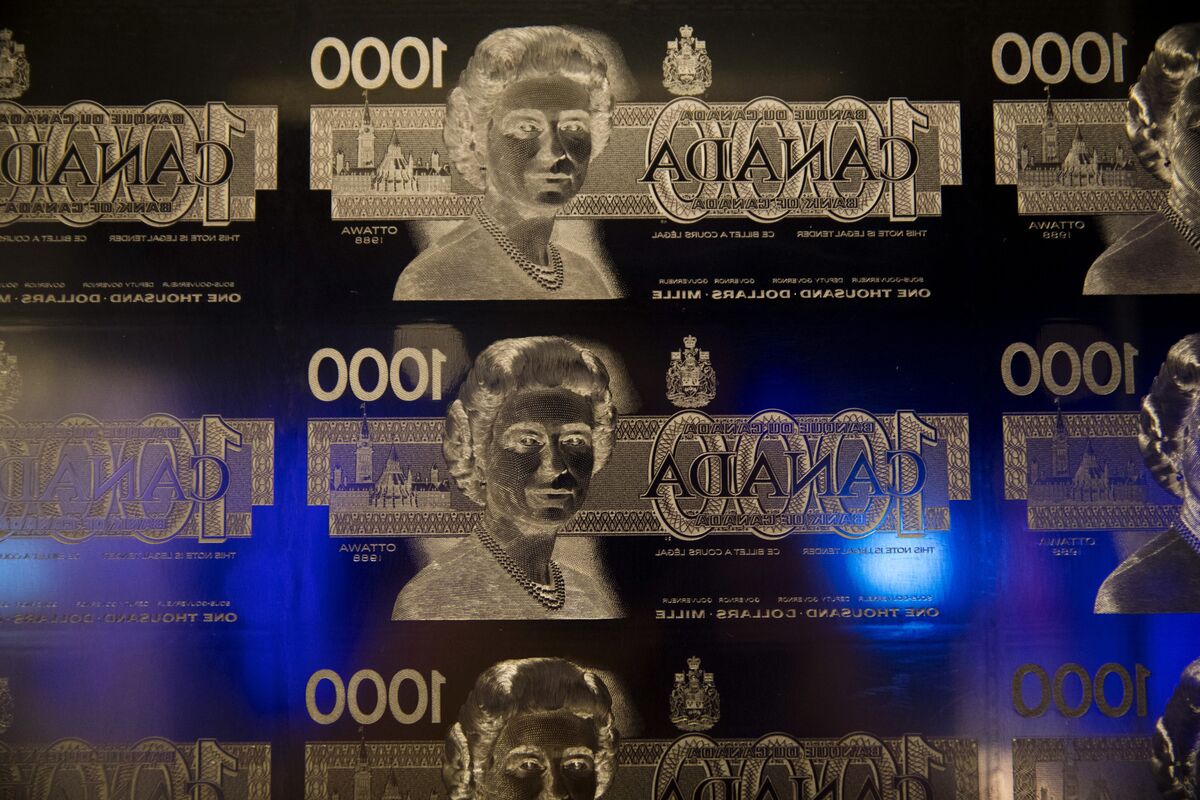

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake.

Table of Contents

Rosenberg's Core Argument: Overly Aggressive Rate Hikes

Rosenberg's central claim is that the Bank of Canada's aggressive interest rate hikes were unnecessarily drastic and have significantly increased the risk of a prolonged and severe economic downturn. He argues that the Bank overreacted to inflationary pressures, neglecting other crucial economic indicators.

-

Evidence cited by Rosenberg: Rosenberg likely points to data suggesting inflation may have already peaked or is cooling more rapidly than the Bank of Canada's projections. He might highlight the resilience of the Canadian labor market despite the rate hikes, suggesting the economy is stronger than perceived. He may also cite specific inflation data points that show a decoupling from the interest rate increases.

-

Comparison to other central banks' approaches: Rosenberg might contrast the Bank of Canada's actions with the more measured approaches adopted by other central banks globally, arguing that a less aggressive strategy could have achieved similar inflation control with fewer economic downsides. For example, he could compare the Canadian approach to those of the US Federal Reserve or the European Central Bank.

-

Potential for a deeper recession: The rapid rate increases, according to Rosenberg, risk triggering a deeper and more prolonged recession than would have occurred under a more gradual approach. The sudden shift in borrowing costs could severely impact businesses and consumers, leading to decreased investment and spending.

