Ryanair Flags Tariff War As Top Growth Obstacle, Announces Share Buyback

Table of Contents

The Impact of Rising Airport Tariffs on Ryanair's Growth

The escalating costs associated with airport tariffs are significantly impacting Ryanair's operational efficiency and future growth potential. This "Ryanair tariff war," as the company terms it, is not a simple price increase; it's a systemic challenge threatening the very foundation of the low-cost model.

Increased Operational Costs

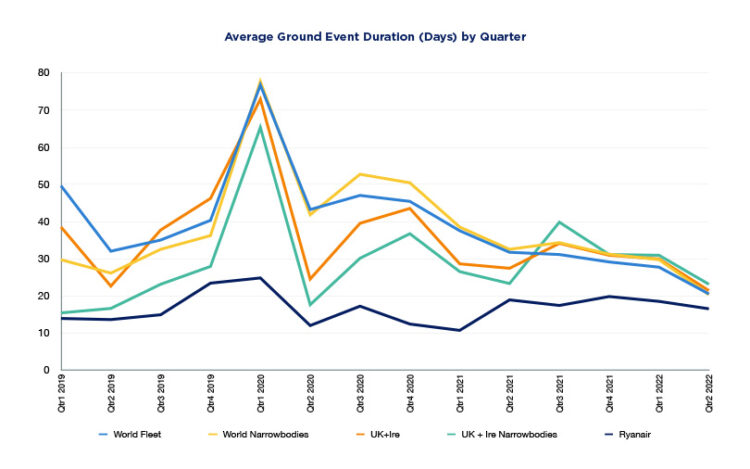

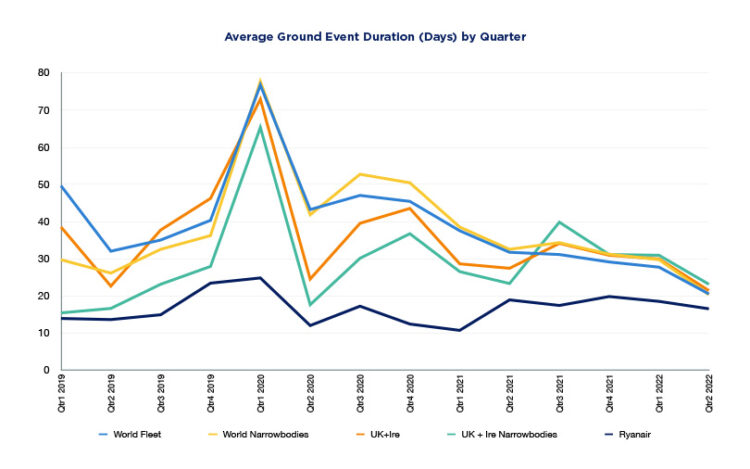

Rising airport tariffs directly translate into increased operational costs for Ryanair. This directly impacts profitability, forcing difficult decisions regarding flight pricing and potentially leading to reduced passenger numbers.

- Specific examples: London Gatwick and Dublin Airport have seen significant tariff increases in recent years, directly impacting Ryanair's operational expenses at these crucial hubs.

- Quantifiable impact: Industry analysts estimate that the cumulative impact of these tariff increases amounts to a double-digit percentage increase in Ryanair's operational costs over the last three years. This increase has necessitated adjustments to fuel surcharges to mitigate the rising expenses.

- Impact on passengers: These increased costs are likely to result in higher airfares or a reduced frequency of flights.

Competition and Market Share

The airport tariff war is not only affecting Ryanair's profitability; it's also impacting its competitive advantage. While Ryanair thrives on its low-cost model, competitors with less reliance on these airports – or those with greater financial reserves – are better positioned to absorb these price increases.

- Competitor Analysis: Airlines such as easyJet and Wizz Air, while also operating low-cost models, may have a more geographically diversified network, mitigating the impact of specific airport tariff hikes.

- Pricing Strategies: Higher costs are forcing Ryanair to reconsider its pricing strategies, potentially eroding its competitive edge of offering the absolute lowest fares. This may lead to a less aggressive pricing approach or a decline in market share.

