Ryanair's Growth Prospects Hampered By Tariff Disputes, Company Initiates Buyback Program

Table of Contents

Tariff Disputes: A Significant Headwind for Ryanair's Expansion

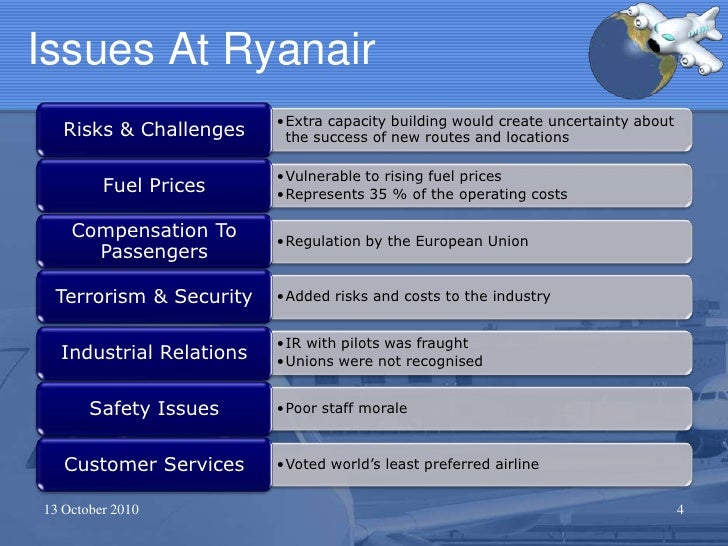

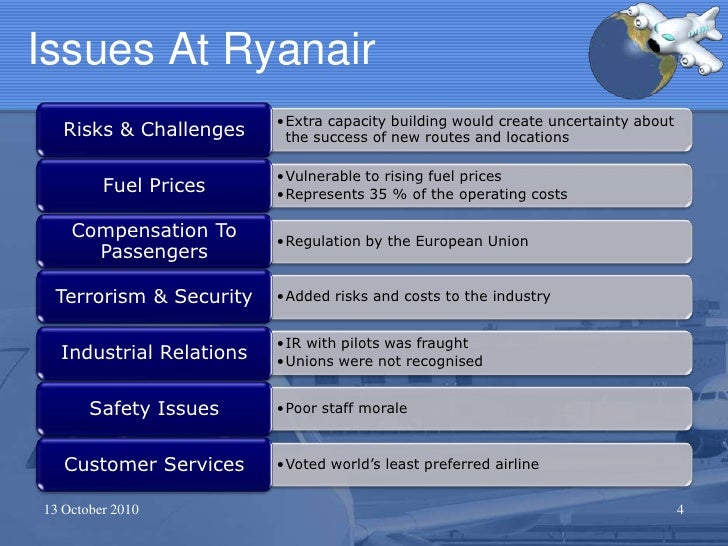

Ryanair's ambitious expansion plans are significantly challenged by a series of ongoing tariff disputes across several European routes. These disputes involve various types of aviation tariffs, including airport charges, air traffic control fees, and landing rights. The impact is felt most acutely on routes connecting key European cities, leading to increased operational costs and potential disruptions.

- Increased Operating Costs: Higher tariffs directly translate into increased operating costs per flight, squeezing profit margins and potentially impacting the affordability of Ryanair's fares.

- Flight Cancellations and Route Adjustments: In some cases, the escalating costs have forced Ryanair to consider canceling less profitable routes or making adjustments to flight schedules, potentially impacting passenger convenience.

- Negative Impact on Passenger Numbers: The increased fares, a direct result of higher tariffs, could deter price-sensitive passengers and reduce overall passenger numbers, impacting revenue.

- Legal Battles and Lobbying Efforts: Ryanair is actively engaged in legal battles and lobbying efforts to challenge unfair or excessive tariffs, advocating for more favorable air travel regulations within the European Union and beyond.

These trade disputes represent a substantial threat to Ryanair's long-term route planning and expansion strategy, potentially hindering its ability to penetrate new markets and maintain its competitive edge within the fiercely competitive aviation industry. The uncertainty surrounding these aviation tariffs creates significant challenges in forecasting future profitability and growth.

