Riot Platforms (RIOT) Stock: A Deep Dive Into Recent Performance

Table of Contents

Recent Performance of RIOT Stock

Price Fluctuations and Key Trends

RIOT stock price has shown considerable volatility, reflecting the unpredictable nature of the Bitcoin mining industry. Analyzing its price movements requires considering both short-term and long-term trends.

-

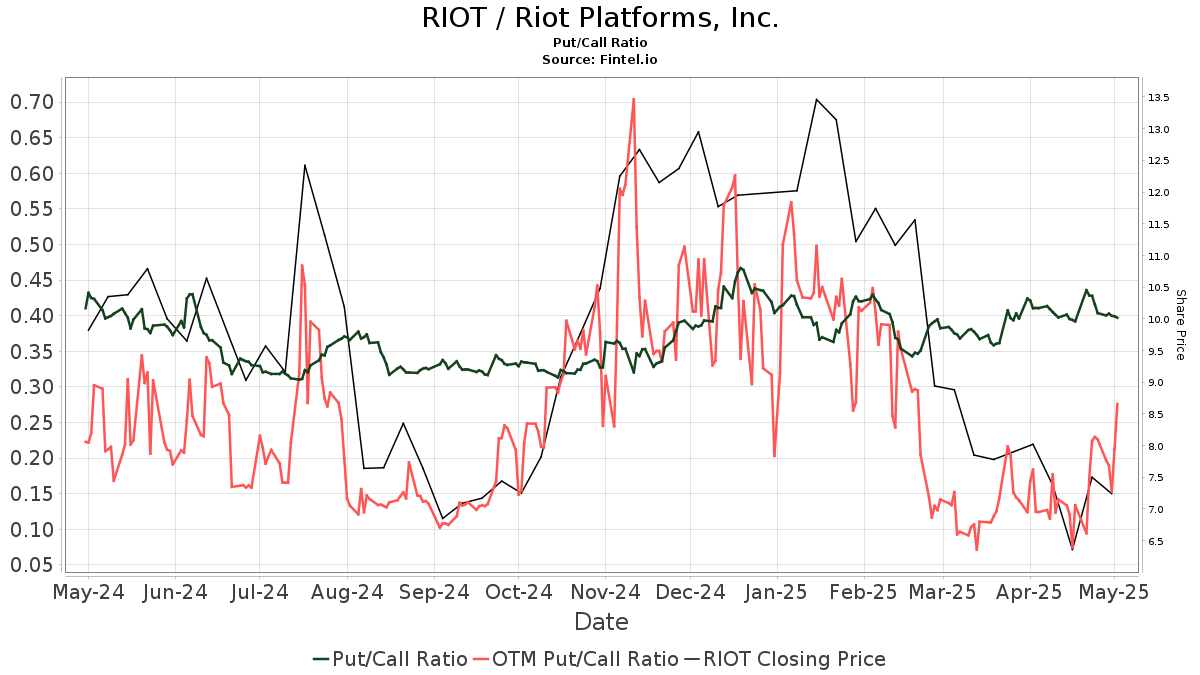

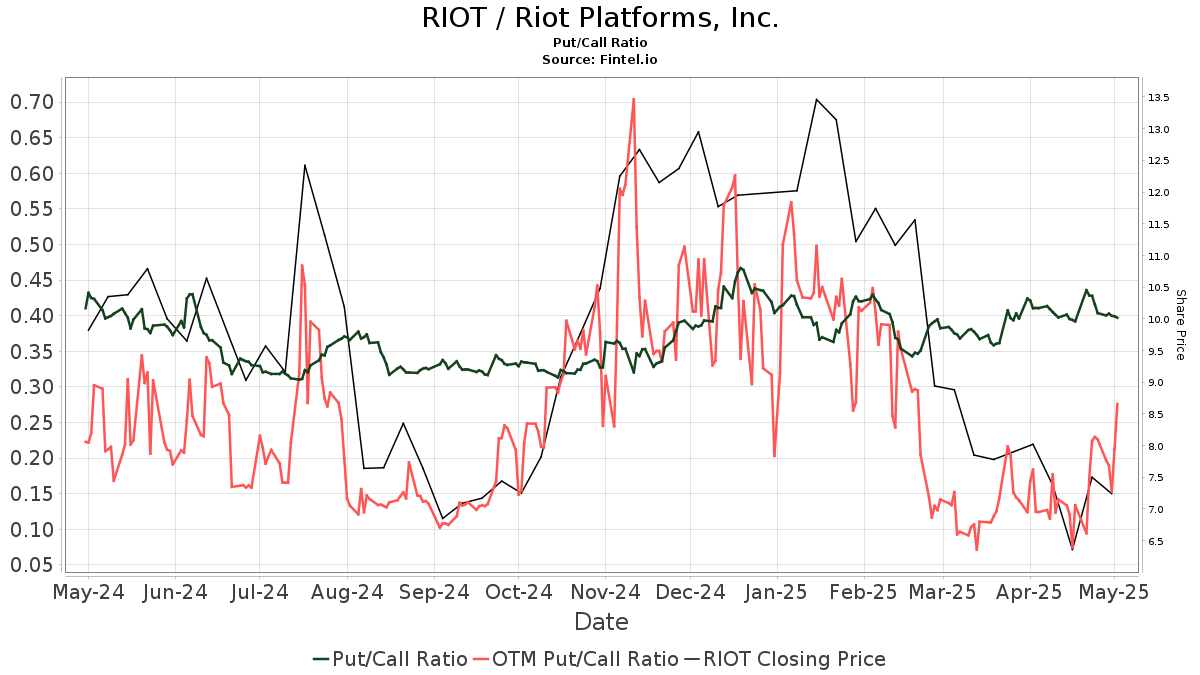

Significant Price Changes: For instance, [Insert specific date] saw a [percentage]% increase in RIOT's stock price, potentially driven by [mention specific news, e.g., positive earnings report or Bitcoin price surge]. Conversely, [Insert specific date] witnessed a [percentage]% decrease, possibly due to [mention specific news, e.g., regulatory concerns or a Bitcoin price dip]. (Include a relevant chart showing price fluctuations over a specific period).

-

Short-Term vs. Long-Term Trends: In the short term, RIOT's stock price often mirrors Bitcoin's price, exhibiting a high degree of correlation. However, a longer-term perspective reveals a more complex picture, influenced by factors like operational efficiency and regulatory changes. (Include a chart comparing RIOT stock price and Bitcoin price over a longer timeframe).

Impact of Bitcoin Price on RIOT Stock

The correlation between Bitcoin's price and RIOT's stock performance is undeniable. Riot Platforms' revenue is directly tied to Bitcoin mining profitability, which is heavily influenced by Bitcoin's market value.

-

Historical Examples: When Bitcoin's price rises, the value of mined Bitcoins increases, boosting Riot's revenue and, consequently, its stock price. Conversely, a Bitcoin price decline reduces the profitability of Bitcoin mining, negatively impacting RIOT's stock performance. (Include a chart illustrating this correlation).

-

Bitcoin Mining Hash Rate: Riot's mining hash rate, representing its computing power dedicated to Bitcoin mining, significantly affects its revenue generation. A higher hash rate translates to a greater share of Bitcoin mining rewards, positively impacting the company's financial results and, in turn, the RIOT stock price.

Factors Influencing RIOT's Stock Performance

Bitcoin Mining Profitability and Operational Efficiency

Profitability in Bitcoin mining is a complex interplay of several factors, heavily impacting RIOT's performance.

-

Mining Hardware and Energy Costs: Riot Platforms utilizes [mention specific ASIC miners] for its Bitcoin mining operations. The efficiency of this hardware and the cost of electricity directly impact its profitability. A focus on renewable energy sources can significantly reduce operational costs, enhancing profitability. (Include data points on Riot's mining hashrate and kWh per Bitcoin mined).

-

Operational Efficiency: Riot's efforts to optimize its mining operations, including improving its mining hardware and energy efficiency, are crucial for maximizing profitability and positively influencing the RIOT stock price.

