Ripple (XRP): Fourth Largest Crypto – Your Millionaire-Making Opportunity?

Table of Contents

Understanding Ripple and XRP

Before exploring the millionaire-making potential, it's crucial to understand the distinction between Ripple (the company) and XRP (the cryptocurrency). Ripple Labs is a technology company that developed RippleNet, a real-time gross settlement system (RTGS), and its associated digital asset, XRP.

- RippleNet: This network uses XRP to enable fast and low-cost international transactions, connecting banks and financial institutions globally. It offers various solutions, including xRapid (for on-demand liquidity), xCurrent (for real-time gross settlement), and xVia (for payment initiation).

- XRP: Unlike Bitcoin or Ethereum, XRP isn't solely reliant on mining for its security. It operates using a unique consensus mechanism, making transactions faster and more energy-efficient. This utility within the RippleNet ecosystem is a key factor in its value proposition.

- Blockchain Technology: XRP utilizes a distributed ledger technology (DLT) akin to a blockchain, although with some key differences. Understanding these technical intricacies is not necessary for investment, but familiarity can help you appreciate XRP's potential.

XRP's Market Position and Price Volatility

XRP's journey has been marked by significant price swings. While it has experienced periods of remarkable growth, reaching all-time highs, it has also faced substantial corrections, mirroring the overall volatility within the cryptocurrency market.

- Historical Performance: Examining XRP's price charts reveals periods of both explosive growth and sharp declines. Past performance is not indicative of future results, but studying this history can give you perspective on the inherent risk.

- Market Capitalization and Ranking: XRP's market capitalization (the total value of all XRP in circulation) constantly changes, affecting its ranking amongst other cryptocurrencies. Regularly monitoring these metrics provides insights into its overall market position.

- Influencing Factors: Factors driving XRP price volatility include regulatory developments (particularly concerning securities classifications), increased adoption by financial institutions, overall cryptocurrency market sentiment, and wider economic conditions.

The Potential for XRP to Make You a Millionaire

While the possibility of becoming a millionaire through XRP investment exists, it's crucial to approach this with realistic expectations. Becoming a millionaire from any investment requires time, patience, and a degree of luck.

- Long-Term Investment: XRP's potential lies largely in its long-term growth prospects, tied to the broader adoption of RippleNet and the increasing demand for faster, cheaper cross-border payments.

- Price Appreciation Scenarios: Several factors could lead to XRP price appreciation, including widespread institutional adoption, successful integration into existing financial systems, and positive regulatory developments. However, equally plausible scenarios exist that could lead to depreciation.

- Risk Management and Diversification: Investing in cryptocurrency, including XRP, carries substantial risk. Market crashes, regulatory uncertainty, and security breaches are all potential threats. Diversifying your portfolio across different asset classes is paramount to mitigating risk.

- Return on Investment (ROI): The ROI on any cryptocurrency investment is highly unpredictable. While the potential for substantial returns exists, the possibility of significant losses is equally real.

Investing in XRP: A Practical Guide

Investing in XRP requires careful consideration and a responsible approach. Here's a step-by-step guide:

- Choosing a Cryptocurrency Exchange: Select a reputable and secure cryptocurrency exchange to buy XRP. Research and compare different exchanges based on fees, security measures, and user reviews.

- Secure Storage: Once you've purchased XRP, store it in a secure crypto wallet. Hardware wallets offer the highest level of security, while software wallets provide convenience.

- Investment Strategies: Dollar-cost averaging (DCA) is a popular strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. Holding long-term is also a viable approach, assuming you're comfortable with the inherent risks.

- Staying Informed: Keep abreast of XRP news, market trends, and regulatory updates through reputable sources. Continual learning is crucial for informed decision-making.

Conclusion: Is Ripple (XRP) Right for Your Investment Portfolio?

Ripple (XRP), with its position in the top 10 cryptocurrencies and its role in cross-border payments, offers a compelling, albeit risky, investment opportunity. The potential for significant returns exists, but so does the potential for substantial losses. Thorough research, careful risk assessment, and responsible investment strategies are crucial. Before investing in XRP or any cryptocurrency, ensure you fully understand the associated risks and develop a well-informed investment strategy. Continue your research on Ripple (XRP) and make informed investment decisions. Remember, this is not financial advice, and you should consult a financial professional before making any investment decisions.

