Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Sasol (SOL), a global integrated energy and chemicals company, has seen its stock price fluctuate significantly, leaving investors demanding clarity on its strategic direction. Recent financial performance has fueled concerns about the company's future, prompting a closer look at its strategy and its ability to navigate the evolving energy landscape. This article analyzes the key investor concerns surrounding Sasol (SOL), examining its recent performance, its response to the energy transition, and the path forward. We’ll explore the challenges and opportunities facing the company, ultimately assessing whether Sasol’s strategy is sufficient to regain investor confidence and deliver long-term shareholder value.

Declining Profitability and Investor Dissatisfaction

Sasol's recent financial reports paint a picture of declining profitability, a major source of investor dissatisfaction. The company has faced challenges in several key areas, impacting its overall financial performance and causing significant fluctuations in the SOL stock price.

- Missed Earnings Targets: Sasol has repeatedly missed earnings targets in recent quarters, failing to meet analyst expectations and prompting concerns about its ability to effectively manage costs and generate revenue.

- Reduced Margins: Profit margins have compressed significantly due to factors such as increased input costs and intense competition in the global energy market. This has directly impacted the return on investment for shareholders.

- Stock Price Volatility: The SOL stock price has experienced considerable volatility, reflecting investor uncertainty and a lack of confidence in the company's short-term and long-term prospects. This volatility underscores the urgent need for a clear and effective strategic response.

The impact on shareholder confidence is undeniable. Many investors are questioning Sasol's ability to deliver consistent returns, leading to a decline in overall investor sentiment and increased pressure on management to provide decisive action.

The Energy Transition and Sasol's Adaptation

The global shift towards cleaner energy sources presents both challenges and opportunities for Sasol. The company acknowledges the need to adapt and has initiated several initiatives aimed at diversifying its energy portfolio and reducing its environmental footprint. However, the effectiveness of these initiatives remains a subject of ongoing debate among investors.

- Investments in Renewables: Sasol has invested in renewable energy projects, including solar and wind power, to reduce its reliance on fossil fuels. However, the scale of these investments compared to its traditional operations remains a point of contention.

- Carbon Capture Initiatives: The company is actively pursuing carbon capture, utilization, and storage (CCUS) technologies to mitigate its carbon emissions. The long-term feasibility and economic viability of these projects are crucial to its future.

- ESG (Environmental, Social, and Governance) Investing: Increasingly, ESG considerations are playing a significant role in investment decisions. Sasol's progress on environmental and social responsibility is being closely scrutinized by investors committed to sustainable investing.

The speed and scale of Sasol's transition to a more sustainable business model will significantly influence its long-term competitiveness and attractiveness to investors concerned about ESG factors.

Operational Challenges and Efficiency Improvements

Sasol has faced a series of operational challenges impacting its efficiency and profitability. Addressing these issues is critical to restoring investor confidence and achieving sustainable growth.

- Production Bottlenecks: Production inefficiencies and bottlenecks have hindered Sasol's ability to meet market demand and maximize output.

- Supply Chain Disruptions: Global supply chain disruptions have added to operational costs and created uncertainty in production planning.

- Cost Reduction Measures: Sasol has implemented cost-cutting measures to improve profitability, but their effectiveness remains to be seen. The balance between cost reduction and maintaining operational efficiency is a critical challenge.

Addressing these operational challenges requires a multifaceted approach, including streamlining production processes, improving supply chain resilience, and implementing effective cost-reduction strategies.

Management's Response and Future Outlook

Sasol's management has acknowledged investor concerns and outlined a strategic plan aimed at addressing declining profitability and adapting to the energy transition. However, the credibility and feasibility of these plans need further scrutiny.

- Management Statements: Public statements and investor presentations from Sasol management offer insights into the company's strategic priorities and anticipated future performance. A careful analysis of these statements is crucial for understanding the company's trajectory.

- Strategic Plan Implementation: The success of Sasol's strategy hinges on the effective implementation of its planned initiatives. Regular monitoring of progress and transparent communication are essential.

- Future Scenarios: Several future scenarios are possible, each with different implications for Sasol's stock price. Considering a range of scenarios is crucial for informed investment decisions.

The success of Sasol's future hinges on the effective execution of its strategic plan, coupled with transparent and consistent communication with investors.

Conclusion: The Future of Sasol (SOL) – Seeking Clarity and Transparency

Investor concerns regarding Sasol's (SOL) declining profitability and its adaptation to the energy transition are valid and demand a clear and transparent response from management. The company's future success hinges on its ability to address operational challenges, improve efficiency, and demonstrate a credible strategy for navigating the energy transition. Clear and consistent communication with investors is crucial for rebuilding confidence and attracting investment. To stay informed about Sasol’s strategic developments and their impact on the SOL stock, we recommend closely following Sasol's investor relations channels for updates and future announcements. Understanding the evolving Sasol strategy is paramount for any investor considering a position in SOL.

