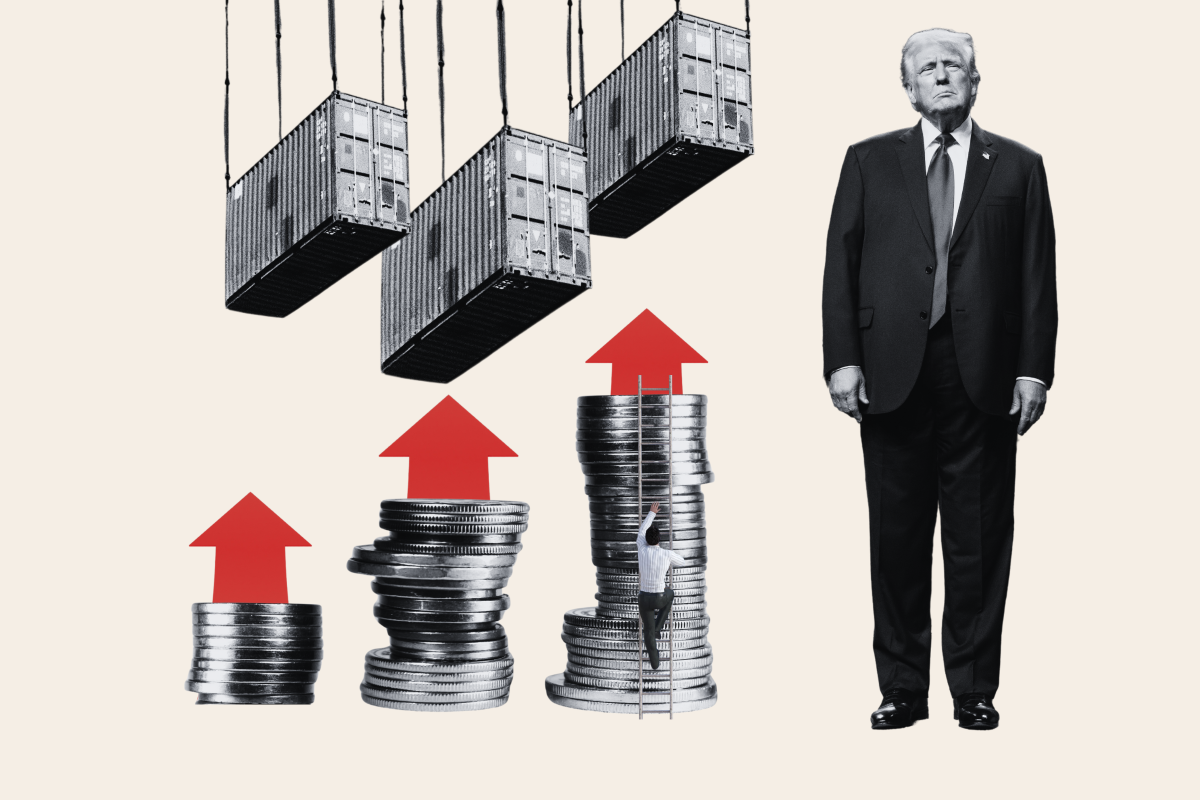

Rising Tariffs: The Chill On Tech Company Initial Public Offerings

Table of Contents

Increased Costs and Reduced Profitability

Rising tariffs directly impact the bottom line of tech companies, creating a less attractive investment opportunity. This effect manifests in two key areas: manufacturing and supply chains, and pricing pressure on consumers.

Impact on Manufacturing and Supply Chains

Rising tariffs directly increase the cost of imported components crucial for many tech products. This increase in input costs significantly impacts manufacturing costs.

- Higher input costs for hardware manufacturers: Companies reliant on imported chips, screens, and other components face immediate and substantial price increases. This directly erodes profit margins.

- Increased reliance on more expensive domestic suppliers: While some companies attempt to source domestically, this often leads to higher costs due to potentially limited supply and higher labor costs.

- Disruptions to established global supply chains: Tariffs disrupt finely tuned global supply chains, causing delays, increased transportation costs, and potential shortages of critical components.

Pricing Pressure and Consumer Demand

The increased production costs due to tariffs often translate directly into higher retail prices for consumers. This can have a significant negative impact on sales.

- Reduced sales volumes impacting revenue projections: Higher prices can lead to decreased consumer demand, impacting projected revenue and ultimately, the attractiveness of the IPO.

- Increased price sensitivity among consumers: In a competitive market, consumers are increasingly price-sensitive. Higher prices can push buyers towards cheaper alternatives or delay purchases altogether.