Featured Posts

-

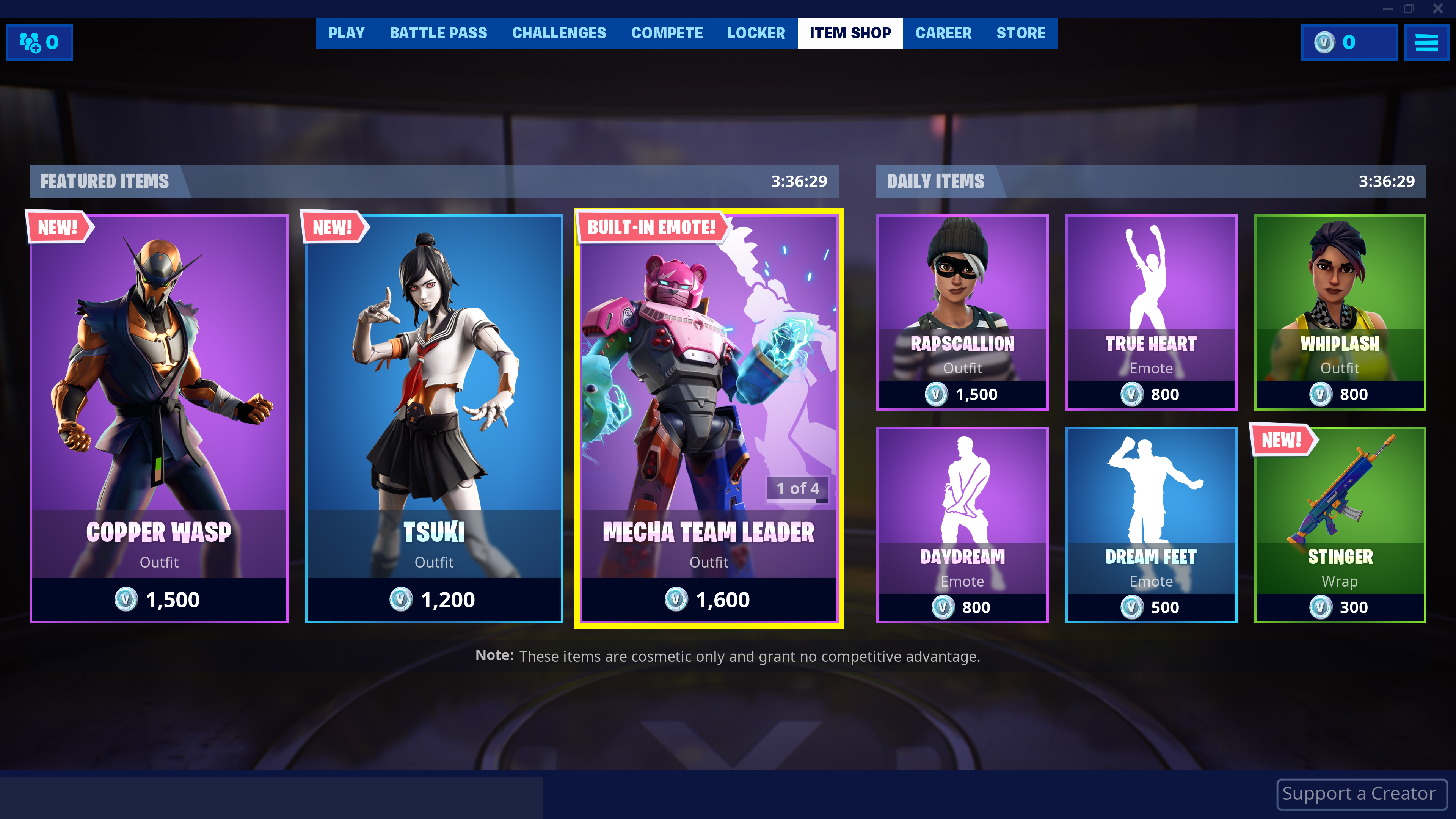

Fortnite Item Shop Update Easier Navigation For Players

May 02, 2025

Fortnite Item Shop Update Easier Navigation For Players

May 02, 2025 -

Rolls Royce 2025 Targets Remain Unchanged Tariff Impact Assessed

May 02, 2025

Rolls Royce 2025 Targets Remain Unchanged Tariff Impact Assessed

May 02, 2025 -

Teleurgestelde Bewoners Oostwold Nieuwe Verdeelstation Een Voldongen Feit

May 02, 2025

Teleurgestelde Bewoners Oostwold Nieuwe Verdeelstation Een Voldongen Feit

May 02, 2025 -

Gaslucht Roden Vals Alarm

May 02, 2025

Gaslucht Roden Vals Alarm

May 02, 2025 -

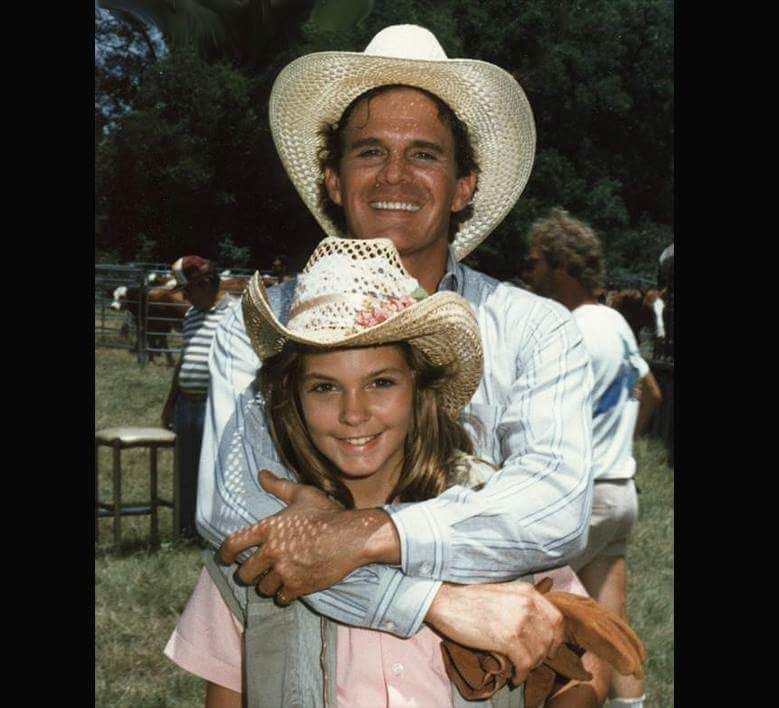

Dallas Tv Show Loss Of Another 80s Icon

May 02, 2025

Dallas Tv Show Loss Of Another 80s Icon

May 02, 2025