Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Federal Student Loan Refinancing

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a private lender. This is different from consolidation, which combines your federal loans into a single federal loan, typically without changing the interest rate. The primary benefit of refinancing is the potential for lower interest rates, leading to lower monthly payments and less interest paid over the life of the loan.

- Lower interest rates: This is the main draw for most borrowers. Lower student loan interest rates can significantly reduce your overall cost.

- Potential for a shorter repayment term: A shorter repayment term means you'll pay off your loans faster, but your monthly payments will be higher.

- Simplified payment process: Dealing with a single lender simplifies your payments and makes budgeting easier.

- Loss of federal student loan benefits: This is a crucial consideration. By refinancing, you lose access to federal benefits like income-driven repayment plans (IDR), loan forgiveness programs (such as Public Service Loan Forgiveness or PSLF), and deferment or forbearance options.

The trade-off between lower student loan interest rates and the loss of federal protections is significant. Carefully weigh the potential savings against the risks before making a decision. Consider your current financial situation and long-term goals, including your eligibility for federal student loan forgiveness programs.

When Refinancing Makes Sense

Refinancing federal student loans is advantageous in certain scenarios:

- High interest rates on existing federal loans: If you have high interest rates on your current federal loans, refinancing could significantly lower your monthly payments.

- Excellent credit score: A strong credit score (generally 700 or above) improves your eligibility for lower interest rates and better loan terms. Lenders consider your creditworthiness when determining the interest rate they offer.

- Stable income and employment history: Lenders want to see a history of consistent income and employment to ensure you can make your loan payments. A stable job is a key factor in approval.

- Desire for a shorter repayment term: If you want to pay off your loans faster, refinancing allows you to choose a shorter repayment term. However, remember that this will result in higher monthly payments.

When Refinancing Might Not Be a Good Idea

Refinancing isn't always the best option. Consider these situations:

- Low credit score: A low credit score will likely result in higher interest rates, potentially negating the benefits of refinancing. Improving your credit score before applying is highly recommended.

- Unstable income or employment: If your income is unstable or you're concerned about job security, refinancing could put you at financial risk.

- Reliance on income-driven repayment plans or loan forgiveness programs: Refinancing means losing access to these federal programs, potentially costing you thousands of dollars over the life of your loan.

- High debt-to-income ratio: A high debt-to-income ratio (DTI) indicates you may already be struggling with debt. Adding another loan could worsen your financial situation.

Exploring Different Refinancing Options

Several refinancing options exist, each with its own advantages and disadvantages:

-

Private lenders: Numerous private lenders offer student loan refinancing programs. It’s crucial to compare interest rates, fees, and terms from multiple lenders.

-

Specific programs: Some employers or professional organizations offer specific refinancing programs with potentially better rates or terms.

-

Compare interest rates from multiple lenders: Don't settle for the first offer you receive. Shop around and compare rates from at least three different lenders.

-

Consider fees and other charges: Be aware of any origination fees, prepayment penalties, or other charges.

-

Review the terms and conditions carefully: Read the fine print carefully before signing any loan documents.

-

Understand the lender's reputation and customer service: Choose a reputable lender with a good track record of customer service.

The Refinancing Process: A Step-by-Step Guide

Refinancing your federal student loans involves several steps:

- Check your credit report and score: Knowing your credit score helps you understand your eligibility for better rates and prepares you for the application process.

- Shop around for the best rates and terms: Compare offers from multiple lenders to find the most favorable terms. Use online comparison tools to simplify the process.

- Complete the application process: This typically involves providing personal and financial information.

- Review the loan documents carefully: Ensure you understand all the terms and conditions before signing.

- Understand the closing process: This is the final step where the loan is officially disbursed and your old loans are paid off.

Conclusion

Refinancing federal student loans can significantly reduce your monthly payments and overall interest paid, but it's crucial to weigh the potential benefits against the loss of federal loan protections. Carefully assess your financial situation, credit score, and long-term goals before making a decision. By understanding when refinancing is advantageous and when it's not, you can make an informed choice that aligns with your financial well-being. Don't hesitate to explore your options and consider if refinancing federal student loans is the right path for you. Start researching lenders and comparing rates today to see if you can achieve a better financial future.

Featured Posts

-

Backwards Music A Fortnite Update Thats Falling Flat

May 17, 2025

Backwards Music A Fortnite Update Thats Falling Flat

May 17, 2025 -

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025

Uber Stocks Recessionary Performance A Deep Dive

May 17, 2025 -

Understanding Tony Bennetts Musical Genius

May 17, 2025

Understanding Tony Bennetts Musical Genius

May 17, 2025 -

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025 -

Knicks Narrow Escape Overtime Loss Analysis

May 17, 2025

Knicks Narrow Escape Overtime Loss Analysis

May 17, 2025

Latest Posts

-

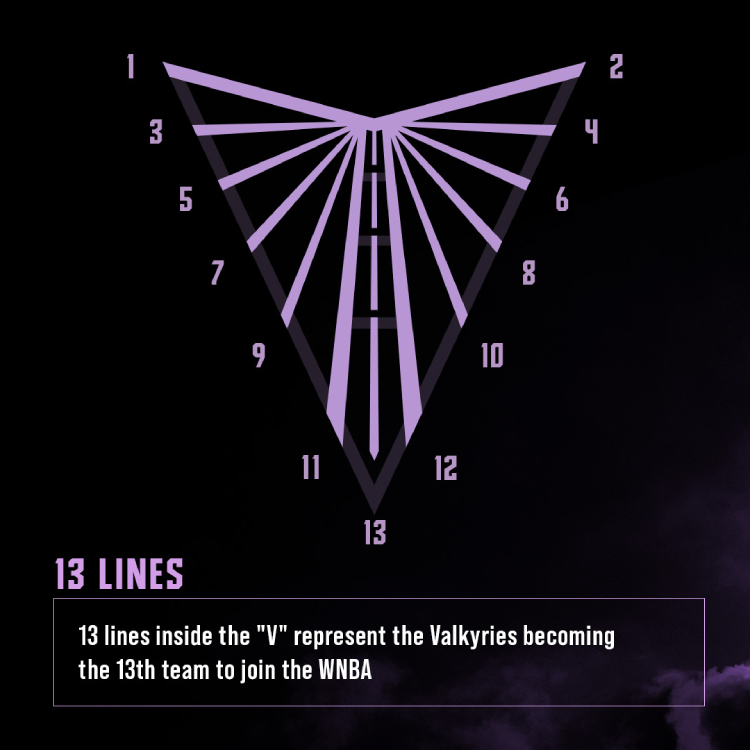

Lynx Standout Finds New Home With Valkyries

May 17, 2025

Lynx Standout Finds New Home With Valkyries

May 17, 2025 -

Toronto Tempo Latest Announcements Signal Strong Wnba Franchise Future

May 17, 2025

Toronto Tempo Latest Announcements Signal Strong Wnba Franchise Future

May 17, 2025 -

Wnba Veteran Signs With Golden State Valkyries

May 17, 2025

Wnba Veteran Signs With Golden State Valkyries

May 17, 2025 -

Former Lynx Player Signs With Golden State Valkyries

May 17, 2025

Former Lynx Player Signs With Golden State Valkyries

May 17, 2025 -

Minnesota Lynx Star Joins Golden State Valkyries

May 17, 2025

Minnesota Lynx Star Joins Golden State Valkyries

May 17, 2025