Regulatory Changes Urged: Indian Insurers And Bond Forward Trading

Table of Contents

Current Regulatory Framework and its Limitations

The current regulatory framework governing Indian insurers' investments, primarily overseen by the IRDAI (Insurance Regulatory and Development Authority of India), imposes significant restrictions on derivative trading, including bond forward contracts. These restrictions stem from a cautious approach to risk management, reflecting concerns about market volatility and the potential for substantial losses. However, these regulations inadvertently hinder insurers from optimizing their investment portfolios and participating fully in the dynamic Indian debt market.

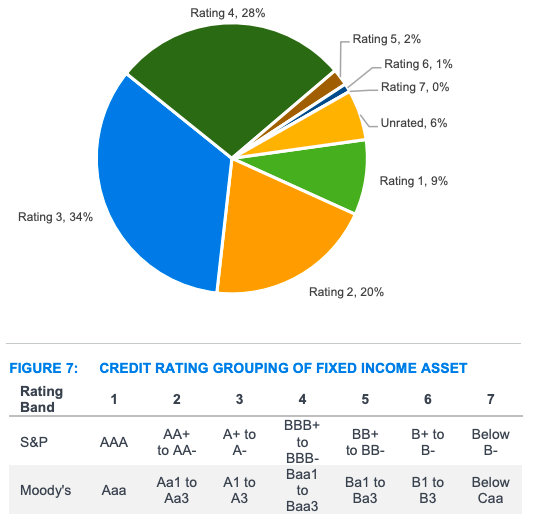

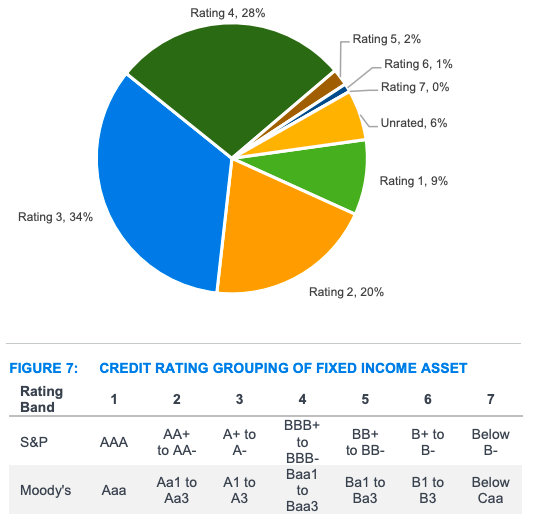

- Current limits on derivatives exposure for insurers: Existing regulations impose strict limits on the percentage of an insurer's portfolio that can be allocated to derivatives, significantly restricting their ability to engage in hedging or yield curve trading strategies using bond forwards.

- Lack of clear guidelines on bond forward trading strategies: The absence of specific guidelines regarding acceptable bond forward trading strategies creates uncertainty and discourages insurers from exploring this potentially lucrative avenue. This lack of clarity increases compliance costs and risks.

- Complexity in reporting and compliance requirements: The reporting and compliance requirements associated with derivative trading are often complex and burdensome, adding to the administrative challenges faced by insurers seeking to engage in bond forward trading.

- Comparison with international regulatory practices: A comparison with international regulatory practices reveals a more permissive environment in many developed markets, allowing insurers greater flexibility in managing their investment portfolios through the use of derivatives. This highlights the potential for regulatory reform in India.

The Potential Benefits of Increased Bond Forward Trading for Insurers

Increased access to bond forward trading offers Indian insurers significant advantages, enabling them to enhance their investment strategies and strengthen their overall financial position.

- Improved risk-adjusted returns through hedging strategies: Bond forwards provide powerful tools for hedging interest rate risk, a crucial consideration given the long-term liabilities of insurance companies. Effective hedging strategies can significantly improve risk-adjusted returns.

- Better liquidity management for long-term liabilities: Bond forwards can facilitate more efficient liquidity management, allowing insurers to better match their asset and liability durations and improve their ability to meet future obligations.

- Opportunities for yield curve trading strategies: Access to bond forwards opens up opportunities for sophisticated yield curve trading strategies, potentially generating alpha and enhancing overall portfolio performance.

- Increased competitiveness with global insurance players: Increased participation in bond forward trading allows Indian insurers to align their investment strategies with global best practices and compete more effectively with international insurance players.

Specific Regulatory Changes Urged

To encourage greater participation by Indian insurers in bond forward trading, several specific regulatory changes are crucial:

- Relaxing limits on derivative exposure for insurers: A gradual and carefully considered relaxation of the current limits on derivative exposure would allow insurers to utilize bond forwards more effectively for risk management and portfolio optimization.

- Providing clearer guidelines on acceptable bond forward trading strategies: The IRDAI should issue clearer guidelines specifying acceptable bond forward trading strategies, eliminating ambiguity and reducing the regulatory burden on insurers.

- Simplifying reporting and compliance requirements: Streamlining reporting and compliance procedures would reduce the administrative burden on insurers, thereby encouraging greater participation in bond forward trading.

- Strengthening supervisory oversight to manage systemic risk: While relaxing restrictions, strengthened supervisory oversight is critical to manage systemic risk and ensure responsible trading practices within the market. This could involve enhanced stress testing and regular reviews of insurer trading strategies.

Addressing Concerns and Mitigation of Risks

While the benefits of increased bond forward trading are significant, it is crucial to acknowledge and mitigate potential risks.

- Implementing robust risk management frameworks for insurers: Insurers need to adopt and implement robust risk management frameworks tailored to the specific characteristics of bond forward trading, ensuring adequate risk assessment and controls.

