Russian Gas Pipeline: Elliott's Exclusive Investment Strategy Revealed

Table of Contents

Understanding Elliott Management's Investment Approach

Elliott Management is an activist hedge fund renowned for its aggressive, often contrarian, investment strategies. They typically target undervalued assets and situations ripe for corporate restructuring, aiming to maximize returns through active engagement and strategic maneuvering. Their approach is characterized by:

-

Focus on distressed assets and situations: Elliott seeks out companies or projects facing financial difficulties, where they can leverage their expertise to improve performance and profitability. This often involves acquiring debt at a discount or acquiring equity at depressed prices. This is a key element of their potential Russian gas pipeline investment strategy.

-

Activist shareholder approach: Elliott isn't afraid to exert pressure on company management to implement changes that benefit shareholders. This can involve proposing board changes, pushing for strategic realignment, or demanding improved corporate governance.

-

Deep due diligence and detailed financial analysis: Before making any investment, Elliott conducts exhaustive research, rigorously analyzing financial statements, market trends, and geopolitical factors. This meticulous approach is crucial for navigating the complexities of Russian gas pipeline investment.

-

Long-term and short-term investment horizons: Depending on the opportunity, Elliott can hold investments for extended periods or seek quick gains through strategic trading or restructuring. The potential for rapid changes in the Russian energy sector might encourage shorter-term investment strategies within their overall Russian gas pipeline investment portfolio.

The Allure of Russian Gas Pipeline Investments

Russian gas pipelines are critical components of the global energy infrastructure, supplying significant volumes of natural gas to Europe and other regions. This geopolitical significance creates both substantial opportunities and significant risks for investors.

-

High potential for profit, but also high risk: The volatile nature of energy prices and the fluctuating geopolitical landscape present the potential for substantial returns, but also exposes investors to significant losses. Successfully navigating this volatility is central to a successful Russian gas pipeline investment strategy.

-

Dependence on global energy demand: The profitability of Russian gas pipelines is directly linked to the global demand for natural gas. Fluctuations in demand, driven by economic factors or alternative energy sources, can impact investment returns.

-

Geopolitical risks: Sanctions, international relations, and regional conflicts present ongoing risks to investments in Russian assets. The political climate surrounding Russia significantly influences the risk profile of any Russian gas pipeline investment.

-

Regulatory hurdles and legal complexities: Navigating the regulatory environment in Russia and related international jurisdictions can be challenging and adds another layer of complexity to any Russian gas pipeline investment.

Deconstructing Elliott's Potential Strategy in the Russian Gas Pipeline Sector

While Elliott's exact strategies are confidential, we can speculate on potential approaches within the Russian gas pipeline sector:

Debt Investments

Elliott might seek opportunities to acquire distressed debt linked to Russian pipeline projects. This could involve purchasing bonds or loans at a significant discount, hoping for a restructuring that increases their value. They might target projects facing financial difficulties due to sanctions, operational challenges, or unfavorable market conditions. For example, they might investigate debt associated with specific pipelines facing delays or cost overruns.

Equity Investments

Another avenue for Elliott could be equity investments in pipeline companies undergoing financial difficulties or restructuring. This might involve acquiring equity stakes at below-market prices, hoping to influence corporate governance and increase shareholder value. They might focus on companies struggling due to geopolitical pressure or economic sanctions.

Activist Investing

Elliott might utilize its activist approach to influence corporate governance within pipeline companies. This might involve advocating for more efficient management, strategic divestments, or other changes intended to enhance the company's financial performance and thus the value of their investment. This could prove especially effective if there’s a mismatch between the value of assets and the share price, creating opportunities within the Russian gas pipeline investment market.

Analyzing the Risks and Rewards

Investing in Russian gas pipelines through any of these strategies represents a high-risk, high-reward proposition.

-

Risk assessment matrix: Key risks include geopolitical instability (sanctions, conflict), regulatory changes, fluctuating energy prices, and operational challenges. The potential impact of each risk varies greatly depending on the specific investment and its related assets.

-

Return on investment projections: Potential returns are high due to commodity price volatility, but equally, potential losses are substantial should geopolitical or economic circumstances worsen. Modeling various scenarios is crucial.

-

Mitigation strategies: Thorough due diligence, diversification across different pipeline projects or companies, and effective risk management are crucial mitigation strategies to reduce the impact of these risks on the overall Russian gas pipeline investment strategy.

Conclusion:

Elliott Management's likely strategy concerning Russian gas pipelines would likely involve a combination of debt and equity investments, potentially supplemented by activist approaches. This high-risk, high-reward approach requires extensive due diligence and robust risk management. Understanding the complexities of the Russian gas pipeline investment landscape and the specific risks involved is crucial before undertaking any investment in this sector. Remember to conduct thorough research and consult with qualified financial professionals before making any investment decisions. This article is for informational purposes only and does not constitute financial advice. Further research into the Russian gas pipeline investment market is strongly recommended.

