Ripple's XRP: SBI Holdings' Shareholder Reward Program Details

Table of Contents

SBI Holdings, a major Japanese financial services company and a significant investor in Ripple, has launched a groundbreaking shareholder reward program centered around XRP, Ripple's native cryptocurrency. This SBI Holdings XRP reward program offers a unique approach to shareholder returns, highlighting the increasing integration of cryptocurrencies into traditional finance. This article delves into the specifics of this innovative program, analyzing its implications for XRP, SBI Holdings, and the broader cryptocurrency market.

H2: Understanding SBI Holdings' XRP Reward Program

The core concept of the SBI Holdings XRP reward program is simple yet revolutionary: rewarding shareholders with XRP, Ripple's digital asset, instead of—or in addition to—traditional cash dividends. This represents a significant shift towards cryptocurrency adoption within established financial institutions.

Eligibility criteria for the program are likely to be defined by SBI Holdings, potentially including minimum shareholding requirements or specific holding periods. Details on these specifics are crucial for potential investors and will likely be published through official SBI Holdings channels.

The distribution method for the XRP rewards is also a key detail currently awaiting clarification. Potential methods could include direct transfer to a cryptocurrency exchange account linked to the shareholder, or perhaps through a dedicated platform managed by SBI Holdings. This aspect warrants close attention as it affects the accessibility and practicality of the reward for shareholders.

- Program timeline: The exact start and end dates of the SBI Holdings XRP reward program are yet to be officially announced. However, updates are expected to be released through official SBI Holdings press releases and investor relations channels.

- Expected XRP distribution amounts per share: The amount of XRP distributed per share will depend on various factors, including SBI Holdings' overall profit and the number of eligible shareholders. This detail is crucial and will significantly influence the program's attractiveness to shareholders.

- Tax implications: Shareholders receiving XRP rewards will need to consider the tax implications in their respective jurisdictions. Tax laws concerning cryptocurrency vary significantly, making it essential for shareholders to seek professional tax advice.

H2: The Significance of SBI Holdings' Adoption of XRP

SBI Holdings' substantial investment in Ripple demonstrates a strong belief in XRP's long-term potential. This reward program further solidifies their commitment, showcasing their confidence in XRP's future and its integration into mainstream finance.

The program's impact on XRP's price and market adoption is potentially significant. The increased demand for XRP generated by the reward program could positively impact its price and increase its overall market liquidity. This could also encourage other companies to explore similar cryptocurrency-based reward programs.

- SBI Holdings' influence: As a major player in the Japanese financial market, SBI Holdings' endorsement of XRP carries substantial weight and influence, potentially inspiring other large financial institutions to explore similar initiatives.

- Message to institutional investors: This program sends a powerful message to institutional investors, highlighting the increasing legitimacy and acceptance of XRP within the financial community.

- Long-term effects on XRP's value and liquidity: The consistent demand for XRP created through this program could lead to increased price stability and potentially contribute to its long-term value appreciation.

H2: Benefits for SBI Holdings and its Shareholders

For SBI Holdings, the XRP reward program offers several compelling benefits. It can enhance shareholder loyalty, bolster brand image as a forward-thinking innovator, and potentially attract new investors seeking exposure to the cryptocurrency market.

Shareholders benefit from exposure to a potentially high-growth asset class. The program diversifies their portfolios beyond traditional dividend payouts, offering participation in a potentially lucrative cryptocurrency.

However, it's crucial to acknowledge potential risks. The inherent volatility of the cryptocurrency market means the value of XRP rewards can fluctuate significantly, representing a potential downside for both SBI Holdings and its shareholders.

- Increased shareholder engagement: The innovative nature of the program is likely to increase shareholder engagement and interest in SBI Holdings' activities.

- Potential for capital appreciation: If the price of XRP appreciates, shareholders receive substantial capital gains, surpassing the returns of traditional dividends.

- Diversification of shareholder portfolios: The program allows shareholders to diversify their investments beyond traditional assets, mitigating risks associated with single-asset holdings.

