Resorts World Las Vegas: $10.5M Money Laundering Fine

Table of Contents

Details of the Money Laundering Violations

The NGCB's investigation revealed significant failings in Resorts World Las Vegas's AML program, leading to the substantial fine. While specific details of individual transactions are often kept confidential due to ongoing investigations and the sensitive nature of the information, the publicly available information suggests that the violations stemmed from a combination of factors. These included:

-

Insufficient Due Diligence: Allegations suggest a lack of proper due diligence on high-value transactions, failing to adequately verify the identities and sources of funds from certain patrons. This is a critical weakness in any casino's AML program.

-

Suspicious Transaction Reporting Failures: The resort allegedly failed to properly report suspicious transactions to the appropriate authorities in a timely manner, a clear violation of Nevada gaming regulations.

-

Inadequate AML Training: It's believed that inadequate training for employees on AML procedures contributed to the failure to identify and report suspicious activity. This highlights the importance of comprehensive, ongoing training for all casino personnel.

-

Specific examples of flagged activity (if reported publicly, e.g., large cash transactions without proper documentation, structured transactions designed to avoid detection, etc.) [Insert specific examples if available from public records. If not, remove this bullet point.]

-

Types of transactions flagged by regulators (e.g., wire transfers, cashier's checks, etc.) [Insert types of transactions if publicly available. If not, remove this bullet point.]

-

Weaknesses in Resorts World's AML program (e.g., lack of a comprehensive risk assessment, insufficient monitoring systems, inadequate record-keeping, etc.) [Insert weaknesses if publicly available. If not, remove this bullet point.]

The Nevada Gaming Control Board's Response

The NGCB conducted a thorough investigation, reviewing thousands of transactions and interviewing numerous employees. Their findings led to the imposing of a $10.5 million fine, one of the largest ever levied against a Nevada casino for money laundering violations. This decisive action demonstrates the NGCB's commitment to maintaining the integrity of Nevada's gaming industry.

- Timeline of the investigation and penalties: [Insert timeline of events if available publicly. If not, remove this bullet point.]

- Specific regulations violated: [List specific Nevada gaming regulations violated, if available publicly. If not, remove this bullet point.]

- Measures taken by Resorts World to address the issues: Resorts World Las Vegas has stated its commitment to improving its AML compliance program, including [Insert measures taken by Resorts World, if publicly available, e.g., enhanced training programs, improved transaction monitoring systems, and hiring of additional compliance personnel].

Impact on Resorts World Las Vegas and the Gaming Industry

The $10.5 million fine represents a significant financial blow to Resorts World Las Vegas. Beyond the direct financial impact, the reputational damage is substantial. The incident raises concerns among investors and potentially impacts future business. For the broader gaming industry, this case serves as a stark reminder of the importance of stringent AML compliance. Increased regulatory scrutiny and potentially stricter penalties are likely consequences.

- Stock market reaction: [Insert stock market reaction if applicable. If not, remove this bullet point.]

- Changes in Resorts World's AML policies and procedures: [Insert changes implemented, if publicly available. If not, remove this bullet point.]

- Potential impact on future licensing applications: [Discuss potential impacts on future licensing. If no information is available, remove the bullet point.]

Preventing Future Money Laundering in Casinos

Preventing money laundering requires a multi-faceted approach. Casinos must implement robust AML programs, including comprehensive employee training, advanced transaction monitoring systems, and thorough due diligence procedures for all patrons.

- Key elements of an effective AML program: These include regular risk assessments, stringent customer identification procedures (KYC), suspicious activity reporting (SAR), and ongoing employee training.

- Importance of due diligence and customer identification: Thorough due diligence is crucial to identify high-risk customers and prevent the use of casinos for money laundering activities.

- Role of technology in detecting suspicious activity: Sophisticated transaction monitoring software can help identify patterns and anomalies that may indicate money laundering.

Conclusion: Understanding the Resorts World Las Vegas Money Laundering Case and Preventing Future Occurrences

The Resorts World Las Vegas money laundering case underscores the critical importance of robust AML compliance in the casino industry. The $10.5 million fine serves as a powerful deterrent, demonstrating the serious consequences of failing to adhere to regulations. Understanding the details of this case and implementing best practices for AML compliance are crucial for all casinos to maintain the integrity of their operations and protect themselves from significant financial and reputational damage. To learn more about casino AML compliance and responsible gaming practices, explore resources from the Nevada Gaming Control Board and other relevant regulatory bodies. Understanding and implementing effective Resorts World Las Vegas money laundering prevention strategies is vital for the future of the casino industry.