Featured Posts

-

Vozvraschenie Kinga V Sotsset X Konflikt S Maskom

May 10, 2025

Vozvraschenie Kinga V Sotsset X Konflikt S Maskom

May 10, 2025 -

European Nuclear Defense A French Ministers Vision

May 10, 2025

European Nuclear Defense A French Ministers Vision

May 10, 2025 -

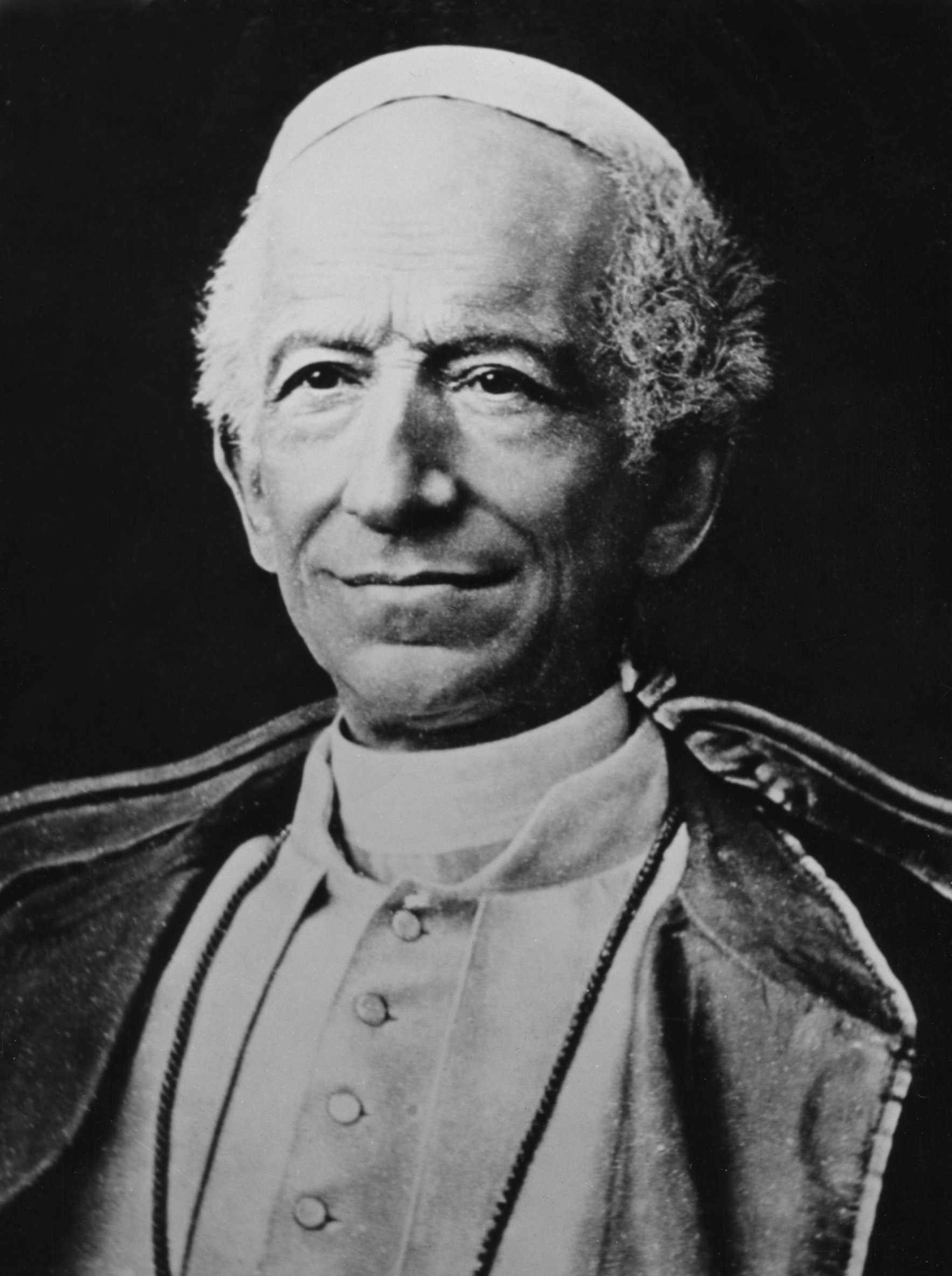

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025 -

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025 -

Bubble Blasters And Beyond The Ripple Effect Of Chinese Trade Disruptions

May 10, 2025

Bubble Blasters And Beyond The Ripple Effect Of Chinese Trade Disruptions

May 10, 2025