposition of [insert example of a specific tariff change] impacted the cost of [insert specific raw material or finished good] for Italian pharmaceutical companies, illustrating the direct impact of tariff volatility.

-

Effect on Deal Structuring and Negotiations: Companies often incorporate clauses into M&A agreements to address tariff risks, potentially delaying or complicating negotiations.

-

Strategies to Mitigate Tariff Risks: Companies are employing strategies like hedging, diversification of sourcing, and regional manufacturing to mitigate these risks.

Case Study: Recordati's Response to Tariff Volatility

Recordati, being a global company, has actively worked to manage the risks associated with tariff volatility. Their strategy includes:

- Specific Actions Taken: Recordati has likely implemented strategies such as hedging against currency fluctuations and diversifying their sourcing of raw materials to reduce their dependence on specific regions or suppliers.

- Analysis of their Financial Performance in Relation to Tariff Changes: A detailed analysis of Recordati’s financial reports during periods of significant tariff fluctuations would reveal how effectively they've managed these challenges.

- Comparison to Competitors' Responses: Comparing Recordati's response to that of its competitors would offer valuable insights into best practices for managing tariff risk in the Italian pharmaceutical industry.

Future Outlook for M&A in the Italian Pharmaceutical Sector

The future of M&A in the Italian pharmaceutical sector remains intertwined with global trade uncertainties. Predicting future tariff scenarios is challenging, but several factors will influence the market:

- Forecasting Future Tariff Scenarios: Predicting future tariff scenarios requires careful consideration of geopolitical factors and global trade negotiations.

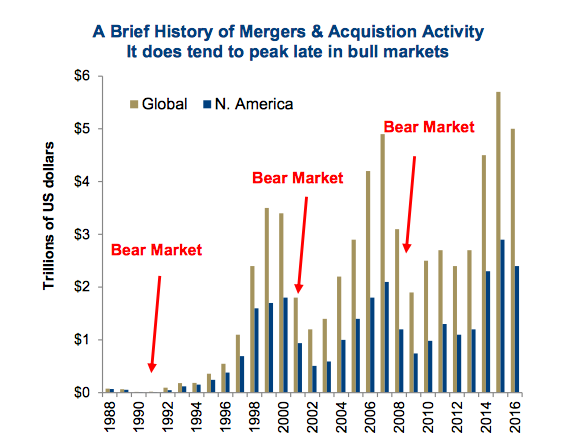

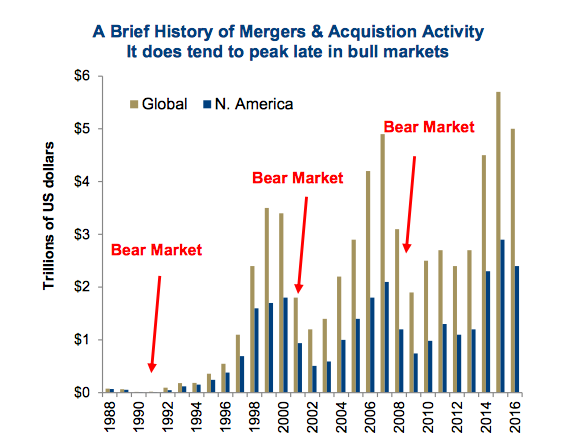

- Potential Changes in M&A Deal Sizes and Frequency: Increased tariff volatility is likely to result in smaller and less frequent deals as companies take a more cautious approach to investment.

- Opportunities and Challenges: While challenges abound, companies that successfully navigate tariff volatility will be well-positioned to take advantage of opportunities within the Italian pharmaceutical market.

Understanding the Implications of Tariff Volatility for Recordati and Future M&A in Italy

In conclusion, tariff volatility poses a significant challenge to M&A activity in the Italian pharmaceutical sector. Recordati's experience highlights the importance of proactive risk management strategies in navigating these uncertainties. Understanding and mitigating tariff risk is crucial for success in future M&A transactions. To further research the complexities of Recordati and the Impact of Tariff Volatility on M&A Activity in Italy, explore resources like AIFA reports, financial analyses of Recordati, and articles on international trade and pharmaceutical regulations. This will provide a deeper understanding of "Italian pharmaceutical M&A," "tariff risk management," and "Recordati investment strategy."

Featured Posts

-

Poilievre Loses Conservative Setback In Canadian Election

May 01, 2025

Poilievre Loses Conservative Setback In Canadian Election

May 01, 2025 -

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025 -

Irishmans Armenian Eurovision Song A Historic Moment

May 01, 2025

Irishmans Armenian Eurovision Song A Historic Moment

May 01, 2025 -

Dragons Den Backs Omnis Innovative Plant Based Dog Food Brand

May 01, 2025

Dragons Den Backs Omnis Innovative Plant Based Dog Food Brand

May 01, 2025 -

Rescued Hostage Noa Argamani Named To Times 100 Most Influential People

May 01, 2025

Rescued Hostage Noa Argamani Named To Times 100 Most Influential People

May 01, 2025