Sagging Housing Market: Realtors Report Crisis-Level Sales

Table of Contents

High Interest Rates Stifle Buyer Demand

The most significant factor contributing to the sagging housing market is the sharp increase in interest rates. The direct correlation between rising rates and decreased affordability is undeniable. Higher interest rates translate directly into higher monthly mortgage payments, significantly reducing the purchasing power of potential homebuyers.

For example, a buyer who could comfortably afford a mortgage at 3% interest may find themselves priced out of the market with rates climbing to 7% or higher. This is especially true considering the historical context; we haven't seen mortgage rates this high in many years. The current rates are impacting the number of qualified buyers dramatically, leading to a significant decline in sales volume.

- Increased monthly mortgage payments: Even a small increase in interest rates can lead to hundreds of extra dollars in monthly payments.

- Reduced borrowing capacity: Higher rates mean lenders approve smaller loan amounts, limiting the price range buyers can afford.

- Fewer qualified buyers: Stricter lending criteria and higher rates filter out many potential homebuyers.

- Increased pressure on existing homeowners: Those locked into lower rates may be hesitant to sell, fearing they won't find a comparable replacement.

Inflation Erodes Purchasing Power and Buyer Confidence

Beyond interest rates, soaring inflation is another major contributor to the sagging housing market. Rising prices for everyday goods and services significantly reduce disposable income, leaving less money available for large purchases like homes. Moreover, inflation is driving up the cost of construction and building materials, further impacting the affordability of new homes. This cost increase filters down to existing homes as well.

The economic uncertainty created by inflation also erodes buyer confidence. With rising prices and economic volatility, potential buyers are hesitant to commit to such a substantial financial investment.

- Rising cost of living: Inflation makes it more expensive to maintain a household, leaving less for a down payment or mortgage.

- Decreased consumer confidence: Economic uncertainty leads to hesitation in making major financial decisions.

- Uncertainty about future economic conditions: Buyers are wary of committing to long-term financial obligations in uncertain times.

- Hesitation to enter the market: Many potential buyers are adopting a "wait-and-see" approach.

Inventory Levels and Market Supply

The current state of housing inventory significantly influences the sagging housing market dynamics. While there are regional variations, a general undersupply of homes in many areas contributes to high prices and reduced sales. This undersupply is a result of several factors, including slow new construction rates and previous market trends that saw a significant increase in demand.

The limited inventory impacts market dynamics in several ways. Buyers often face fierce competition, potentially leading to bidding wars and inflated prices, while a shortage of available homes creates a less favorable market for sellers.

- Low inventory levels: A limited supply of homes for sale fuels competition and drives up prices.

- Regional variations in housing supply: Inventory levels and market conditions vary substantially across different geographic areas.

- Impact of new construction on market dynamics: Increased new home construction can help alleviate inventory shortages, but this has been slow recently.

- Influence on price negotiations: Low inventory typically limits buyers' negotiating power.

The Impact on Realtors and the Real Estate Industry

The sagging housing market presents significant challenges for realtors and the real estate industry as a whole. The decreased sales volume directly translates into reduced commissions and potential job losses. The increased competition among realtors necessitates innovative marketing strategies and a greater focus on client relationships. The industry might see consolidation as smaller firms struggle to stay afloat.

- Reduced sales volume and commissions: Fewer transactions mean less income for real estate agents.

- Increased competition among realtors: Agents are vying for a smaller pool of clients.

- Need for innovative marketing strategies: Realtors must adapt to reach potential buyers in a challenging market.

- Potential for industry consolidation: Weaker firms may be acquired or forced to close.

Conclusion: Navigating the Sagging Housing Market

The current sagging housing market is a complex situation driven by a confluence of factors: high interest rates, inflation, and limited inventory. This has significantly impacted buyers, sellers, and the real estate industry. While the future remains uncertain, understanding these underlying forces is crucial for navigating this challenging market. Will the market recover? Predicting the exact timing is difficult, but factors such as interest rate adjustments and inflation control will play a significant role.

To effectively cope with the sagging housing market, seek advice from experienced real estate professionals. They can provide valuable insights into current market trends, help you understand your options, and guide you through the process of buying or selling a home in this challenging environment. Informed decision-making is paramount to success in today's dynamic housing landscape. Understanding the sagging housing market and working with professionals who understand the nuances of this challenging period will make all the difference in your real estate journey.

