Rolls-Royce: 2025 Financial Outlook And Tariff Management Strategy

Table of Contents

Rolls-Royce's 2025 Financial Projections: A Deep Dive

Revenue Projections and Growth Drivers

Rolls-Royce's 2025 revenue projections hinge on several key factors. While precise figures remain confidential, analysts predict continued growth driven by several key areas:

- Strong Sales of Existing Models: The consistent demand for iconic models like the Phantom and Cullinan will continue to be a major revenue contributor.

- New Model Launches: The introduction of new vehicles or significant updates to existing lines will stimulate sales and attract new customer segments. Any electric vehicle strategy will be a critical factor here.

- Bespoke Customization: Rolls-Royce's renowned bespoke customization options command premium prices and contribute significantly to overall revenue. The unique, personalized experience remains a core driver of sales.

- Expansion into New Markets: Strategic expansion into emerging luxury markets in Asia and the Middle East will be crucial for growth.

However, potential risks exist:

- Global Economic Downturn: A significant global recession could negatively impact demand for luxury goods.

- Supply Chain Disruptions: Continued global supply chain instability could hinder production and impact revenue targets.

- Geopolitical Instability: Uncertainties in global politics can significantly affect market stability and consumer confidence.

Profitability and Margin Analysis

Maintaining profitability in the luxury automotive sector requires a delicate balance. Rolls-Royce aims to enhance profitability through:

- Efficient Cost Management: Optimizing production processes and supply chain management will be essential to control costs.

- Premium Pricing: Maintaining a strong brand image and justifying premium pricing is critical for high profit margins.

- Operational Excellence: Streamlining operations and reducing waste will be crucial for maximizing profitability.

Factors affecting profitability include:

- Raw Material Costs: Fluctuations in the price of raw materials (e.g., precious metals, leather) directly impact production costs.

- Labor Costs: Maintaining skilled labor while managing labor costs will be a balancing act.

- Research and Development (R&D): Investments in R&D, particularly in electric vehicle technology, are crucial for long-term competitiveness, but represent a significant upfront cost.

Investment Strategy and Capital Expenditure

Rolls-Royce's investment strategy focuses on securing future growth:

- R&D Investment: Significant investments in R&D are necessary to develop new technologies, such as electric powertrains, and maintain a competitive edge.

- Manufacturing Upgrades: Modernizing manufacturing facilities and improving production efficiency are essential for increased output and reduced costs.

- Marketing and Brand Building: Maintaining the Rolls-Royce brand image through targeted marketing and brand building initiatives will be crucial for attracting and retaining customers.

The expected return on these investments is vital for long-term financial health. Successful execution of these plans is essential for meeting the ambitious Rolls-Royce 2025 financial outlook.

Navigating Global Trade: Rolls-Royce's Tariff Management Strategy

Impact of Tariffs on Rolls-Royce's Operations

Tariffs and trade policies significantly influence Rolls-Royce's global operations:

- Import/Export Tariffs: Tariffs on imported components or finished vehicles directly impact costs and competitiveness in various markets.

- Supply Chain Diversification: Rolls-Royce mitigates risk by sourcing materials and components from multiple regions globally, lessening reliance on any single source.

- Market Vulnerability: Changes in tariff policies in key markets like the US, China, and the EU can significantly impact sales and profitability.

Mitigation Strategies and Risk Management

Rolls-Royce employs various strategies to minimize tariff-related risks:

- Geographic Diversification of Production: Manufacturing in multiple locations helps offset the impact of tariffs in any single region.

- Strategic Pricing Adjustments: Adjusting pricing strategies in different markets to compensate for tariffs is a key mitigation tool.

- Supply Chain Optimization: Continuous optimization of the global supply chain helps minimize the cost impacts of tariffs.

- Proactive Risk Assessment: Regular assessments of potential tariff changes and their impact on the business are critical for proactive planning.

Lobbying and Advocacy Efforts

Rolls-Royce actively engages with governments and regulatory bodies to influence trade policies:

- Industry Associations: Participation in relevant industry associations allows for collective advocacy on trade policy issues.

- Direct Engagement with Governments: Direct lobbying efforts with governments in key markets help influence tariff decisions.

Effective engagement helps to shape a more favorable trade environment for Rolls-Royce's global operations.

Securing the Future: A Look Ahead for Rolls-Royce's Financial Strategy

Rolls-Royce's 2025 financial outlook depends heavily on successfully navigating a complex global landscape. Proactive financial planning and a robust tariff management strategy are essential for maintaining profitability and growth. While challenges remain – including economic uncertainty and volatile global trade – Rolls-Royce's commitment to innovation, brand prestige, and strategic risk management positions it well for the future. Successfully navigating these challenges will be pivotal in securing its position as a leader in the luxury automotive sector. Stay informed about the latest developments in the Rolls-Royce 2025 financial outlook and tariff management strategy by following our updates.

