Ripple (XRP) On The Rise: A Look At Its Potential To Hit $3.40

Table of Contents

1. Introduction:

Ripple, a real-time gross settlement system, currency exchange, and remittance network, uses its native cryptocurrency, XRP, to facilitate fast and low-cost international money transfers. Currently trading at [Insert Current XRP Price], XRP has a rich history marked by periods of significant volatility and growth. Understanding its past performance is crucial when assessing the plausibility of an XRP price reaching $3.40. This article aims to provide a balanced perspective on the potential for XRP price increases, examining the factors contributing to its possible growth, as well as the significant challenges ahead.

2. Main Points:

H2: Factors Contributing to XRP's Potential Growth:

H3: Increasing Institutional Adoption: The growing interest from financial institutions is a significant driver of XRP's potential growth. Major banks and payment providers are increasingly recognizing the efficiency and cost-effectiveness of Ripple's technology for cross-border payments.

- Examples of partnerships: Ripple boasts partnerships with major banks such as [Insert Examples of Banks using RippleNet], facilitating faster and cheaper international transactions.

- Increasing transaction volume: The volume of XRP transactions processed through RippleNet is steadily increasing, signaling growing adoption and confidence in the system. This increased XRP transaction volume directly influences the demand for the cryptocurrency.

- Positive regulatory developments: While the SEC lawsuit remains a significant factor, positive regulatory developments in other jurisdictions could lead to increased institutional adoption and a surge in XRP price. This regulatory clarity XRP needs is crucial for further growth. Keywords: Institutional adoption XRP, Ripple partnerships, cross-border payments, XRP transaction volume.

H3: Technological Advancements and RippleNet Expansion: Ripple's continuous development and expansion of its RippleNet network are crucial to its success. Improvements in speed, efficiency, and scalability are attracting new customers and enhancing the platform's capabilities.

- New features: Ripple is constantly adding new features to RippleNet, enhancing its functionality and appeal to financial institutions. These improvements in XRP technology are fundamental for broader adoption.

- Improved speed and efficiency: RippleNet offers significantly faster and more efficient cross-border payments compared to traditional methods, reducing transaction times and costs. This scalability is a key selling point for XRP.

- Expansion into new markets: RippleNet's ongoing expansion into new markets is increasing its reach and potential user base, fueling demand for XRP. RippleNet expansion is key for the future of XRP.

- Growing number of RippleNet members: The increasing number of financial institutions joining RippleNet demonstrates growing confidence in the platform and its underlying technology. Keywords: RippleNet, XRP technology, blockchain technology, scalability, RippleNet expansion.

H3: Positive Regulatory Developments and Legal Battles: The ongoing legal battle with the SEC remains a significant uncertainty for XRP. However, positive legal developments or a favorable resolution could significantly impact market sentiment and propel the XRP price upward.

- Discussion of the lawsuit: The SEC lawsuit alleges that XRP is an unregistered security. The outcome of this legal battle will significantly influence XRP's price.

- Potential outcomes: Various potential outcomes exist, ranging from a complete dismissal of the lawsuit to a settlement or even a ruling against Ripple. Each outcome will likely have a substantial impact on the XRP price.

- Impact of positive legal rulings on market sentiment: A positive ruling or a clear path towards regulatory clarity would likely lead to a surge in market sentiment and a potential price increase for XRP. Keywords: SEC lawsuit XRP, Ripple legal battle, regulatory clarity XRP, positive legal developments.

H2: Analyzing the $3.40 Price Target:

H3: Market Analysis and Price Predictions: Reaching $3.40 would represent a significant increase from the current XRP price. Various market analyses and price predictions exist, with some experts suggesting it's possible, while others remain cautious.

- Data from reputable sources: [Include data from reputable sources such as CoinMarketCap, CoinGecko, etc., with proper attribution and links]. This data is crucial for understanding the current XRP price and market capitalization XRP.

- Technical analysis charts: Technical analysis of XRP price charts can offer insights into potential price movements, though it's important to remember that these are not guarantees. Technical analysis XRP can provide valuable context.

- Expert opinions: [Include opinions from reputable crypto analysts, but always mention that these are opinions and not financial advice]. Keywords: XRP price prediction, XRP price analysis, technical analysis XRP, market capitalization XRP, $3.40 XRP target.

H3: Potential Challenges and Risks: Several factors could hinder XRP's price increase. These must be considered when evaluating the $3.40 XRP target's feasibility.

- Regulatory uncertainty: The ongoing SEC lawsuit and broader regulatory uncertainty in the cryptocurrency market pose a significant risk. Regulatory uncertainty XRP faces is a major factor.

- Market volatility: The cryptocurrency market is inherently volatile, and XRP is no exception. Sudden price drops are possible. Cryptocurrency volatility is a major risk for all cryptocurrencies, including XRP.

- Competition from other cryptocurrencies: XRP faces competition from other cryptocurrencies offering similar functionalities. Competition in the crypto market is fierce.

- General market downturns: A broader downturn in the financial markets could negatively impact the price of XRP. Market risk XRP faces is significant. Keywords: XRP risks, cryptocurrency volatility, market risk XRP, regulatory uncertainty XRP.

3. Conclusion:

The potential for XRP to reach $3.40 hinges on several factors, including increased institutional adoption, technological advancements within RippleNet, and positive regulatory developments, particularly a favorable resolution to the SEC lawsuit. However, considerable challenges and risks remain, including regulatory uncertainty, market volatility, and competition within the cryptocurrency space.

