Ripple Vs. SEC: Analyzing The $50M Settlement And Its Impact On XRP

Table of Contents

The Ripple-SEC Lawsuit: A Summary

The SEC's lawsuit against Ripple, filed in December 2020, alleged that Ripple conducted unregistered securities offerings of XRP, violating federal securities laws. The SEC argued that XRP functioned as an investment contract, meeting the criteria of the Howey Test, which defines what constitutes a security. This meant that investors purchased XRP with the expectation of profit generated by Ripple's efforts.

Ripple, on the other hand, countered that XRP is a decentralized digital asset with utility beyond investment, functioning as a bridge currency on its payment network. They argued that the SEC’s definition was overly broad and would stifle innovation in the cryptocurrency space.

- SEC's claim: XRP is an unregistered security sold in violation of federal securities laws.

- Ripple's counterargument: XRP is a decentralized digital asset with utility, not a security.

- Timeline:

- December 2020: SEC files lawsuit against Ripple.

- 2021-2022: Extensive legal proceedings, including motions and discovery.

- April 2023: The settlement is reached.

The $50 Million Settlement: Terms and Conditions

The $50 million settlement marked the end of the protracted legal battle. Ripple agreed to pay this sum without admitting or denying the SEC's allegations. Crucially, the settlement does not establish a legal precedent regarding whether XRP is a security. This ambiguity is a significant point of discussion and analysis within the crypto community.

- Settlement Amount: $50 million

- Stipulations: The settlement includes stipulations regarding future sales of XRP, though the specifics are not overly restrictive compared to initial fears.

- Admission of Guilt/Liability: Ripple did not admit guilt or liability.

- Impact on Executives: The settlement did not specifically target Ripple executives, unlike some initial predictions.

Impact on XRP Price and Market Sentiment

The settlement announcement initially caused a surge in XRP's price, reflecting a wave of relief among investors. However, the long-term impact remains uncertain. While the price saw immediate positive movement, its future trajectory remains dependent on broader market conditions and regulatory developments.

- Price Fluctuations: Significant price swings were observed before, during, and after the announcement.

- Trading Volume and Market Capitalization: Both experienced noticeable changes post-settlement.

- Investor Confidence: The settlement fostered a degree of renewed confidence, although uncertainty persists.

Implications for Crypto Regulation and the Future of XRP

The Ripple-SEC settlement holds significant implications for the future of cryptocurrency regulation, both domestically and internationally. It brings some measure of resolution for Ripple, but leaves open many questions about how the SEC will approach the classification of other cryptocurrencies. The lack of a clear definition of what constitutes a security under current legislation casts a long shadow on the industry.

- Impact on Other Cryptocurrencies: The case's outcome may influence how regulators approach other crypto projects.

- SEC's Future Approach: The SEC's strategy for regulating digital assets remains unclear, contributing to ongoing uncertainty in the market.

- Ripple's Future Plans: Ripple plans to continue its development and expansion in the cross-border payment space.

- XRP Adoption: The future adoption and use of XRP will depend heavily on market sentiment and regulatory clarity.

Legal Analysis of the Ripple vs. SEC Case

The Ripple vs. SEC case established no definitive legal precedent concerning XRP's classification as a security. The Howey Test, the cornerstone of securities law, remained central to the arguments, with both sides presenting their interpretations of its application to digital assets. The lack of a clear ruling leaves the legal landscape surrounding cryptocurrencies ambiguous and sets the stage for future legal challenges.

- Influence on Other SEC Cases: The outcome could influence future SEC cases against crypto companies, but it’s unlikely to provide definitive answers on the applicability of security laws to similar digital assets.

- Legal Framework: The case highlighted the limitations of applying existing securities law to the novel technology of cryptocurrencies.

- Howey Test Application: The case further exposed the complexities of applying the Howey Test to the decentralized and often multifaceted nature of crypto assets.

Conclusion

The Ripple vs. SEC settlement, while concluding a significant legal battle, leaves many questions unanswered. The $50 million payment did not resolve the core issue of XRP's legal classification. The outcome created both relief and uncertainty within the cryptocurrency market, affecting XRP's price and the overall regulatory landscape. Understanding the complexities of the Ripple vs. SEC case and its impact on XRP remains critical for anyone invested in or interested in the future of cryptocurrencies. Stay informed about ongoing developments in the Ripple vs SEC saga and the evolving regulatory landscape for cryptocurrencies to make informed decisions. Further research into the intricacies of the Ripple vs. SEC case and its impact on XRP will help investors and enthusiasts alike make informed decisions in the volatile cryptocurrency market.

Featured Posts

-

International Harry Potter Day Find The Perfect Fan Merchandise Online

May 02, 2025

International Harry Potter Day Find The Perfect Fan Merchandise Online

May 02, 2025 -

Fortnite Understanding The Recent Game Mode Discontinuations

May 02, 2025

Fortnite Understanding The Recent Game Mode Discontinuations

May 02, 2025 -

How To Join The Sony Play Station Beta Program

May 02, 2025

How To Join The Sony Play Station Beta Program

May 02, 2025 -

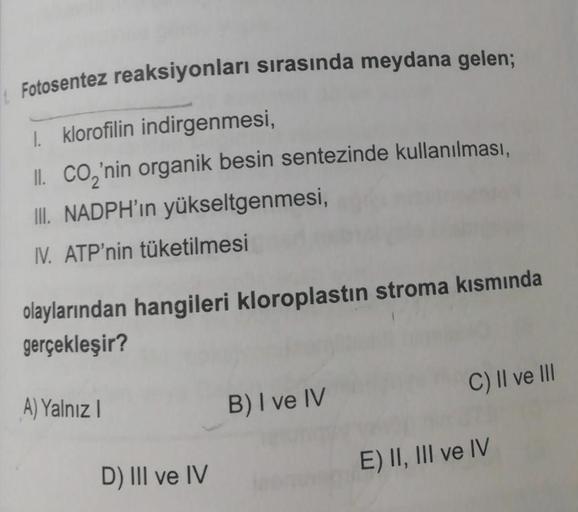

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede

May 02, 2025

1 Mayis Kocaeli Kutlamalar Sirasinda Meydana Gelen Arbede

May 02, 2025 -

The Future Of Valorant Mobile Insights From The Pubg Mobile Studio

May 02, 2025

The Future Of Valorant Mobile Insights From The Pubg Mobile Studio

May 02, 2025