- Market share implications: If Ryanair's costs continue to rise disproportionately, it could lead to a decline in market share, particularly on routes heavily impacted by high airport tariffs.

Route Planning and Network Adjustments

To mitigate the effects of the tariff war, Ryanair is likely to adjust its route network. This could involve avoiding airports with exorbitant tariffs or reducing flight frequencies on less profitable routes.

- Potential route adjustments: We may see Ryanair shifting operations from high-cost airports to those with lower charges, even if it means sacrificing access to certain markets.

- Impact on passengers: These route adjustments could impact passenger convenience, limiting connectivity and forcing travelers to make alternative travel arrangements.

- Regional economic implications: Reduced flight frequency or the abandonment of specific routes could have negative consequences for regional economies dependent on tourism and air connectivity facilitated by Ryanair.

Ryanair's Share Buyback Program: A Strategic Move?

Ryanair's announcement of a significant share buyback program adds another layer of complexity to its strategy. This seemingly counter-intuitive move amidst the "Ryanair tariff war" requires careful analysis.

Reasons Behind the Buyback

Several factors might explain Ryanair's decision to initiate a share buyback:

- Undervaluation: Ryanair's management may believe that its stock is currently undervalued in the market, presenting a good opportunity to repurchase shares at a discount.

- Confidence in future performance: The buyback could signal confidence in the company's ability to overcome the challenges posed by the airport tariff war and achieve future growth.

- Return of capital: It could represent a return of excess capital to shareholders, reflecting a strategic decision to prioritize shareholder returns over further expansion or investment.

- Buyback size: The scale of the buyback will indicate the level of confidence Ryanair has in its future prospects.

Implications for Investors

The share buyback has significant implications for investors:

- Signal of Confidence: The move signals confidence in the company's future financial performance, even amidst the tariff challenges.

- Potential Returns: Share buybacks generally reduce the number of outstanding shares, potentially increasing earnings per share and boosting the stock price.

- Risk and Reward: While the buyback suggests positive sentiment, investors need to consider the risks associated with the ongoing tariff war and its potential impact on Ryanair's financial performance.

- Analyst Predictions: Financial analysts' reaction to the buyback will provide crucial insights into the market's overall perception of Ryanair's future prospects.

Balancing Growth and Shareholder Value

Ryanair faces the challenge of balancing ambitious growth plans with maximizing shareholder value in a turbulent environment.

- Long-term strategies: Ryanair might explore cost-cutting measures to offset the impact of rising tariffs while maintaining service quality.

- Financial Health: A strong financial position is essential to navigate the "Ryanair tariff war" successfully, demonstrating the company's resilience.

Conclusion

Ryanair's announcement highlights the significant challenges facing low-cost carriers, with rising airport tariffs creating a formidable "Ryanair tariff war." The simultaneous share buyback indicates a sophisticated strategy balancing growth with shareholder returns. While the tariff increases present substantial hurdles, understanding Ryanair's response—navigating cost increases and its strategic use of capital—is vital for investors and industry observers alike. To remain informed about the ongoing impact of the Ryanair tariff war and the company's strategic responses, continue to follow industry news and analysis.

Featured Posts

-

Optimalisatie Van Uw Kamerbrief Certificaten Verkoop Bij Abn Amro

May 21, 2025

Optimalisatie Van Uw Kamerbrief Certificaten Verkoop Bij Abn Amro

May 21, 2025 -

O Baggelis Giakoymakis To Xroniko Mias Friktis Istorias Sxolikoy Ekfovismoy

May 21, 2025

O Baggelis Giakoymakis To Xroniko Mias Friktis Istorias Sxolikoy Ekfovismoy

May 21, 2025 -

Femicide Understanding The Rise In Incidents

May 21, 2025

Femicide Understanding The Rise In Incidents

May 21, 2025 -

Controverse A Clisson Trop De Croix Autour Du Cou

May 21, 2025

Controverse A Clisson Trop De Croix Autour Du Cou

May 21, 2025 -

Out Now Premier League 2024 25 Champions Picture Special

May 21, 2025

Out Now Premier League 2024 25 Champions Picture Special

May 21, 2025