Ripple And SEC Near Settlement? XRP's Commodity Status In Question

Table of Contents

The SEC's Case Against Ripple

The SEC's core argument centers on the assertion that XRP is an unregistered security. They contend that Ripple's sales of XRP constituted the offering and sale of unregistered investment contracts, violating federal securities laws. The SEC's case heavily relies on the application of the Howey Test, a four-pronged test used to determine whether an investment constitutes a security. This test considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived primarily from the efforts of others.

The SEC highlights several key aspects in their case:

- Programmatic Sales: The SEC argues that Ripple's large-scale sales of XRP to institutional and retail investors constitute a continuous offering of securities.

- Focus on Ripple's Actions: The SEC emphasizes Ripple's active promotion and marketing of XRP, suggesting an intent to raise capital through the sale of a security.

- Lack of Registration: The SEC highlights the absence of proper registration with the SEC before the sale of XRP, which is a violation of federal securities laws.

The SEC's ultimate goal is to establish a precedent, setting clear guidelines for how cryptocurrencies are classified and regulated under US law. This pursuit aims to protect investors and maintain the integrity of the financial markets.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized, functional cryptocurrency, not a security. They contend that XRP operates as a medium of exchange and a store of value, akin to other cryptocurrencies like Bitcoin and Ethereum. Ripple's defense rests on several key arguments:

- Decentralization: Ripple emphasizes the decentralized nature of XRP and its operation on a public blockchain, independent of Ripple's control.

- Utility and Functionality: Ripple highlights XRP's use in facilitating cross-border payments through its RippleNet platform, showcasing its practical application beyond mere investment.

- Programmatic Sales Justification: Ripple argues that their sales were necessary for the development and growth of the XRP ecosystem and that these transactions were not equivalent to a traditional securities offering.

Ripple's legal strategies have included presenting expert witnesses, highlighting the vast difference between XRP and the types of assets the Howey test was designed to address, and pushing for more regulatory clarity in the space. They have provided extensive documentation and evidence to support their claims, focusing on the technical aspects of XRP and its functionality within the broader crypto market.

Potential Settlement Outcomes and Their Implications for XRP

Several settlement scenarios are possible, each carrying significant implications for XRP's future. These scenarios range from a complete dismissal of the SEC's claims to a settlement requiring Ripple to pay fines and possibly agree to specific restrictions on future XRP sales or marketing activities.

- Complete Dismissal: A complete victory for Ripple would likely send XRP's price soaring, boosting investor confidence and potentially attracting significant institutional investment.

- Partial Settlement with Stipulations: A compromise might involve Ripple admitting to certain regulatory missteps while avoiding a full-scale classification of XRP as a security. This scenario could lead to a moderate increase in XRP's price, but could still create some regulatory uncertainty.

- Adverse Settlement: An unfavorable settlement, where XRP is deemed a security, could severely impact XRP's price, potentially leading to delisting from major exchanges and significant investor losses.

The uncertainty surrounding the possible outcomes and the impact on XRP's market cap and price volatility makes this case a pivotal moment for the cryptocurrency market.

