Rockwell Automation Earnings Beat Expectations: Stock Surges With Other Market Leaders

Table of Contents

Rockwell Automation Q[Quarter] Earnings Report: Exceeding Expectations

Rockwell Automation's Q[Quarter] earnings report significantly exceeded expectations, showcasing strong financial performance across key metrics. This positive outcome reflects the company's ability to navigate the current economic landscape and capitalize on the growing demand for industrial automation solutions.

Key Financial Highlights:

- Earnings Per Share (EPS): Rockwell Automation reported an EPS of $[Insert EPS figure], surpassing the consensus estimate of $[Insert Consensus Estimate] by $[Insert Percentage Difference]%. This substantial increase demonstrates the company's profitability and efficiency.

- Revenue Growth: Revenue reached $[Insert Revenue Figure], representing a [Insert Percentage] increase compared to the same quarter last year. This impressive growth highlights strong demand for Rockwell Automation's products and services.

- Order Backlog: The order backlog stood at $[Insert Order Backlog Figure], indicating sustained future demand and revenue visibility. This substantial backlog suggests continued strong growth in the coming quarters.

- Profit Margin: The company's profit margin also improved, reaching [Insert Percentage]%, reflecting successful cost management and operational efficiencies.

The factors contributing to these positive results include strong demand across key industrial sectors, successful product launches focusing on digital transformation, and effective cost-cutting measures. Rockwell Automation's commitment to smart manufacturing solutions and its robust supply chain resilience also played a crucial role.

Stock Market Reaction: Rockwell Automation Stock Price Soars

The market reacted swiftly and positively to Rockwell Automation's impressive earnings report. The announcement triggered a significant increase in the company's stock price and trading volume.

Immediate Market Response:

- Stock Price Increase: Following the earnings announcement, Rockwell Automation's stock price surged by [Insert Percentage]%, reaching a new high of $[Insert Stock Price]. This dramatic increase reflects investor confidence in the company's future growth potential.

- Market Capitalization: The company's market capitalization increased significantly, solidifying its position as a leading player in the industrial automation market.

- Trading Volume: Trading volume spiked considerably, indicating high investor interest and active participation in the stock. Many analysts upgraded their price targets for Rockwell Automation's stock.

Wider Market Implications:

The positive performance of Rockwell Automation also had a ripple effect on the broader market. The strong earnings report boosted investor confidence in the industrial automation sector, leading to similar positive movements in related stocks.

- Market Sentiment: The overall market sentiment improved, with investors viewing Rockwell Automation's success as a positive indicator for the sector's future growth.

- Industrial Stocks: Other industrial automation companies experienced positive movements in their stock prices, demonstrating a positive correlation and increased investor confidence in the overall sector.

- Sector Performance: The industrial automation sector saw a significant improvement in its performance following Rockwell Automation's earnings announcement.

Underlying Factors Driving Rockwell Automation's Success

Several key factors contributed to Rockwell Automation's exceptional performance. These include strong demand across key industries, strategic initiatives focused on innovation, and a positive outlook for the future.

Strong Demand in Key Industries:

Rockwell Automation experienced strong demand across several key end markets, including automotive, food and beverage, and pharmaceuticals. The ongoing trend towards automation and digital transformation in these industries is driving significant growth for the company.

- Automotive: The automotive industry's focus on electric vehicles and autonomous driving is fueling demand for advanced automation solutions.

- Food and Beverage: The food and beverage industry is increasingly adopting automation to improve efficiency, safety, and product quality.

- Pharmaceuticals: The pharmaceutical industry requires highly automated and controlled manufacturing processes to ensure product quality and regulatory compliance.

Rockwell Automation's Strategic Initiatives:

Rockwell Automation's strategic initiatives, including investments in digital twin technology, predictive maintenance solutions, and the Industrial Internet of Things (IIoT), have significantly contributed to its success.

- Digital Twin: The implementation of digital twin technology allows for improved design, simulation, and optimization of industrial processes.

- Predictive Maintenance: Predictive maintenance solutions help reduce downtime and improve operational efficiency.

- IIoT Solutions: Rockwell Automation's IIoT solutions connect machines and systems, enabling real-time data analysis and improved decision-making.

Future Outlook and Guidance:

Rockwell Automation's management provided positive guidance for the next quarter and year, projecting continued revenue growth and market share expansion. However, they also acknowledged potential risks and challenges, including global economic uncertainty and supply chain disruptions.

- Revenue Projections: The company projects continued revenue growth, driven by strong demand and new product launches.

- Market Outlook: Rockwell Automation anticipates continued growth in the industrial automation market, driven by trends such as digital transformation and Industry 4.0.

