Retirement Of CFP Board CEO: Implications For The Financial Planning Industry

Table of Contents

Leadership Transition and its Potential Impact

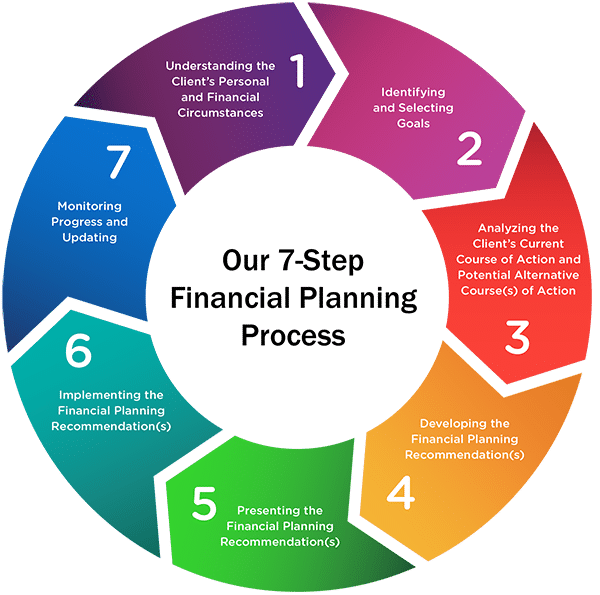

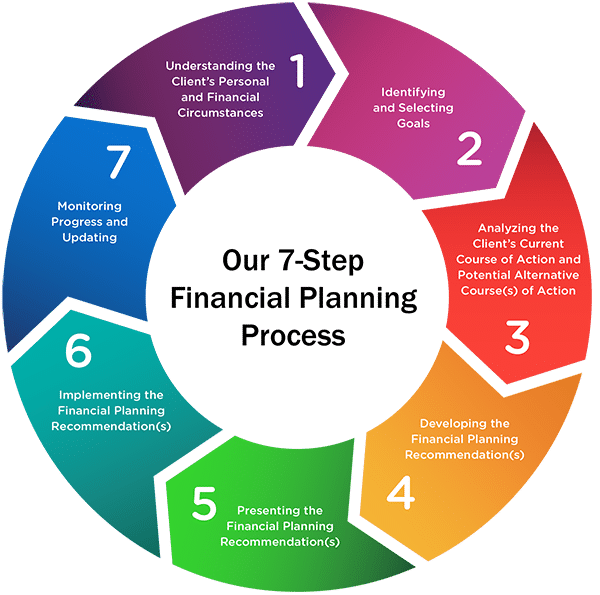

The selection of a new CEO will be a pivotal process for the CFP Board. The individual chosen will need to possess a comprehensive understanding of the financial planning industry, navigate complex regulatory compliance issues, and effectively address the ever-evolving needs of consumers.

Finding a Suitable Replacement

The search for a suitable replacement is paramount. The ideal candidate should exhibit a blend of skills and experience vital to guiding the CFP Board through the challenges ahead.

- Experience with technology and fintech integration: The financial planning landscape is rapidly transforming with the integration of technology. The new CEO must possess a strong understanding of fintech and its potential impact on the industry. This includes proficiency in utilizing technology to enhance efficiency, improve client services, and maintain compliance.

- Strong leadership skills to navigate complex regulatory changes: The regulatory environment for financial advisors is constantly evolving. The new CEO must be capable of navigating this complex landscape, ensuring the CFP Board remains compliant and proactively adapts to new regulations. This includes experience in lobbying and working with regulatory bodies.

- Commitment to maintaining the integrity of the CFP certification: The CFP certification is a hallmark of professionalism and trust. The new CEO must be steadfast in upholding its integrity and value. This includes maintaining rigorous ethical standards and ensuring the continuing education requirements remain relevant and effective.

Short-Term Uncertainty

While the long-term vision is crucial, a leadership transition inherently creates short-term uncertainty. This period requires careful management to minimize disruption.

- Potential delays in policy implementation: Ongoing initiatives and policy implementations might experience temporary delays during the transition. This necessitates transparent communication with stakeholders.

- Temporary shifts in communication strategies: The communication style and frequency might change during this period. Maintaining consistent and clear communication is essential to mitigate any anxiety among certificants.

