Refinancing Federal Student Loans: Private Lender Options Explained

Table of Contents

Understanding the Pros and Cons of Refinancing Federal Student Loans

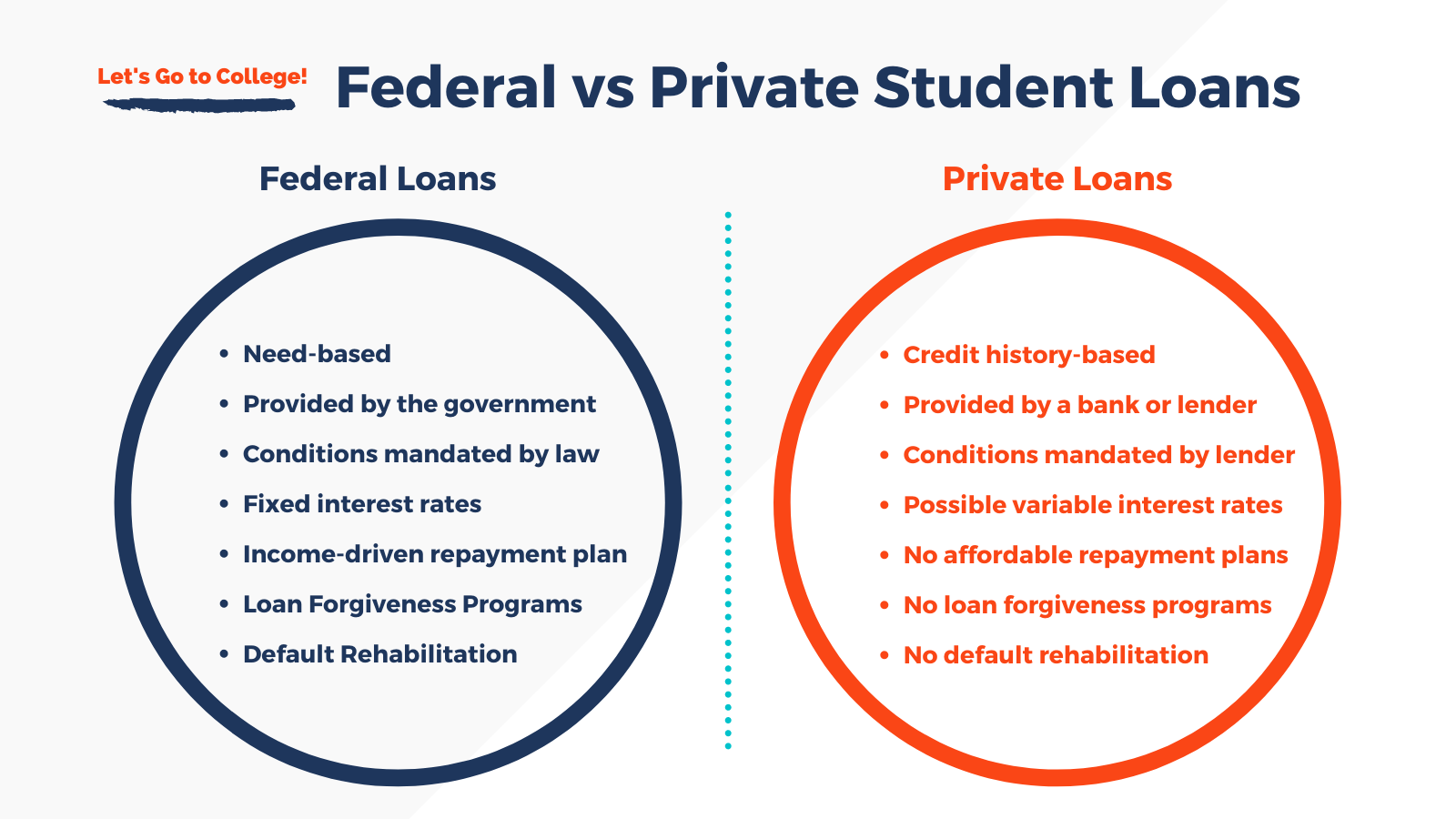

Before diving into private lender options, it's crucial to understand the potential benefits and drawbacks of refinancing federal student loans.