Featured Posts

-

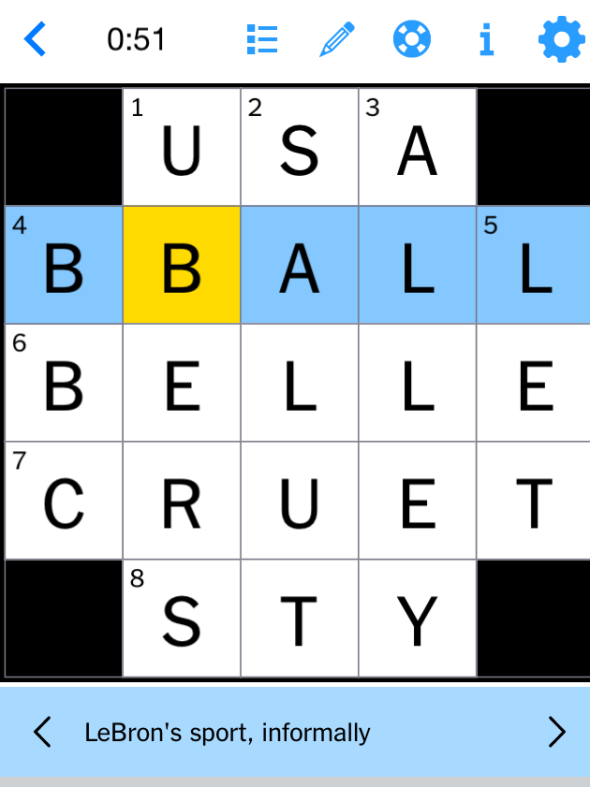

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025

Nyt Mini Crossword Thursday April 10 Clues And Solutions

May 31, 2025 -

New Study Highlights Positive Impacts Of Tulsas Remote Worker Program

May 31, 2025

New Study Highlights Positive Impacts Of Tulsas Remote Worker Program

May 31, 2025 -

Giro D Italia 2025 Vatican City To Host Final Stage In Papal Honor

May 31, 2025

Giro D Italia 2025 Vatican City To Host Final Stage In Papal Honor

May 31, 2025 -

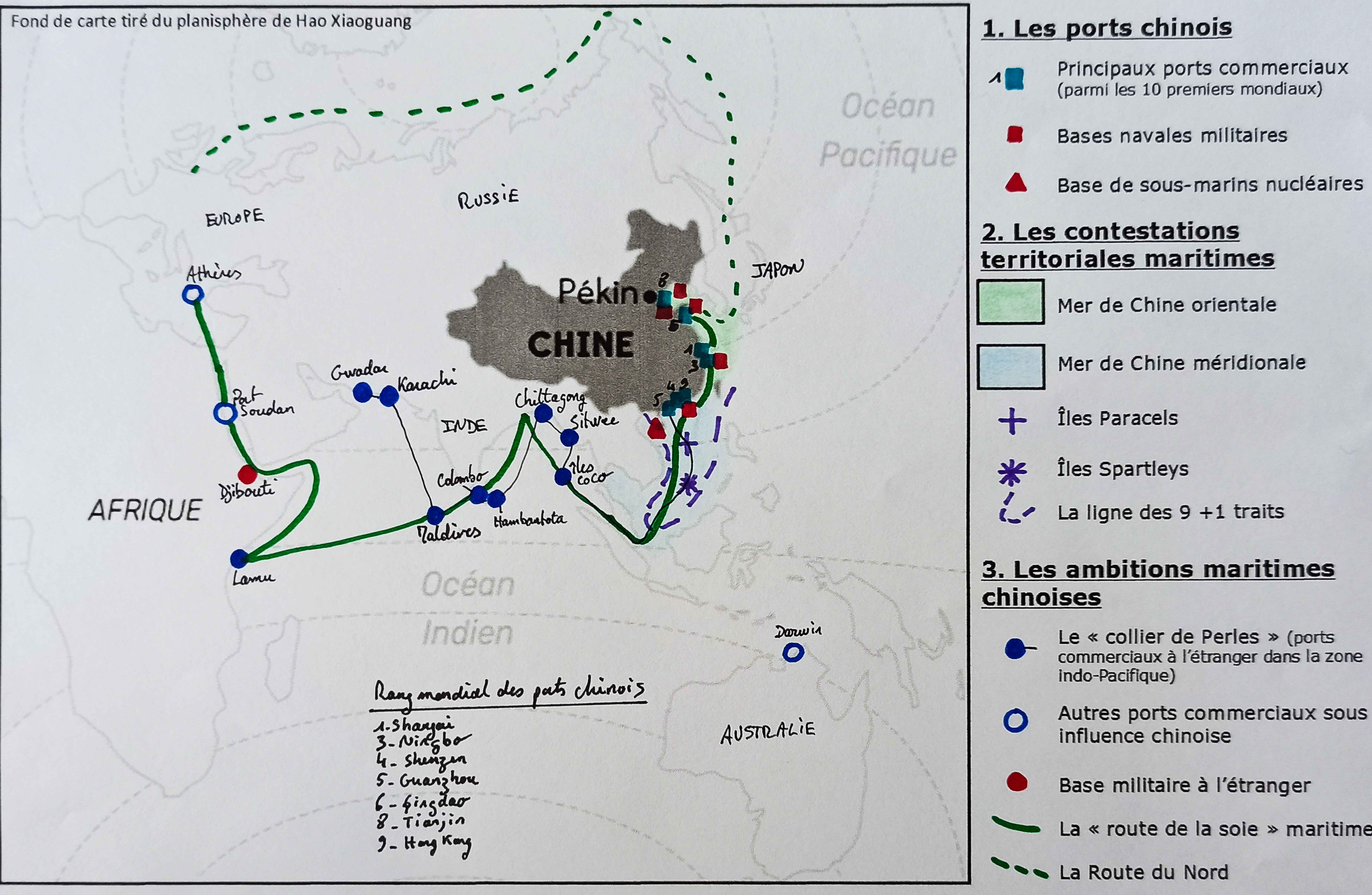

Port Saint Louis Du Rhone Programme Du Festival De La Camargue Sur Le Theme Des Mers Et Oceans

May 31, 2025

Port Saint Louis Du Rhone Programme Du Festival De La Camargue Sur Le Theme Des Mers Et Oceans

May 31, 2025 -

Alcaraz Victorious In Rome Passaro Upsets Dimitrov Italian International Highlights

May 31, 2025

Alcaraz Victorious In Rome Passaro Upsets Dimitrov Italian International Highlights

May 31, 2025