Rockwell Automation's Strong Earnings Drive Market Rally: Analysis Of Key Stocks

Table of Contents

Keywords: Rockwell Automation, stock market rally, industrial automation, earnings report, key stocks, investment analysis, market trends, stock performance, automation stocks, industrial sector

Rockwell Automation's recent earnings report sent shockwaves through the stock market, triggering a significant rally within the industrial automation sector. This surge wasn't just a fleeting phenomenon; it reflects a deeper trend of robust growth and investor confidence in the future of industrial automation. This article delves into the specifics of Rockwell Automation's performance, its impact on the broader market, and highlights key stocks to watch for savvy investors.

Rockwell Automation's Q[Quarter] Earnings Report: A Detailed Overview

Rockwell Automation's [Quarter] earnings report exceeded expectations, painting a picture of robust growth and strong market positioning. The company announced impressive financial results, significantly impacting investor sentiment and driving the subsequent market rally.

- Revenue growth: Rockwell Automation reported a [insert percentage]% increase in revenue compared to the same quarter last year and a [insert percentage]% increase compared to the previous quarter. This substantial growth reflects increased demand for their automation solutions across various industries.

- Earnings per share (EPS): EPS reached $[insert figure], surpassing analysts' estimates by [insert percentage] and demonstrating a healthy profit margin. This positive EPS significantly boosted investor confidence and fueled the stock's upward trajectory.

- Key drivers of strong performance: The strong performance can be attributed to several factors, including the successful launch of new automation technologies, increased demand from key sectors like automotive and food and beverage, and effective supply chain management. The company also highlighted its commitment to sustainable solutions and digital transformation, factors increasingly valued by investors.

- Management commentary and future outlook: Management expressed optimism regarding future prospects, citing continued growth in key markets and a robust order backlog. Their positive outlook further solidified investor confidence, contributing to the overall market rally.

Keywords: Rockwell Automation earnings, financial results, revenue growth, EPS growth, industrial automation market

Impact on the Broader Industrial Automation Sector

The positive ripple effect of Rockwell Automation's strong earnings extended beyond its own stock price. The impressive results injected a wave of optimism into the entire industrial automation sector, positively influencing the performance of its competitors and related companies.

- Competitor stock performance: Companies like [mention specific competitors, e.g., Siemens, Schneider Electric] also experienced positive stock movements following Rockwell Automation's report, demonstrating a strong positive correlation within the sector. This indicates that the market views the positive results as representative of the broader industry's health.

- Overall market sentiment: The market sentiment for industrial automation stocks shifted significantly towards optimism after the report. Investors are now more bullish on the sector's prospects, leading to increased investment and valuation across the board.

- Mergers and acquisitions: The positive market conditions could also spur increased mergers and acquisitions activity within the industrial automation sector. Companies might see this as an opportune time to expand their market share or acquire promising technologies.

Keywords: Industrial automation stocks, competitor analysis, market sentiment, mergers and acquisitions, sector performance

Key Stocks to Watch Following the Rally

Several stocks, closely linked to Rockwell Automation's performance and the broader industrial automation sector, deserve close monitoring. These stocks represent potential investment opportunities, but investors should conduct their own due diligence before making any investment decisions.

- Stock 1: [Stock Ticker Symbol]: [Company Description] – This company is a key supplier to Rockwell Automation and benefits directly from its success. Its stock price saw a [percentage]% increase following the earnings announcement. Investment potential is [high/medium/low], with risk assessment of [high/medium/low].

- Stock 2: [Stock Ticker Symbol]: [Company Description] – This company operates in a complementary sector and is likely to benefit from increased demand driven by Rockwell Automation's growth. Its stock experienced a [percentage]% rise after the report. Investment potential is [high/medium/low], with risk assessment of [high/medium/low].