Advantages of Refinancing with a Private Lender:

Refinancing your federal student loans with a private lender can offer several attractive advantages:

- Lower monthly payments (potentially): By securing a lower interest rate or extending your loan term, you might significantly reduce your monthly payments, making your debt more manageable. This can free up cash flow for other financial priorities.

- Reduced interest rates (potentially): If your credit score has improved since you initially took out your federal loans, you may qualify for a lower interest rate from a private lender, saving you substantial money in the long run. This is a key benefit of student loan refinancing.

- Streamlined repayment with a single loan: Consolidating multiple federal loans into a single private loan simplifies repayment, providing a clearer picture of your debt and making it easier to track your progress.

- Fixed interest rate options for stability: A fixed interest rate protects you from fluctuating interest rates, providing predictability and peace of mind regarding your monthly payments. This is especially beneficial in times of economic uncertainty.

- Possibility of shorter loan terms: While this may lead to higher monthly payments, a shorter loan term means you'll pay off your debt faster and pay less interest overall. This strategy can be attractive to borrowers who prioritize quicker debt elimination.

- Keywords: Lower interest rates, lower monthly payments, student loan refinancing benefits.

Disadvantages of Refinancing Federal Student Loans:

While refinancing offers potential benefits, it's essential to be aware of the drawbacks:

- Loss of federal student loan benefits: This is perhaps the most significant disadvantage. Refinancing with a private lender means losing access to federal programs like income-driven repayment plans (IDR), forbearance, and potential loan forgiveness programs. These programs offer crucial protection for borrowers facing financial hardship.

- Higher interest rates (potentially, depending on credit score and market conditions): If your credit score isn't strong, you might not qualify for a lower interest rate, or you might even receive a higher rate than your current federal loans.

- Risk of default impacting credit score: Defaulting on a private student loan will severely damage your credit score, making it more difficult to obtain credit in the future.

- Increased risk if your financial situation changes: Without the safety net of federal loan protections, unexpected financial setbacks could make repayment much more challenging.

- Keywords: Student loan refinancing drawbacks, risks of refinancing, loss of federal benefits.

Choosing the Right Private Lender for Your Needs

Selecting the right private lender is crucial for a successful student loan refinancing experience.

Factors to Consider When Selecting a Lender:

Several factors should guide your decision when comparing private lenders:

- Interest rates and fees (APR): The Annual Percentage Rate (APR) encompasses the interest rate and any associated fees, giving you a complete picture of the loan's true cost. Focus on finding the lowest APR possible.

- Loan terms and repayment options (fixed vs. variable): Consider both the length of the loan term and whether you prefer a fixed or variable interest rate. Fixed rates provide stability, while variable rates can fluctuate with market conditions.

- Lender reputation and customer reviews: Research the lender's reputation by checking online reviews and ratings from independent sources. Look for lenders with a history of excellent customer service and fair lending practices.

- Eligibility requirements and credit score impact: Understand the lender's eligibility requirements, including minimum credit score requirements. A higher credit score generally qualifies you for better interest rates.

- Prepayment penalties: Some lenders charge prepayment penalties if you pay off your loan early. Avoid lenders with these fees.

- Keywords: Best private student loan lenders, compare student loan lenders, student loan refinancing rates.

Comparing Offers from Different Lenders:

To find the best deal, actively compare offers from multiple lenders:

- Utilize online comparison tools: Many websites provide tools to compare student loan refinancing rates and terms from various lenders.

- Request multiple quotes to compare rates and fees: Don't settle for the first offer you receive. Get quotes from several lenders to ensure you're getting the most competitive rate.

- Carefully read the terms and conditions of each loan offer: Don't overlook the fine print. Make sure you fully understand the terms and conditions of each loan before making a decision.

- Check for hidden fees or prepayment penalties: Be wary of hidden fees that can significantly increase the overall cost of your loan.

- Keywords: Student loan refinancing comparison, compare student loan rates, find the best student loan refinance.

The Refinancing Application Process

The application process for student loan refinancing involves several key steps.

Preparing Your Application:

Before applying, take these steps to streamline the process:

- Gather necessary financial documents (income statements, credit reports): Lenders will need proof of your income and creditworthiness.

- Check your credit score and address any errors: A higher credit score improves your chances of getting a favorable interest rate.

