Revised Offer For Lion Electric: Investor Group Submits New Bid

Table of Contents

Details of the Revised Offer

The investor group, led by [Name of Leading Investor/Investment Firm] and [Name of another key investor, if applicable], has submitted a revised offer for Lion Electric valued at [Total Value of the Offer] – representing a [Percentage increase/decrease] change from the previous bid. This translates to a price per share of [Price per Share]. Key terms of the offer include [mention key conditions, e.g., financing contingencies, regulatory approvals].

- Key Players: The investor group comprises a mix of [describe the investor group's composition, e.g., private equity firms, strategic investors, etc.].

- Changes from Previous Offer: The revised bid differs from the previous offer primarily in [explain the key changes, e.g., increased price per share, altered financing structure, revised timeline].

- Financing: The acquisition is reportedly being financed through a combination of [specify financing sources, e.g., equity investment, debt financing, etc.].

- Timeline: The investor group has set a deadline of [Date] for Lion Electric to accept or reject the offer.

Lion Electric's Response and Current Stock Performance

Lion Electric has issued an official statement [link to statement if available], acknowledging receipt of the revised offer and stating that its board of directors is currently reviewing the proposal. The company has refrained from commenting further at this time, pending a thorough evaluation.

The news of the revised offer has immediately impacted Lion Electric's stock price. Following the announcement, the Lion Electric stock experienced a [Describe the stock price movement, e.g., sharp increase, modest increase, or decrease] , reaching a high of [High Price] and a low of [Low Price] within the trading session. Trading volume also increased significantly, indicating heightened investor interest and activity.

- Stock Price Fluctuations: [Insert specific data points on stock price changes, including percentage changes and comparison to previous trading days].

- Analyst Commentary: Analysts at [Name of Financial Institutions] have issued [positive/negative/neutral] ratings on the revised offer, citing [reasoning behind the rating].

- Investor Reactions: Early investor reactions suggest [summarize investor sentiment, e.g., a wait-and-see approach, strong buying interest, or selling pressure].

Implications for the Future of Lion Electric

The acceptance or rejection of the revised offer will significantly shape Lion Electric's future. If accepted, the acquisition could bring [mention potential benefits such as, access to capital, enhanced technological capabilities, improved market reach]. Alternatively, rejection could lead to continued exploration of other strategic options, potentially including further collaboration with existing partners or a renewed focus on organic growth.

- Potential Benefits: Under the new ownership, Lion Electric could benefit from [List potential benefits, e.g., increased investment in R&D, expansion into new markets, streamlining of operations].

- Potential Risks: The acquisition also presents potential risks, including [List potential risks, e.g., integration challenges, disruption to existing operations, potential loss of key personnel].

- Future Direction: The outcome will significantly influence Lion Electric's EV production strategy, its market positioning, and its overall competitive landscape within the electric vehicle industry.

The Broader EV Market Context

The Lion Electric situation unfolds against the backdrop of a rapidly evolving electric vehicle market. Competition is intense, with established automakers and new entrants vying for market share. The success or failure of this acquisition will have implications not only for Lion Electric but also for the broader EV ecosystem.

- Key Competitors: Lion Electric faces stiff competition from established players like [List key competitors, e.g., Tesla, Rivian, etc.] and other emerging EV manufacturers.

- Market Trends: Current market trends show [Describe current market trends, e.g., growing demand for EVs, government incentives, technological advancements].

- Industry-Wide Impacts: The acquisition's outcome could influence investment sentiment in the EV sector, potentially impacting funding for other startups and influencing mergers and acquisitions activity.

Conclusion

The revised offer for Lion Electric represents a pivotal moment for the company and the broader electric vehicle sector. The outcome will significantly impact Lion Electric's future trajectory, influencing its production capabilities, market position, and overall growth potential. The details of the offer, the company's response, and the subsequent market reaction will be closely watched by investors and industry experts alike.

Call to Action: Stay informed about the evolving situation with Lion Electric. Continue to monitor the progress of this revised offer and its impact on the Lion Electric stock price and the future of electric vehicle manufacturing. Follow our website for further updates on the Lion Electric acquisition and other relevant news in the EV industry.