- Potential Risks: The company acknowledges potential risks associated with global economic uncertainty, geopolitical instability, and potential supply chain disruptions.

Conclusion: Investing in Rockwell Automation and the Future of Industrial Automation

Rockwell Automation's outstanding Q[Quarter] earnings report, exceeding expectations across key metrics, resulted in a significant stock surge and boosted investor confidence in the industrial automation sector. The strong performance reflects robust demand across key industries, successful strategic initiatives, and the company's commitment to innovation. Rockwell Automation's position in the rapidly growing industrial automation market, fueled by digital transformation and the Industrial Internet of Things (IIoT), positions it well for continued success. Consider learning more about Rockwell Automation, conducting your own Rockwell Automation stock analysis, and following Rockwell Automation's progress in shaping the future of industrial automation. Investing in Rockwell Automation could offer significant potential for future growth.

Featured Posts

-

2025 Presidential Update Trumps Middle East Visit On May 15th

May 17, 2025

2025 Presidential Update Trumps Middle East Visit On May 15th

May 17, 2025 -

Essential Viewing 12 Sci Fi Shows You Shouldnt Miss

May 17, 2025

Essential Viewing 12 Sci Fi Shows You Shouldnt Miss

May 17, 2025 -

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025

Investing In Ubers Autonomous Driving Tech Through Etfs

May 17, 2025 -

Knicks Landry Shamet Dilemma A Roster Conundrum

May 17, 2025

Knicks Landry Shamet Dilemma A Roster Conundrum

May 17, 2025 -

The Impact Of Trump Tariffs On Cell Phone Repair Prices

May 17, 2025

The Impact Of Trump Tariffs On Cell Phone Repair Prices

May 17, 2025

Latest Posts

-

Indiana Fever Preseason Schedule 2025 Watch Caitlin Clark And The Team Prepare

May 17, 2025

Indiana Fever Preseason Schedule 2025 Watch Caitlin Clark And The Team Prepare

May 17, 2025 -

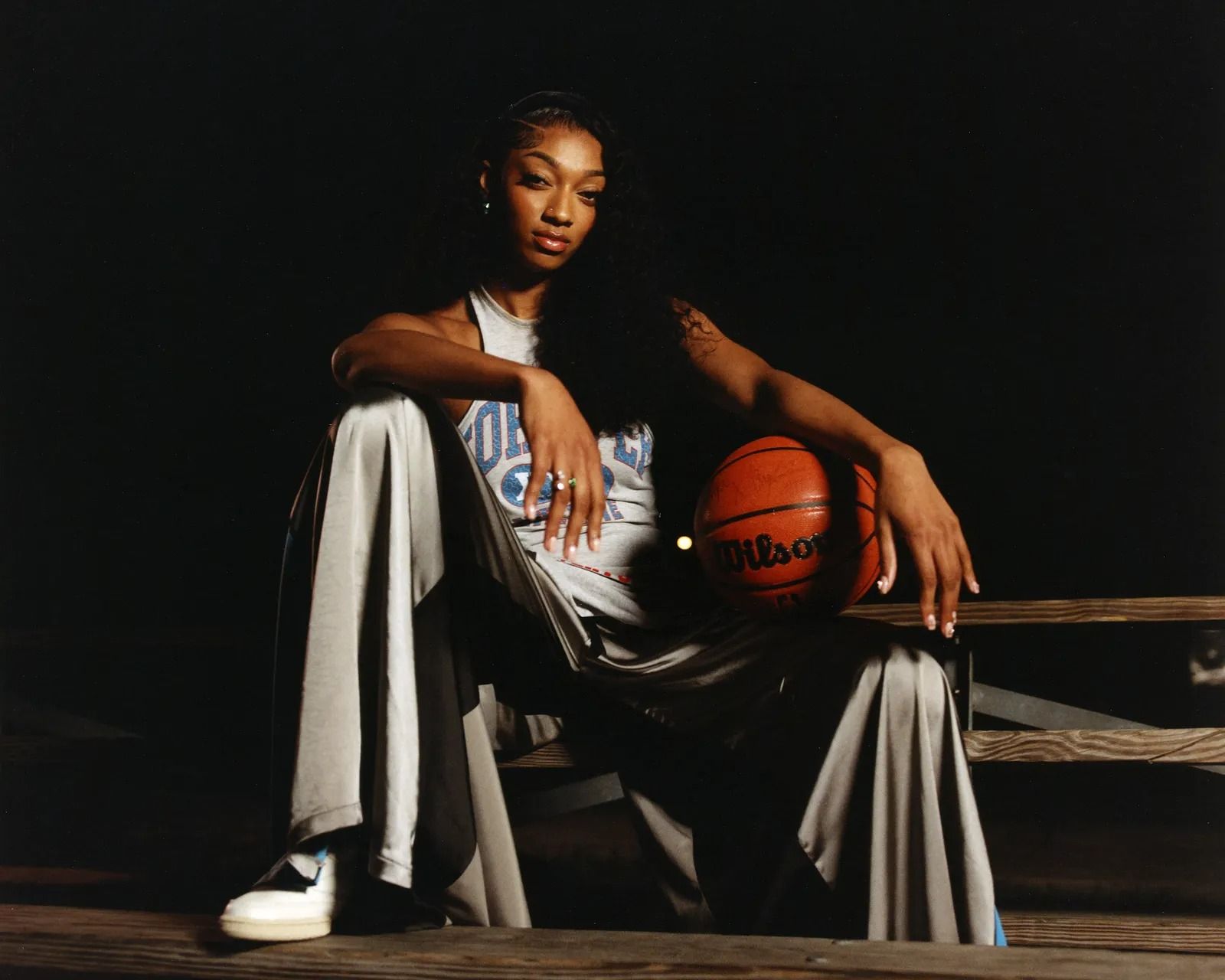

Will Angel Reeses Support Impact A Potential Wnba Lockout

May 17, 2025

Will Angel Reeses Support Impact A Potential Wnba Lockout

May 17, 2025 -

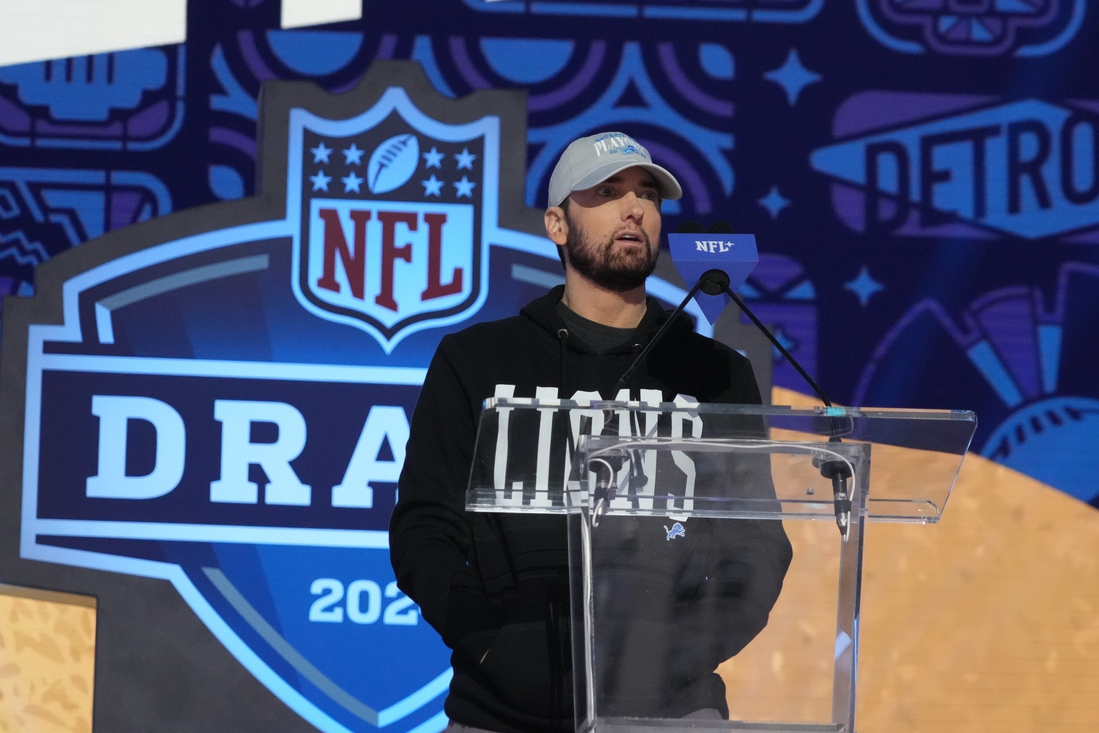

Eminems Potential Wnba Ownership Bid

May 17, 2025

Eminems Potential Wnba Ownership Bid

May 17, 2025 -

Angel Reese On Potential Wnba Lockout Players Deserve More

May 17, 2025

Angel Reese On Potential Wnba Lockout Players Deserve More

May 17, 2025 -

Is Eminem Buying A Wnba Franchise

May 17, 2025

Is Eminem Buying A Wnba Franchise

May 17, 2025