Ripple And The SEC: Will XRP Be Deemed A Commodity?

Table of Contents

The SEC's Case Against Ripple

The SEC's case hinges on the application of the Howey Test, a legal framework used to determine whether an investment constitutes a security.

The Howey Test and its Application to XRP

The Howey Test has four elements: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived primarily from the efforts of others. The SEC argues that XRP satisfies all four elements.

- The SEC's claim regarding XRP's investment contract nature: The SEC contends that XRP sales were investment contracts, where investors purchased XRP anticipating profits generated by Ripple's efforts to increase XRP's value and adoption.

- The SEC's focus on Ripple's sales and distribution of XRP: The SEC emphasizes the significant amount of XRP sold by Ripple to institutional investors and the potential for profit from these sales.

- The role of reasonable expectation of profits from Ripple's efforts: The SEC argues that investors reasonably expected profits from Ripple's promotional activities and development efforts related to XRP.

Ripple's Defense Strategy

Ripple counters the SEC's arguments, asserting that XRP operates as a decentralized digital asset, distinct from a security.

- Arguments that XRP functions as a currency/decentralized asset: Ripple emphasizes that XRP is traded on numerous exchanges independently of Ripple's actions, functioning as a medium of exchange similar to other cryptocurrencies.

- Emphasis on XRP's widespread adoption and independent trading: Ripple highlights XRP's large and active market capitalization, showing it's traded independently of Ripple's control.

- Challenges to the SEC's application of the Howey Test: Ripple challenges the SEC's interpretation of the Howey Test, arguing that the test does not apply to XRP due to its decentralized nature and independent market functioning.

The Potential Outcomes and Their Implications

The court's decision will have far-reaching consequences.

If XRP is Deemed a Security

If the court rules XRP a security, the implications are significant:

- Potential penalties and fines for Ripple: Ripple could face substantial financial penalties and legal repercussions.

- Implications for XRP exchanges and trading platforms: Exchanges listing XRP might face regulatory scrutiny and potential delisting of XRP.

- The effect on investor confidence and the broader crypto market: A ruling against Ripple could negatively impact investor confidence in the broader cryptocurrency market.

If XRP is Deemed a Commodity

Conversely, if XRP is classified as a commodity, the implications are also substantial:

- Increased regulatory clarity for XRP and other cryptocurrencies: This would create more regulatory certainty for XRP and potentially other cryptocurrencies.

- Potential for increased XRP adoption and value: Greater clarity could lead to increased adoption and a rise in XRP's value.

- The impact on the legal landscape for crypto regulation: This would influence how future digital assets are classified and regulated.

The Broader Implications for Cryptocurrency Regulation

The Ripple case carries immense weight beyond the fate of XRP.

Setting a Precedent for Future Cases

The court's decision will establish a significant legal precedent for future cases involving cryptocurrency classification. This will influence how regulatory bodies approach similar situations with other cryptocurrencies.

The Impact on Investor Confidence

The outcome will significantly influence investor confidence in the crypto market. A clear and definitive ruling, regardless of the outcome, could foster stability and attract further investment.

The Future of Regulatory Frameworks

This case highlights the need for more comprehensive and specific regulatory frameworks tailored to the unique characteristics of cryptocurrencies. The ruling will likely prompt reviews and adjustments of existing regulations.

Conclusion

The SEC versus Ripple case is a landmark legal battle that will shape the future of cryptocurrency regulation. The question, "Will XRP be deemed a commodity?" remains central, with the answer holding profound implications for Ripple, XRP holders, and the entire cryptocurrency ecosystem. Both the SEC and Ripple present strong arguments, making the outcome unpredictable. The court's decision will undoubtedly impact investor confidence and necessitate adjustments to existing regulatory frameworks. Stay tuned for updates on this crucial case that will shape the future of XRP and cryptocurrency regulation.