While the $3.40 XRP target remains ambitious, the factors discussed above suggest significant potential. Conduct your own thorough research and carefully consider the risks before making any investment decisions regarding Ripple (XRP). Remember that investing in cryptocurrencies involves substantial risk, and you could lose some or all of your investment. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Is The Great Decoupling Inevitable Exploring Key Factors

May 08, 2025

Is The Great Decoupling Inevitable Exploring Key Factors

May 08, 2025 -

Galen Erso Rogue One 1 6 Figure A Hot Toys Japan Exclusive

May 08, 2025

Galen Erso Rogue One 1 6 Figure A Hot Toys Japan Exclusive

May 08, 2025 -

Debate Reignites Has Saving Private Ryan Been Overtaken As The Best War Film

May 08, 2025

Debate Reignites Has Saving Private Ryan Been Overtaken As The Best War Film

May 08, 2025 -

Watch Inter Vs Barcelona Live Uefa Champions League Football

May 08, 2025

Watch Inter Vs Barcelona Live Uefa Champions League Football

May 08, 2025 -

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025

Latest Posts

-

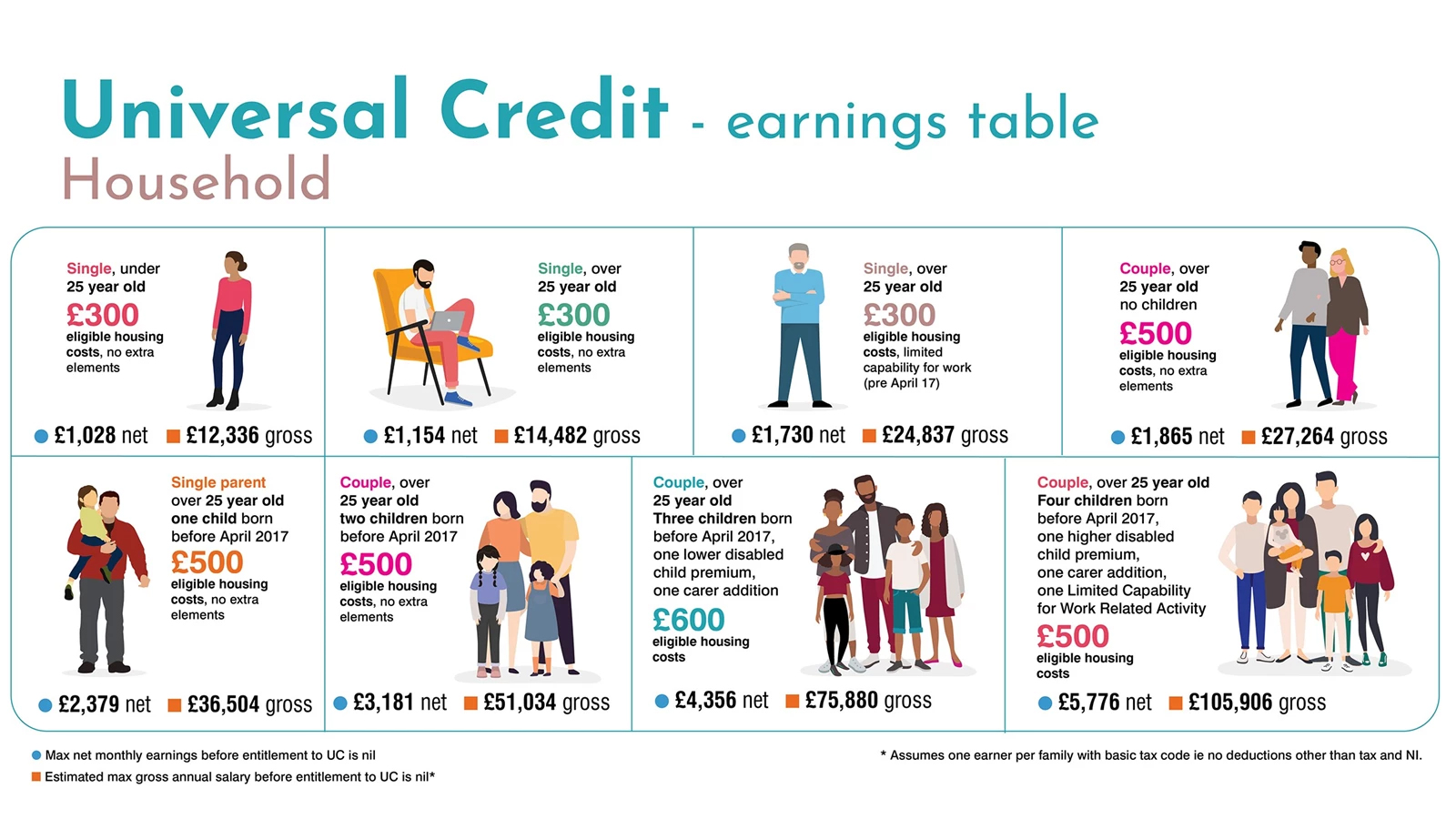

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

The Scholar Rock Stock Drop On Monday What Happened

May 08, 2025

The Scholar Rock Stock Drop On Monday What Happened

May 08, 2025 -

Impact Of Dwps New Six Month Universal Credit Regulation

May 08, 2025

Impact Of Dwps New Six Month Universal Credit Regulation

May 08, 2025 -

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025 -

Analyzing Scholar Rock Stocks Unexpected Monday Fall

May 08, 2025

Analyzing Scholar Rock Stocks Unexpected Monday Fall

May 08, 2025