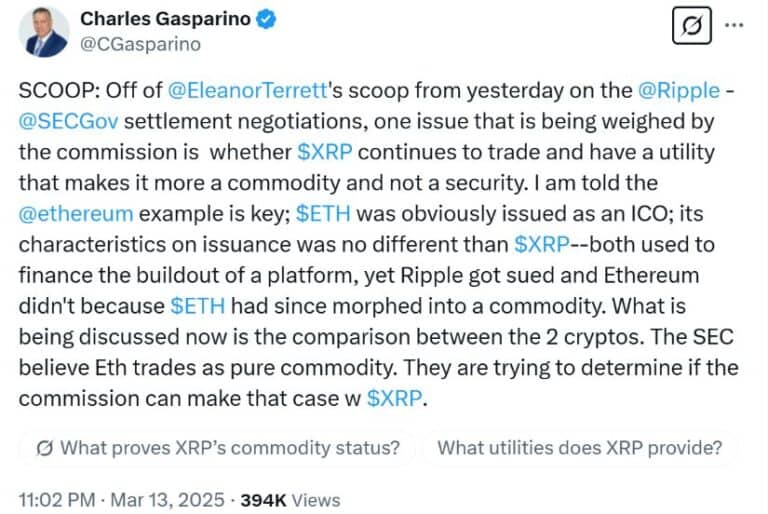

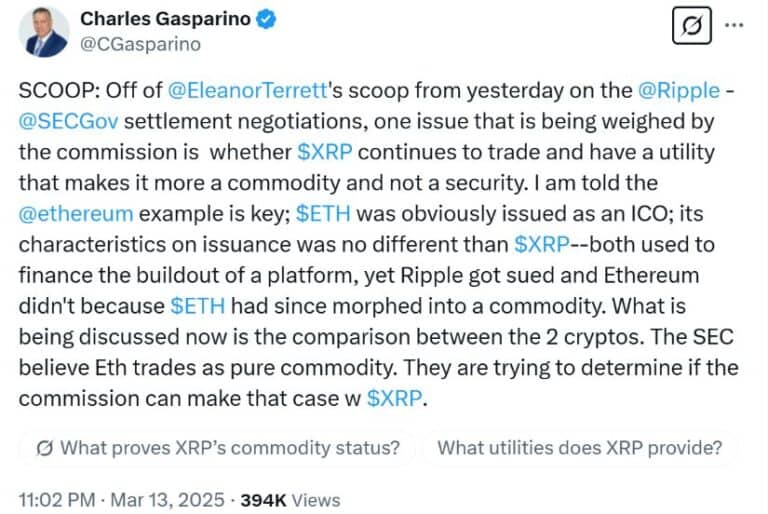

XRP's Commodity Status Debate and Legal Precedents

The core of the dispute lies in the legal definition of a security versus a commodity. While securities represent ownership in a company or asset, commodities are generally raw materials or other tangible goods. Cryptocurrencies occupy a gray area, blurring the lines between these two categories.

- The Howey Test's Application: The SEC's application of the Howey Test is central to their case, but the interpretation and application of this test to decentralized cryptocurrencies remains a point of contention.

- Lack of Clear Precedent: There is currently a lack of clear legal precedent specifically addressing the classification of cryptocurrencies like XRP.

- Arguments for Commodity Status: Proponents of XRP's commodity status emphasize its decentralized nature, its use as a medium of exchange, and its functional utility beyond mere investment.

The outcome of this case will significantly influence how future cryptocurrency projects are classified and regulated. Analyzing the various interpretations of the Howey Test and relevant case law is crucial to understanding the complexities of this legal battle.

Impact on the Broader Cryptocurrency Market

The Ripple-SEC case has far-reaching implications for the broader cryptocurrency market, impacting not only XRP but also investor confidence and the regulatory landscape.

- Regulatory Uncertainty: The outcome will influence how regulators approach other cryptocurrencies, potentially leading to increased regulatory scrutiny or greater clarity.

- Investor Sentiment: The case's outcome will significantly influence investor sentiment towards cryptocurrencies and could affect overall market stability.

- Market Volatility: Regardless of the outcome, the legal battle is expected to continue to cause market volatility in the short term, influencing other crypto prices.

The uncertainty surrounding crypto regulation has created a volatile market climate, and the Ripple-SEC case is a significant factor contributing to this volatility.

Conclusion: The Future of XRP After a Potential Ripple and SEC Settlement

The Ripple and SEC case is a landmark legal battle with significant ramifications for the cryptocurrency industry. The arguments presented by both sides, the potential settlement outcomes, and the implications for XRP's commodity status highlight the ongoing need for clearer regulatory guidelines in the rapidly evolving crypto space. The uncertainty surrounding XRP's future underscores the importance of remaining informed about the case's progress. To stay updated on the latest developments in this critical case and to receive timely analysis regarding XRP price prediction and Ripple settlement news, subscribe to our newsletter or follow us on social media. Understanding the evolving regulatory status of XRP and other cryptocurrencies is crucial for navigating the complexities of this dynamic market.

Featured Posts

-

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025 -

Brtanwy Parlymnt Ky Kshmyr Ke Msyle Pr Hmayt Azad Kshmyr Ke Sdr Ka Byan

May 02, 2025

Brtanwy Parlymnt Ky Kshmyr Ke Msyle Pr Hmayt Azad Kshmyr Ke Sdr Ka Byan

May 02, 2025 -

The Urgent Need To Invest In Childhood To Avert A Mental Health Catastrophe

May 02, 2025

The Urgent Need To Invest In Childhood To Avert A Mental Health Catastrophe

May 02, 2025 -

Christina Aguilera Photoshopped To Perfection Or A Distorted Reality

May 02, 2025

Christina Aguilera Photoshopped To Perfection Or A Distorted Reality

May 02, 2025 -

Hollywood Production Frozen The Combined Writers And Actors Strike

May 02, 2025

Hollywood Production Frozen The Combined Writers And Actors Strike

May 02, 2025