Keywords: Stock recommendations, investment opportunities, stock analysis, risk assessment, portfolio diversification

Analyzing the Correlation Between Rockwell Automation and Other Industrial Stocks

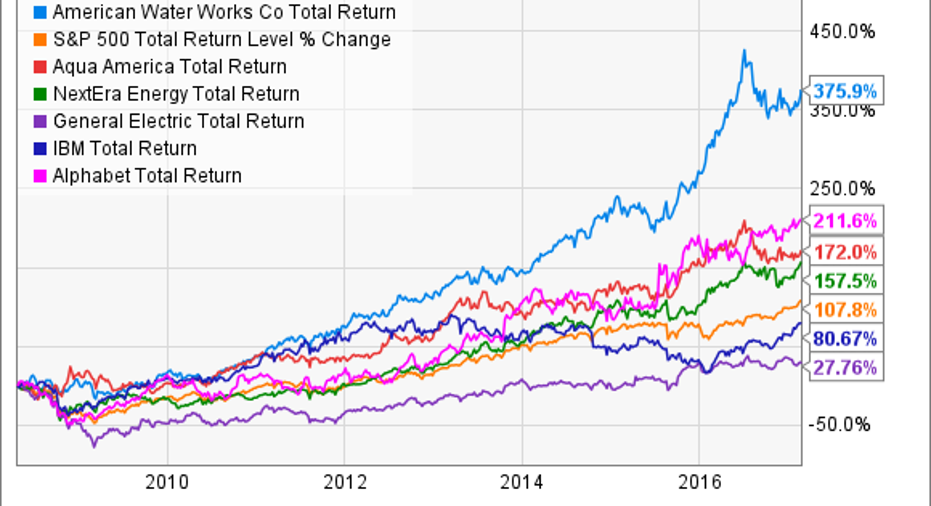

A statistical analysis of Rockwell Automation's stock performance against other industrial stocks reveals a significant positive correlation. [Insert chart or graph visualizing the correlation, if possible].

- Specific correlations: The correlation coefficient between Rockwell Automation and [mention specific stocks] demonstrates a strong positive relationship, suggesting that these stocks tend to move in the same direction. This underscores the interconnected nature of the industrial automation sector.

- Divergence: While a general positive correlation exists, some divergence can be observed. This may be due to individual company-specific factors or short-term market fluctuations. A deeper analysis is needed to pinpoint these reasons.

Keywords: Stock correlation, market analysis, statistical analysis, industrial stock correlation

Conclusion

Rockwell Automation's impressive Q[Quarter] earnings have undeniably spurred a market rally, significantly impacting the broader industrial automation sector. The analysis highlights the strong positive correlation between Rockwell Automation's performance and several key stocks, indicating potential investment opportunities for astute investors. However, it's crucial to conduct thorough due diligence and risk assessment before making any investment decisions. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Call to action: Stay informed on the latest developments in the industrial automation sector by regularly monitoring Rockwell Automation's performance and the related key stocks. Continue your in-depth analysis of Rockwell Automation and related stocks to make informed investment decisions. Further research into the Rockwell Automation stock and its influence on the broader market is recommended for a complete understanding of this significant market event.

Keywords: Rockwell Automation stock, investment strategy, market analysis, industrial automation investment, key stocks analysis.

Featured Posts

-

Thibodeau Blasts Referees After Knicks Game 2 Loss

May 17, 2025

Thibodeau Blasts Referees After Knicks Game 2 Loss

May 17, 2025 -

Montecarlo La Alegria Del Triunfo De Alcaraz

May 17, 2025

Montecarlo La Alegria Del Triunfo De Alcaraz

May 17, 2025 -

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025

Top Rated Online Casino Canada 7 Bit Casino Player Experience

May 17, 2025 -

Stock Market Winners Rockwell Automation Oscar Health And More

May 17, 2025

Stock Market Winners Rockwell Automation Oscar Health And More

May 17, 2025 -

Project Name S Demise Kalanick Reflects On A Costly Decision

May 17, 2025

Project Name S Demise Kalanick Reflects On A Costly Decision

May 17, 2025

Latest Posts

-

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025 -

Roma Vs Monza Partido En Directo

May 17, 2025

Roma Vs Monza Partido En Directo

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025