- Risks associated with cryptocurrency price volatility: The unpredictable nature of cryptocurrency markets presents a significant risk, potentially leading to losses if XRP's price declines.

H3: Comparison to Traditional Dividend Programs

Traditional dividend programs typically involve cash payouts, offering predictable returns but often limited growth potential. The SBI Holdings XRP reward program, in contrast, offers potential for higher growth but with significantly greater volatility.

Traditional dividends provide a stable income stream, suitable for risk-averse investors. The XRP program, however, targets investors with a higher risk tolerance seeking potentially higher returns. The long-term implications of this shift towards crypto-based rewards could reshape the landscape of corporate payouts.

Conclusion:

This article has detailed SBI Holdings' innovative shareholder reward program using XRP, highlighting its potential impact on XRP adoption, the broader cryptocurrency market, and the future of corporate dividend distributions. This program signifies a bold step by a major financial institution, underscoring XRP's growing acceptance and potential within the financial world. The SBI Holdings XRP reward program represents a significant development in the intersection of traditional finance and the cryptocurrency space.

Call to Action: Stay informed about the latest developments in the SBI Holdings XRP reward program and learn more about how XRP is reshaping the financial landscape. Research further the opportunities presented by SBI Holdings' adoption of XRP and its potential implications for the future of finance. Understanding the intricacies of this innovative program is crucial for investors interested in both XRP and the evolving landscape of shareholder rewards.

Featured Posts

-

Lisa Ann Keller Obituary Remembering A Life Well Lived In East Idaho

May 02, 2025

Lisa Ann Keller Obituary Remembering A Life Well Lived In East Idaho

May 02, 2025 -

Find Michael Sheen And Sharon Horgans Latest British Drama Online

May 02, 2025

Find Michael Sheen And Sharon Horgans Latest British Drama Online

May 02, 2025 -

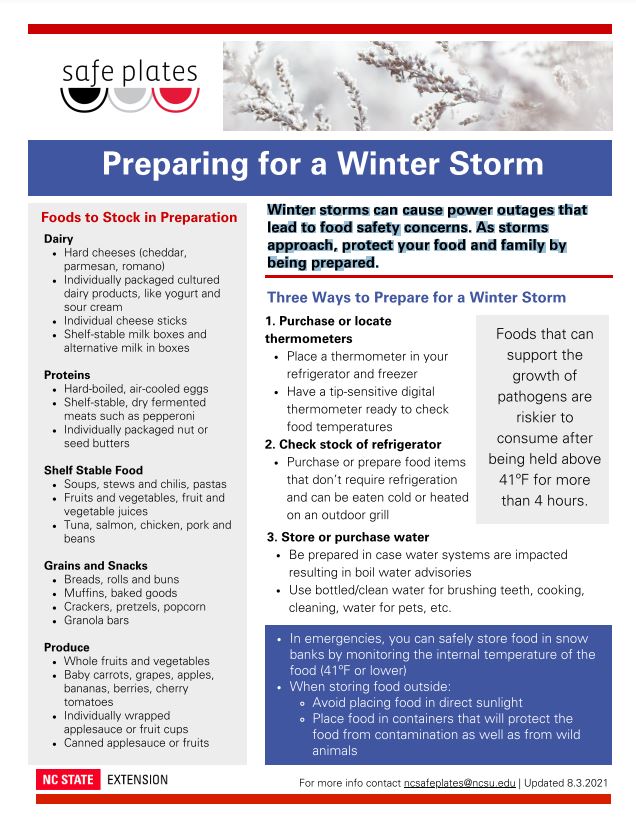

Tulsa Winter Storm Preparedness 66 Salt Spreaders On The Roads

May 02, 2025

Tulsa Winter Storm Preparedness 66 Salt Spreaders On The Roads

May 02, 2025 -

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 02, 2025

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 02, 2025 -

This Iconic Band Will Only Play A Music Festival If Its Life Or Death

May 02, 2025

This Iconic Band Will Only Play A Music Festival If Its Life Or Death

May 02, 2025