- Understand the lender's eligibility requirements: Make sure you meet the lender's requirements before starting the application.

- Compare loan offers and choose the best option: Carefully compare offers from multiple lenders before making a decision.

- Keywords: Student loan refinancing application, student loan refinance requirements.

Completing and Submitting the Application:

Once prepared, follow these steps to submit your application:

- Fill out the application accurately and completely: Accuracy is crucial to avoid delays or rejections.

- Provide all required supporting documentation: Submit all necessary documentation to avoid delays.

- Monitor the application status and contact the lender if necessary: Stay informed about the status of your application.

- Keywords: Student loan refinance process, apply for student loan refinance.

Conclusion

Refinancing federal student loans with a private lender can offer significant advantages, such as lower monthly payments and reduced interest rates, but it's crucial to carefully weigh the potential drawbacks, including the loss of federal loan benefits. By understanding the process, comparing offers from various lenders, and carefully considering your financial situation, you can make an informed decision about whether refinancing federal student loans is the right choice for you. Before you start the process, thoroughly research the best private lender options and compare their offerings to ensure you secure the best deal possible for your student loan refinancing needs. Remember to weigh the pros and cons carefully. Don't hesitate to seek financial advice if needed before making a final decision on refinancing federal student loans.

Featured Posts

-

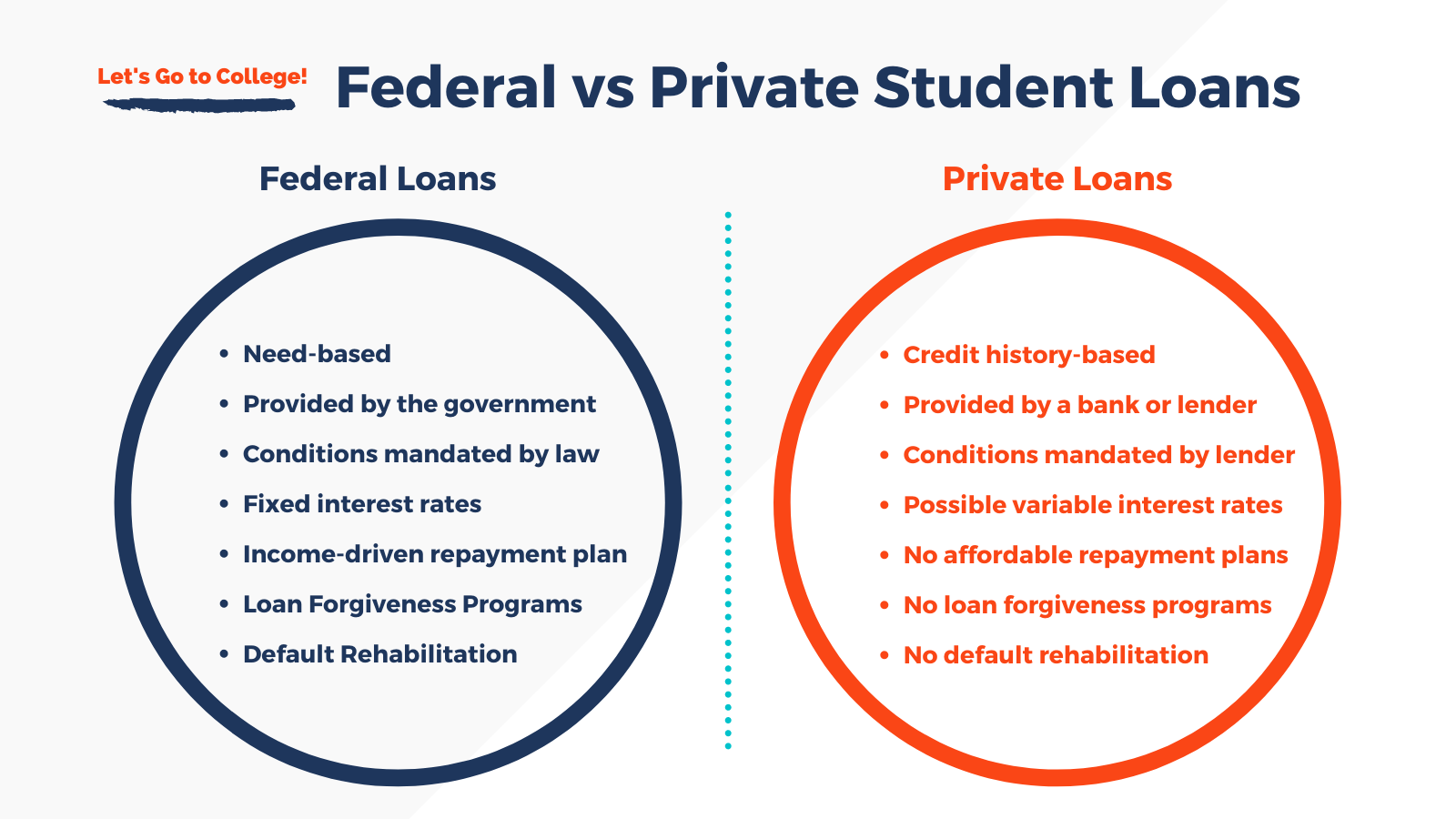

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025

Can Uber Stock Survive A Recession Expert Analysis

May 17, 2025 -

China Open To Formal Trade Deal With Canada Ambassadors Statement

May 17, 2025

China Open To Formal Trade Deal With Canada Ambassadors Statement

May 17, 2025 -

Addressing Canadas Housing Shortage Exploring The Potential Of Modular Construction

May 17, 2025

Addressing Canadas Housing Shortage Exploring The Potential Of Modular Construction

May 17, 2025 -

Uber Kenyas New Initiative Cashback Rewards And Increased Order Volume

May 17, 2025

Uber Kenyas New Initiative Cashback Rewards And Increased Order Volume

May 17, 2025 -

The Future Of Trumps 30 Tariffs On China Predictions To Late 2025

May 17, 2025

The Future Of Trumps 30 Tariffs On China Predictions To Late 2025

May 17, 2025

Latest Posts

-

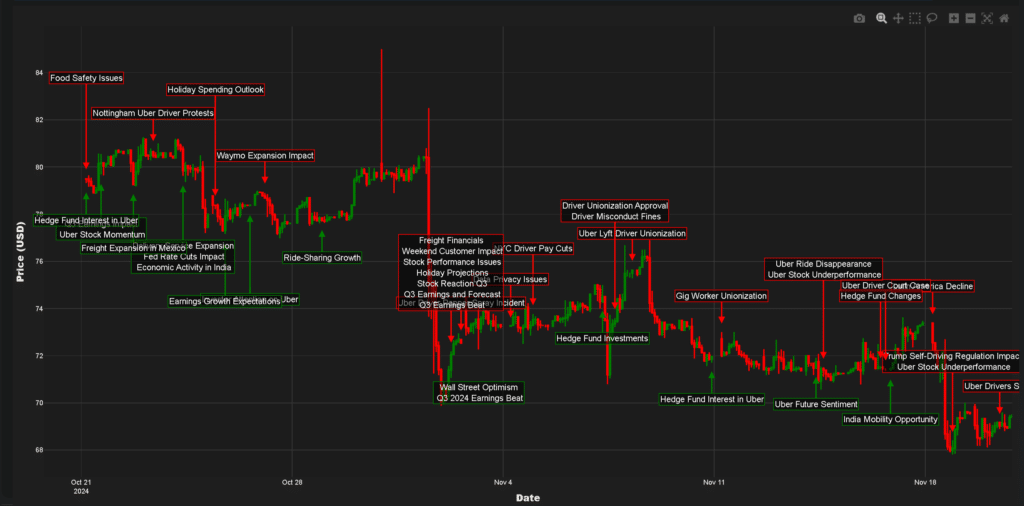

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnite Cowboy Bebop Bundle Price Check For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025

Cowboy Bebop Faye Valentine And Spike Spiegel Fortnite Skins Price And Release Date

May 17, 2025 -

Fortnite Players Express Disappointment With New Shop Items

May 17, 2025

Fortnite Players Express Disappointment With New Shop Items

May 17, 2025 -

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025

Fortnites Cowboy Bebop Skins How Much Does The Faye Valentine And Spike Spiegel Bundle Cost

May 17, 2025 -

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025

Fortnite Fans Furious Over Latest Item Shop Update

May 17, 2025