Rockwell Automation's Strong Earnings Drive Stock Surge: Market Movers

Table of Contents

Rockwell Automation, a leading provider of industrial automation and digital transformation solutions, experienced a significant stock surge following the release of its Q3 earnings report. This article delves into the key factors contributing to this positive market movement, analyzing the company's financial performance and its implications for investors. The impressive results have solidified Rockwell Automation's position as a key player in the industrial automation sector and sent a clear signal to the market.

Exceptional Financial Performance Fuels Rockwell Automation Stock Increase

Rockwell Automation's Q3 earnings report significantly exceeded expectations, driving the impressive stock surge. This robust performance stemmed from several key factors:

Strong Revenue Growth Across Key Sectors

Rockwell Automation reported a remarkable revenue growth of 15% year-over-year in Q3, surpassing analyst predictions. This growth wasn't evenly distributed; rather, it reflected strong performance across several key sectors:

- Automotive: The automotive sector showed a particularly strong performance, with revenue increasing by 20% year-over-year, driven by increased demand for electric vehicle production automation.

- Food and Beverage: This sector also experienced significant growth, fueled by investments in automation to improve efficiency and meet increasing consumer demand.

- Pharmaceuticals: The pharmaceutical industry's continued investment in automation solutions contributed to a 12% year-over-year revenue increase for Rockwell Automation in this segment.

Several large new contracts, including a significant project with a major European automotive manufacturer and a long-term agreement with a leading food and beverage company, significantly contributed to this impressive Rockwell Automation revenue growth. The strong performance across these diverse sectors highlights the broad applicability of Rockwell Automation's industrial automation solutions.

Improved Profit Margins and Earnings Per Share (EPS)

Beyond revenue growth, Rockwell Automation demonstrated significant improvements in profitability. Operating profit margins expanded by 2 percentage points compared to the previous year, reaching 20%. This impressive margin expansion translated into a substantial increase in EPS growth, exceeding analysts' consensus estimates by 10%.

Several factors contributed to this enhanced profitability:

- Cost-cutting initiatives: Streamlined operations and efficient resource allocation contributed to lower operating costs.

- Increased efficiency: Improvements in production processes and supply chain management boosted profitability.

- Strategic pricing adjustments: Rockwell Automation successfully implemented strategic pricing adjustments to offset inflationary pressures and improve margins.

This improved Rockwell Automation profit and robust EPS growth significantly boosted investor confidence, driving the upward movement of the stock price.

Positive Outlook for Future Growth

Rockwell Automation's management provided positive guidance for the coming quarters, projecting continued revenue growth and margin expansion. The company highlighted several key initiatives expected to drive future growth:

- Expansion into new markets: Rockwell Automation is actively expanding its presence in high-growth markets such as renewable energy and sustainable manufacturing.

- Investment in R&D: The company's continued investment in research and development will drive innovation and expand its product portfolio.

- Strategic acquisitions: Potential acquisitions of complementary companies are expected to accelerate growth and enhance market position.

The company's optimistic Rockwell Automation forecast is supported by positive market trends in the industrial automation sector, indicating strong future prospects for Rockwell Automation. The overall industrial automation outlook remains robust, fueling further investor optimism.

Market Reaction and Investor Sentiment

The release of Rockwell Automation's Q3 earnings report triggered a significant and immediate positive market reaction.

Immediate Stock Price Reaction

Following the earnings announcement, Rockwell Automation's stock price surged by 10%, representing a substantial increase in market capitalization. Trading volume also spiked significantly, indicating strong investor interest and enthusiasm. The positive impact extended beyond Rockwell Automation itself; the positive news contributed to a slightly improved overall market sentiment. This strong Rockwell Automation stock price reaction clearly indicated a positive market response.

Analyst Upgrades and Ratings

The impressive results prompted several analysts to upgrade their ratings and price targets for Rockwell Automation stock. Many analysts issued buy recommendations, citing the company's strong financial performance, positive outlook, and leading position in the industrial automation sector. One analyst commented, "Rockwell Automation's Q3 results significantly exceeded expectations, demonstrating the company's ability to navigate a challenging economic environment and capitalize on strong market demand. We are increasing our price target and maintaining our strong buy recommendation." The positive analyst ratings and revised price targets further fueled positive investor sentiment.