- Increased need for clarity and transparency from the interim leadership: The interim leadership team plays a vital role in ensuring a smooth transition and maintaining confidence within the organization and the broader financial planning community. Open and frequent communication will be key to this success.

Future Direction of the CFP Board

The new leadership will shape the future trajectory of the CFP Board, impacting both the profession and the consumers it serves.

Maintaining the Value of the CFP Certification

The CFP mark remains a significant credential within the financial planning field. Sustaining its value and relevance will be a priority.

- Strengthening the ethics and competency standards: Continuously reviewing and updating the ethical and competency standards is critical. This ensures CFP professionals maintain the highest standards of practice and adapt to evolving client needs.

- Addressing emerging challenges like technological disruption and financial fraud: The financial planning industry is constantly facing new challenges. The CFP Board must proactively address these challenges, providing resources and support to its certificants.

- Advocating for the profession at the regulatory level: The CFP Board must effectively represent the interests of its certificants to regulatory bodies, ensuring a fair and supportive regulatory environment.

Adapting to Industry Trends

The financial planning world is dynamic. The CFP Board must embrace change and innovation to remain relevant.

- Developing new educational resources and continuing education requirements: The CFP Board needs to adapt its educational materials and continuing education requirements to reflect current trends and technologies. This will ensure that CFP professionals remain at the forefront of their field.

- Exploring partnerships with fintech companies: Collaboration with fintech companies can provide access to innovative technologies and improve the efficiency of financial planning services.

- Promoting financial literacy among the public: The CFP Board should actively promote financial literacy initiatives to better equip the public to manage their finances effectively.

Implications for Financial Planners

The CFP Board CEO retirement and subsequent leadership changes will have both direct and indirect consequences for individual financial planners.

Maintaining Professional Standards

Maintaining the high standards associated with the CFP certification remains crucial for individual professionals.

- Staying up-to-date on regulatory changes: Financial planners must remain informed on the latest regulatory updates to ensure compliance.

- Participating in continuing education: Continued professional development is essential to staying abreast of industry changes and maintaining competency.

- Adhering to the CFP Board's Code of Ethics and Professional Responsibility: Strict adherence to the ethical guidelines is fundamental to maintaining public trust and the integrity of the CFP certification.

Impact on Client Relationships

While the change in leadership at the CFP Board may have minimal direct impact on the client-planner relationship, indirect impacts are possible.

- Potential changes in required disclosures: New regulations might necessitate changes to client disclosures.

- New regulations impacting investment strategies: Changes in regulatory frameworks may influence investment strategies and advice provided to clients.

- Enhanced client communication protocols: The CFP Board may introduce updated communication protocols that improve transparency and client engagement.

Conclusion

The retirement of the CFP Board CEO presents both challenges and opportunities for the financial planning industry. The successful transition and selection of a new CEO are critical to preserving the integrity and relevance of the CFP certification. Financial planners must proactively adapt to emerging trends, uphold the highest professional standards, and remain informed on developments related to the CFP Board CEO retirement. Actively engaging with the CFP Board's communications and participating in continuous professional development are crucial for navigating this evolving landscape and ensuring long-term success in the financial planning profession.

Featured Posts

-

Six Nations Frances Championship Win Scotlands Defeat Ramoss Impact

May 02, 2025

Six Nations Frances Championship Win Scotlands Defeat Ramoss Impact

May 02, 2025 -

Kshmyr Ky Azady Ky Jdwjhd Ywm Ykjhty Ke Prwgram

May 02, 2025

Kshmyr Ky Azady Ky Jdwjhd Ywm Ykjhty Ke Prwgram

May 02, 2025 -

Christina Aguilera A Changed Look Leaves Fans Confused

May 02, 2025

Christina Aguilera A Changed Look Leaves Fans Confused

May 02, 2025 -

Riot Platforms Inc Press Release Details On Waiver And Irrevocable Proxy

May 02, 2025

Riot Platforms Inc Press Release Details On Waiver And Irrevocable Proxy

May 02, 2025 -

Xrps Meteoric Rise Could It Be Your Ticket To Millionaire Status

May 02, 2025

Xrps Meteoric Rise Could It Be Your Ticket To Millionaire Status

May 02, 2025