Rising Federal Debt: How It Impacts Mortgage Borrowers

Table of Contents

The Relationship Between Federal Debt and Interest Rates

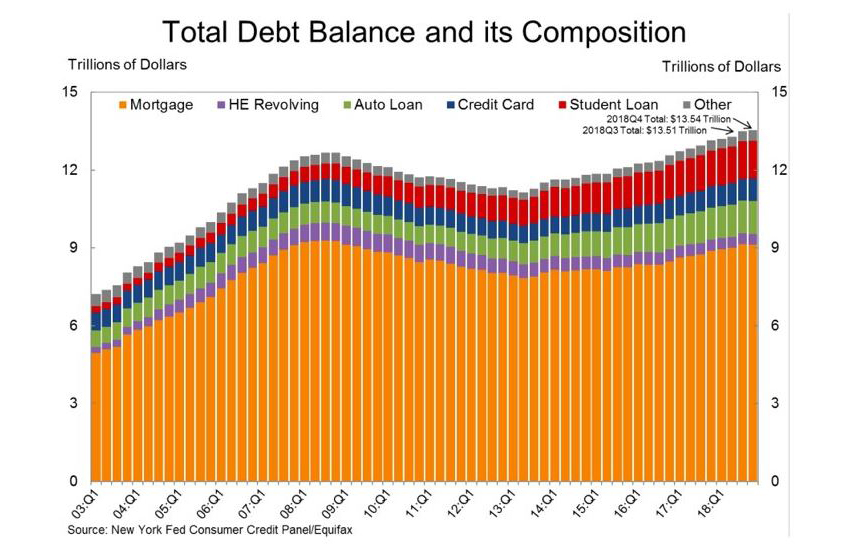

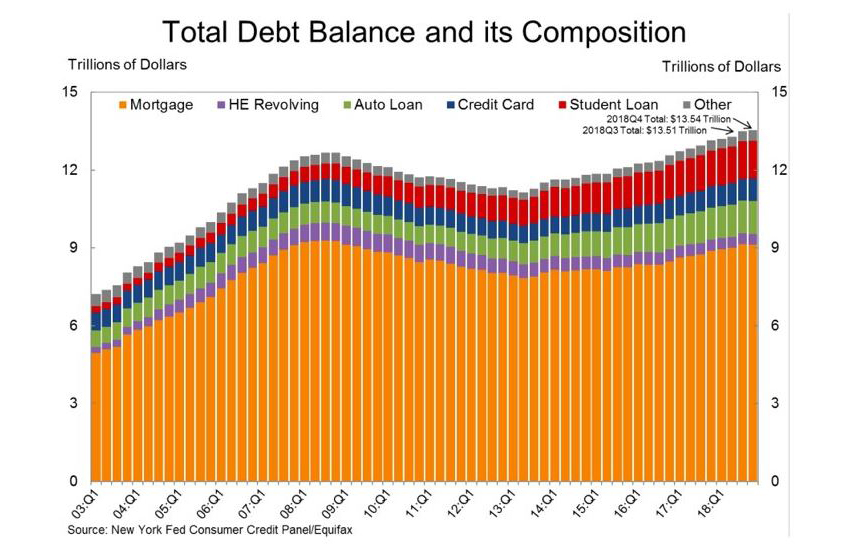

Increased government borrowing to finance the national debt directly influences interest rates. When the government borrows heavily, it increases the demand for loans, pushing interest rates upward. This heightened demand competes with the private sector's borrowing needs, further driving up rates. The Federal Reserve, tasked with managing the nation's monetary policy, often responds to high federal debt levels by raising interest rates to curb inflation. This creates a ripple effect throughout the economy.

- Increased demand for loans pushes interest rates up. The sheer volume of government borrowing creates a surge in demand for loanable funds.

- Government borrowing competes with private sector borrowing. This competition for funds drives up the cost of borrowing for individuals and businesses.

- Potential for inflation leading to higher interest rates. Increased government spending, often financed through borrowing, can fuel inflation, prompting the Federal Reserve to increase interest rates to combat it.