Featured Posts

-

Shrek On Bbc Three Tv Guide And Schedule

May 18, 2025

Shrek On Bbc Three Tv Guide And Schedule

May 18, 2025 -

Mlb History Made Riley Greenes Two 9th Inning Home Runs

May 18, 2025

Mlb History Made Riley Greenes Two 9th Inning Home Runs

May 18, 2025 -

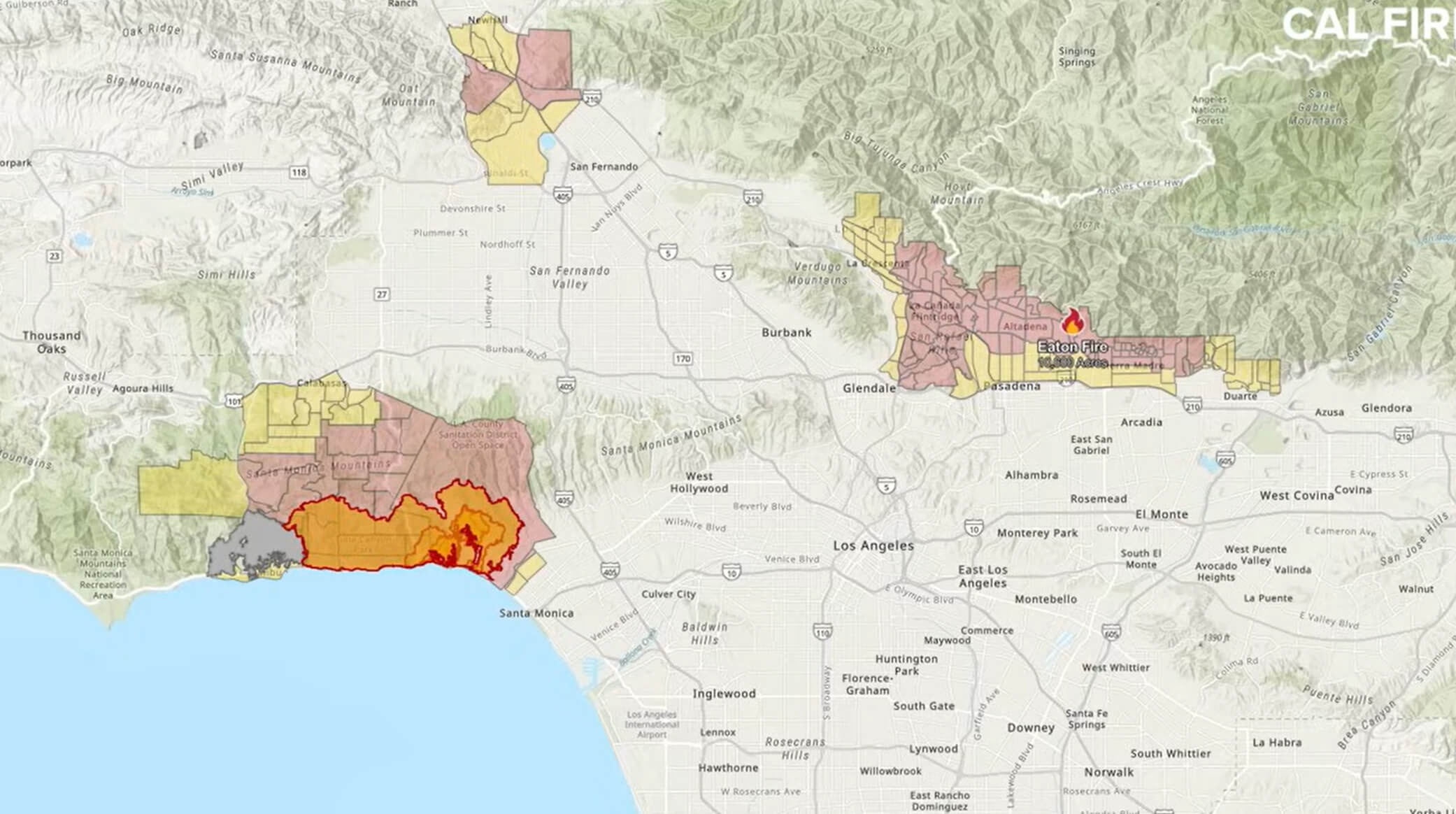

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025 -

Negosiasi Panjang Pertukaran Satu Tentara Israel Dengan 1 027 Tahanan Palestina

May 18, 2025

Negosiasi Panjang Pertukaran Satu Tentara Israel Dengan 1 027 Tahanan Palestina

May 18, 2025 -

Offseason Heartbreak Angels Star Faces Family Health Challenges

May 18, 2025

Offseason Heartbreak Angels Star Faces Family Health Challenges

May 18, 2025

Latest Posts

-

Nyt Mini Crossword Answers March 3 2025 Complete Solutions

May 18, 2025

Nyt Mini Crossword Answers March 3 2025 Complete Solutions

May 18, 2025 -

Nyt Mini Crossword Solutions February 27 2025

May 18, 2025

Nyt Mini Crossword Solutions February 27 2025

May 18, 2025 -

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 18, 2025

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 18, 2025 -

Konflikten Mellan Pedro Pascal Och J K Rowling Vad Haende

May 18, 2025

Konflikten Mellan Pedro Pascal Och J K Rowling Vad Haende

May 18, 2025 -

Offentlig Kritik Pedro Pascal Mot J K Rowling

May 18, 2025

Offentlig Kritik Pedro Pascal Mot J K Rowling

May 18, 2025