The Impact on the Canadian Economy: A Looming Recession?

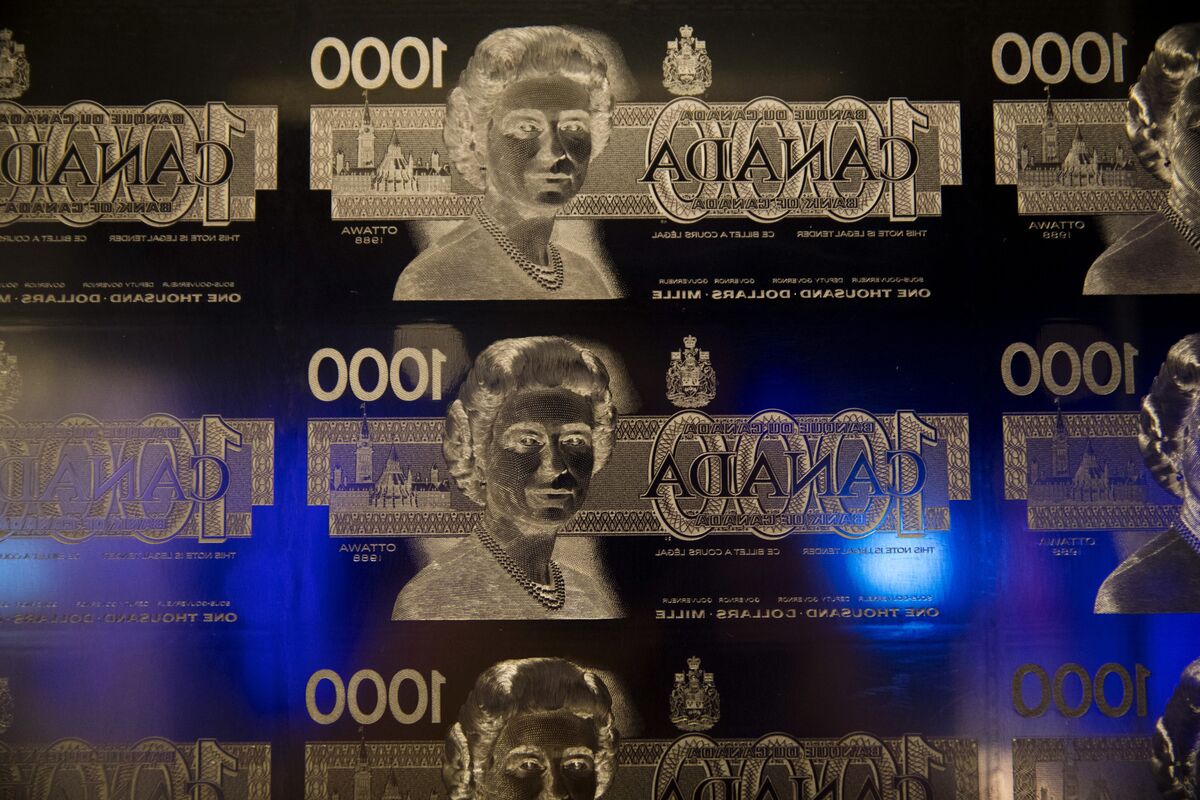

The potential consequences of the Bank of Canada's policy are far-reaching and could significantly impact various sectors of the Canadian economy.

-

Impact on housing market: Higher interest rates have already cooled the once-hot Canadian housing market, leading to price declines and decreased affordability. This could further depress consumer confidence and economic activity.

-

Effects on consumer spending and business investment: Rising borrowing costs discourage consumer spending and business investment, potentially leading to job losses and decreased economic growth. Businesses may postpone expansion plans, and consumers may reduce spending on non-essential goods and services.

-

Job market implications: While the job market has remained relatively strong, continued aggressive rate hikes could lead to job losses, particularly in interest-rate sensitive sectors like construction and real estate. Increased unemployment would further dampen consumer spending and economic activity.

-

Potential for a debt crisis: The increased debt burden on Canadian households and businesses, combined with higher interest rates, could increase the risk of a debt crisis, leading to defaults and further economic instability.

Alternative Monetary Policy Strategies: What Rosenberg Suggests

Rosenberg likely advocates for alternative monetary policy approaches that prioritize a more gradual and nuanced response to inflation.