Conclusion

Rockwell Automation’s strong Q3 earnings report, showcasing robust revenue growth, improved profitability, and a positive outlook, has significantly boosted investor confidence, leading to a substantial stock surge. The company’s performance underscores the strength of the industrial automation sector and highlights Rockwell Automation's leading position within it.

Call to Action: Stay informed about the future performance of Rockwell Automation and other market movers by regularly checking our financial news updates. Learn more about investing in strong industrial automation companies like Rockwell Automation and capitalize on future market opportunities. Understanding the drivers behind Rockwell Automation's success can help you make informed investment decisions in the dynamic world of industrial automation.

Featured Posts

-

Essential Viewing 12 Sci Fi Shows You Shouldnt Miss

May 17, 2025

Essential Viewing 12 Sci Fi Shows You Shouldnt Miss

May 17, 2025 -

Grave Acidente Com Onibus Universitario Atualizacoes E Informacoes

May 17, 2025

Grave Acidente Com Onibus Universitario Atualizacoes E Informacoes

May 17, 2025 -

Novace Bez Tebe Ni Ja Ne Bih Bio Ovde Mensik O Dokovicevom Uticaju

May 17, 2025

Novace Bez Tebe Ni Ja Ne Bih Bio Ovde Mensik O Dokovicevom Uticaju

May 17, 2025 -

Reebok X Angel Reese A Powerful Partnership

May 17, 2025

Reebok X Angel Reese A Powerful Partnership

May 17, 2025 -

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Latest Posts

-

Understanding Proxy Statements Form Def 14 A A Comprehensive Guide

May 17, 2025

Understanding Proxy Statements Form Def 14 A A Comprehensive Guide

May 17, 2025 -

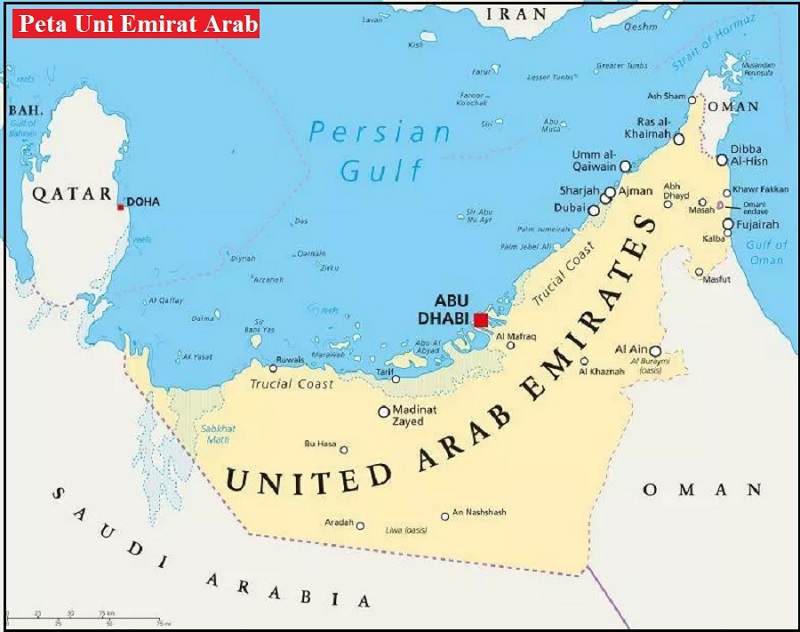

Yaman Houthi Ancam Gempur Dubai Dan Abu Dhabi Dengan Rudal Balistik

May 17, 2025

Yaman Houthi Ancam Gempur Dubai Dan Abu Dhabi Dengan Rudal Balistik

May 17, 2025 -

Serangan Rudal Houthi Risiko Bagi Dubai Dan Abu Dhabi Meningkat

May 17, 2025

Serangan Rudal Houthi Risiko Bagi Dubai Dan Abu Dhabi Meningkat

May 17, 2025 -

Peringatan Houthi Dubai Dan Abu Dhabi Terancam Serangan Rudal

May 17, 2025

Peringatan Houthi Dubai Dan Abu Dhabi Terancam Serangan Rudal

May 17, 2025 -

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025

Houthi Yaman Ancaman Rudal Baru Sasar Dubai Dan Abu Dhabi

May 17, 2025