Ryanair's Buyback Program: A Strategic Response to Challenges?

In a move that has sparked considerable discussion, Ryanair recently announced a significant share buyback program. The program, involving a substantial sum of money over a defined timeframe, aims to return capital to shareholders. The rationale behind this buyback is multifaceted.

- Response to Tariff Disputes?: While not explicitly stated, some analysts see the buyback as a response to the challenges posed by the tariff disputes, suggesting that Ryanair believes it can weather the storm and remains confident in its long-term profitability.

- Sign of Confidence: The buyback could also be interpreted as a signal of confidence in Ryanair’s future performance, suggesting the management team believes the current share price undervalues the company's potential.

- Alternative Uses of Capital: The capital allocated to the share buyback program could have been used for other strategic initiatives, such as fleet expansion, route development, or technological upgrades. The decision to prioritize share buybacks underscores the company's current strategic priorities.

The buyback program's impact on share price and investor sentiment will be closely monitored. The impact on the company's financial position and debt levels will also need careful assessment.

Analyzing the Interplay Between Tariff Disputes and the Buyback Program

The relationship between the tariff disputes and Ryanair's buyback decision is complex and warrants further scrutiny. Does the buyback signal a strategic response to the challenges posed by increased tariffs, or is it driven by other factors entirely?

- Confidence in Overcoming Challenges?: The buyback could indeed reflect confidence in Ryanair's ability to successfully navigate the tariff disputes and maintain profitability.

- Appeasing Investors?: Alternatively, it might be seen as an attempt to appease investors who are concerned about the impact of the tariff disputes on growth prospects and future returns.

- Other Factors: It's crucial to remember that other factors, such as overall market conditions and internal financial assessments, could be influencing the buyback decision.

Ultimately, the interplay between these two elements requires a thorough analysis considering all possible motivations and their implications for Ryanair's overall strategic direction.

Future Outlook for Ryanair's Growth Prospects

Despite the considerable challenges posed by tariff disputes, Ryanair's future growth prospects remain somewhat positive. While the tariff issues are a significant headwind, Ryanair's efficient operational model, robust brand recognition, and potential for expansion into new markets remain key strengths.

- New Routes and Market Expansion: The potential for new routes and expansion into less-saturated markets could offset some of the impact of tariff-related cost increases.

- Technological Advancements: Technological advancements in aircraft efficiency and operational processes can help Ryanair mitigate the impact of higher tariffs.

- Macroeconomic Factors: The impact of broader macroeconomic factors on air travel demand will also play a significant role in shaping Ryanair’s future trajectory.

The effectiveness of the buyback program in bolstering investor confidence and influencing share price will be a key determinant of Ryanair's future success.

Conclusion: The Future of Ryanair's Growth Prospects

In conclusion, Ryanair's growth prospects face a complex interplay of challenges and opportunities. The ongoing tariff disputes present a significant headwind, impacting operational costs and potentially hindering expansion plans. The strategic decision to initiate a share buyback program adds another layer of complexity to the analysis, raising questions about the airline's strategic priorities and confidence in its future performance. Careful monitoring of the interplay between these factors is essential for understanding the future trajectory of Ryanair's growth. Stay tuned for further updates on Ryanair's growth prospects and how the company navigates these significant challenges.

Featured Posts

-

Profession De Cordiste A Nantes Evolution Et Perspectives Face A L Urbanisation

May 21, 2025

Profession De Cordiste A Nantes Evolution Et Perspectives Face A L Urbanisation

May 21, 2025 -

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 21, 2025

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 21, 2025 -

Sandylands U Tv Guide Your Complete Episode Guide

May 21, 2025

Sandylands U Tv Guide Your Complete Episode Guide

May 21, 2025 -

The Sound Perimeter Understanding Musics Collective Power

May 21, 2025

The Sound Perimeter Understanding Musics Collective Power

May 21, 2025 -

Antiques Roadshow Couple Sentenced For Unknowing National Treasure Trafficking

May 21, 2025

Antiques Roadshow Couple Sentenced For Unknowing National Treasure Trafficking

May 21, 2025