Featured Posts

-

Brtanwy Parlymnt Ka Kshmyr Ke Msyle Ke Hl Ky Khly Hmayt Sdr Azad Kshmyr Ka Byan

May 01, 2025

Brtanwy Parlymnt Ka Kshmyr Ke Msyle Ke Hl Ky Khly Hmayt Sdr Azad Kshmyr Ka Byan

May 01, 2025 -

Bet Mgm Rotobg 150 150 Bonus For Tonights Nba Playoffs Game

May 01, 2025

Bet Mgm Rotobg 150 150 Bonus For Tonights Nba Playoffs Game

May 01, 2025 -

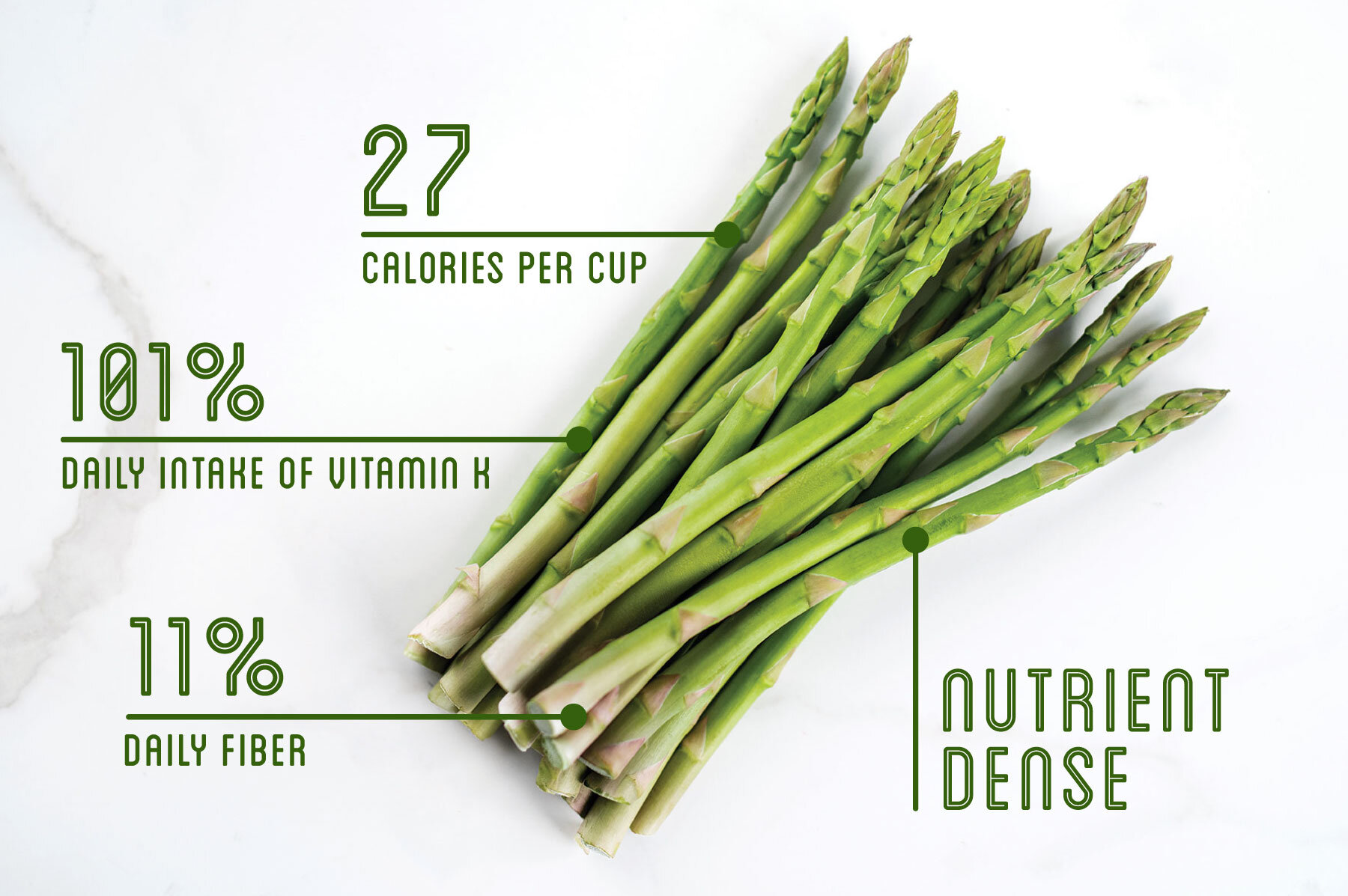

Asparagus Nutrition How This Vegetable Improves Your Health

May 01, 2025

Asparagus Nutrition How This Vegetable Improves Your Health

May 01, 2025 -

Northumberland Man Sets Sail A Homemade Boats Global Journey

May 01, 2025

Northumberland Man Sets Sail A Homemade Boats Global Journey

May 01, 2025 -

Zdravk Colic I Njegova Prva Ljubav Prica O Rastancima I Vencanju

May 01, 2025

Zdravk Colic I Njegova Prva Ljubav Prica O Rastancima I Vencanju

May 01, 2025