Featured Posts

-

Todays Nyt Mini Crossword Answers For March 13

May 20, 2025

Todays Nyt Mini Crossword Answers For March 13

May 20, 2025 -

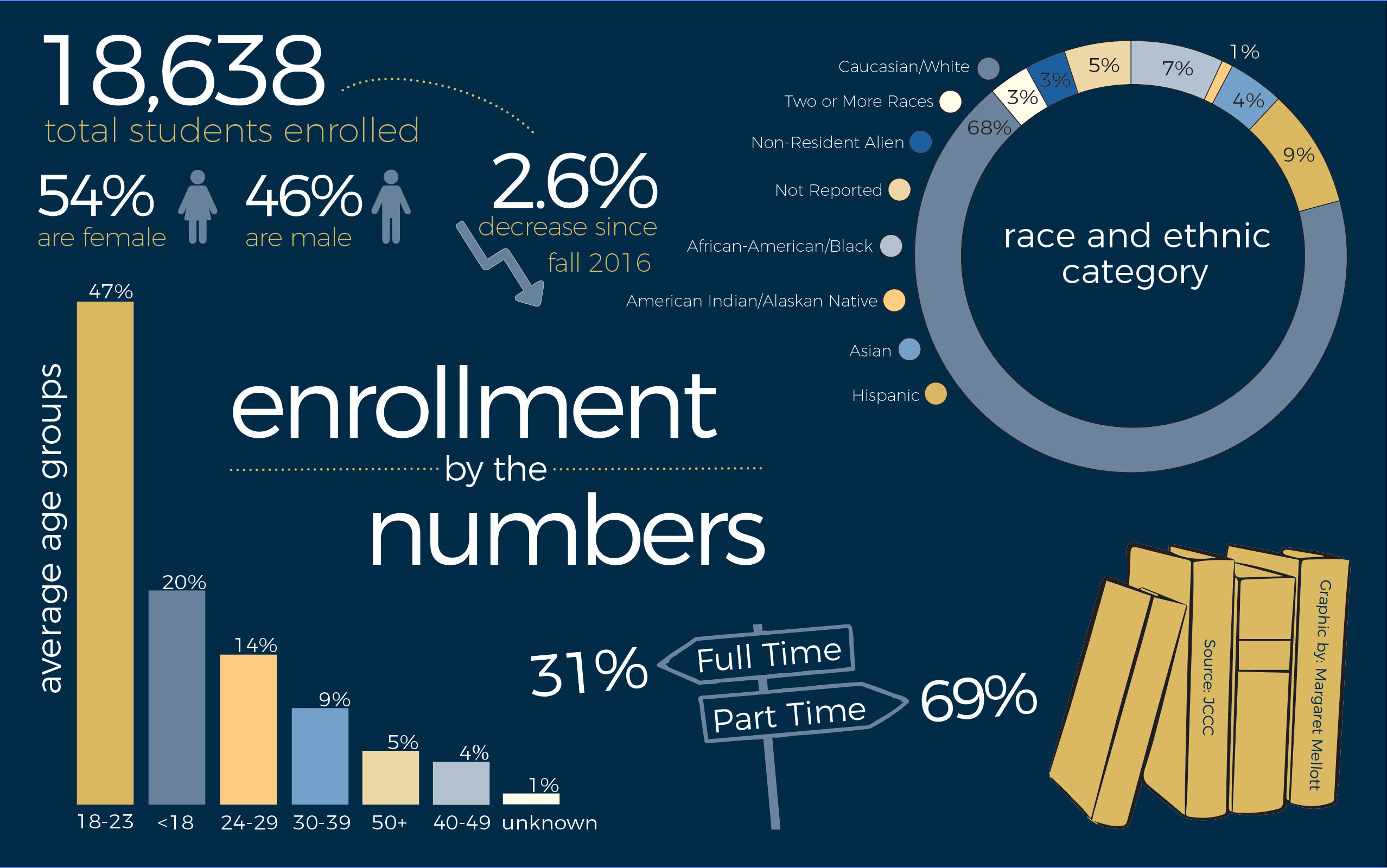

College Towns In Crisis Enrollment Decline And Economic Fallout

May 20, 2025

College Towns In Crisis Enrollment Decline And Economic Fallout

May 20, 2025 -

Le Projet D Adressage Du District Autonome D Abidjan Une Mise A Jour

May 20, 2025

Le Projet D Adressage Du District Autonome D Abidjan Une Mise A Jour

May 20, 2025 -

Bbc Adapting Agatha Christies Endless Night For Tv Series

May 20, 2025

Bbc Adapting Agatha Christies Endless Night For Tv Series

May 20, 2025 -

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025

Retired Four Star Admiral Convicted Corruption Scandal Details

May 20, 2025