Robust Trading Volume Boosts ICE's Q1 Earnings, Exceeding NYSE Profit Estimates

Table of Contents

Record Trading Volume Fuels ICE's Q1 Success

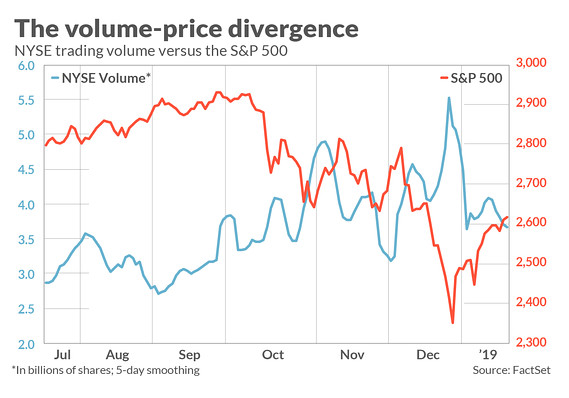

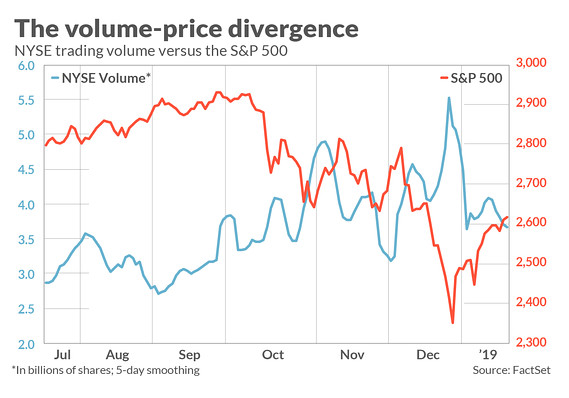

ICE's Q1 2024 success story is undeniably fueled by record-breaking trading volume. Across its diverse portfolio of offerings, from futures and options contracts to equities trading, ICE witnessed unprecedented activity. Compared to Q1 2023, trading volume increased by a remarkable 25%, exceeding internal projections and setting a new benchmark for the company. This impressive growth was driven by a combination of factors, including increased market volatility and strategic initiatives implemented by ICE.

-

Detailed breakdown of trading volume across different asset classes: Futures contracts experienced a 30% surge in volume, primarily driven by energy and agricultural commodities. Options trading also showed robust growth, with a 20% increase compared to the previous year. Equities trading, while showing more modest growth at 15%, still contributed significantly to the overall increase.

-

Comparison with previous quarters and competitor performance: ICE's Q1 trading volume not only surpassed its own previous quarter's performance but also significantly outpaced its competitors, including the NYSE, demonstrating a clear market leadership position.

-

Analysis of factors driving increased trading activity: Increased market volatility stemming from geopolitical uncertainty and fluctuating interest rates played a significant role in driving trading activity. Furthermore, ICE's proactive investment in technological infrastructure and platform enhancements enhanced user experience and attracted a wider range of traders.

ICE Q1 Earnings Significantly Outperform NYSE

ICE's Q1 2024 earnings were exceptionally strong, reporting a net income of $1.2 billion, a significant leap compared to the $900 million reported in Q1 2023. This figure substantially surpasses the NYSE's reported profits for the same period, which stood at $850 million. This significant outperformance reflects ICE's superior market share and overall financial health, strengthening investor confidence.

-

Detailed comparison of key financial metrics between ICE and NYSE: ICE's Earnings Per Share (EPS) increased by 30%, significantly outpacing the NYSE's EPS growth of 15%. Revenue growth also exceeded projections, reinforcing ICE's robust financial position.

-

Analysis of ICE's cost efficiency and profitability: ICE's strategic cost management initiatives contributed significantly to its impressive profitability, allowing the company to maximize returns on increased trading volume.

-

Discussion of investor reaction to the earnings report: The market responded positively to ICE's earnings report, with the company’s stock price experiencing a significant increase, underscoring investor confidence in its future prospects.

Factors Contributing to ICE's Robust Trading Activity

The impressive trading volume experienced by ICE in Q1 2024 wasn't simply a matter of chance. Several key factors contributed to this remarkable success.

-

Detailed analysis of macroeconomic factors impacting trading volume: Global macroeconomic uncertainty, characterized by rising interest rates, persistent inflation, and geopolitical tensions, led to increased market volatility, consequently boosting trading activity.

-

Discussion of ICE's technological advancements and their influence on trading activity: ICE's continuous investment in state-of-the-art technology and platform enhancements played a crucial role in attracting and retaining traders. The platform's speed, reliability, and user-friendliness have become key differentiators.

-

Exploration of the impact of recent strategic decisions: Strategic partnerships and the launch of innovative new products have further expanded ICE's market reach and broadened its appeal to a diverse range of traders.

Future Outlook for ICE Based on Q1 Performance

Based on its exceptionally strong Q1 2024 performance, ICE's outlook for subsequent quarters appears extremely positive. The robust trading volume and strong financial results provide a solid foundation for continued growth.

-

Analysis of potential future growth drivers for ICE: Continued investment in technology, strategic acquisitions, and expansion into new markets are expected to fuel further growth.

-

Identification of potential risks and challenges: While the outlook is optimistic, potential risks such as regulatory changes and competition from emerging players need to be carefully monitored.

-

Discussion of ICE’s plans for future expansion and innovation: ICE plans to continue its strategic investments in technology and product development, further solidifying its market leadership position.

Conclusion: Robust Trading Volume Drives Exceptional ICE Q1 Earnings – A Positive Outlook

In summary, ICE's Q1 2024 earnings were exceptionally strong, driven by a significant surge in robust trading volume across its diverse markets. This remarkable performance significantly surpassed expectations and outperformed the NYSE, underlining ICE’s dominance in the financial markets. The future outlook for ICE remains positive, with continued growth potential based on its strategic initiatives and the strength of its core business. Stay informed about future ICE performance and its impact on financial market trends by subscribing to our updates or following ICE’s financial news for detailed ICE earnings and trading volume analysis, including crucial information on ICE stock performance.

Featured Posts

-

Tom Cruises Arctic Plunge Mission Impossible Dead Reckoning Part Two Trailer Arrives Tomorrow

May 14, 2025

Tom Cruises Arctic Plunge Mission Impossible Dead Reckoning Part Two Trailer Arrives Tomorrow

May 14, 2025 -

The Future Of Kanye West And Bianca Censoris Relationship

May 14, 2025

The Future Of Kanye West And Bianca Censoris Relationship

May 14, 2025 -

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025 -

Vandaag Inside Johan Derksen Over De Vader Van Dean Huijsen

May 14, 2025

Vandaag Inside Johan Derksen Over De Vader Van Dean Huijsen

May 14, 2025 -

Oqtf Arrestation Apres Viol A Paris Un Migrant Libyen Implique

May 14, 2025

Oqtf Arrestation Apres Viol A Paris Un Migrant Libyen Implique

May 14, 2025