Featured Posts

-

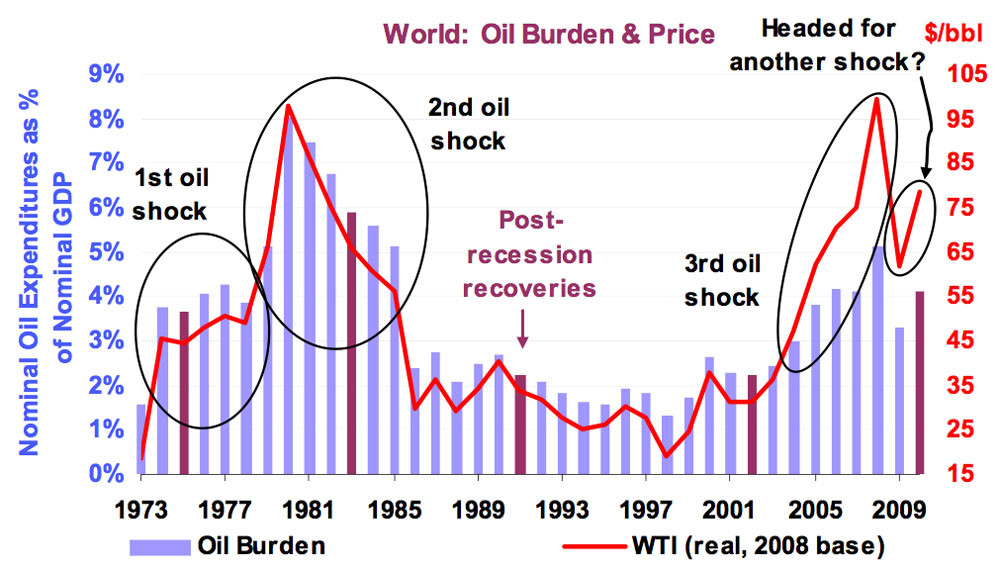

Oil Supply Shocks How The Airline Industry Is Feeling The Heat

May 03, 2025

Oil Supply Shocks How The Airline Industry Is Feeling The Heat

May 03, 2025 -

Nat West Reaches Settlement With Nigel Farage

May 03, 2025

Nat West Reaches Settlement With Nigel Farage

May 03, 2025 -

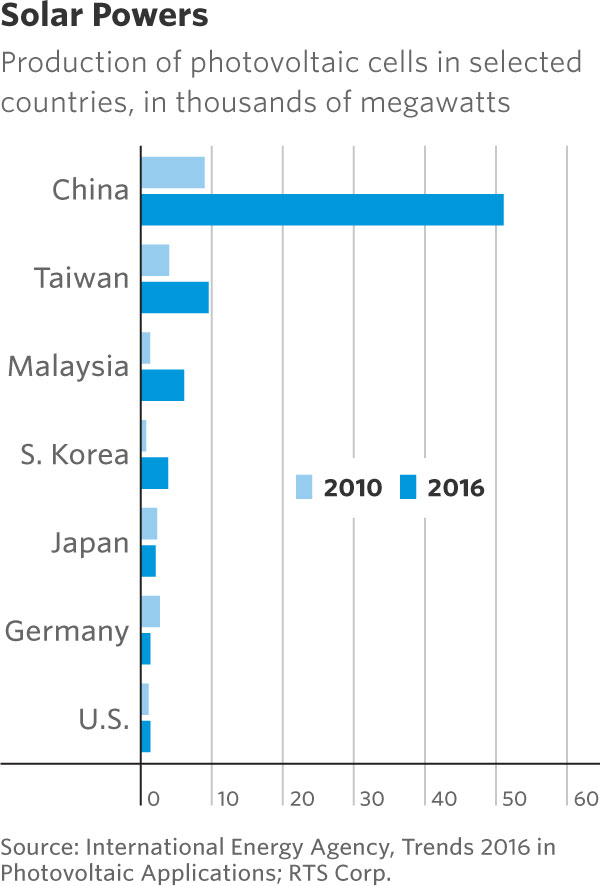

Dutch Energy Providers Test Reduced Tariffs With High Solar Output

May 03, 2025

Dutch Energy Providers Test Reduced Tariffs With High Solar Output

May 03, 2025 -

Zayavlenie Makrona Usilenie Davleniya Na Rossiyu Iz Za Ukrainy

May 03, 2025

Zayavlenie Makrona Usilenie Davleniya Na Rossiyu Iz Za Ukrainy

May 03, 2025 -

Reform Uk Figure Rupert Lowe Facing Police Inquiry Amid Bullying Claims

May 03, 2025

Reform Uk Figure Rupert Lowe Facing Police Inquiry Amid Bullying Claims

May 03, 2025