Sabic's Gas Business IPO: What To Expect From Saudi Arabia's Petrochemical Giant

Table of Contents

The Strategic Rationale Behind SABIC's Gas Business IPO

The decision to pursue a Sabic's Gas Business IPO stems from several key strategic objectives aimed at boosting Saudi Arabia's economic diversification and securing future growth.

Diversification and Economic Growth

The Saudi government's Vision 2030 initiative prioritizes reducing reliance on oil revenues and fostering economic diversification. SABIC's Gas Business IPO is a critical component of this strategy. By listing its gas business on the stock market, SABIC aims to:

- Increased foreign investment: Attract significant foreign direct investment (FDI) into the Saudi Arabian economy.

- Reduced reliance on oil revenues: Diversify revenue streams, lessening the kingdom's vulnerability to fluctuations in global oil prices.

- Funding for future projects: Generate capital to fund further expansion and innovation within SABIC and the broader Saudi petrochemical sector. This includes investments in renewable energy and sustainable technologies.

The Sabic's Gas Business IPO is directly aligned with Saudi Vision 2030's goals for economic diversification and sustainable growth.

Unlocking Value and Attracting Investment

The IPO aims to unlock the inherent value of SABIC's substantial gas assets, currently underutilized. By listing the business separately, its true market worth can be accurately assessed and capitalized upon. Key objectives include:

- Increased market capitalization: Achieve a higher overall valuation for SABIC's gas operations than would be possible within the existing corporate structure.

- Access to global capital markets: Tap into international capital markets to secure substantial funding for future growth and expansion.

- Enhanced corporate governance: Improve transparency and accountability, attracting a wider range of investors.

The anticipated high valuation of the Sabic's Gas Business IPO will showcase the strength of Saudi Arabia's energy sector to global investors.

Assessing the Potential Market Value and Investor Interest

Predicting the precise market value of SABIC's gas business is complex, depending on various factors.

Market Analysis and Projections

The projected market value will hinge on several key elements:

- Global demand for natural gas: The ongoing transition towards cleaner energy sources is driving increased demand for natural gas as a transitional fuel.

- Regional competition: The competitive landscape within the Middle East and globally will influence pricing and market share.

- Pricing strategies: SABIC's pricing strategies and ability to compete effectively will impact profitability and valuation.

- Regulatory environment: Government regulations and policies regarding gas production, pricing, and environmental considerations will play a crucial role.

Analyzing these factors, combined with independent valuations, will help determine the final IPO valuation. A strong and robust natural gas market is essential for the success of the Sabic's Gas Business IPO.

Attracting International Investors

Several factors will contribute to attracting both domestic and international investor interest:

- Investment grade rating: A strong credit rating will enhance investor confidence and attract significant capital.

- Strong financial performance: A history of consistent profitability and strong financial performance will be crucial.

- Growth potential: The potential for future growth within the gas sector and SABIC's ability to capitalize on emerging market opportunities will influence investor interest.

- Dividends: Attractive dividend payouts will incentivize investors seeking passive income. The influence of Saudi Aramco, a major shareholder, also adds credibility and investor confidence.

Challenges and Risks Associated with the IPO

While the Sabic's Gas Business IPO offers substantial potential, various challenges and risks must be considered.

Geopolitical Risks and Market Volatility

The global energy market is subject to significant volatility, influenced by geopolitical events. Potential risks include:

- Global energy price fluctuations: Sharp price swings in the natural gas market can significantly impact profitability and valuation.

- Regional conflicts: Geopolitical instability in the Middle East could disrupt operations and investor confidence.

- Regulatory changes: Changes in government regulations and policies could negatively impact the business's operations.

- Environmental concerns: Growing environmental awareness and stricter regulations could increase operational costs and hinder growth.

Careful risk management is crucial to mitigate these potential challenges to the Sabic's Gas Business IPO.

Competition and Market Saturation

The gas sector faces intense competition, and market saturation remains a possibility:

- Competition from other producers: Competition from established players and new entrants could limit market share and profitability.

- Potential oversupply: Overproduction of natural gas could lead to price decreases and reduced profitability.

- Technological advancements: Technological advancements in renewable energy sources could gradually reduce demand for natural gas in the long term.

A thorough understanding of the competitive landscape and the ability to adapt to changing market dynamics are crucial for the long-term success of SABIC's gas business.

Conclusion

SABIC's Gas Business IPO is a strategically significant event, aligning with Saudi Arabia's Vision 2030 goals for economic diversification and sustainable growth. While offering substantial potential for growth and attracting significant investment, the IPO also presents challenges related to geopolitical risks, market volatility, and competition. The success of the Sabic's Gas Business IPO will depend on careful planning, effective risk management, and a keen understanding of the evolving global energy market. Stay informed about the developments surrounding Sabic's Gas Business IPO. This significant event will reshape the energy landscape and presents opportunities for investors interested in the burgeoning Saudi Arabian economy and the global petrochemical industry. Learn more about Sabic's Gas Business IPO and other investment opportunities in Saudi Arabia by visiting [link to relevant resource].