- Potential for loss of market share to less affected competitors: Companies that can source components more efficiently or are less reliant on imports may gain a competitive advantage, potentially stealing market share from tariff-burdened competitors.

Uncertainty and Investor Sentiment

The uncertainty created by fluctuating tariffs significantly impacts investor sentiment, making them less likely to invest in tech IPOs.

Economic Uncertainty and Risk Aversion

Tariffs contribute to broader economic uncertainty, prompting investors to become more risk-averse. This makes them less inclined to invest in companies with potentially volatile futures.

- Concerns about future profitability and growth: Investors worry about the long-term impact of tariffs on the company's ability to maintain profitability and achieve projected growth.

- Reduced investor appetite for new ventures: The perceived increased risk associated with tech IPOs in a tariff-affected market leads to a reduction in overall investor interest.

- Shift towards safer, more established investments: Investors may shift their focus towards more established, less volatile companies perceived as safer bets in uncertain times.

Difficulty in Accurately Forecasting Future Earnings

The volatile nature of tariffs makes accurate financial forecasting incredibly challenging for tech companies. This uncertainty deters investors who require clear projections.

- Impact on valuation models and investor expectations: Uncertainties around future costs directly impact valuation models, leading to lower valuations and potentially impacting the success of the IPO.

- Increased difficulty in securing favorable financing terms: Lenders are also less willing to offer favorable terms to companies facing significant uncertainties due to tariffs.

- Potential for lower IPO valuations due to uncertainty: The overall risk associated with tariff fluctuations can significantly decrease the expected valuation of a tech IPO.

Geopolitical Risks and Global Expansion

Rising tariffs exacerbate geopolitical risks, impacting market access and global expansion strategies for tech companies preparing for an IPO.

Trade Wars and Market Access

Escalating trade tensions can create significant barriers to market access for tech companies, reducing their overall growth potential.

- Limitations on exporting products to key markets: Tariffs can impose significant limitations on exporting products to key international markets, restricting revenue streams.

- Increased regulatory hurdles and compliance costs: Navigating complex tariff regulations and complying with new trade rules increases administrative burdens and costs.

- Potential for retaliatory tariffs from other countries: Trade wars can easily escalate, leading to retaliatory tariffs that further restrict market access and increase costs.

Shift in Investment Strategies

Companies may be forced to adapt their global expansion strategies, potentially reducing their attractiveness to investors focused on international growth.

- Increased investment in domestic production and R&D: Companies may prioritize domestic production to mitigate tariff risks, potentially impacting their global competitiveness.

- Reduced investment in overseas expansion projects: Uncertainty surrounding future tariffs may discourage investment in overseas expansion projects deemed too risky.

- Potential loss of opportunities in high-growth international markets: The inability to access key markets due to tariffs can lead to the loss of potentially lucrative growth opportunities.

Conclusion

The impact of rising tariffs on tech company initial public offerings is undeniable. Increased costs, economic uncertainty, and geopolitical risks are creating a challenging environment for tech startups. Investors are increasingly cautious, and the valuations of tech IPOs are being affected. Understanding the multifaceted impact of rising tariffs is crucial for both tech companies planning IPOs and investors considering such investments. Navigating this complex landscape requires careful planning, strategic adaptation, and a thorough assessment of the risks associated with rising tariffs and their effect on tech IPOs. Thoroughly researching the current economic climate and the potential impact of trade policies is vital before making any decisions related to tech initial public offerings in this volatile market.

Featured Posts

-

Rachel Zegler Attends Snow White Spain Premiere Gal Gadots Absence Explained

May 14, 2025

Rachel Zegler Attends Snow White Spain Premiere Gal Gadots Absence Explained

May 14, 2025 -

Deportation Oqtf Saint Pierre Et Miquelon Wauquiez Persiste Malgre Les Critiques

May 14, 2025

Deportation Oqtf Saint Pierre Et Miquelon Wauquiez Persiste Malgre Les Critiques

May 14, 2025 -

Captain America Brave New World Pvod Streaming Options

May 14, 2025

Captain America Brave New World Pvod Streaming Options

May 14, 2025 -

Pokemon Go Sweet Discoveries Event Date Time And Rewards

May 14, 2025

Pokemon Go Sweet Discoveries Event Date Time And Rewards

May 14, 2025 -

L Ironie De Saint Pierre Et Miquelon Face Aux Oqtf Et Aux Propositions De Wauquiez

May 14, 2025

L Ironie De Saint Pierre Et Miquelon Face Aux Oqtf Et Aux Propositions De Wauquiez

May 14, 2025