-

Gradual interest rate adjustments: Instead of sharp rate hikes, Rosenberg might suggest smaller, more incremental adjustments, allowing the Bank of Canada to better monitor the impact of its actions on the economy.

-

Focus on other economic indicators beyond inflation: He might argue for a broader consideration of economic indicators beyond inflation, such as employment levels, wage growth, and consumer confidence, to gain a more holistic view of the economic situation.

-

Government fiscal policy coordination: Rosenberg might call for closer coordination between the Bank of Canada's monetary policy and the government's fiscal policy to create a more comprehensive and effective response to economic challenges.

The Role of Supply Chain Issues in Inflation

A key aspect of Rosenberg's critique likely involves the Bank of Canada's handling of supply chain disruptions. He might argue that the Bank did not adequately account for the impact of these disruptions on inflation, focusing excessively on interest rate hikes while neglecting supply-side solutions.

-

Analysis of the impact of supply chain bottlenecks on inflation: Rosenberg would highlight how supply chain bottlenecks contributed significantly to inflationary pressures, and that addressing these issues directly might have been a more effective strategy than solely focusing on interest rate control.

-

Whether the Bank of Canada should have focused more on addressing supply-side issues: He likely advocates for policies aimed at easing supply chain constraints, such as infrastructure investments and targeted support for specific industries.

Expert Opinions and Counterarguments

While Rosenberg's critique is forceful, it's essential to consider counterarguments and alternative perspectives.

-

Views supporting the Bank of Canada's approach: Some economists might argue that the Bank of Canada's aggressive approach was necessary to prevent runaway inflation and protect the long-term health of the Canadian economy. They may point to the potential for even more severe consequences had inflation been left unchecked.

-

Alternative interpretations of economic data: Different economists may interpret the same economic data differently, leading to varying conclusions about the effectiveness of the Bank of Canada's policy. Disagreements on the appropriate weight given to various indicators are common.

-

Discussion of the uncertainties and complexities of monetary policy decision-making: Monetary policy decision-making is inherently complex and uncertain, involving numerous interacting factors and potential unforeseen consequences. Critiquing these decisions requires acknowledging this inherent uncertainty.

Conclusion

David Rosenberg's sharp criticism of the Bank of Canada's monetary policy highlights the significant debate surrounding its interest rate hikes and their potential impact on the Canadian economy. His core argument centers on the assertion that overly aggressive rate increases have unnecessarily heightened the risk of a severe recession, impacting the housing market, consumer spending, and the job market. While counterarguments exist, Rosenberg's concerns regarding the Bank's approach and the potential for a debt crisis warrant careful consideration. His suggested alternatives, including a more gradual approach to interest rate adjustments and a focus on supply-side issues, offer important perspectives for ongoing discussions.

Call to Action: Stay informed about the Bank of Canada’s monetary policy decisions and their implications for the Canadian economy. Learn more about the debate surrounding Rosenberg's accusations against the Bank of Canada and understand the potential consequences of this alleged monetary policy mistake by following reputable financial news sources and economic analysis.

Featured Posts

-

Key Factors In Deadly Black Hawk And Jet Collision Revealed

Apr 29, 2025

Key Factors In Deadly Black Hawk And Jet Collision Revealed

Apr 29, 2025 -

From America To Spain A Contrast In Expat Experiences

Apr 29, 2025

From America To Spain A Contrast In Expat Experiences

Apr 29, 2025 -

Diamond Johnsons Next Stop Minnesota Lynx Wnba Training Camp

Apr 29, 2025

Diamond Johnsons Next Stop Minnesota Lynx Wnba Training Camp

Apr 29, 2025 -

Negeri Sembilans Data Center Boom Investment And Infrastructure

Apr 29, 2025

Negeri Sembilans Data Center Boom Investment And Infrastructure

Apr 29, 2025 -

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide To Solving

Apr 29, 2025

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide To Solving

Apr 29, 2025

Latest Posts

-

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025

Controversial Cardinals Conclave Voting Rights Under Scrutiny

Apr 29, 2025 -

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025

Papal Conclave Disputed Voting Rights Of A Convicted Cardinal

Apr 29, 2025 -

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025

Convicted Cardinal Fights For Conclave Voting Rights

Apr 29, 2025 -

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025

Cardinal Maintains Voting Eligibility Despite Conviction

Apr 29, 2025 -

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025

Controversial Cardinal Fights For Conclave Inclusion

Apr 29, 2025