Featured Posts

-

Spanish Broadcaster Calls For Debate On Israels Eurovision Entry

May 14, 2025

Spanish Broadcaster Calls For Debate On Israels Eurovision Entry

May 14, 2025 -

Tommy Fury Budapest Visszateres Es Paul Valasza

May 14, 2025

Tommy Fury Budapest Visszateres Es Paul Valasza

May 14, 2025 -

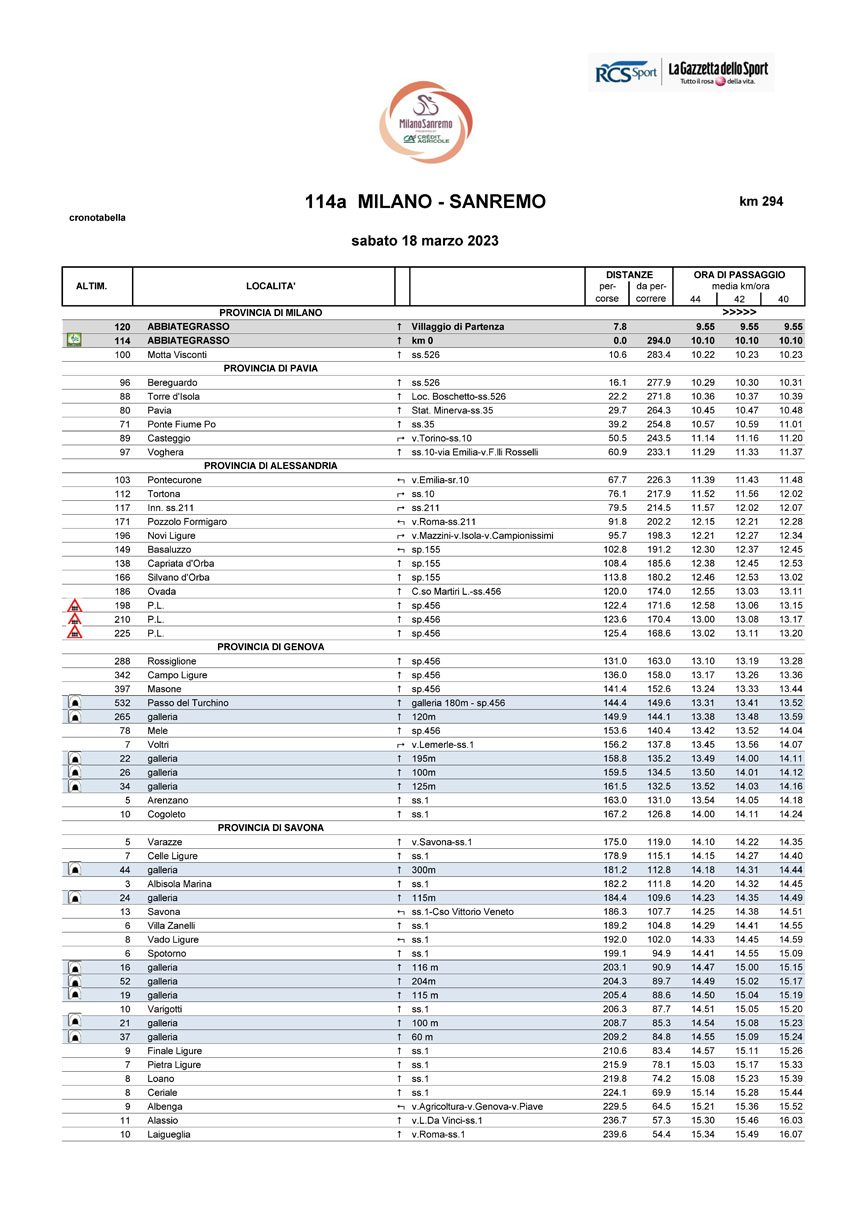

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025 -

The Ghost Story Of Suits La Investigation

May 14, 2025

The Ghost Story Of Suits La Investigation

May 14, 2025 -

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025