- Strengthening capital adequacy requirements to absorb potential losses: Appropriate adjustments to capital adequacy requirements may be necessary to absorb potential losses arising from adverse market movements in bond forward positions.

- Introducing stress tests to evaluate market volatility impact: Regular stress tests simulating various market scenarios are essential to assess the potential impact of market volatility on insurers’ bond forward positions.

- Collaboration between regulators and industry experts: Open communication and collaboration between the IRDAI, industry bodies, and insurance companies are crucial to develop appropriate regulations and effective risk management frameworks.

Conclusion

Regulatory changes are urgently needed to unlock the full potential of bond forward trading for Indian insurers. Increased participation in bond forward trading offers substantial benefits, including improved risk management, enhanced returns, and a more dynamic and competitive Indian debt market. A balanced approach, combining carefully considered deregulation with robust risk management frameworks and strengthened supervisory oversight, is crucial. We urge proactive regulatory reforms to unlock the potential of bond forward trading for Indian insurers, fostering a more robust and globally competitive Indian insurance and debt market. Constructive dialogue between the IRDAI, industry bodies, and insurers is essential to achieve this goal, ensuring safe and successful growth in Indian insurers' bond forward trading activities.

Featured Posts

-

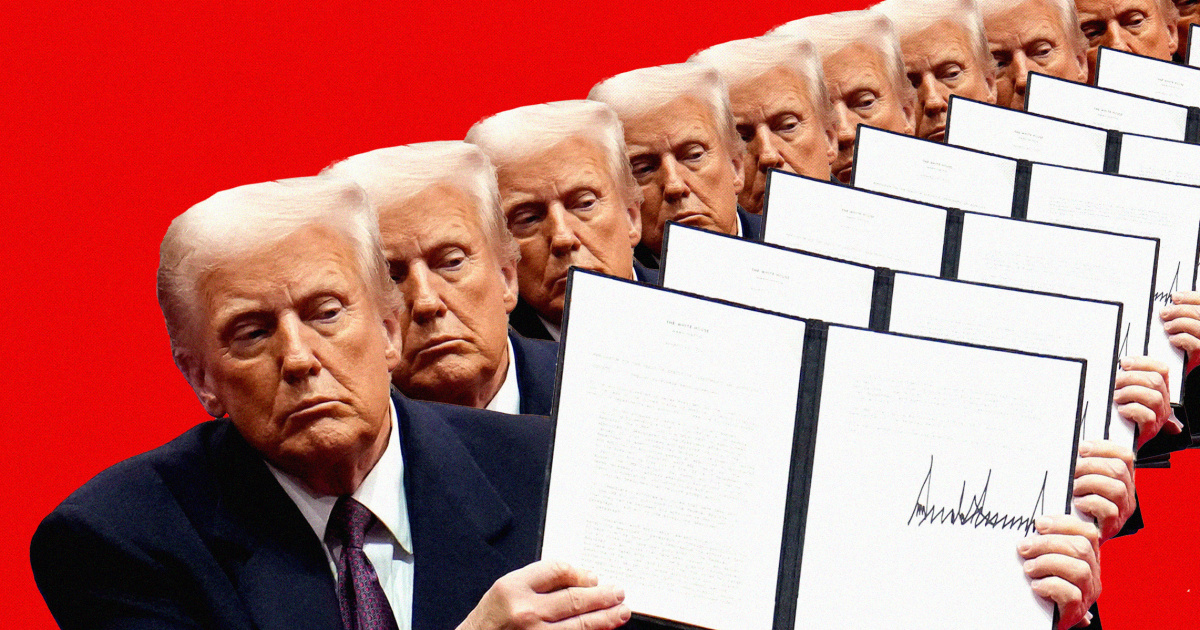

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 10, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 10, 2025 -

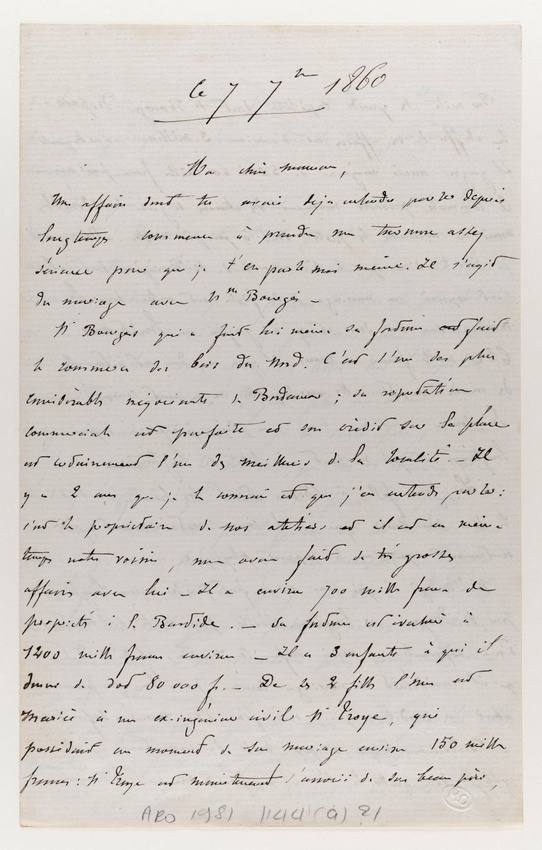

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025

Gustave Eiffel Et Sa Mere Melanie L Histoire Meconnue De Dijon

May 10, 2025 -

Trumps Transgender Military Ban A Critical Analysis Of The Policy

May 10, 2025

Trumps Transgender Military Ban A Critical Analysis Of The Policy

May 10, 2025