- Impact on mortgage rates: Higher interest rates mean higher monthly payments for new and existing mortgages. This makes homeownership more expensive and less accessible. Even refinancing can become considerably more costly.

Inflation's Impact on Mortgage Borrowers

Rising federal debt often contributes to inflation. When the government borrows extensively and prints more money to cover its debts, it can lead to an increase in the overall money supply. This excess money circulating in the economy can outpace the growth in goods and services, resulting in higher prices. Inflation significantly erodes the purchasing power of money, making mortgages more expensive.

- Increased money supply due to government borrowing can fuel inflation. The increased money supply devalues existing currency.

- Inflation erodes the value of money, making mortgages more expensive. The same mortgage amount buys less, increasing the real cost of borrowing.

- Higher prices for goods and services reduce disposable income for mortgage payments. This creates financial strain for homeowners.

- Impact on real estate values: Inflation can impact property values, creating uncertainty for homeowners. While inflation might initially push up property prices, it can also lead to market volatility.

Economic Uncertainty and Mortgage Lending

High levels of federal debt contribute to economic uncertainty. Lenders, faced with this instability, become more cautious about extending credit. This uncertainty translates into tighter lending standards, making it harder for individuals to qualify for a mortgage. The availability of mortgages may decrease, and the cost of borrowing may rise due to increased risk assessments.

- Increased uncertainty makes lenders more cautious about extending credit. Lenders assess a higher risk associated with loan defaults during economic instability.

- Tighter lending standards can make it harder to qualify for a mortgage. Stricter requirements for credit scores and down payments become common.

- Potential for reduced mortgage availability and higher borrowing costs. Lenders might reduce the number of loans offered or increase interest rates to compensate for the increased risk.

- Impact on refinancing options: Economic uncertainty can affect refinancing opportunities for existing homeowners. Refinancing becomes more difficult or less advantageous.

Strategies for Mortgage Borrowers in Times of Rising Federal Debt

Navigating the challenges posed by rising federal debt requires proactive financial management. Here are some strategies for mortgage borrowers:

- Improve credit score to qualify for better rates. A higher credit score demonstrates creditworthiness and can lead to more favorable mortgage terms.

- Save a larger down payment to reduce loan amount. A larger down payment minimizes the loan needed, thus reducing risk for lenders and potentially securing lower interest rates.

- Shop around for the best mortgage rates. Comparing offers from multiple lenders can save you substantial amounts over the life of the loan.

- Consider fixed-rate mortgages to avoid fluctuating interest rates. This protects against rising interest rates, offering predictable monthly payments.

- Budget carefully and plan for potential interest rate increases. Creating a realistic budget and anticipating potential rate hikes helps maintain financial stability.

Conclusion

Rising federal debt significantly impacts mortgage borrowers through higher interest rates, increased inflation, and heightened economic uncertainty. Understanding the connection between national debt and personal finances is crucial for navigating these challenges. Stay informed about economic trends, proactively manage your finances amidst rising federal debt, and take steps to improve your financial position. Consider consulting with a financial advisor for personalized guidance on managing your mortgage and understanding the impact of rising federal debt on your financial planning. By understanding these factors, you can effectively manage your mortgage and secure your financial future even in the face of rising federal debt.

Featured Posts

-

Maastricht Airport Passenger Forecast A Significant Decrease In Early 2025

May 19, 2025

Maastricht Airport Passenger Forecast A Significant Decrease In Early 2025

May 19, 2025 -

Finalen I Melodifestivalen 2025 Vem Vinner Artister Och Startordning

May 19, 2025

Finalen I Melodifestivalen 2025 Vem Vinner Artister Och Startordning

May 19, 2025 -

Kibris Baris Suereci Stefanos Stefanu Nun Oenemi

May 19, 2025

Kibris Baris Suereci Stefanos Stefanu Nun Oenemi

May 19, 2025 -

Bmw And Porsches China Challenges A Growing Trend

May 19, 2025

Bmw And Porsches China Challenges A Growing Trend

May 19, 2025 -

Parcay Sur Vienne Cent Participants A La Fete De La Marche

May 19, 2025

Parcay Sur Vienne Cent Participants A La Fete De La Marche

May 19, 2025