Featured Posts

-

Erling Haaland Injury Expected Return Date For Man City Star

May 19, 2025

Erling Haaland Injury Expected Return Date For Man City Star

May 19, 2025 -

The Fight To Save Jersey Battle Of Flowers A Local Heros Journey

May 19, 2025

The Fight To Save Jersey Battle Of Flowers A Local Heros Journey

May 19, 2025 -

Geopolitique Et Environnement Maritime Un Point De Vue Credit Mutuel Am

May 19, 2025

Geopolitique Et Environnement Maritime Un Point De Vue Credit Mutuel Am

May 19, 2025 -

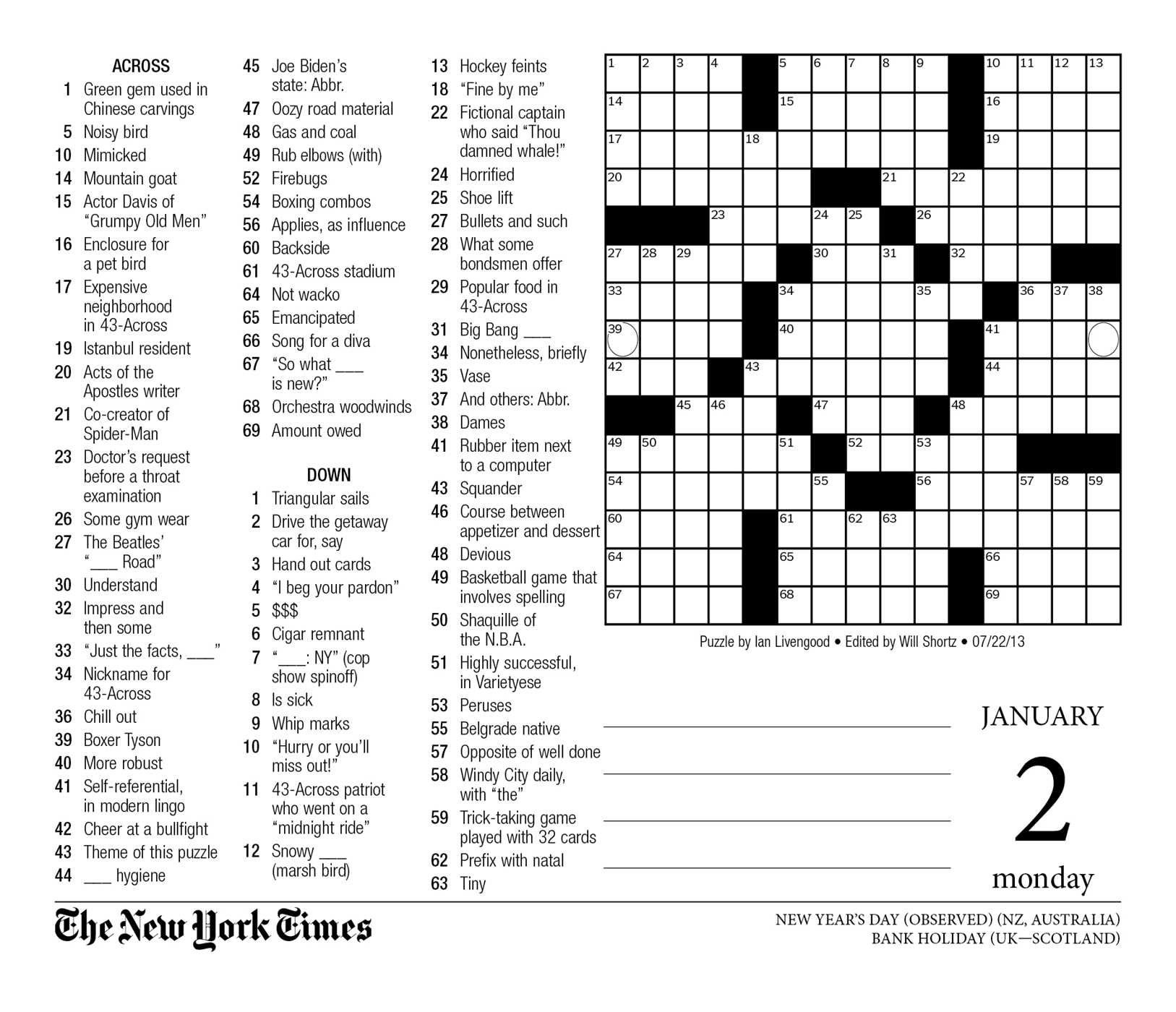

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 19, 2025

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 19, 2025 -

Fete De La Marche A Parcay Sur Vienne Un Succes Avec 100 Participants

May 19, 2025

Fete De La Marche A Parcay Sur Vienne Un Succes Avec 100 Participants

May 19, 2025