Regulatory Landscape and Market Sentiment

The regulatory environment surrounding Bitcoin mining and cryptocurrencies significantly influences investor confidence in RIOT.

-

Regulatory Changes: Changes in regulatory frameworks in various jurisdictions can impact the operational viability and profitability of Bitcoin mining. For example, [mention specific regulations and their potential impact].

-

Market Sentiment: Overall market sentiment towards Bitcoin and the cryptocurrency industry plays a substantial role. Positive sentiment boosts investor confidence, increasing demand for RIOT stock, while negative sentiment can lead to price drops. (Discuss relevant investor sentiment indicators).

Competition in the Bitcoin Mining Sector

Riot Platforms operates in a competitive Bitcoin mining landscape. Understanding its position relative to its competitors is essential.

- Key Competitors: Major competitors include [list key competitors, e.g., Marathon Digital Holdings, Canaan Inc.]. Comparing key metrics like mining capacity, operational costs, and market share provides a clearer picture of Riot's competitive standing. (Include a comparative table highlighting these metrics).

Conclusion

RIOT stock's recent performance is intricately linked to the Bitcoin price, operational efficiency, and the regulatory landscape. While short-term fluctuations are common, long-term performance hinges on Riot's ability to maintain operational efficiency, navigate regulatory changes, and capitalize on opportunities within the competitive Bitcoin mining market. Understanding the strong correlation between Bitcoin's price and RIOT's performance is crucial for any investor considering this stock.

Thoroughly research Riot Platforms (RIOT) stock and the broader cryptocurrency market before making any investment decisions. Further research should include examining Riot's financial reports, tracking industry news, and analyzing the long-term viability of Bitcoin mining as a business model. Informed decision-making is paramount when investing in RIOT stock or any cryptocurrency-related investment.

Featured Posts

-

Dutch Energy Providers Test Reduced Tariffs With High Solar Output

May 03, 2025

Dutch Energy Providers Test Reduced Tariffs With High Solar Output

May 03, 2025 -

Press Release Riot Platforms Inc Files Early Warning Report On Irrevocable Proxy

May 03, 2025

Press Release Riot Platforms Inc Files Early Warning Report On Irrevocable Proxy

May 03, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

May 03, 2025

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

May 03, 2025 -

Arsenals Havertz A Disappointing Epl Start Souness Weighs In

May 03, 2025

Arsenals Havertz A Disappointing Epl Start Souness Weighs In

May 03, 2025 -

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025